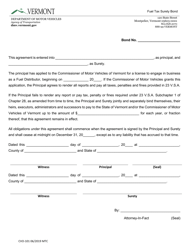

This version of the form is not currently in use and is provided for reference only. Download this version of

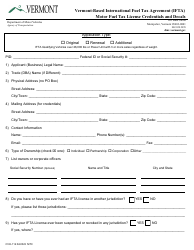

Form CVO-003

for the current year.

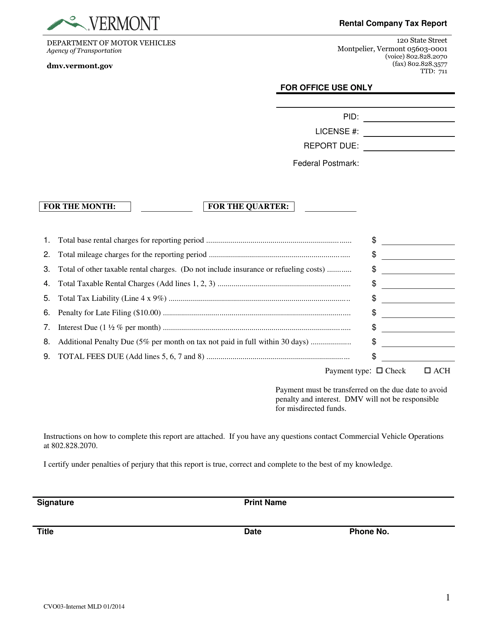

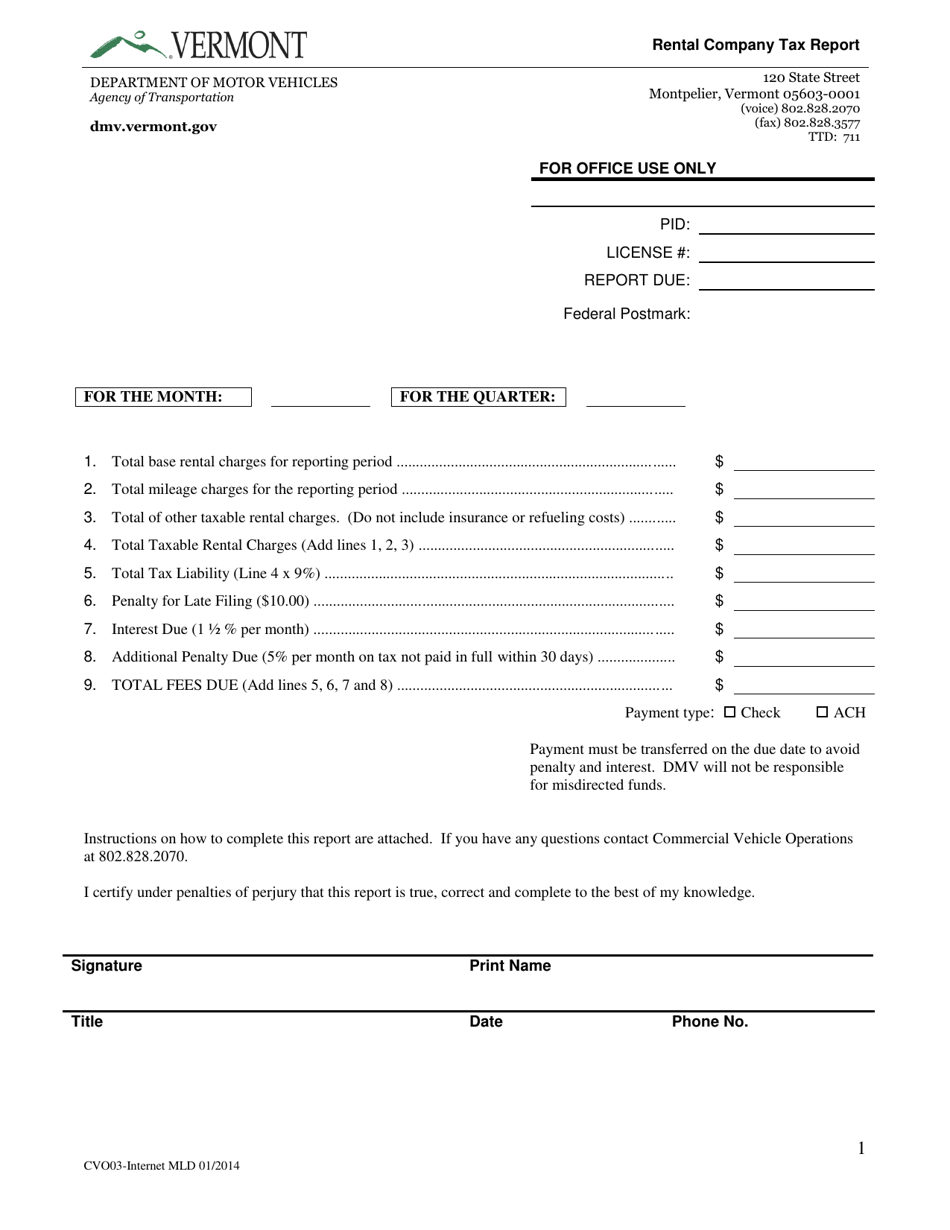

Form CVO-003 Rental Company Tax Report - Vermont

What Is Form CVO-003?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

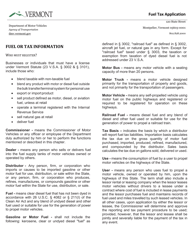

Q: What is Form CVO-003?

A: Form CVO-003 is the Rental Company Tax Report used in Vermont.

Q: Who needs to complete Form CVO-003?

A: Rental companies in Vermont are required to complete Form CVO-003.

Q: What is the purpose of Form CVO-003?

A: Form CVO-003 is used to report rental company tax in Vermont.

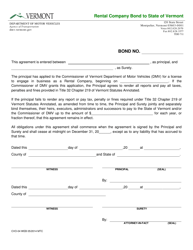

Q: Is Form CVO-003 required to be filed annually?

A: Yes, Form CVO-003 needs to be filed annually.

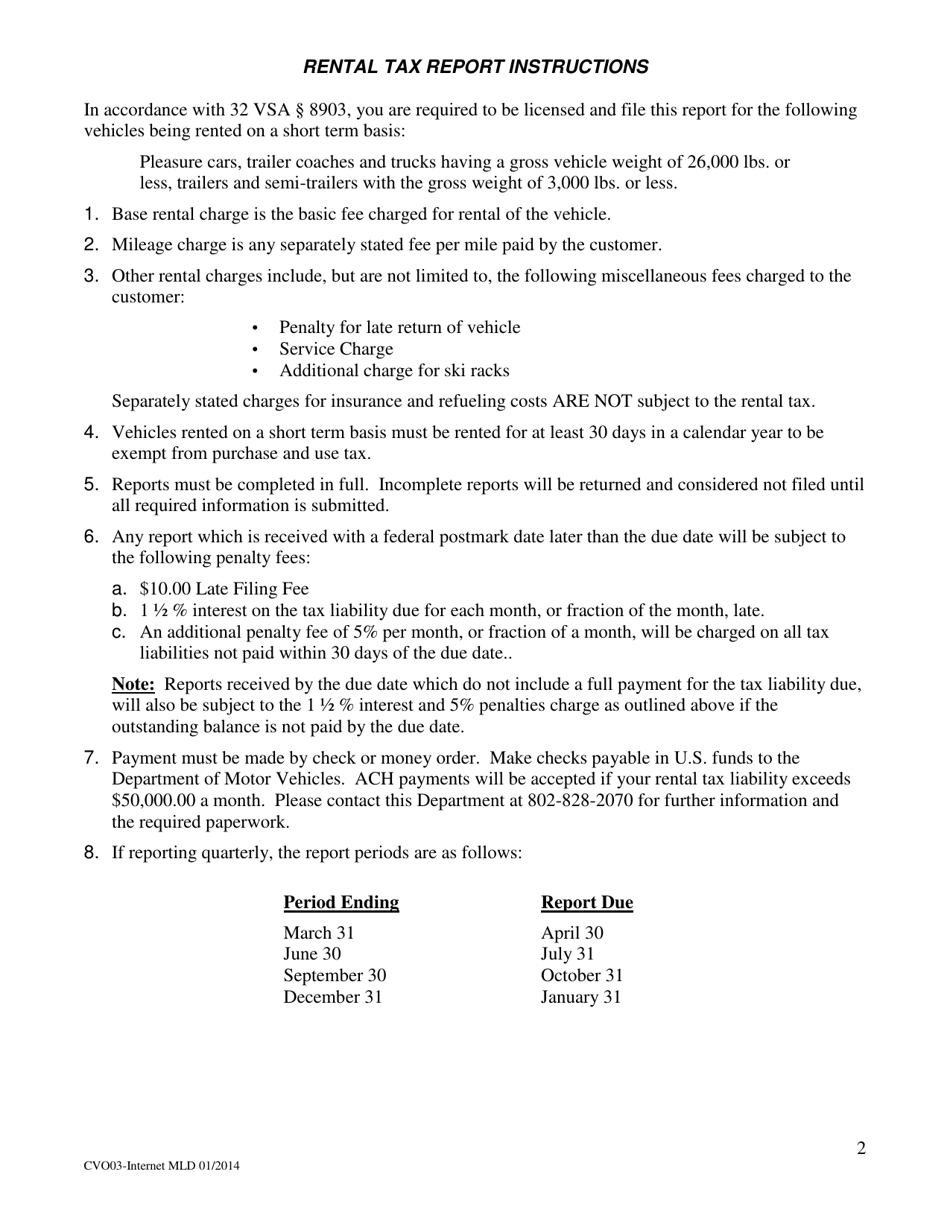

Q: Are there any penalties for not filing Form CVO-003?

A: Yes, there may be penalties for not filing Form CVO-003 or filing it late. It is important to comply with the deadlines.

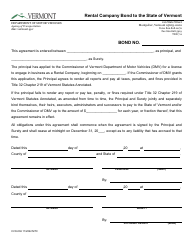

Q: Are there any exemptions or deductions available on Form CVO-003?

A: Specific exemptions or deductions may be available on Form CVO-003. It is recommended to refer to the instructions provided with the form or consult a tax professional for guidance.

Q: What should I do if I have questions or need assistance with Form CVO-003?

A: If you have questions or need assistance with Form CVO-003, you can contact the Vermont Department of Taxes for guidance and support.

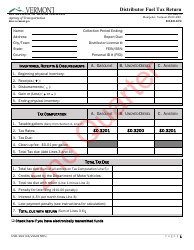

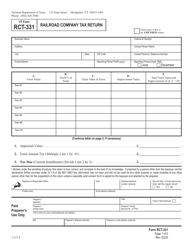

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-003 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.