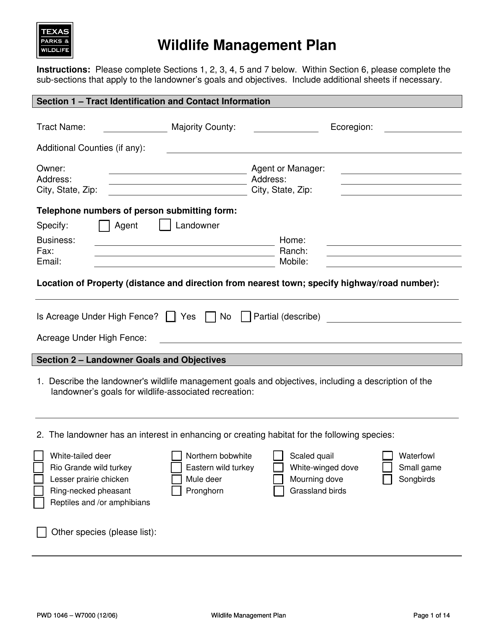

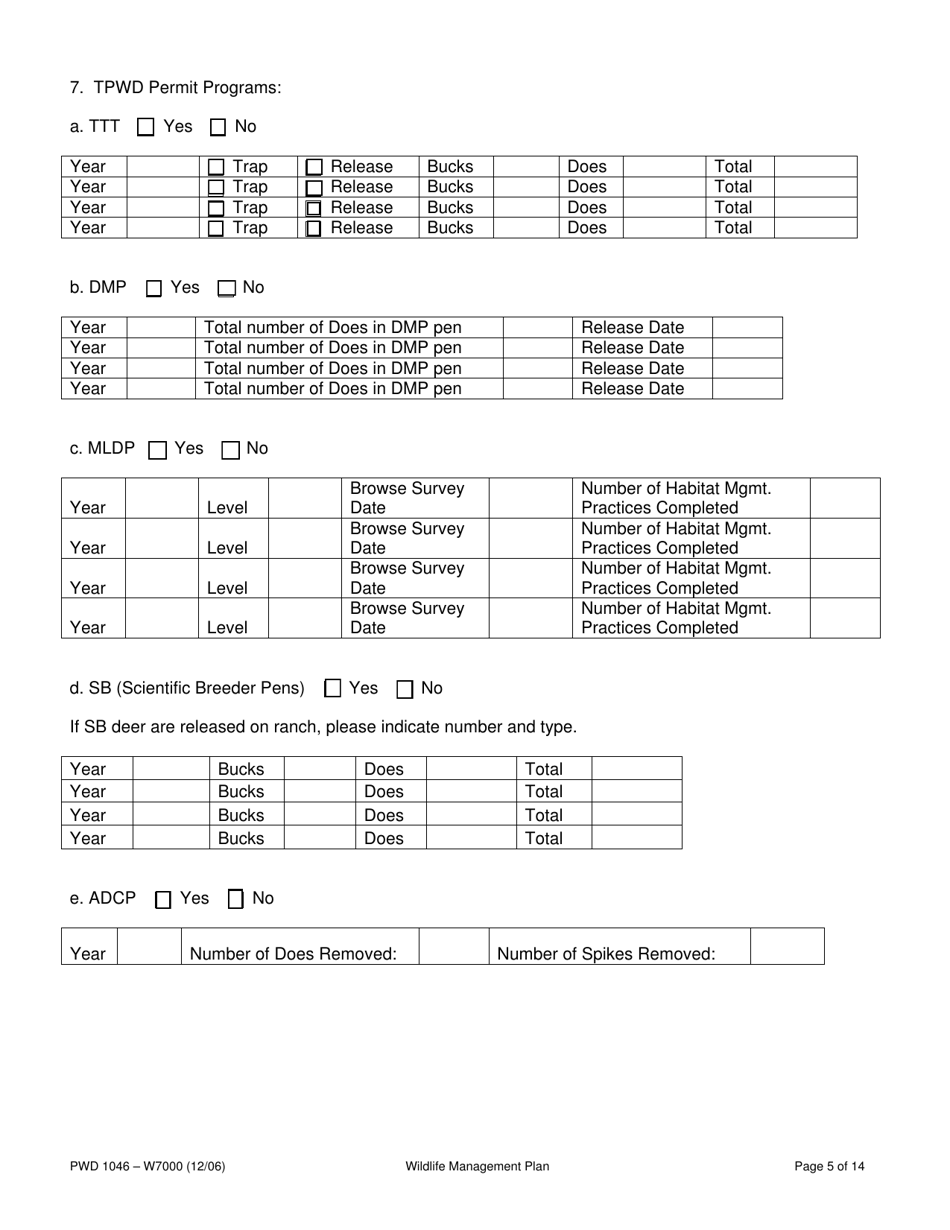

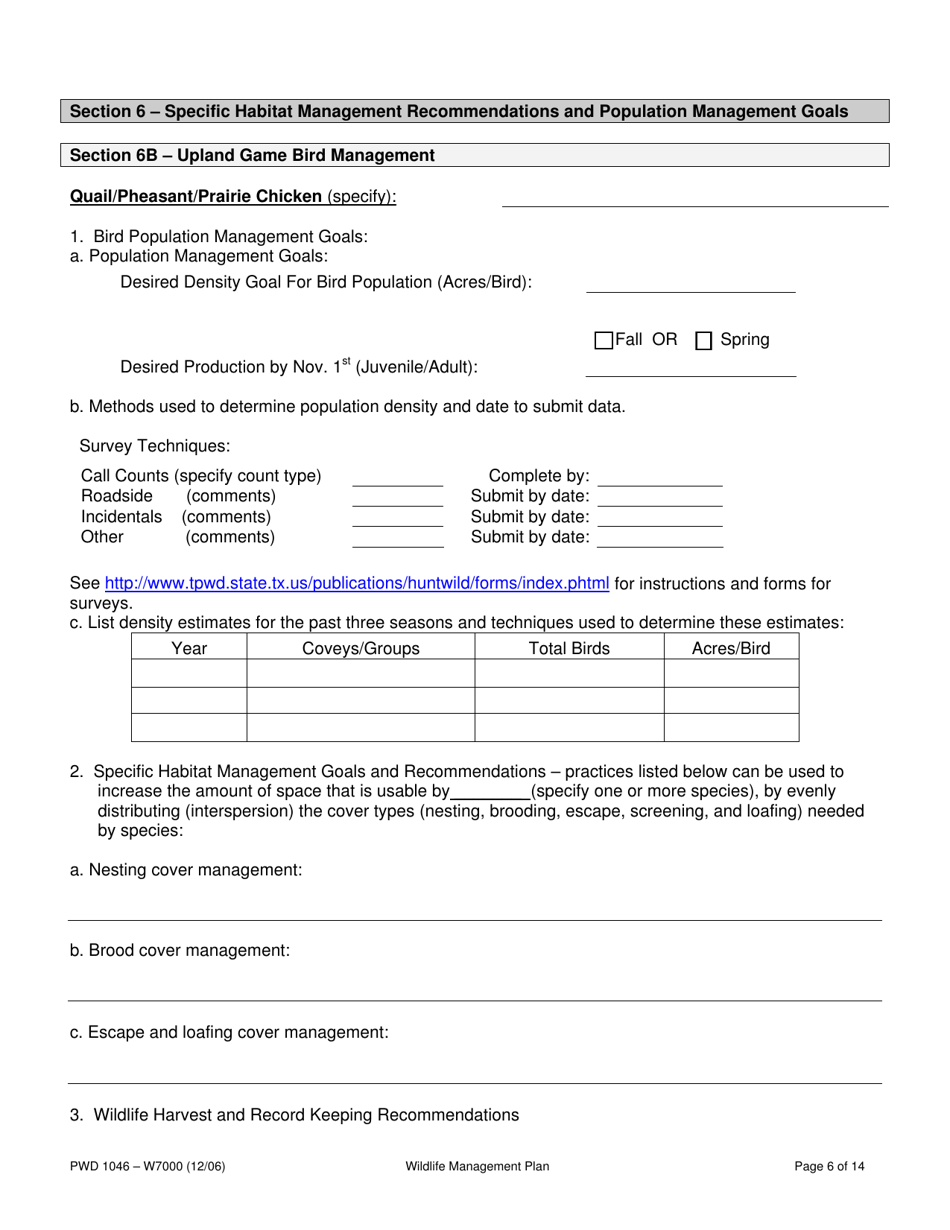

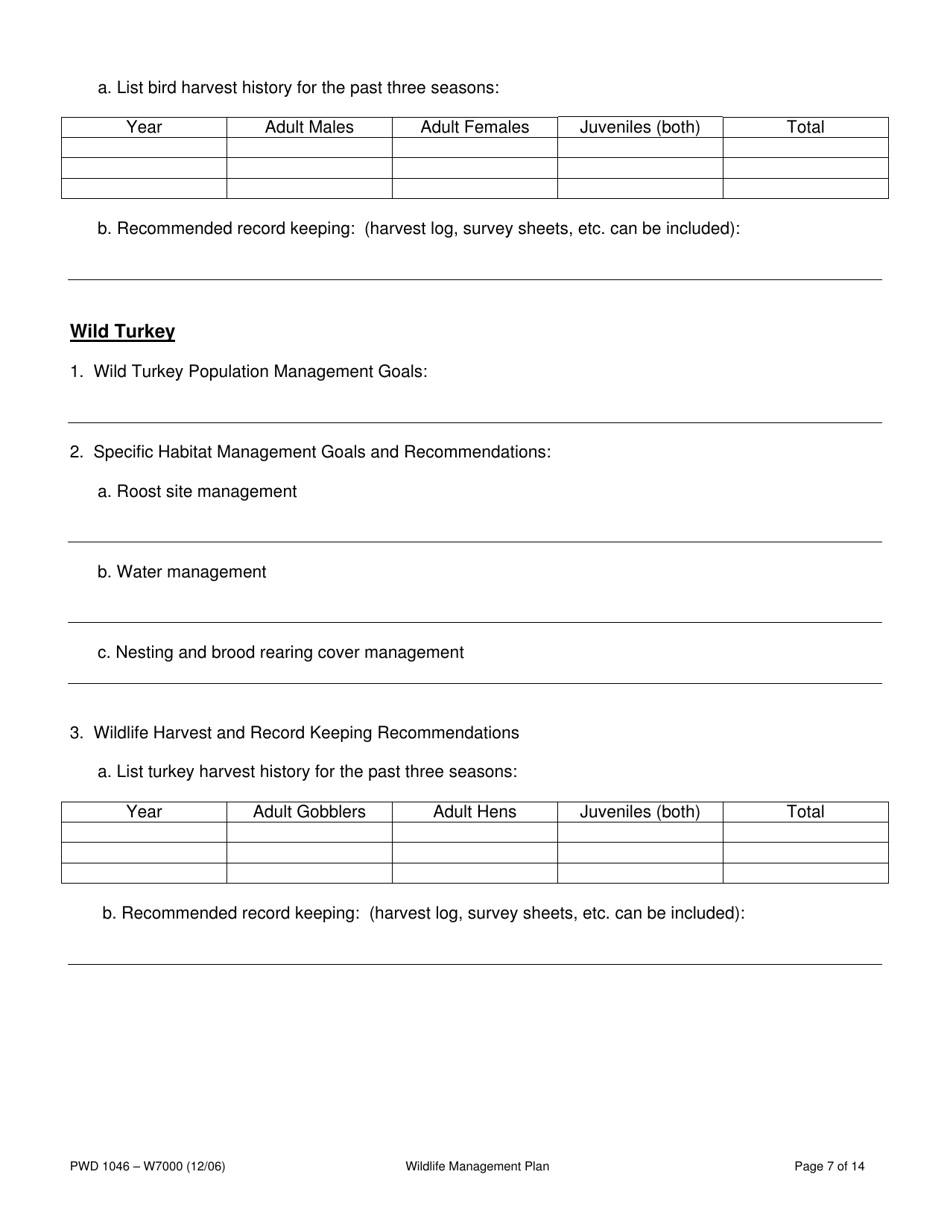

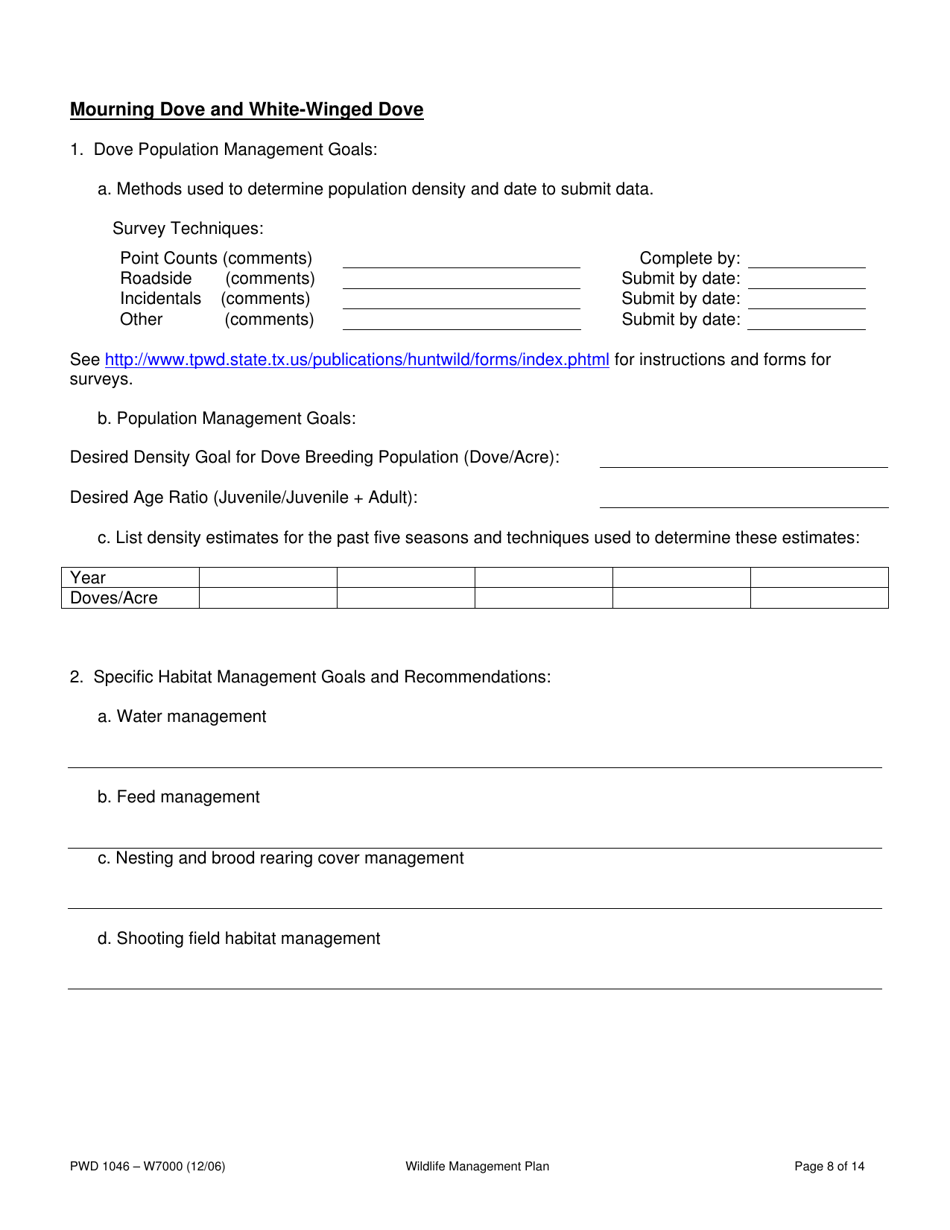

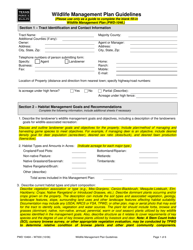

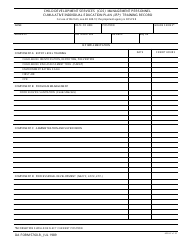

Form PWD1046 Wildlife Management Plan - Texas

What Is Form PWD1046?

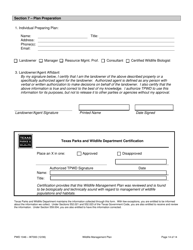

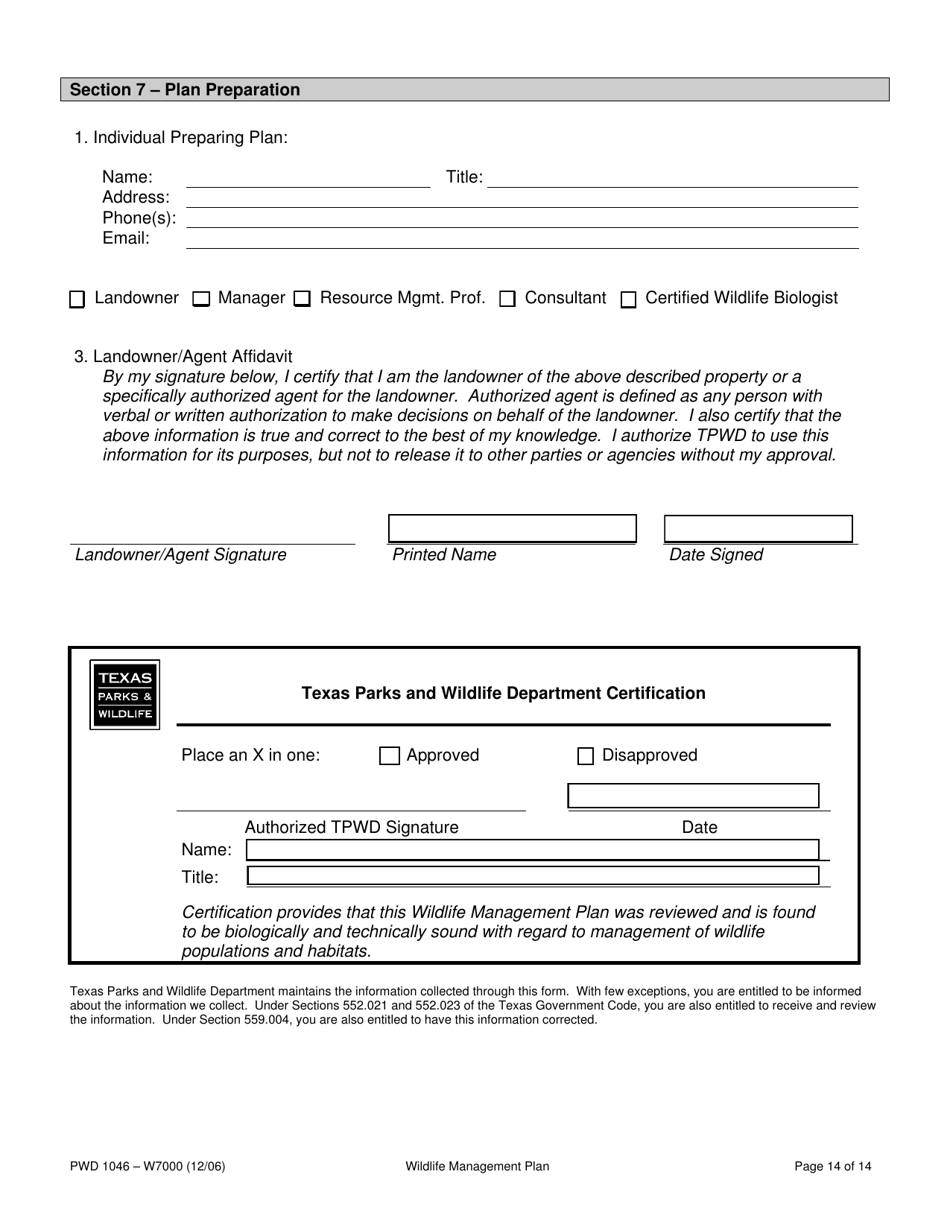

This is a legal form that was released by the Texas Parks and Wildlife Department - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PWD1046?

A: Form PWD1046 is a Wildlife Management Plan specifically for Texas.

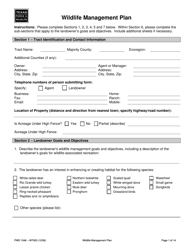

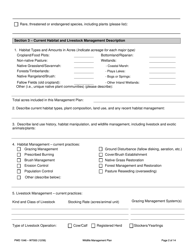

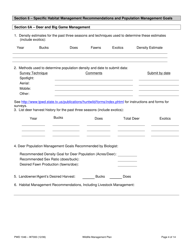

Q: What is a Wildlife Management Plan?

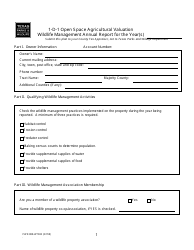

A: A Wildlife Management Plan is a document that outlines goals and strategies for managing wildlife on a specific property.

Q: Who needs to complete Form PWD1046?

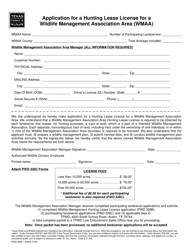

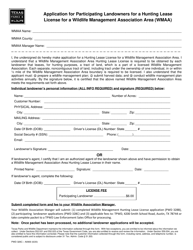

A: Landowners in Texas who want to participate in the Wildlife Tax Valuation program need to complete Form PWD1046.

Q: What is the Wildlife Tax Valuation program?

A: The Wildlife Tax Valuation program in Texas allows landowners to receive a reduced property tax rate in exchange for implementing and maintaining a Wildlife Management Plan.

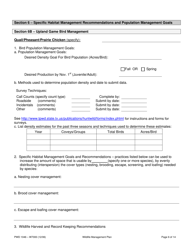

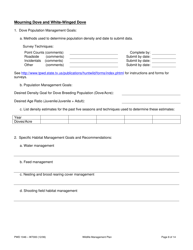

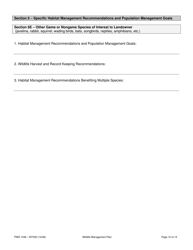

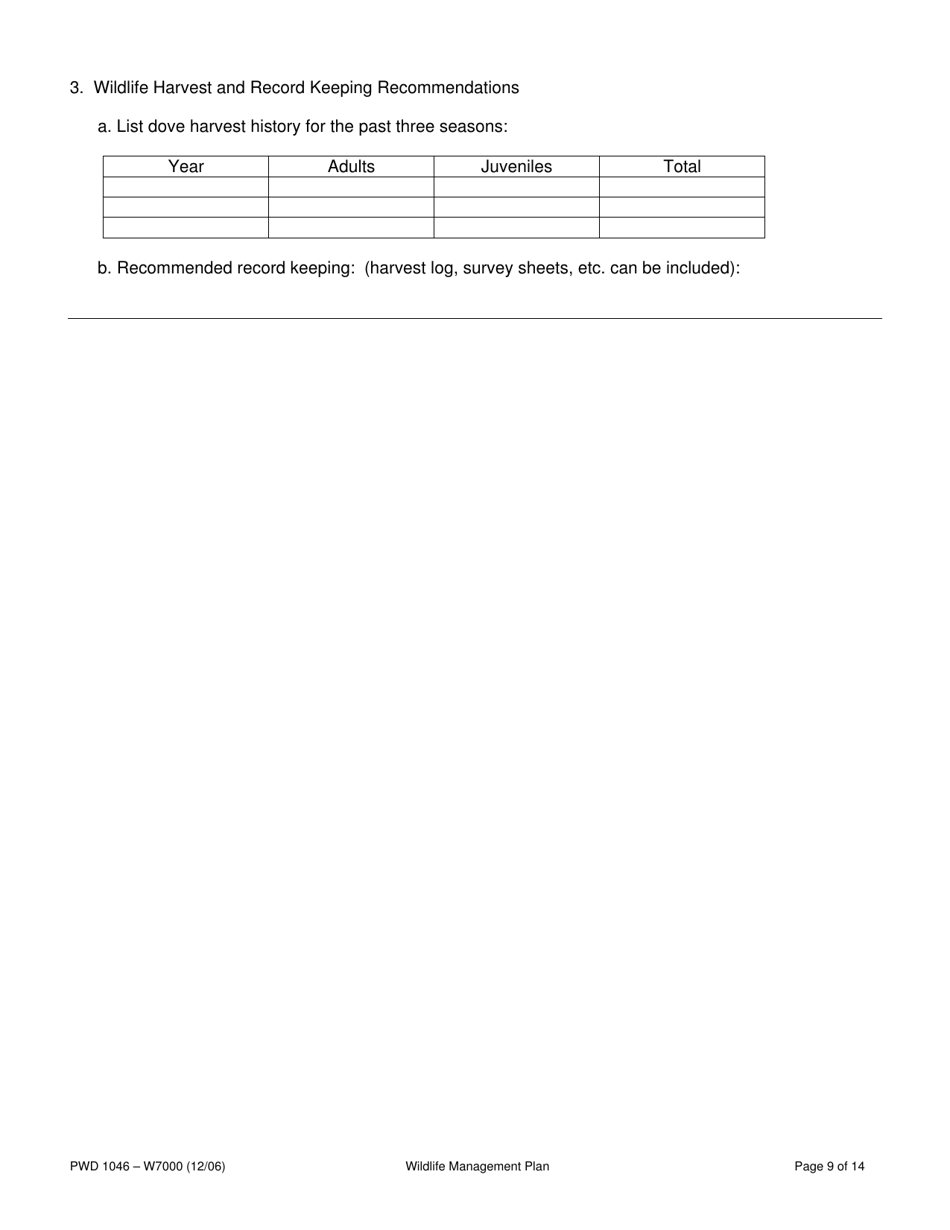

Q: What information is required in Form PWD1046?

A: Form PWD1046 requires information about the property, the landowner, and the specific wildlife management practices that will be implemented.

Q: Are there any fees associated with submitting Form PWD1046?

A: There are no fees associated with submitting Form PWD1046.

Q: Is assistance available for completing Form PWD1046?

A: Yes, the Texas Parks and Wildlife Department provides assistance and resources for landowners completing Form PWD1046.

Q: Can I make changes to my Wildlife Management Plan after submitting Form PWD1046?

A: Yes, landowners are allowed to make changes to their Wildlife Management Plan as long as they continue to meet the program requirements.

Q: What are the benefits of participating in the Wildlife Tax Valuation program?

A: The benefits of participating in the Wildlife Tax Valuation program include reduced property taxes and conservation of wildlife habitat.

Form Details:

- Released on December 1, 2006;

- The latest edition provided by the Texas Parks and Wildlife Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PWD1046 by clicking the link below or browse more documents and templates provided by the Texas Parks and Wildlife Department.