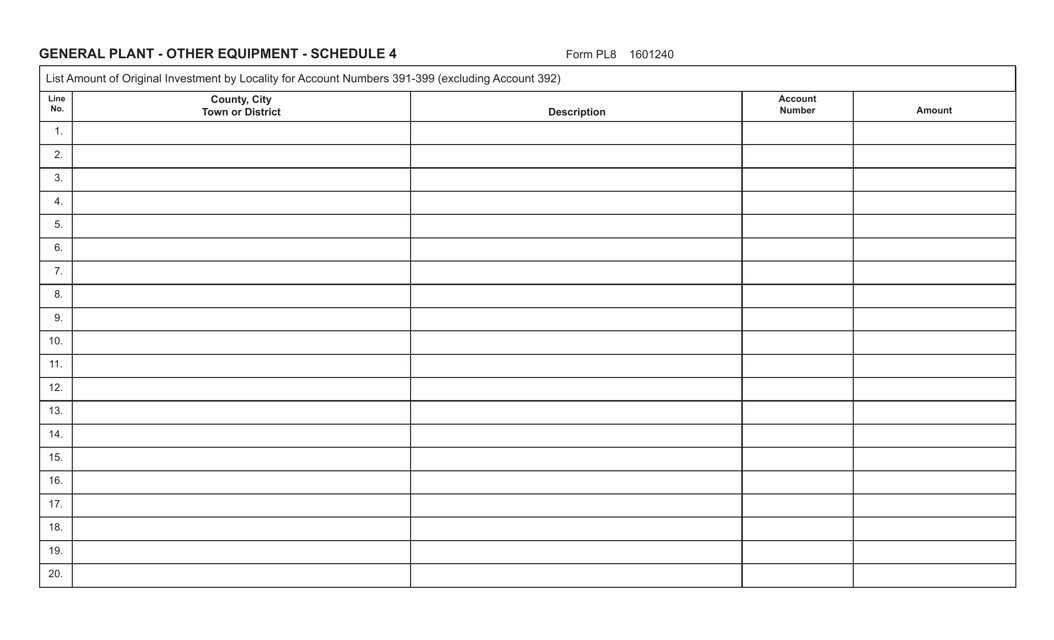

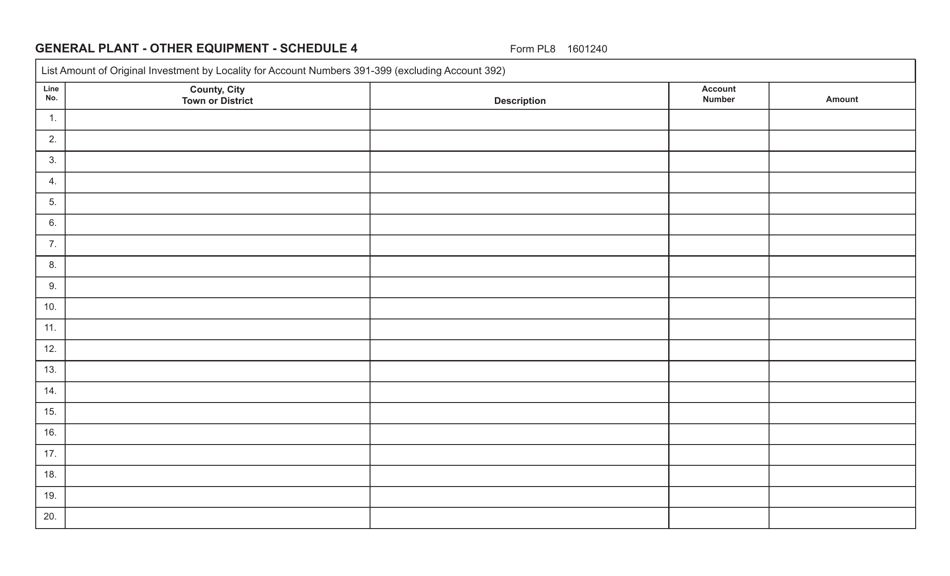

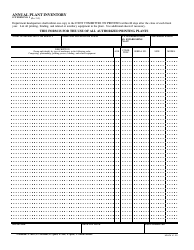

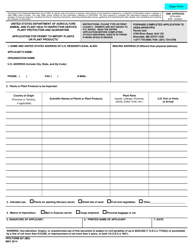

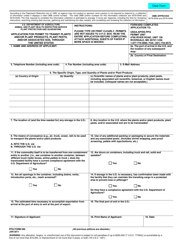

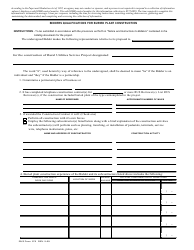

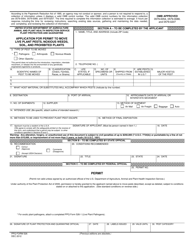

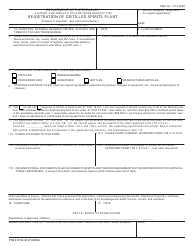

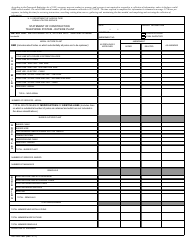

Form PL8 Schedule 4 General Plant - Other Equipment - Virginia

What Is Form PL8 Schedule 4?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a PL8 Schedule 4?

A: PL8 Schedule 4 refers to a reporting form used to document general plant and other equipment in Virginia.

Q: What does General Plant mean?

A: General Plant refers to the various equipment and machinery used by a business or organization for its operations.

Q: What type of equipment is included in PL8 Schedule 4?

A: PL8 Schedule 4 includes equipment other than vehicles, such as machinery, tools, computers, and other assets used for business purposes.

Q: Is PL8 Schedule 4 specific to Virginia?

A: Yes, PL8 Schedule 4 is specific to Virginia and is used for reporting equipment and assets in the state.

Q: Do I need to fill out PL8 Schedule 4?

A: If you own or operate a business in Virginia and have general plant and other equipment, you may need to fill out PL8 Schedule 4 for reporting purposes.

Q: What information is required for PL8 Schedule 4?

A: PL8 Schedule 4 requires information such as the description, quantity, year acquired, cost, and other details of the equipment being reported.

Q: Can I report vehicles on PL8 Schedule 4?

A: No, PL8 Schedule 4 is specifically for reporting general plant and other equipment, not vehicles. Vehicles are reported on different forms such as PL8 Schedule 1 or PL8 Schedule 2.

Form Details:

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PL8 Schedule 4 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.