This version of the form is not currently in use and is provided for reference only. Download this version of

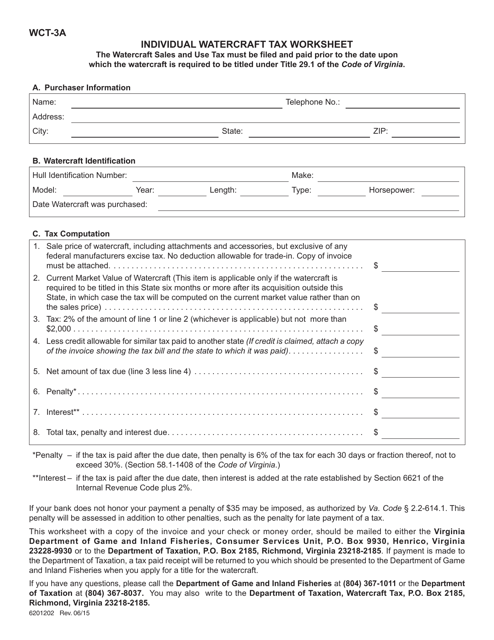

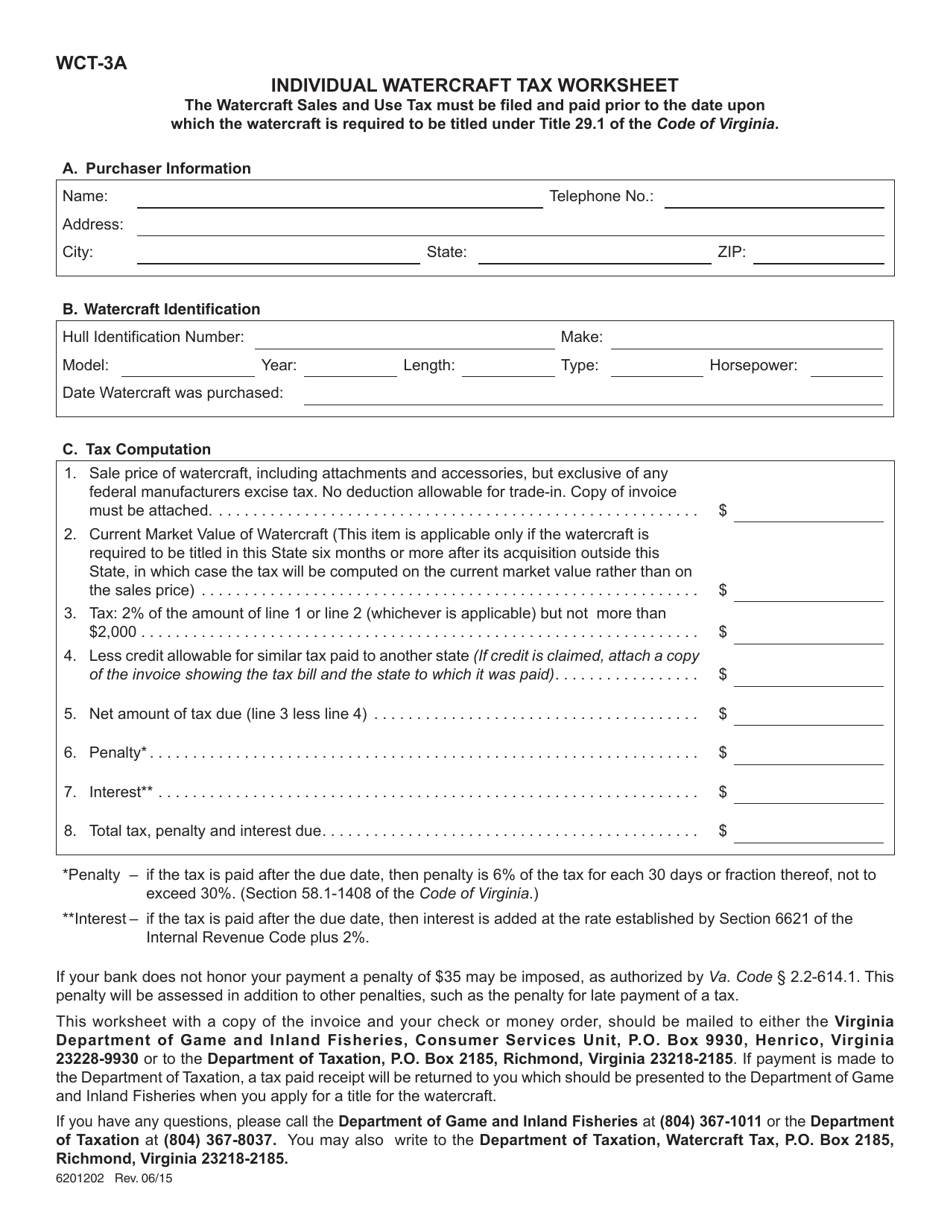

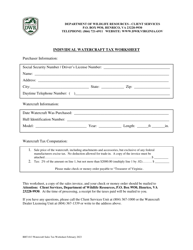

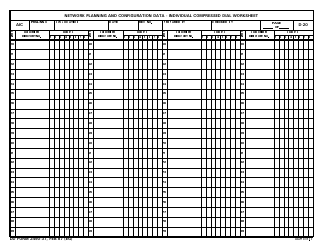

Form WCT-3A

for the current year.

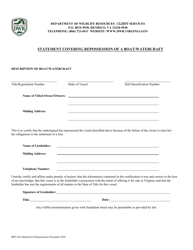

Form WCT-3A Individual Watercraft Tax Worksheet - Virginia

What Is Form WCT-3A?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WCT-3A?

A: Form WCT-3A is the Individual Watercraft Tax Worksheet.

Q: What is the purpose of Form WCT-3A?

A: Form WCT-3A is used to calculate the individual watercraft tax in Virginia.

Q: Who needs to file Form WCT-3A?

A: Anyone who owns a watercraft in Virginia and is subject to the individual watercraft tax needs to file Form WCT-3A.

Q: What information is required on Form WCT-3A?

A: Form WCT-3A requires details about the watercraft, such as its value, horsepower, and length, as well as information about the owner.

Q: When is Form WCT-3A due?

A: Form WCT-3A is due on or before January 31st of each year.

Q: Is there a fee for filing Form WCT-3A?

A: No, there is no fee for filing Form WCT-3A, but the individual watercraft tax must be paid separately.

Q: What happens if I don't file Form WCT-3A?

A: Failure to file Form WCT-3A may result in penalties and interest.

Q: Can I amend my Form WCT-3A?

A: Yes, if there are changes or corrections to be made, you can file an amended Form WCT-3A.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WCT-3A by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.