This version of the form is not currently in use and is provided for reference only. Download this version of

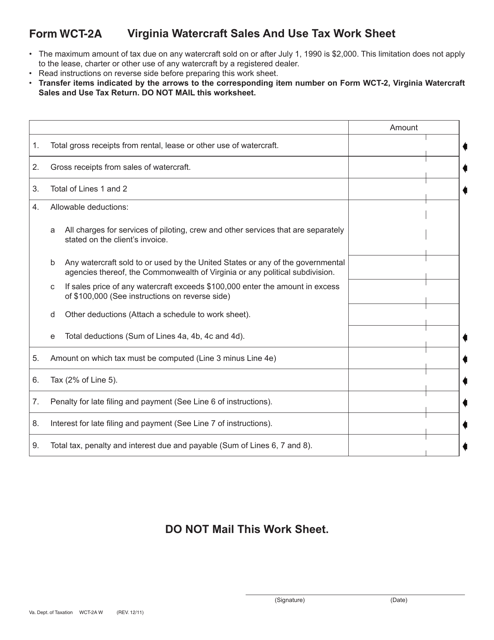

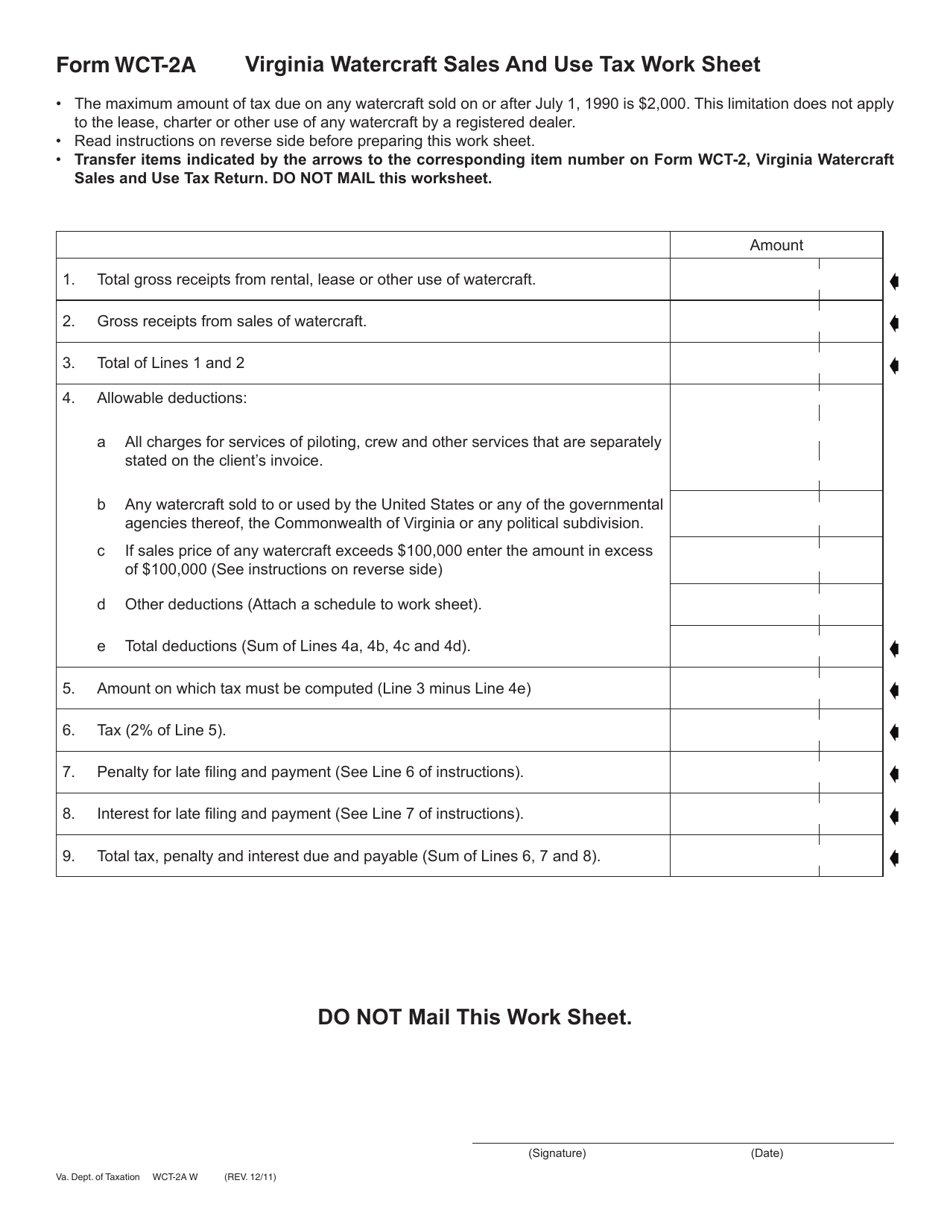

Form WCT-2A

for the current year.

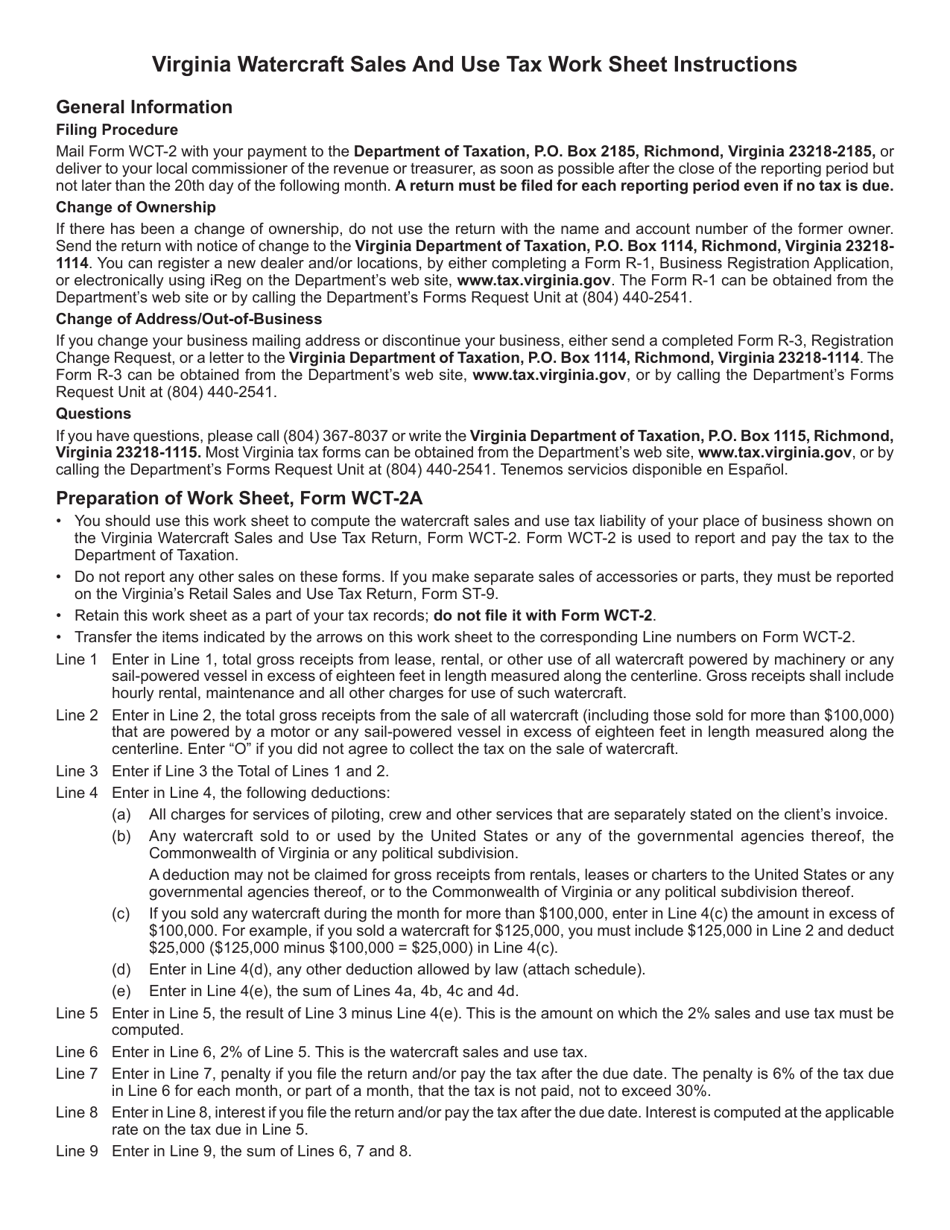

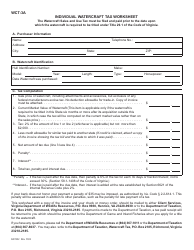

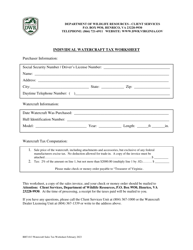

Form WCT-2A Virginia Watercraft Sales and Use Tax Worksheet - Virginia

What Is Form WCT-2A?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WCT-2A?

A: Form WCT-2A is the Virginia Watercraft Sales and Use Tax Worksheet.

Q: What is the purpose of Form WCT-2A?

A: Form WCT-2A is used to calculate the sales and use tax due on the purchase of a watercraft in Virginia.

Q: Who needs to fill out Form WCT-2A?

A: Anyone who has purchased a watercraft in Virginia and needs to calculate the sales and use tax owed must fill out Form WCT-2A.

Q: Is Form WCT-2A specific to Virginia only?

A: Yes, Form WCT-2A is specific to the state of Virginia and is used to calculate the sales and use tax for watercraft purchased in Virginia.

Q: What information do I need to fill out Form WCT-2A?

A: You will need information such as the purchase price of the watercraft, any trade-in allowances, and the local tax rate.

Q: When do I need to submit Form WCT-2A?

A: Form WCT-2A should be submitted within 30 days of purchasing the watercraft.

Q: What happens after I submit Form WCT-2A?

A: After submitting Form WCT-2A, you will receive a notice indicating the amount of sales and use tax owed.

Q: What if I don't submit Form WCT-2A?

A: Failure to submit Form WCT-2A or pay the sales and use tax can result in penalties and interest being assessed by the Virginia Department of Taxation.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WCT-2A by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.