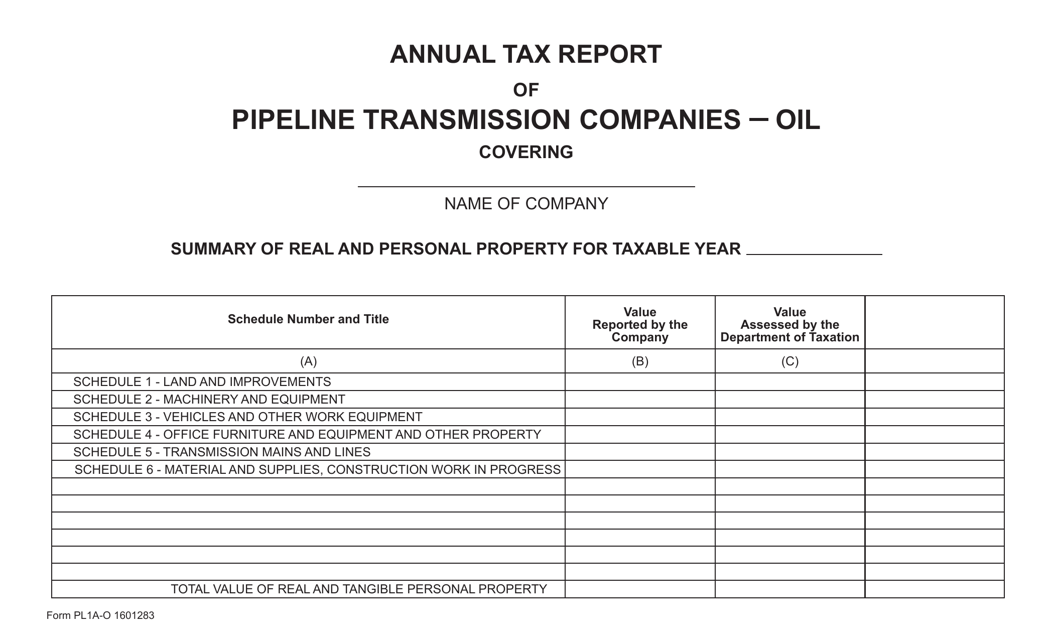

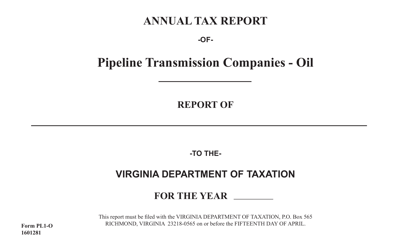

Form PL1A-O Annual Tax Report of Pipeline Transmission Companies - Oil - Virginia

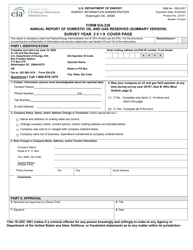

What Is Form PL1A-O?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PL1A-O?

A: Form PL1A-O is the Annual Tax Report for Pipeline Transmission Companies - Oil in Virginia.

Q: Who needs to file Form PL1A-O?

A: Pipeline Transmission Companies involved in the transportation of oil in Virginia need to file Form PL1A-O.

Q: What is the purpose of Form PL1A-O?

A: The purpose of Form PL1A-O is to report the annual tax information for pipeline transmission companies in the oil industry.

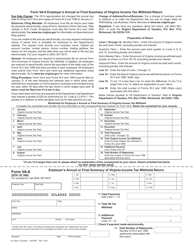

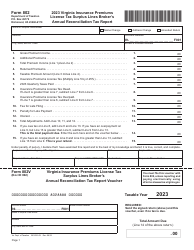

Q: What information is required on Form PL1A-O?

A: Form PL1A-O requires the company's financial data, operating revenues, operating expenses, taxable income, tax due, and other relevant information.

Q: When is the deadline to file Form PL1A-O?

A: The deadline to file Form PL1A-O is usually on or before the 15th day of the third month following the close of the company's fiscal year.

Q: Are there any penalties for not filing Form PL1A-O?

A: Yes, there are penalties for not filing Form PL1A-O, including late filing penalties and interest charges on the tax due.

Q: Is there any fee to file Form PL1A-O?

A: No, there is no fee to file Form PL1A-O.

Q: What should I do if I have questions about Form PL1A-O?

A: If you have questions about Form PL1A-O, you should contact the Virginia Department of Taxation for assistance.

Form Details:

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PL1A-O by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.