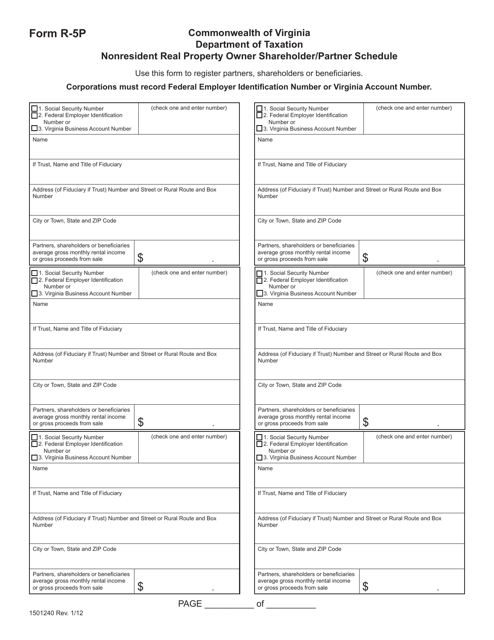

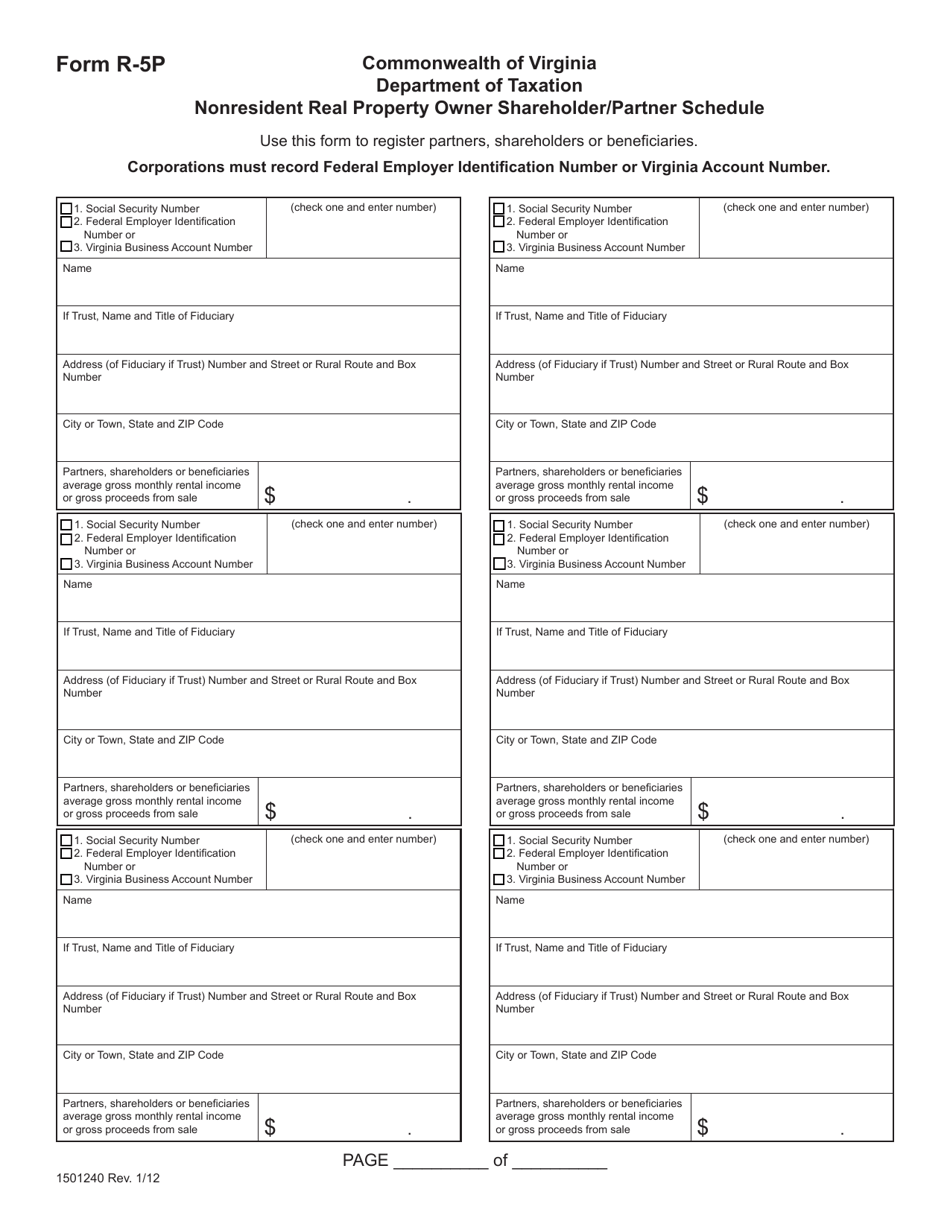

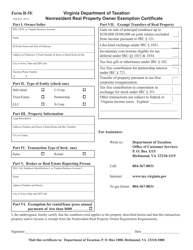

Form R-5P Nonresident Real Property Owner Shareholder / Partner Schedule - Virginia

What Is Form R-5P?

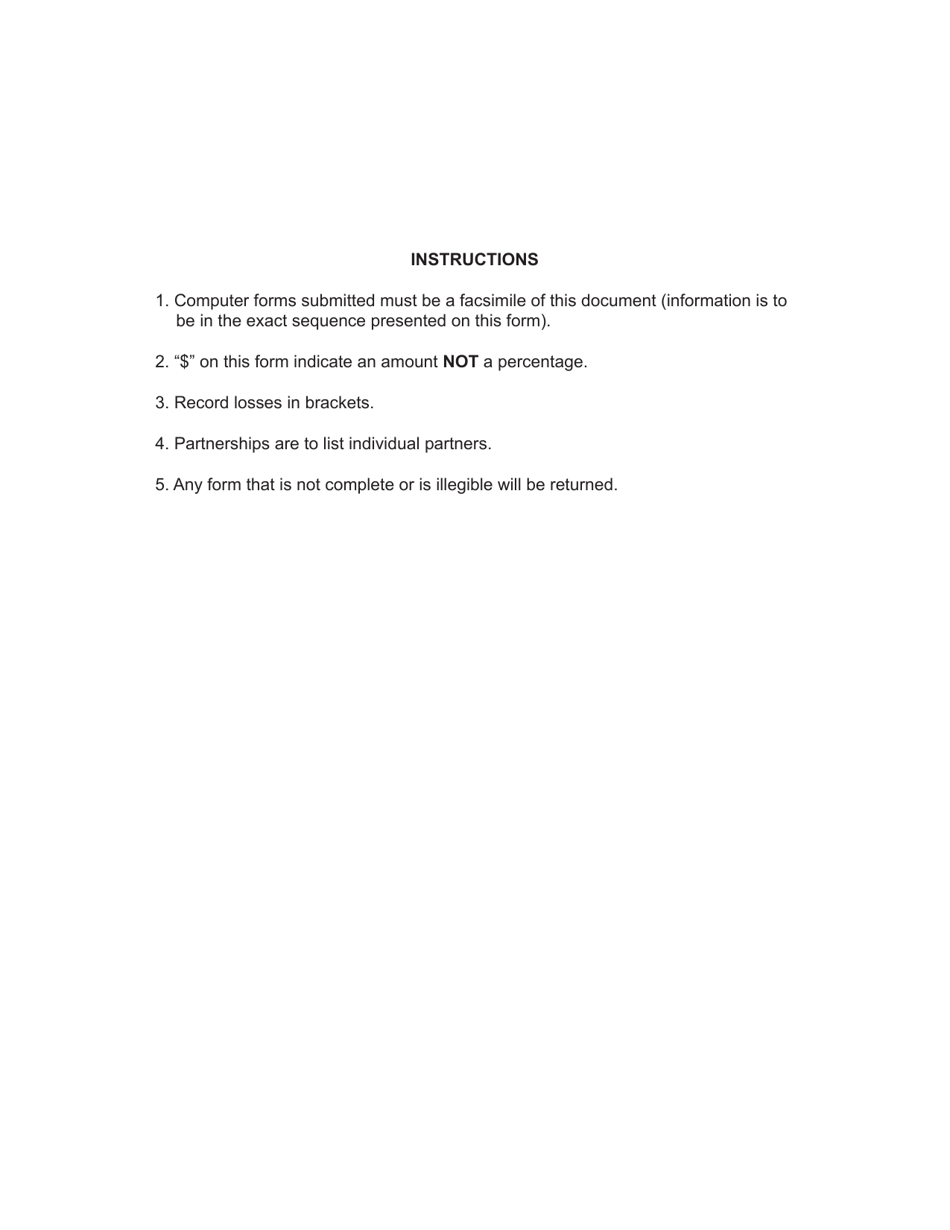

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form R-5P?

A: The Form R-5P is a schedule used by nonresident real property owner shareholder/partners in Virginia.

Q: Who needs to use Form R-5P?

A: Nonresident real property owner shareholder/partners in Virginia.

Q: What is the purpose of Form R-5P?

A: The purpose of Form R-5P is to report the income and deductions from rental real estate activities in Virginia.

Q: What information is required on Form R-5P?

A: Form R-5P requires information about the rental income, expenses, and ownership details of the real property.

Q: When is Form R-5P due?

A: Form R-5P is generally due by May 1st of each year.

Q: Are there any penalties for late filing of Form R-5P?

A: Yes, there are penalties for late filing of Form R-5P. It is important to file the form on time to avoid penalties and interest.

Q: Do I need to attach any additional documents to Form R-5P?

A: Yes, you may need to attach supporting documents such as rental income statements and expense receipts to Form R-5P.

Q: Is Form R-5P applicable to residents of Virginia?

A: No, Form R-5P is specifically for nonresident real property owner shareholder/partners in Virginia.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5P by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.