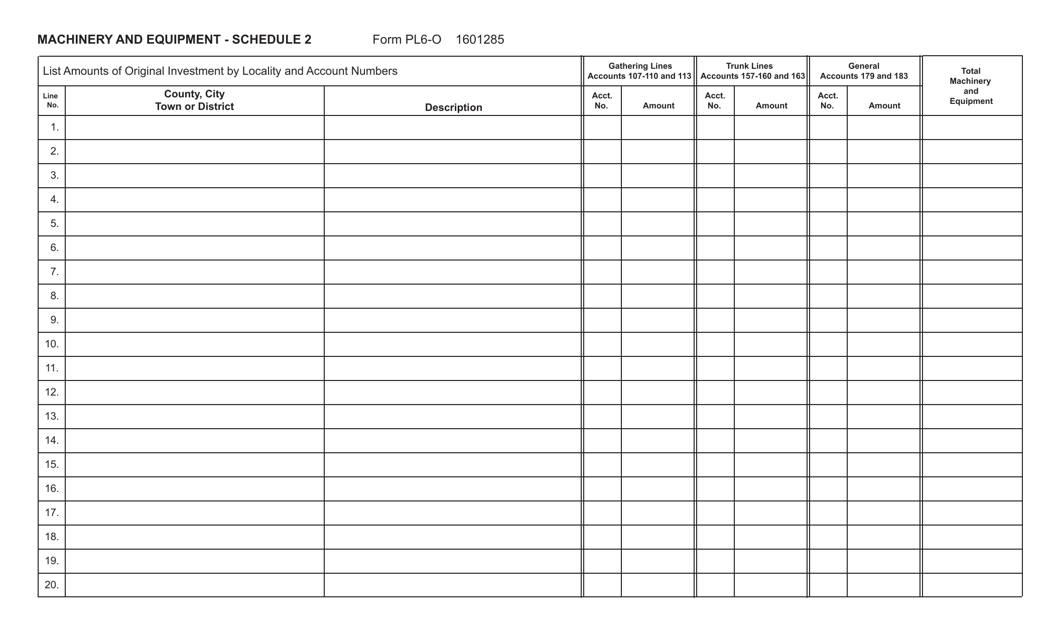

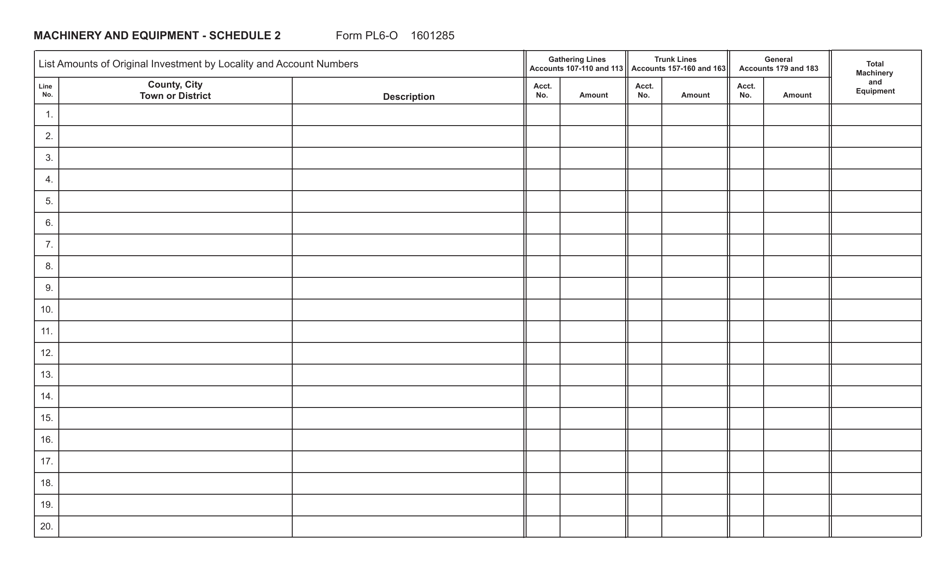

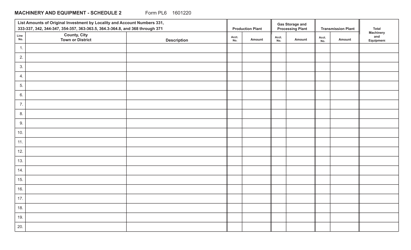

Form PL6-O Schedule 2 Machinery and Equipment - Virginia

What Is Form PL6-O Schedule 2?

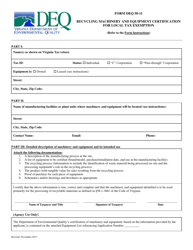

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PL6-O Schedule 2?

A: Form PL6-O Schedule 2 is a document related to property tax assessments in Virginia.

Q: What is the purpose of Form PL6-O Schedule 2?

A: The purpose of Form PL6-O Schedule 2 is to report machinery and equipment for property tax assessment purposes in Virginia.

Q: Who needs to fill out Form PL6-O Schedule 2?

A: Property owners in Virginia who own machinery and equipment are required to fill out Form PL6-O Schedule 2.

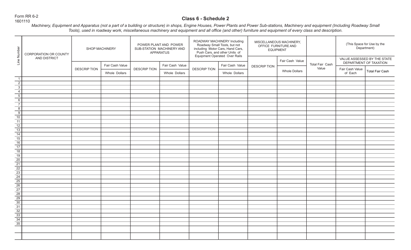

Q: What information is required on Form PL6-O Schedule 2?

A: Form PL6-O Schedule 2 requires information about the machinery and equipment, such as its description, location, and assessed value.

Q: When is Form PL6-O Schedule 2 due?

A: The due date for Form PL6-O Schedule 2 varies by jurisdiction in Virginia, so it is important to check with the local assessor's office for the specific deadline.

Q: Are there any penalties for not filing Form PL6-O Schedule 2?

A: Failure to file Form PL6-O Schedule 2 or filing it late may result in penalties or fines imposed by the local jurisdiction in Virginia.

Q: Can I appeal the assessment of machinery and equipment on Form PL6-O Schedule 2?

A: Yes, property owners in Virginia have the right to appeal the assessment of their machinery and equipment by following the procedures outlined by the local jurisdiction.

Q: Is there a fee for filing Form PL6-O Schedule 2?

A: There is typically no fee for filing Form PL6-O Schedule 2, but it is advisable to check with the local assessor's office for any specific requirements or fees.

Form Details:

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PL6-O Schedule 2 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.