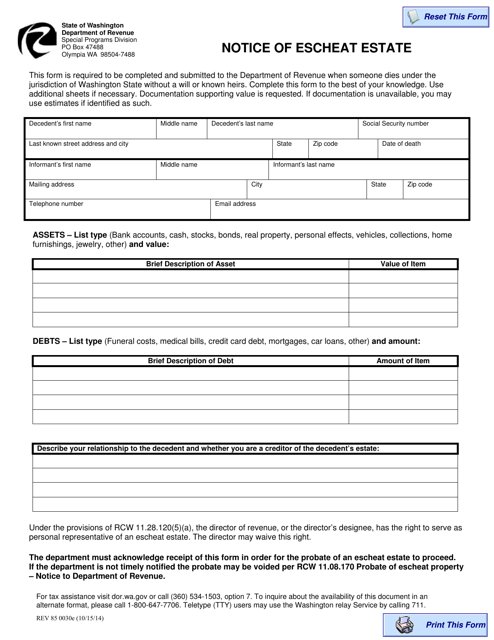

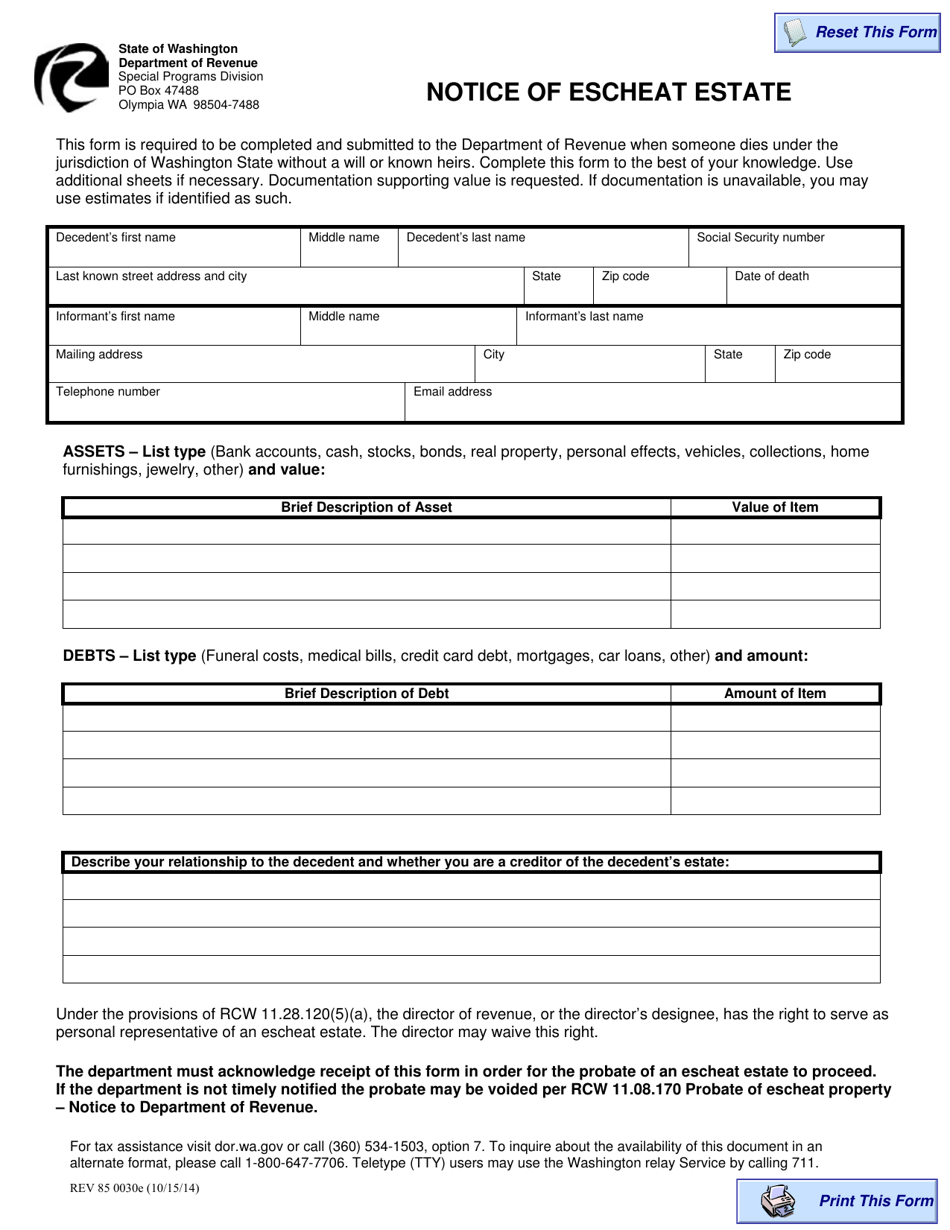

Form REV85 0030E Notice of Escheat Estate - Washington

What Is Form REV85 0030E?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV85 0030E?

A: Form REV85 0030E is a Notice of Escheat Estate specifically for the state of Washington.

Q: What is Escheat?

A: Escheat is the process by which unclaimed property is turned over to the state.

Q: Who needs to file Form REV85 0030E?

A: The personal representative of an estate in Washington needs to file Form REV85 0030E.

Q: When should Form REV85 0030E be filed?

A: Form REV85 0030E should be filed within 30 days of the closing of an estate.

Q: What information is required on Form REV85 0030E?

A: Form REV85 0030E requires information about the deceased person, the personal representative, and the assets of the estate.

Q: Are there any fees associated with filing Form REV85 0030E?

A: There are no fees associated with filing Form REV85 0030E in Washington.

Q: What happens after I file Form REV85 0030E?

A: After you file Form REV85 0030E, the state will review the information and take custody of any unclaimed property.

Q: Is Form REV85 0030E specific to Washington state?

A: Yes, Form REV85 0030E is specific to Washington state and cannot be used for estates in other states.

Q: What are the consequences of not filing Form REV85 0030E?

A: Failure to file Form REV85 0030E can result in penalties and interest charges imposed by the state.

Form Details:

- Released on October 15, 2014;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV85 0030E by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.