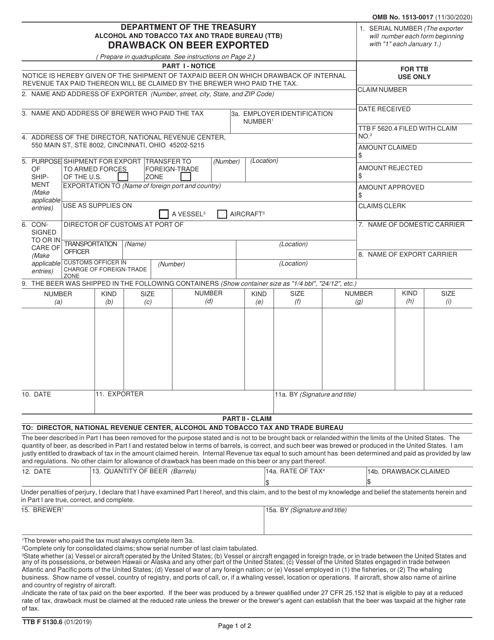

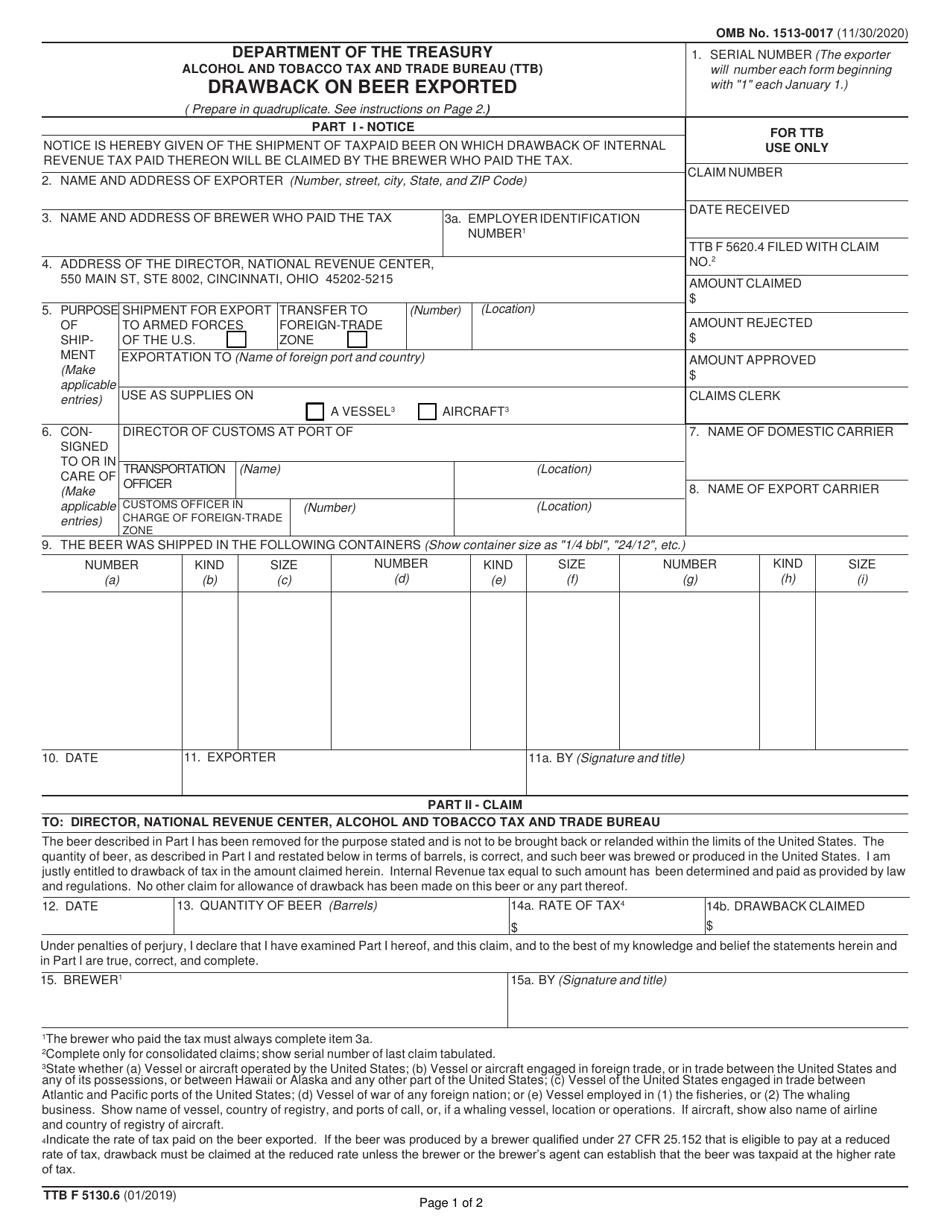

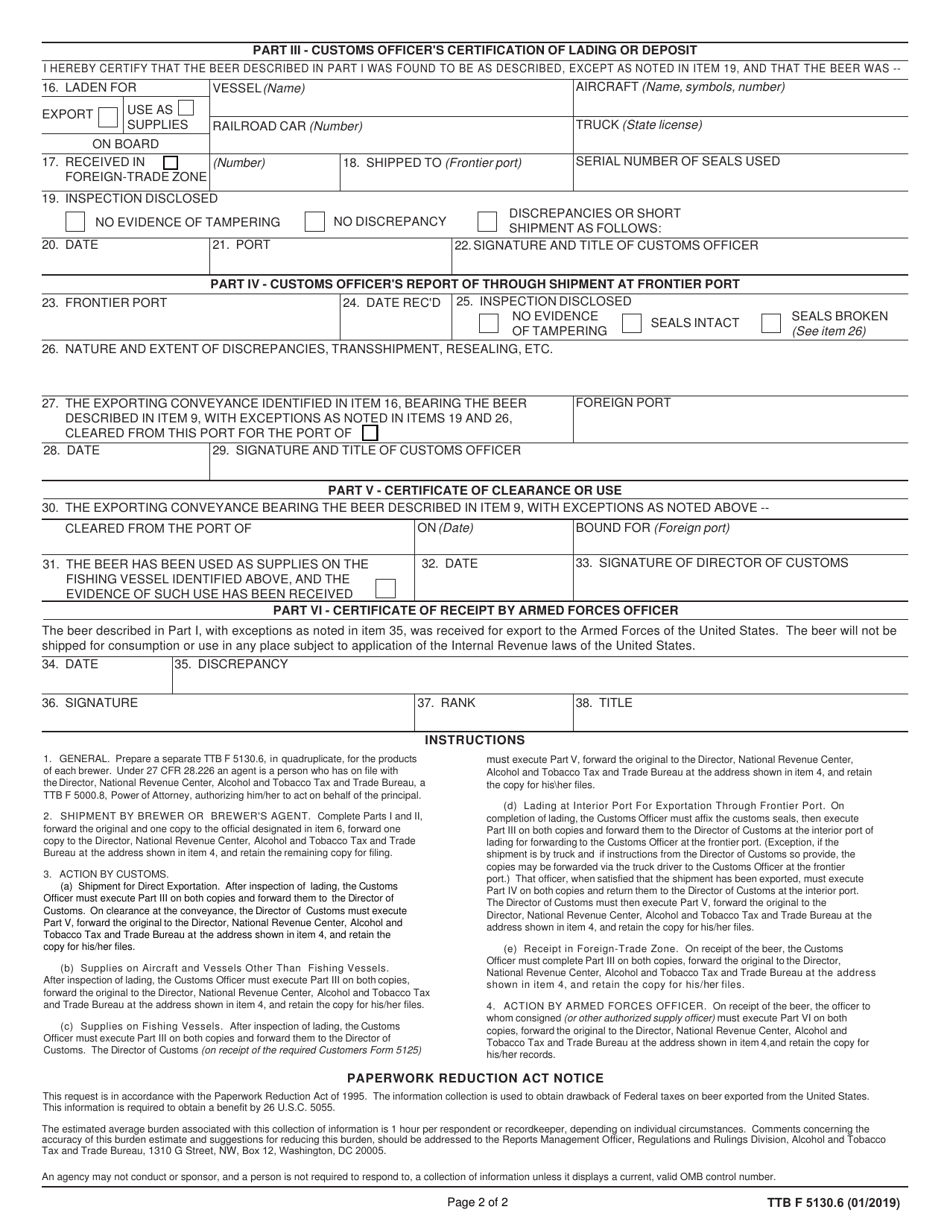

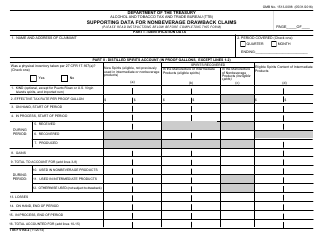

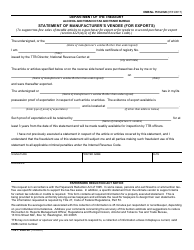

TTB Form 5130.6 Drawback on Beer Exported

What Is TTB Form 5130.6?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on January 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5130.6?

A: TTB Form 5130.6 is a specific form used for requesting a drawback on beer exported.

Q: What is a drawback on beer exported?

A: A drawback on beer exported refers to a refund of federal excise tax that was paid on beer that is later exported.

Q: Who can request a drawback on beer exported?

A: Generally, brewers, brewpubs, and other eligible persons who have paid federal excise tax on beer can request a drawback on beer exported.

Q: How can I request a drawback on beer exported?

A: You can request a drawback on beer exported by submitting a completed TTB Form 5130.6 to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

Q: Are there any specific requirements or conditions for requesting a drawback on beer exported?

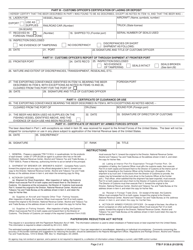

A: Yes, there are specific requirements and conditions that must be met, such as providing proof of exportation and complying with TTB regulations.

Q: Is there a deadline for requesting a drawback on beer exported?

A: Yes, there is a deadline for filing the claim, which is generally within three years from the date of exportation.

Q: Is there a fee for filing a TTB Form 5130.6?

A: No, there is no fee for filing a TTB Form 5130.6.

Form Details:

- Released on January 1, 2019;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5130.6 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.