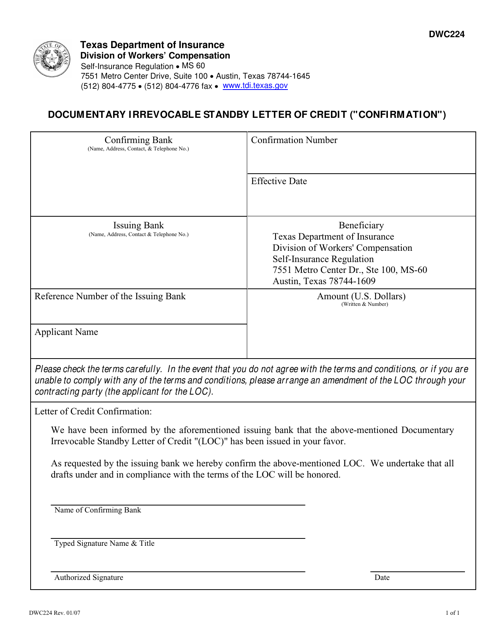

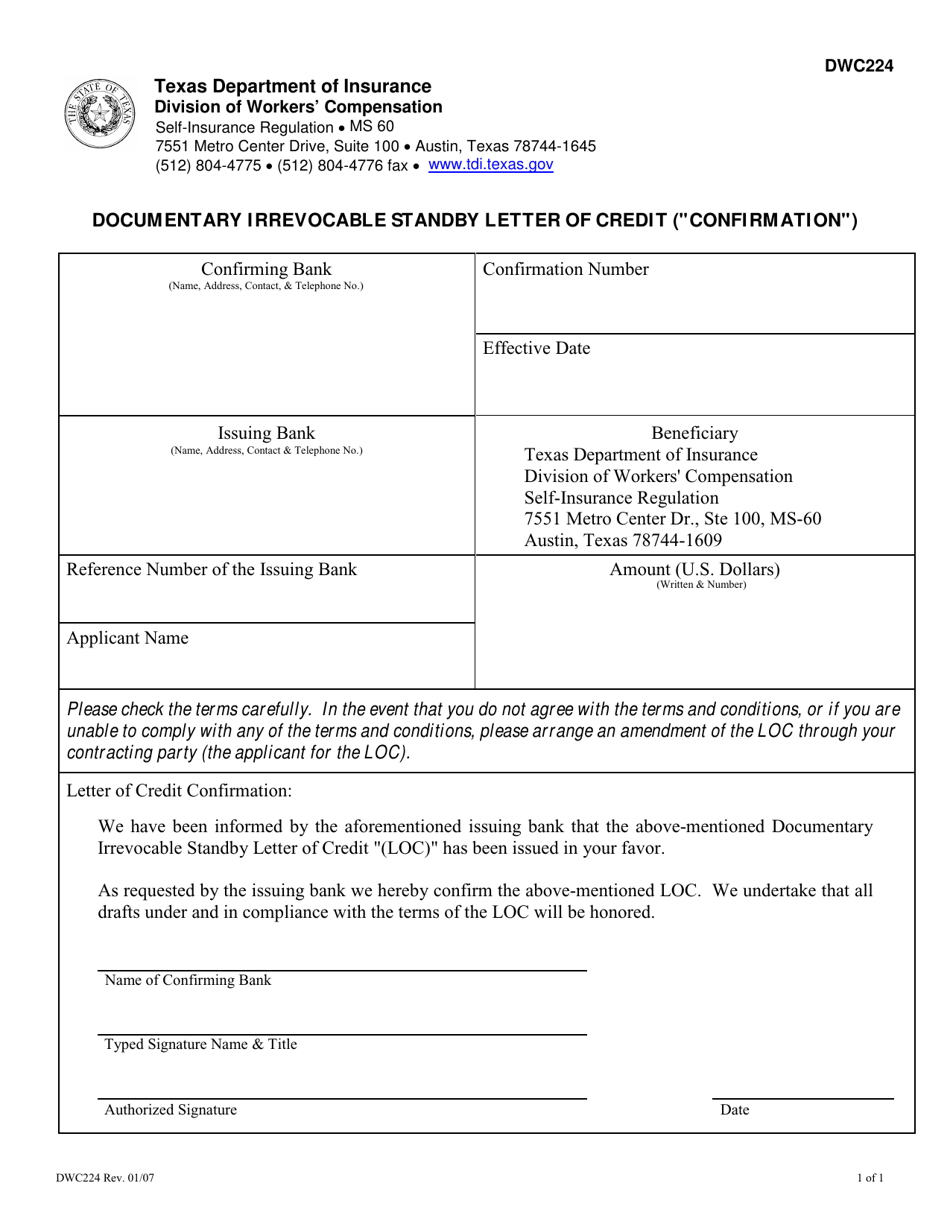

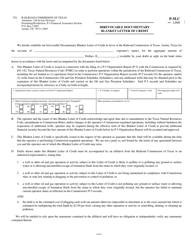

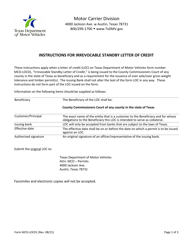

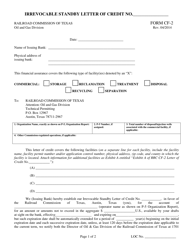

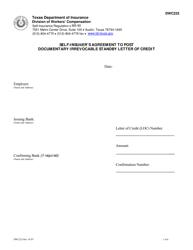

Form DWC224 Documentary Irrevocable Standby Letter of Credit (Confirmation) - Texas

What Is Form DWC224?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

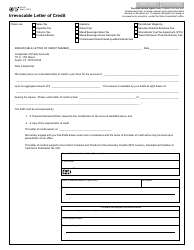

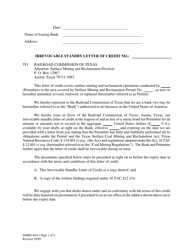

Q: What is a DWC224 Documentary Irrevocable Standby Letter of Credit?

A: A DWC224 Documentary Irrevocable Standby Letter of Credit is a financial instrument used to guarantee payment to a beneficiary in case the applicant fails to fulfill their obligations.

Q: What is the purpose of a DWC224 Documentary Irrevocable Standby Letter of Credit?

A: The purpose of this type of letter of credit is to provide assurance to a beneficiary that they will receive payment if the applicant fails to fulfill their contractual or financial obligations.

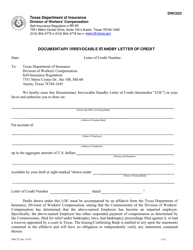

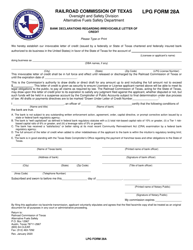

Q: Can a DWC224 Documentary Irrevocable Standby Letter of Credit be confirmed?

A: Yes, this type of letter of credit can be confirmed by a confirming bank, which adds an additional layer of assurance to the beneficiary.

Q: Is the DWC224 Documentary Irrevocable Standby Letter of Credit specific to Texas?

A: No, the DWC224 Documentary Irrevocable Standby Letter of Credit is not specific to Texas. It can be used in any location within the United States and Canada.

Q: How does a DWC224 Documentary Irrevocable Standby Letter of Credit work?

A: When a beneficiary presents the necessary documents to the issuing bank, the bank is obligated to make payment according to the terms of the letter of credit, provided the applicant has not met their obligations.

Q: What documents are required for a DWC224 Documentary Irrevocable Standby Letter of Credit?

A: The specific documents required may vary, but typically include a written demand, proof of default by the applicant, and any other relevant supporting documents outlined in the letter of credit.

Q: Can the terms of a DWC224 Documentary Irrevocable Standby Letter of Credit be modified?

A: Yes, the terms of the letter of credit can be modified or amended through mutual agreement between the applicant and the beneficiary, and with the consent of the issuing bank.

Q: Can a DWC224 Documentary Irrevocable Standby Letter of Credit be revoked?

A: Once issued, a DWC224 Documentary Irrevocable Standby Letter of Credit cannot be revoked or cancelled without the agreement of all parties involved.

Q: What is the difference between an irrevocable and a revocable letter of credit?

A: An irrevocable letter of credit cannot be cancelled or revoked without the agreement of all parties, whereas a revocable letter of credit can be cancelled or modified by the issuing bank without the consent of the beneficiary.

Q: Who pays the fees associated with a DWC224 Documentary Irrevocable Standby Letter of Credit?

A: Typically, the applicant (buyer) is responsible for paying the fees associated with issuing and confirming a DWC224 Documentary Irrevocable Standby Letter of Credit.

Form Details:

- Released on January 1, 2007;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DWC224 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.