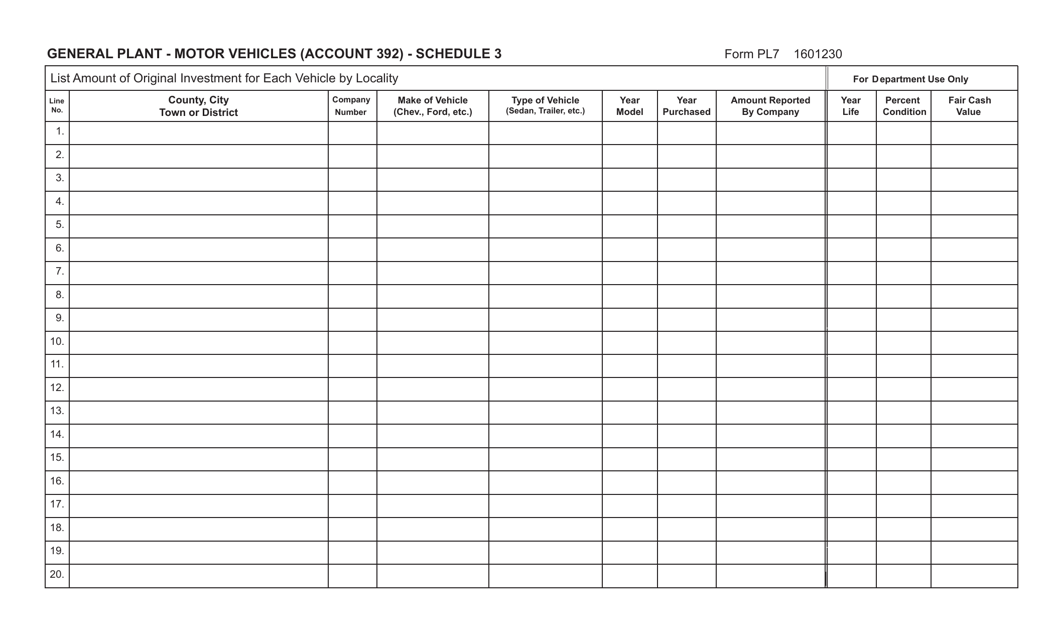

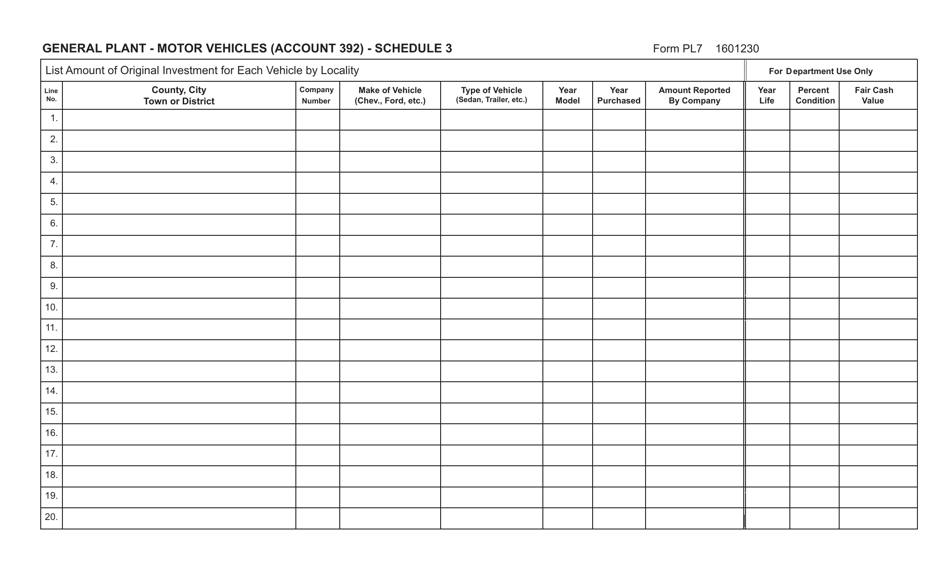

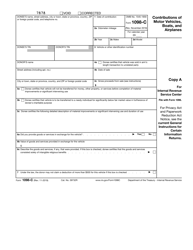

Form PL7 Schedule 3 General Plant - Motor Vehicles (Account 392) - Virginia

What Is Form PL7 Schedule 3?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PL7 Schedule 3?

A: Form PL7 Schedule 3 is a tax form related to general plant motor vehicles in Virginia.

Q: What is Account 392?

A: Account 392 is a specific accounting category related to motor vehicles in Virginia.

Q: What is the purpose of Form PL7 Schedule 3?

A: The purpose of Form PL7 Schedule 3 is to report and track general plant motor vehicles for tax purposes in Virginia.

Q: Who needs to fill out Form PL7 Schedule 3?

A: Businesses and individuals who own or use general plant motor vehicles in Virginia need to fill out this form.

Q: Are there any deadlines for filing Form PL7 Schedule 3?

A: Yes, the deadlines for filing Form PL7 Schedule 3 are determined by the Virginia Department of Taxation and may vary.

Q: Is there a penalty for not filing Form PL7 Schedule 3?

A: Yes, failure to file or late filing of Form PL7 Schedule 3 may result in penalties imposed by the Virginia Department of Taxation.

Q: What information is required to fill out Form PL7 Schedule 3?

A: Some information required to fill out Form PL7 Schedule 3 includes the description and value of the motor vehicles, as well as other relevant details.

Q: Are there any additional supporting documents required with Form PL7 Schedule 3?

A: Depending on the specific circumstances, additional supporting documents such as vehicle registrations, sales records, or lease agreements may be required to accompany Form PL7 Schedule 3.

Form Details:

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PL7 Schedule 3 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.