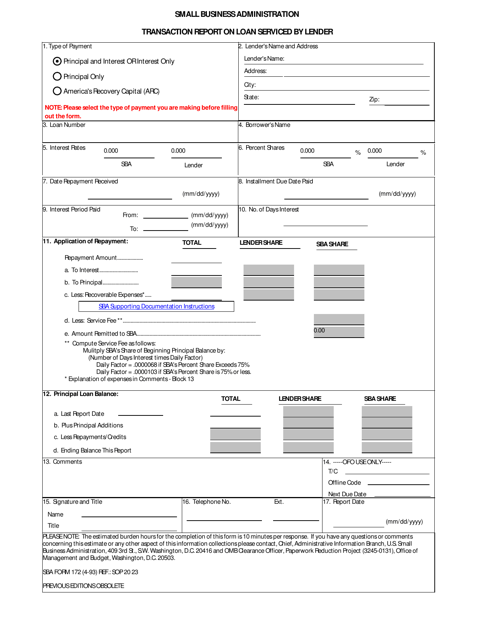

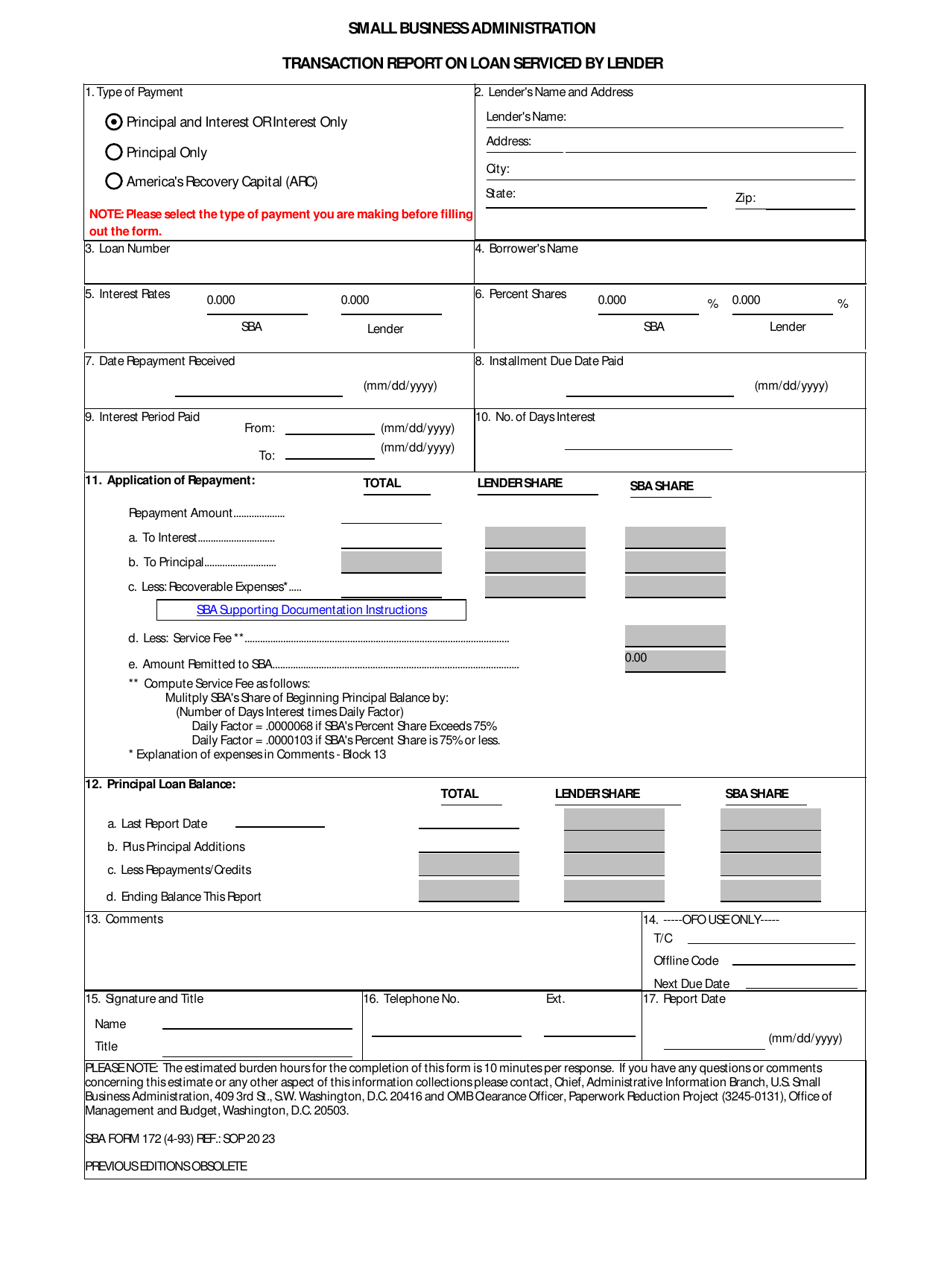

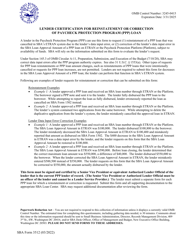

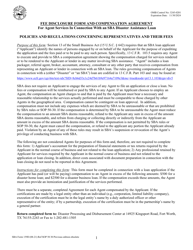

SBA Form 172 Transaction Report on Loan Serviced by Lender

What Is SBA Form 172?

This is a legal form that was released by the U.S. Small Business Administration on April 1, 1993 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 172?

A: SBA Form 172 is the Transaction Report on Loan Serviced by Lender.

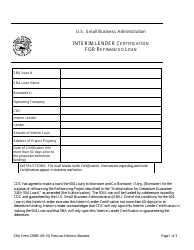

Q: Who uses SBA Form 172?

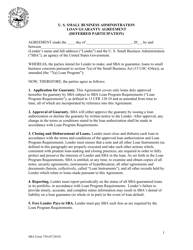

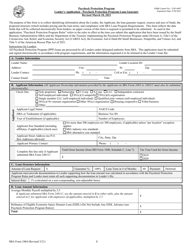

A: Lenders use SBA Form 172 to report information about loans they service on behalf of the Small Business Administration (SBA).

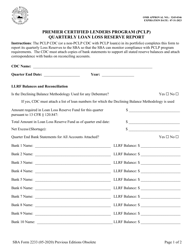

Q: What information is included in SBA Form 172?

A: SBA Form 172 includes details about the loan, such as the loan amount, interest rate, repayment terms, and any changes or updates to the loan.

Q: Why is SBA Form 172 important?

A: SBA Form 172 is important for the SBA to monitor and track the performance of loans in its portfolio and ensure compliance with program requirements.

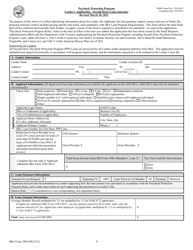

Q: Are there any fees associated with filing SBA Form 172?

A: No, there are no fees associated with filing SBA Form 172.

Q: Is SBA Form 172 confidential?

A: The information provided on SBA Form 172 may be subject to disclosure under the Freedom of Information Act (FOIA), unless exempted by law.

Form Details:

- Released on April 1, 1993;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of SBA Form 172 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.