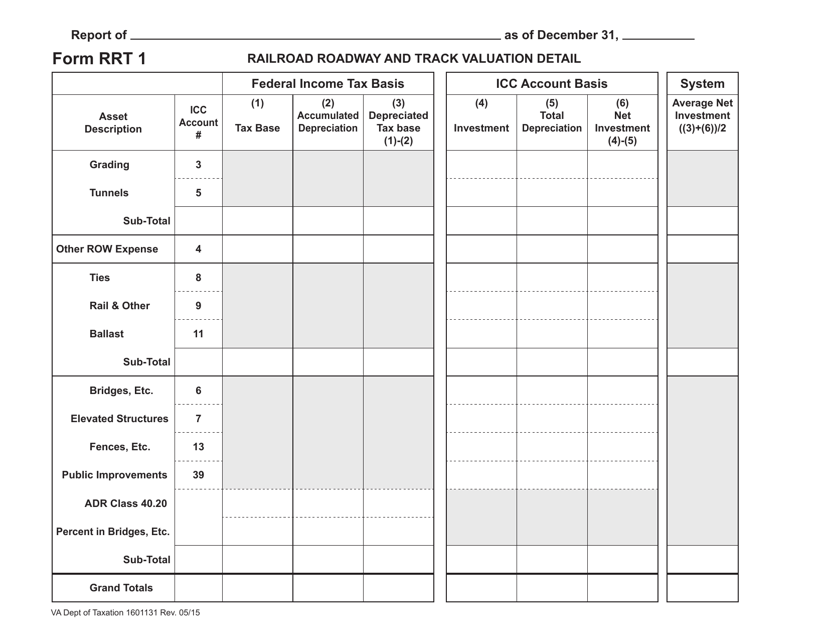

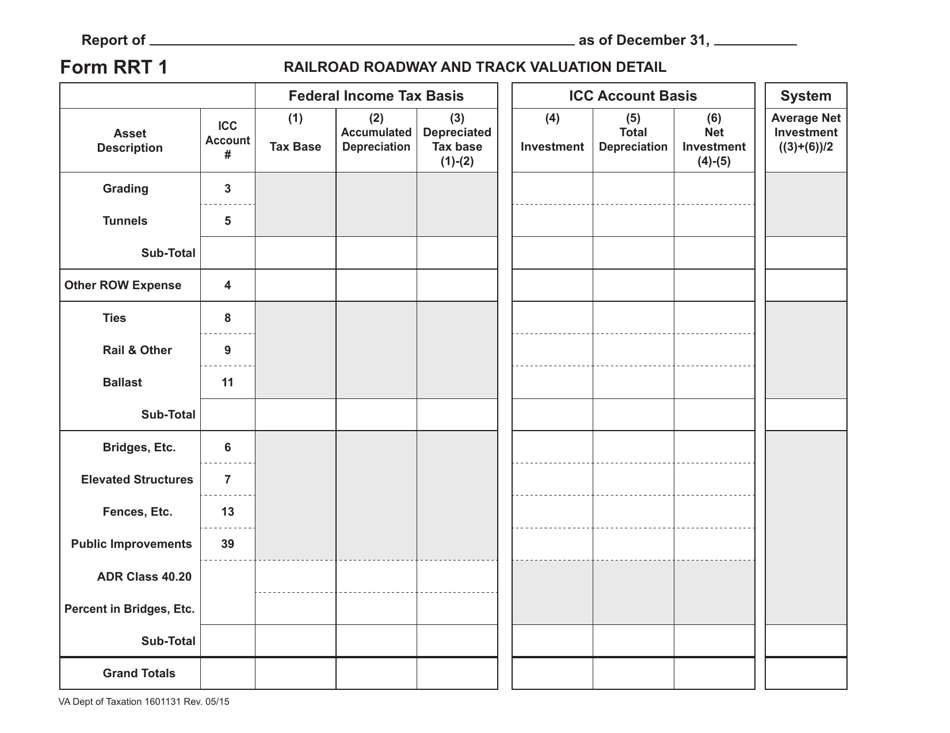

Form RRT1 Railroad Roadway and Track Valuation Detail - Virginia

What Is Form RRT1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RRT1?

A: The Form RRT1 is the Railroad Roadway and Track Valuation Detail form.

Q: What does the Form RRT1 capture?

A: The Form RRT1 captures information about the valuation of railroad roadway and track in Virginia.

Q: What is the purpose of the Form RRT1?

A: The purpose of the Form RRT1 is to provide a detailed valuation of the railroad roadway and track in Virginia.

Q: Who uses the Form RRT1?

A: The Form RRT1 is used by entities involved in the valuation of railroad roadway and track in Virginia, such as transport agencies and regulatory bodies.

Q: Why is the valuation of railroad roadway and track important?

A: Valuing railroad roadway and track is important for assessing the value of the rail infrastructure, determining fair compensation for landowners, and making informed decisions about infrastructure investments.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RRT1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.