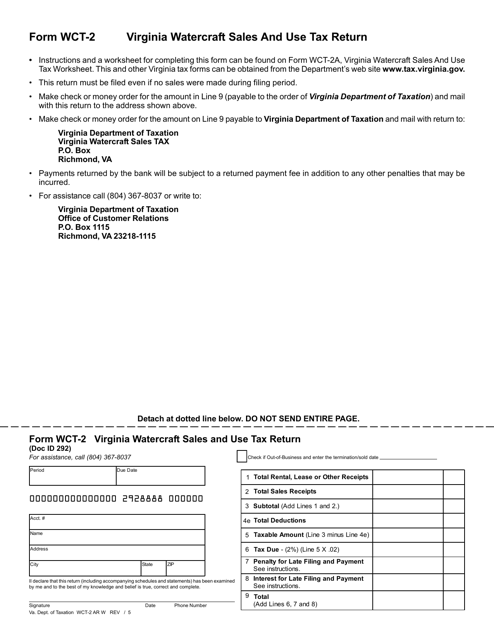

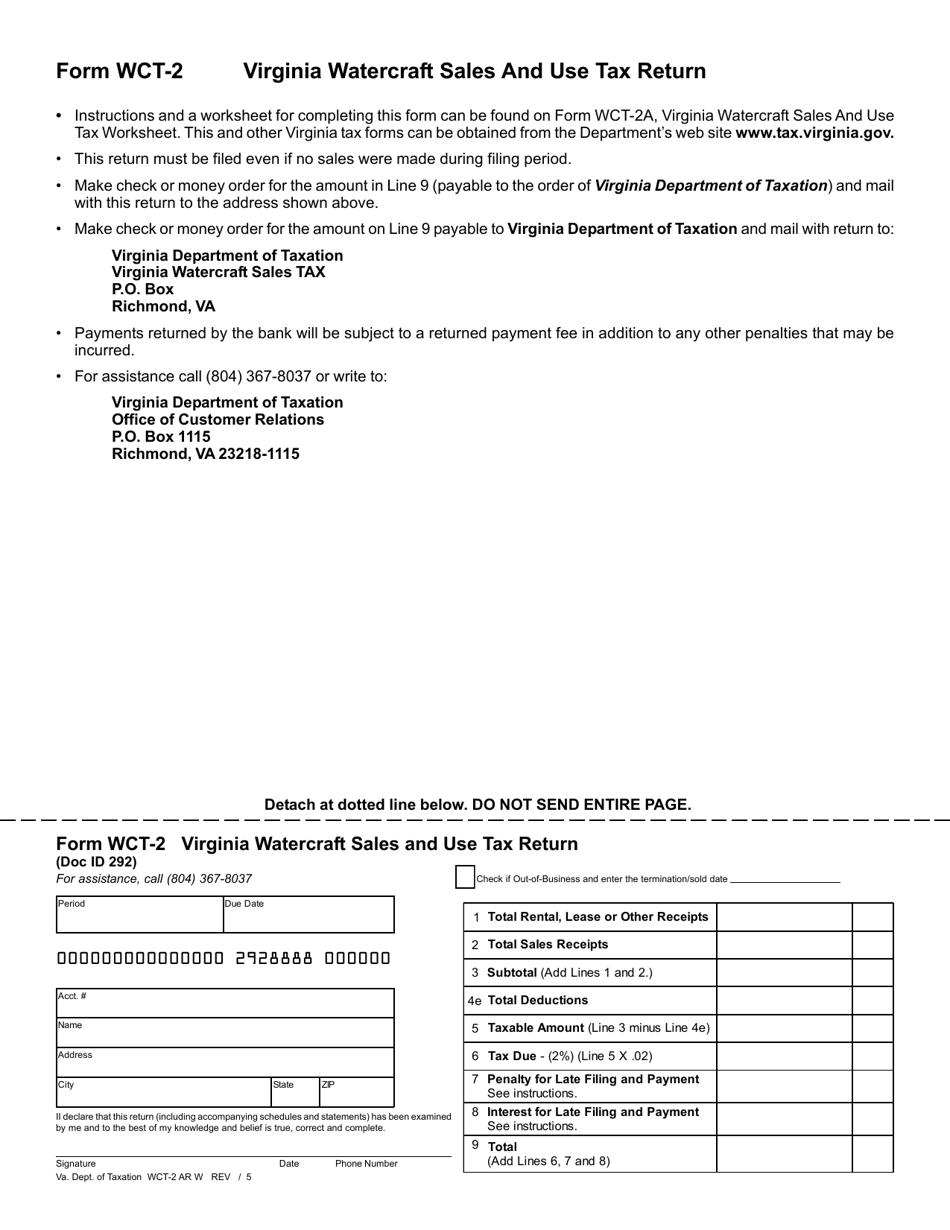

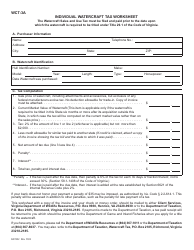

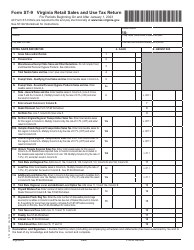

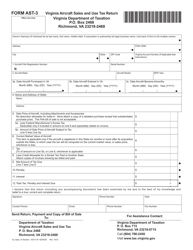

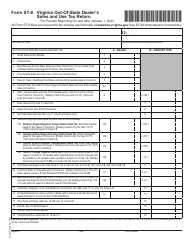

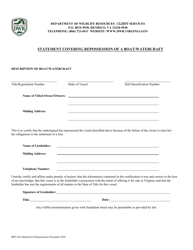

Form WCT-2 Virginia Watercraft Sales and Use Tax Return - Virginia

What Is Form WCT-2?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WCT-2?

A: Form WCT-2 is the Virginia Watercraft Sales and Use Tax Return.

Q: What is the purpose of Form WCT-2?

A: Form WCT-2 is used to report and pay the sales and use tax on watercraft purchased or used in Virginia.

Q: Who needs to file Form WCT-2?

A: Anyone who purchases or uses a watercraft in Virginia may need to file Form WCT-2.

Q: What is the sales and use tax rate for watercraft in Virginia?

A: The sales and use tax rate for watercraft in Virginia is 4.3%.

Q: When is Form WCT-2 due?

A: Form WCT-2 is due on or before the 20th day of the month following the end of the quarter in which the purchase or use occurred.

Q: What should I include with Form WCT-2?

A: You should include any supporting documentation, such as invoices or receipts, with Form WCT-2.

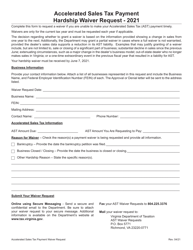

Q: What happens if I don't file Form WCT-2?

A: If you don't file Form WCT-2 or pay the sales and use tax on watercraft in Virginia, you may be subject to penalties and interest.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WCT-2 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.