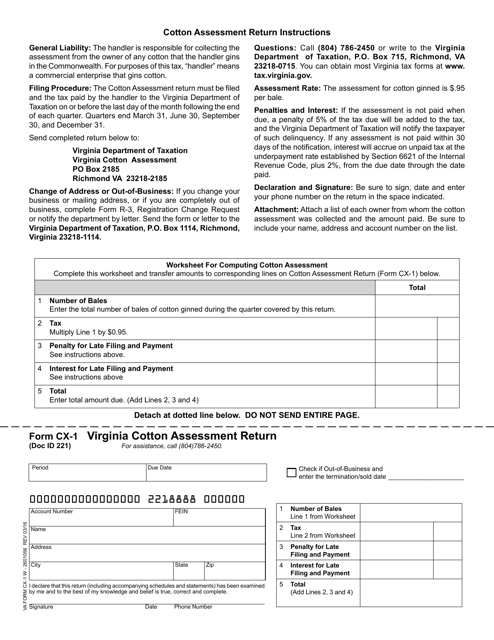

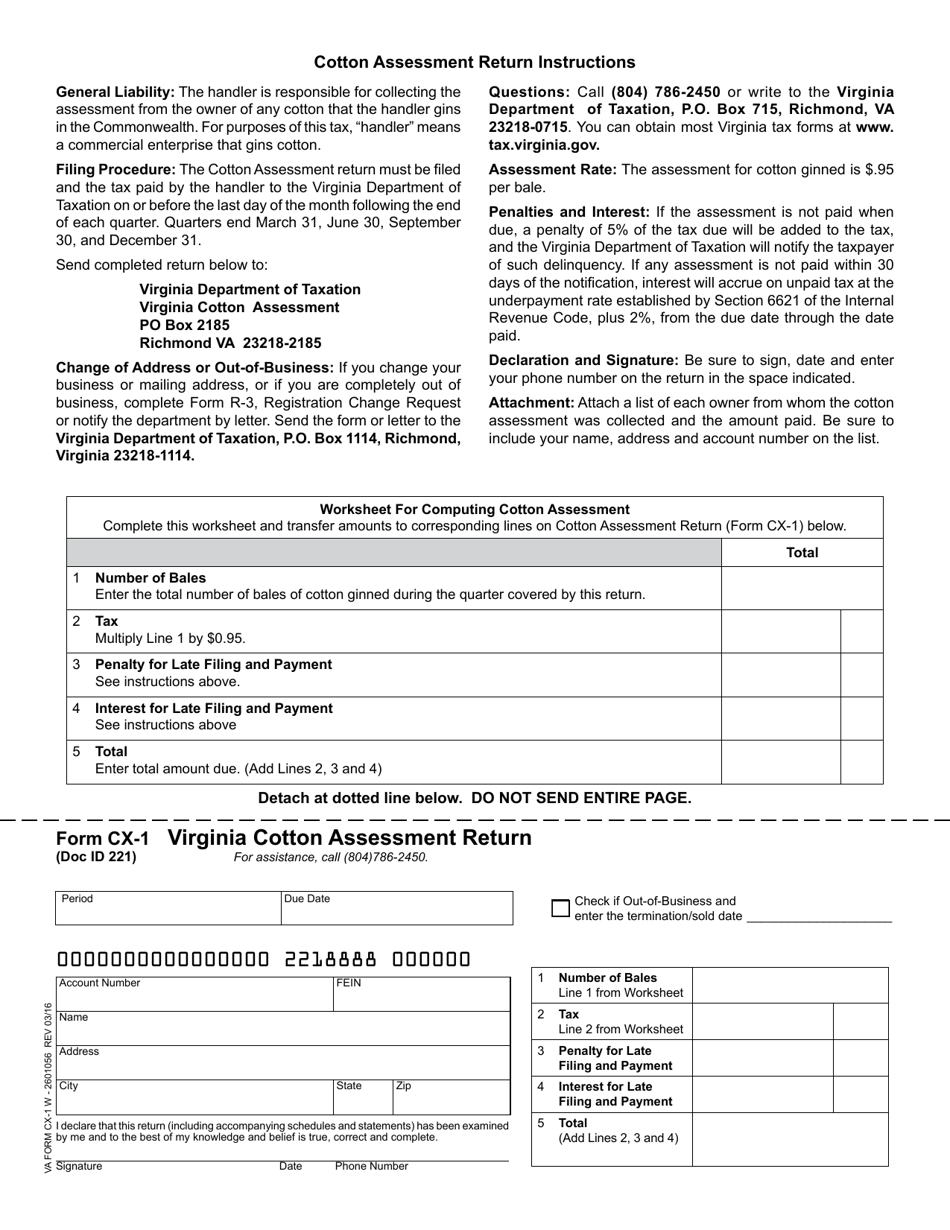

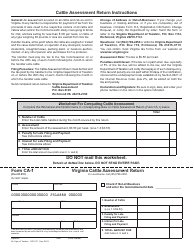

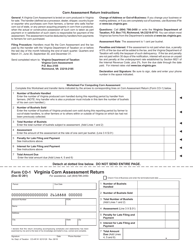

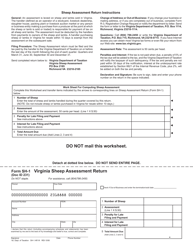

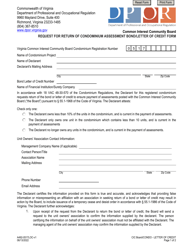

Form CX-1 Virginia Cotton Assessment Return - Virginia

What Is Form CX-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CX-1?

A: Form CX-1 is the Virginia Cotton Assessment Return.

Q: Who needs to file Form CX-1?

A: Farmers who grow or produce cotton in Virginia need to file Form CX-1.

Q: What is the purpose of Form CX-1?

A: Form CX-1 is used to report the cotton production and pay the required assessment to the Virginia Cotton Board.

Q: When is Form CX-1 due?

A: Form CX-1 is due on or before January 31st of the following year.

Q: How can Form CX-1 be filed?

A: Form CX-1 can be filed electronically or by mail.

Q: What information is required on Form CX-1?

A: Form CX-1 requires the farmer to provide information about the cotton acreage, harvested bales, and other production details.

Q: Is there any penalty for not filing Form CX-1?

A: Yes, failure to file Form CX-1 may result in penalties or legal action.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CX-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.