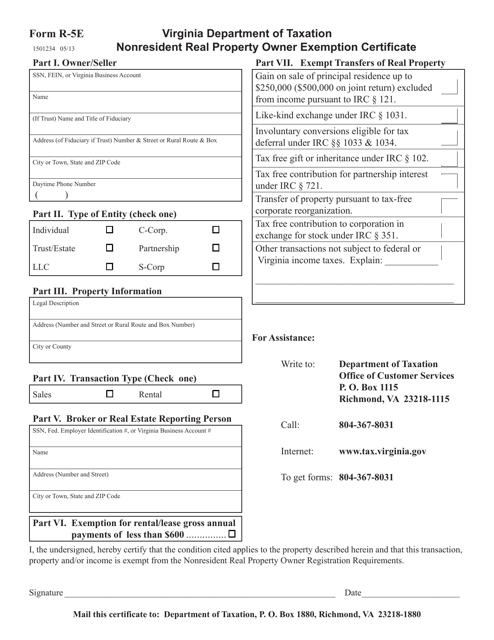

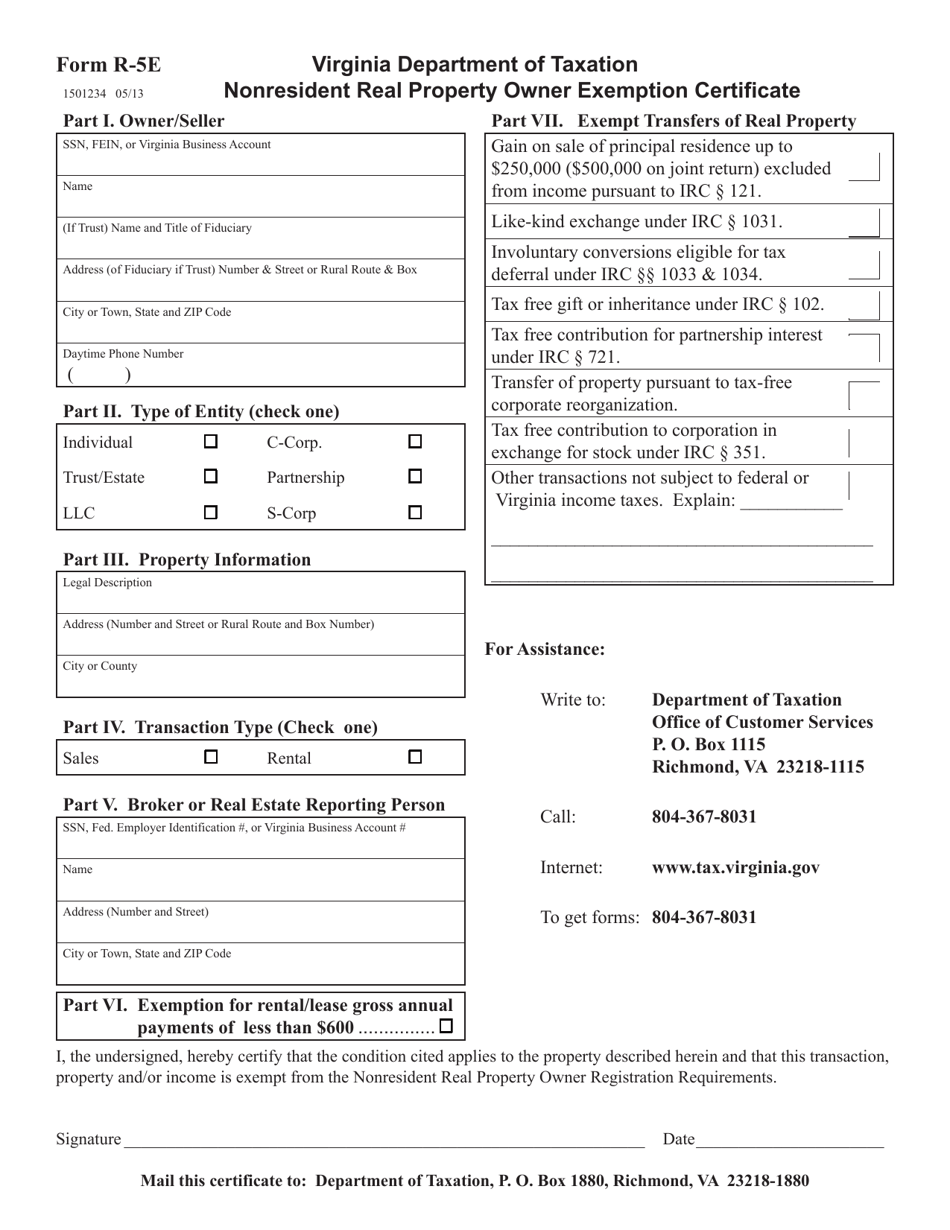

Form R-5E Nonresident Real Property Owner Exemption Certificate - Virginia

What Is Form R-5E?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form R-5E?

A: The Form R-5E is a Nonresident Real Property Owner Exemption Certificate.

Q: Who needs to use the Form R-5E?

A: Nonresident real property owners in Virginia need to use the Form R-5E.

Q: What is the purpose of the Form R-5E?

A: The purpose of the Form R-5E is to claim exemption from withholding on rental income.

Q: What information do I need to provide on the Form R-5E?

A: You will need to provide your personal information, property details, and certification on the Form R-5E.

Q: When should I submit the Form R-5E?

A: You should submit the Form R-5E to the Virginia Department of Taxation before the first rental payment is made.

Q: Is there a fee for filing the Form R-5E?

A: No, there is no fee for filing the Form R-5E.

Q: How long is the exemption valid for?

A: The exemption is valid for one year.

Q: What should I do if my circumstances change and I no longer qualify for the exemption?

A: If your circumstances change and you no longer qualify for the exemption, you should notify the Virginia Department of Taxation immediately.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5E by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.