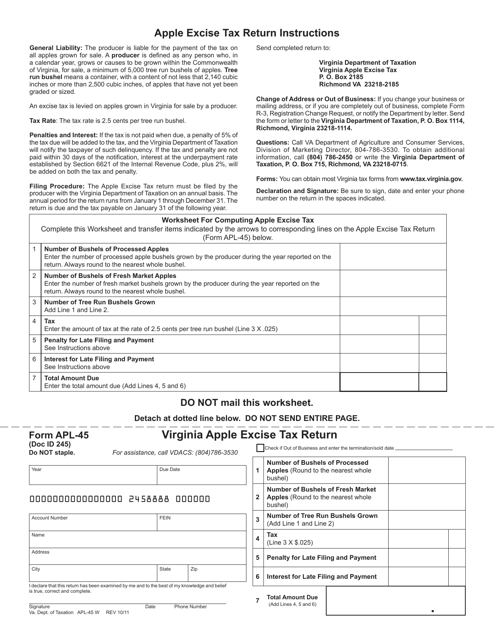

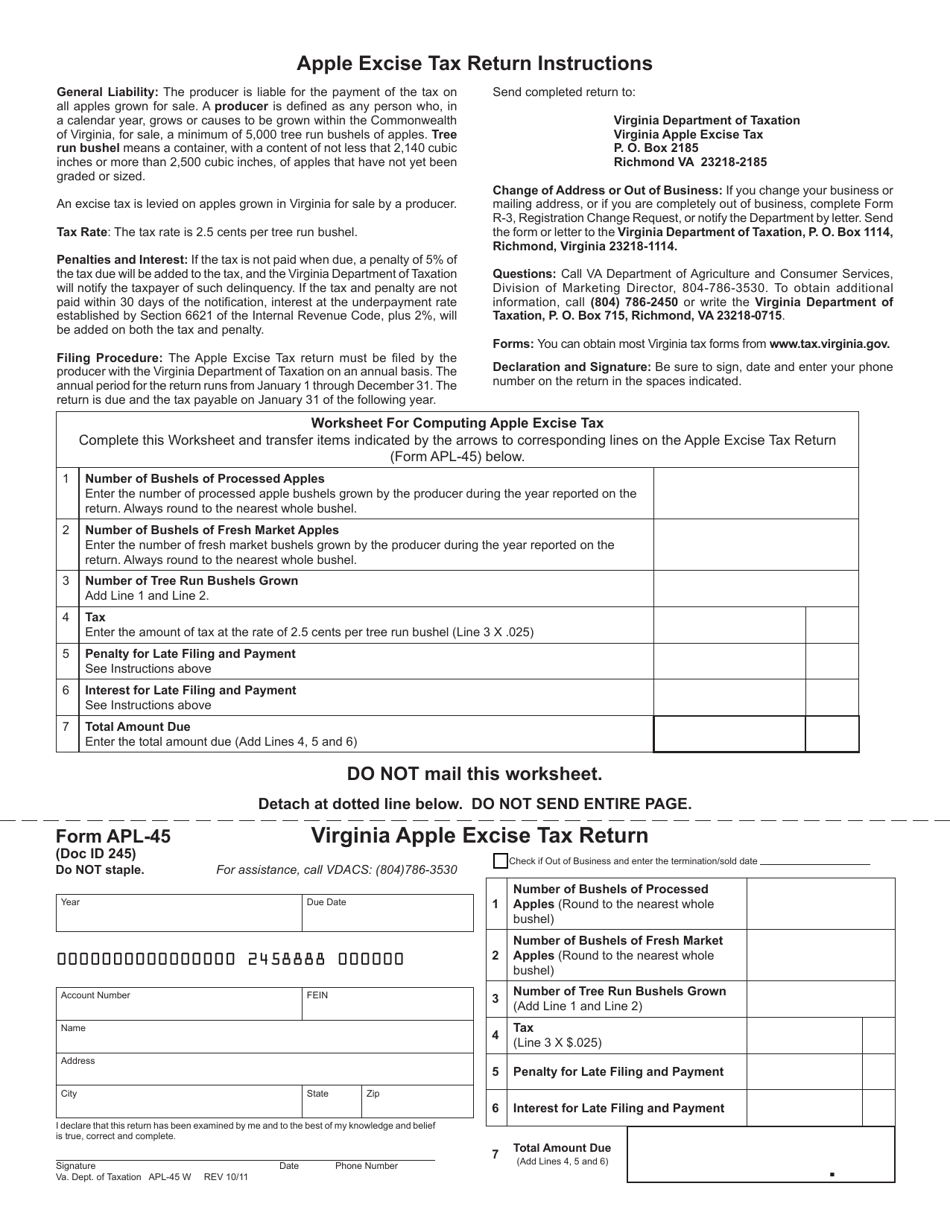

Form APL-45 Virginia Apple Excise Tax Return - Virginia

What Is Form APL-45?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the APL-45 Virginia Apple Excise Tax Return?

A: The APL-45 Virginia Apple Excise Tax Return is a form used in Virginia to report and pay the excise tax on apples.

Q: What is an excise tax?

A: An excise tax is a tax imposed on specific goods or activities, such as the sale of apples.

Q: Who needs to file the APL-45 Virginia Apple Excise Tax Return?

A: Anyone engaged in the business of selling apples in Virginia needs to file this tax return.

Q: How often do I need to file the APL-45 Virginia Apple Excise Tax Return?

A: This tax return is filed on a quarterly basis, meaning four times a year.

Q: How do I file the APL-45 Virginia Apple Excise Tax Return?

A: The form can be filed electronically or by mail, following the instructions provided on the form.

Q: What information do I need to provide on the APL-45 Virginia Apple Excise Tax Return?

A: You will need to provide information about the quantity and value of apples sold during the reporting period.

Q: Is there a deadline for filing the APL-45 Virginia Apple Excise Tax Return?

A: Yes, the return must be filed on or before the 20th day of the month following the end of the reporting period.

Form Details:

- Released on October 1, 2011;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APL-45 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.