This version of the form is not currently in use and is provided for reference only. Download this version of

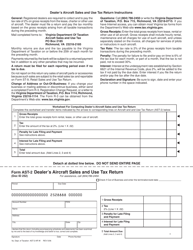

Form AST-3

for the current year.

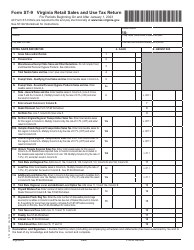

Form AST-3 Virginia Aircraft Sales and Use Tax Return - Virginia

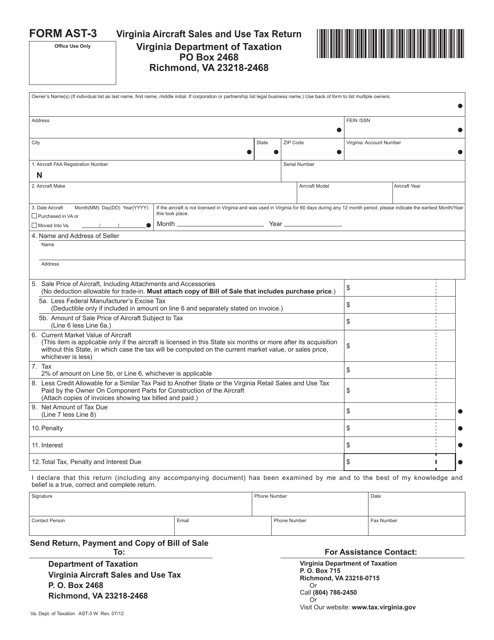

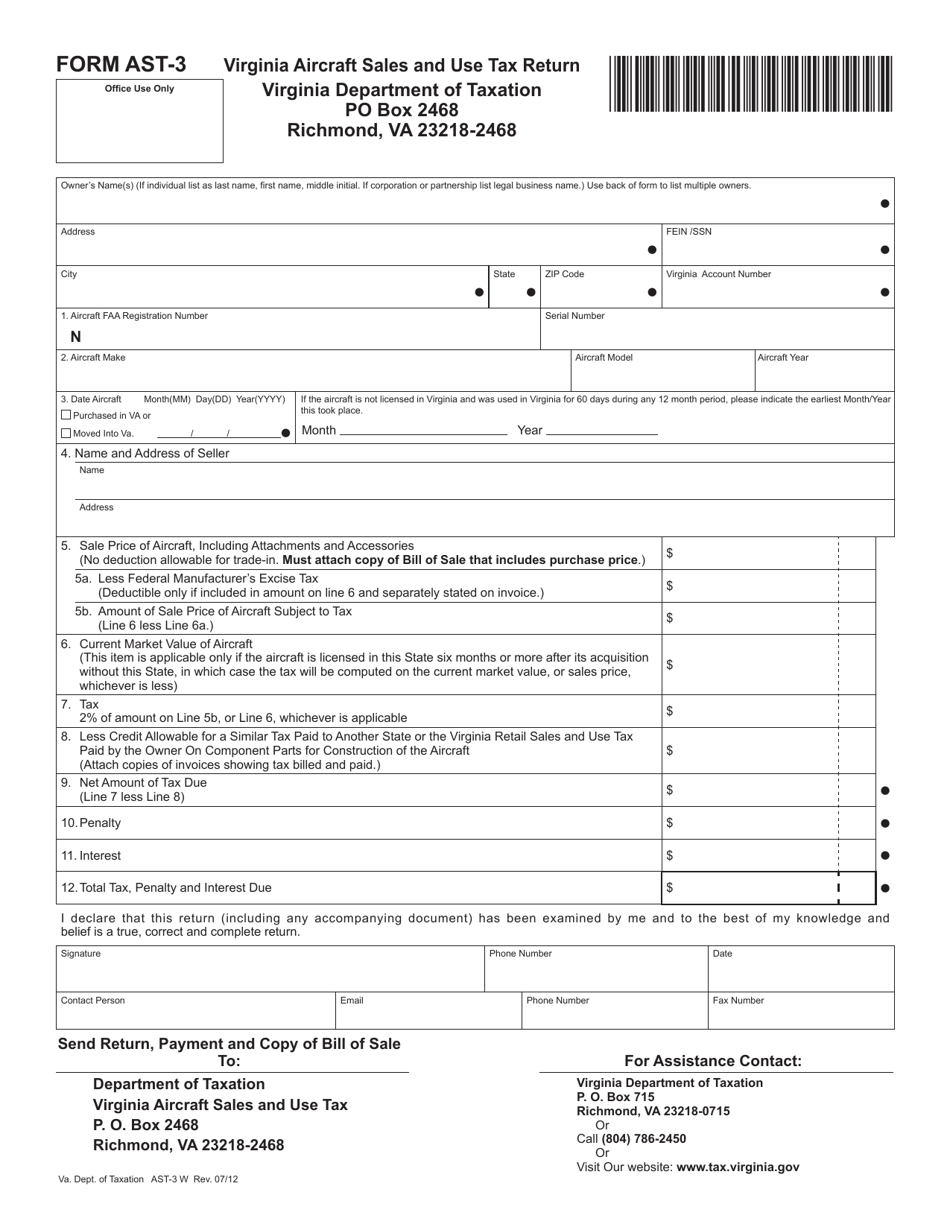

What Is Form AST-3?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AST-3?

A: Form AST-3 is the Virginia Aircraft Sales and Use Tax Return.

Q: What is the purpose of Form AST-3?

A: Form AST-3 is used to report and remit sales and use tax on aircraft sales in Virginia.

Q: Who needs to file Form AST-3?

A: Any individual or business that sells or uses an aircraft in Virginia may need to file Form AST-3.

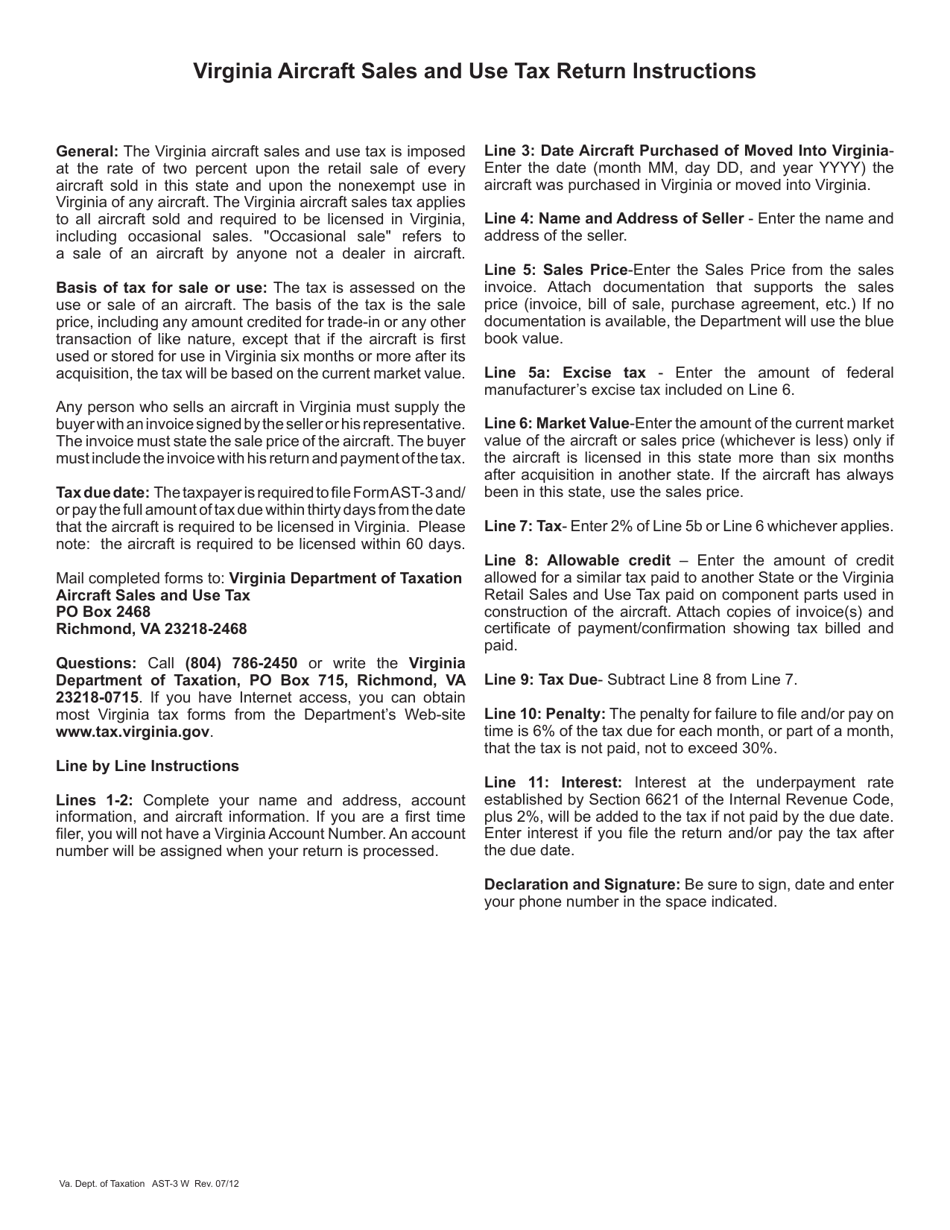

Q: What does the Form AST-3 require?

A: Form AST-3 requires detailed information about the aircraft, including its purchase price, registration number, and seller information.

Q: How often should Form AST-3 be filed?

A: Form AST-3 should be filed by the 20th day of the month following the month in which the sale or use occurred.

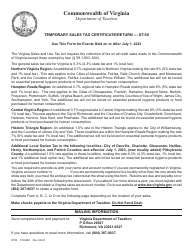

Q: Are there any exemptions or deductions available on Form AST-3?

A: Yes, there may be exemptions or deductions available for certain sales or uses of aircraft. These should be included on Form AST-3, if applicable.

Q: What are the consequences of not filing Form AST-3?

A: Failure to file Form AST-3 and pay the appropriate sales and use tax may result in penalties and interest.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AST-3 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.