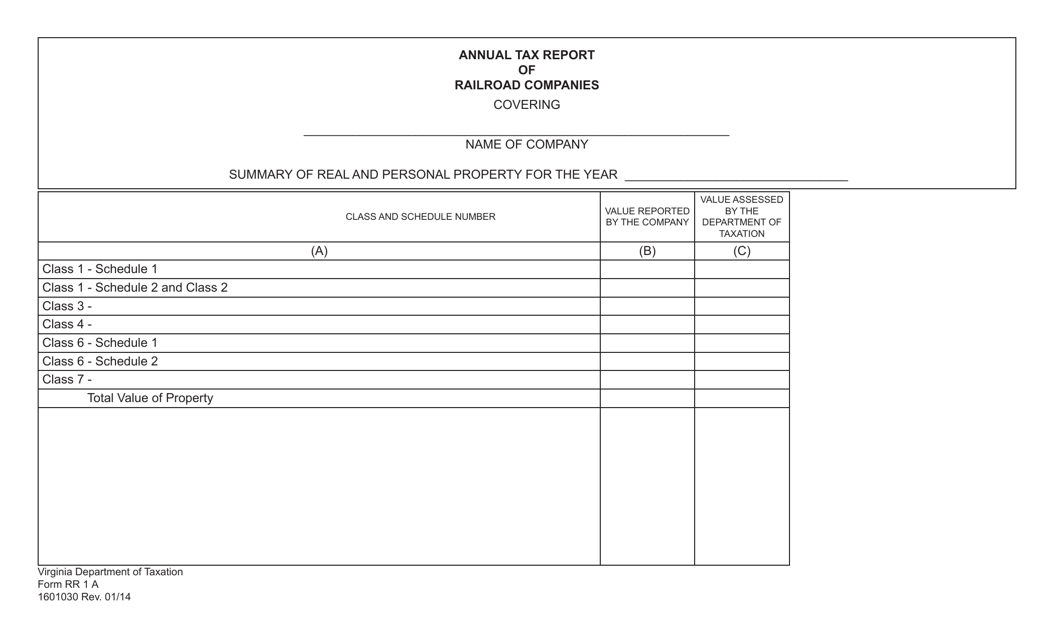

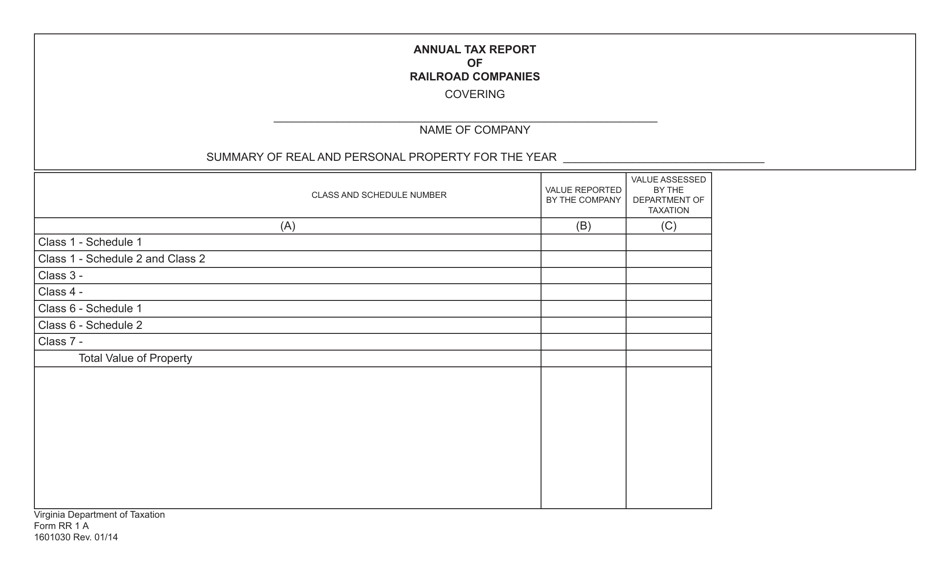

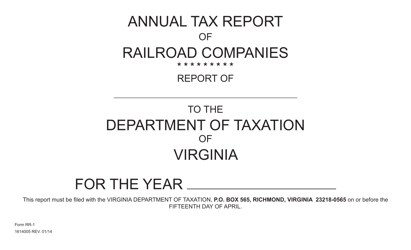

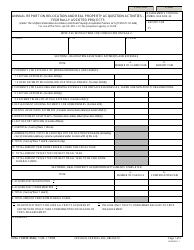

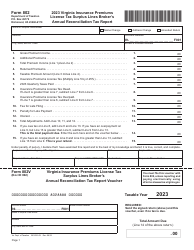

Form RR1 A Annual Tax Report of Railroad Companies Summary of Real and Personal Property - Virginia

What Is Form RR1 A?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RR1 A?

A: Form RR1 A is the Annual Tax Report of Railroad Companies.

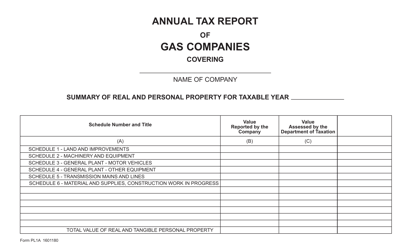

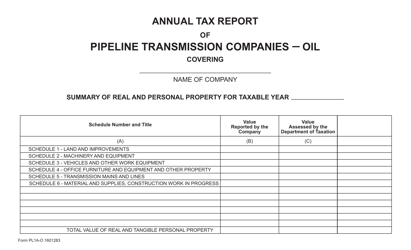

Q: What information does Form RR1 A provide?

A: Form RR1 A provides a summary of real and personal property related to railroad companies in Virginia.

Q: Who needs to file Form RR1 A?

A: Railroad companies in Virginia need to file Form RR1 A.

Q: What is the purpose of Form RR1 A?

A: The purpose of Form RR1 A is to report the value of real and personal property owned by railroad companies for tax assessment purposes.

Q: When does Form RR1 A need to be filed?

A: Form RR1 A needs to be filed annually.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RR1 A by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.