This version of the form is not currently in use and is provided for reference only. Download this version of

ATF Form 5630.7

for the current year.

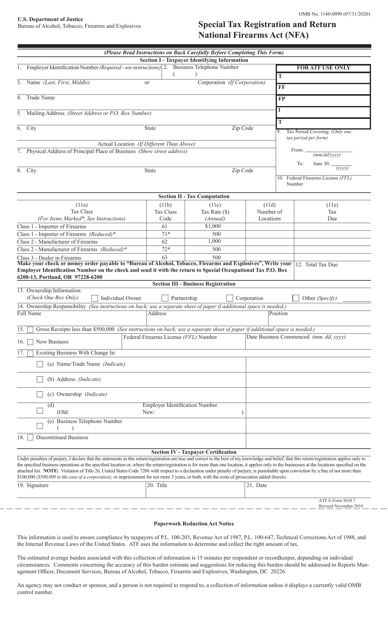

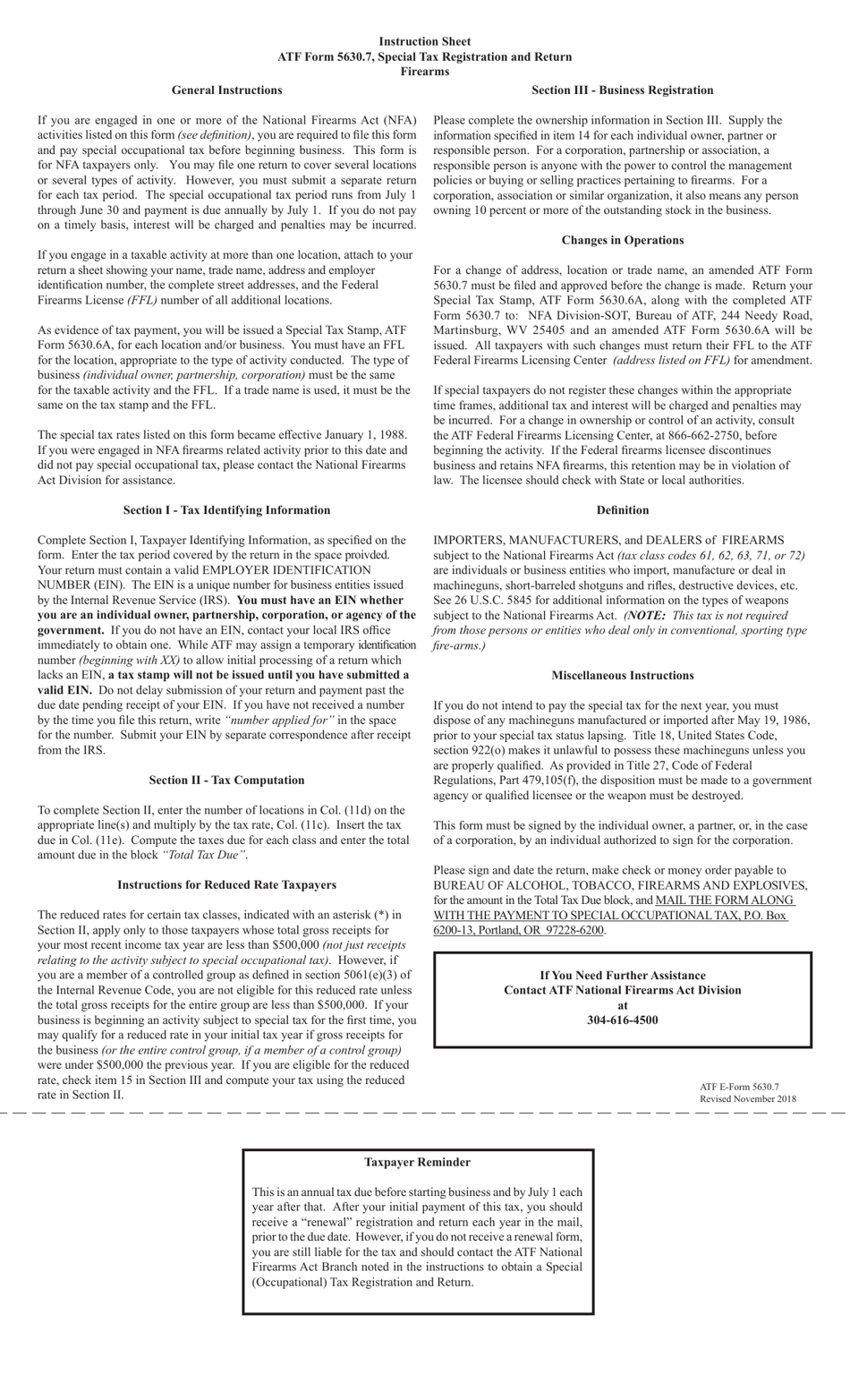

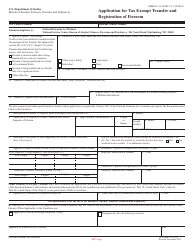

ATF Form 5630.7 Special Tax Registration and Return National Firearms Act (Nfa)

What Is ATF Form 5630.7?

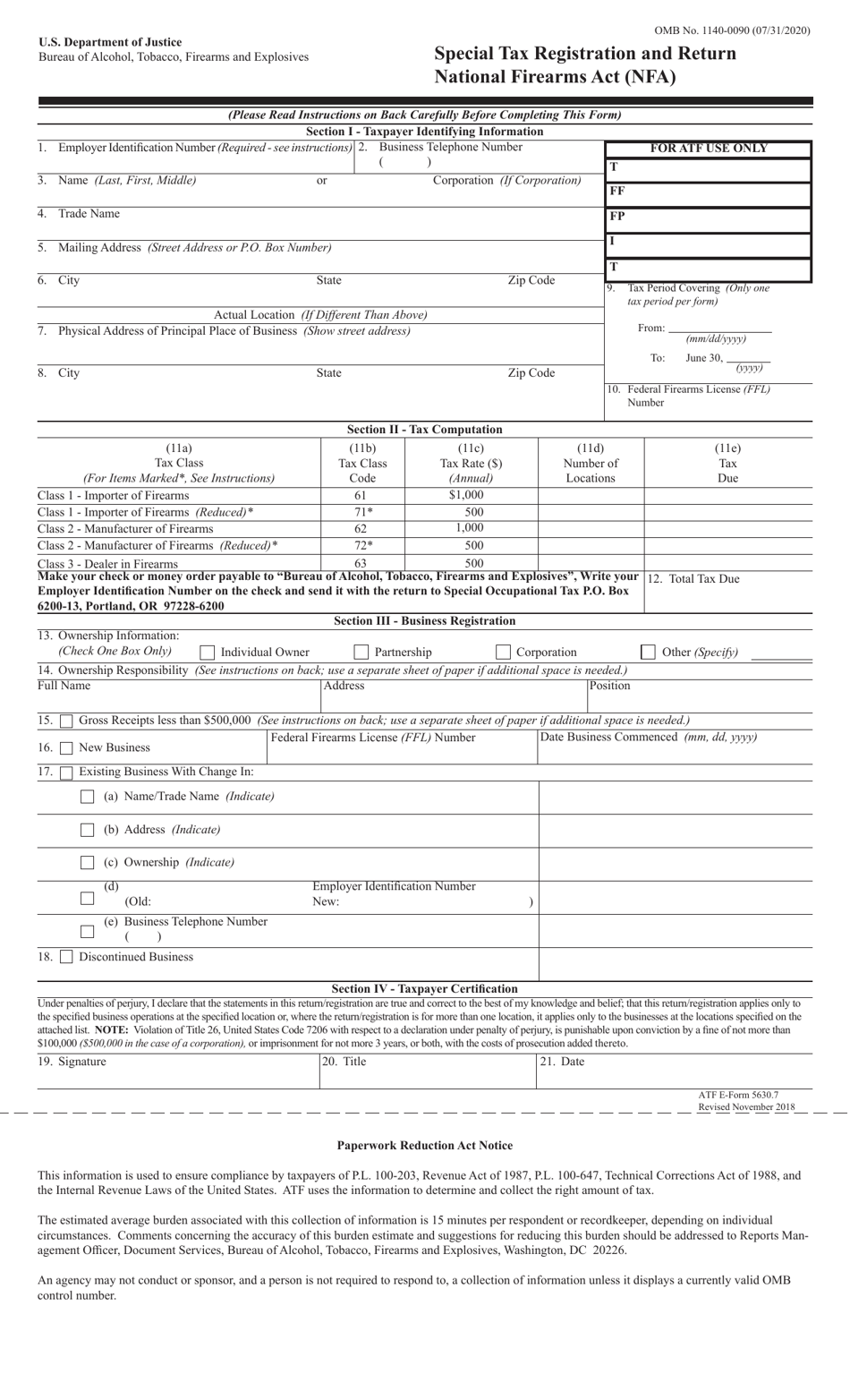

ATF Form 5630.7, National Firearms Act (NFA) - also known as the ATF E-Form 5630.7 - is a form used to provide special occupational tax information and payment. All Federal Firearms Licensees (FFLs) who want to engage in importing, manufacturing, or dealing in NFA firearms are required by law to file this form with the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) before starting their business.

The latest edition of the form was released on November 1, 2018 . An updated ATF Form 5630.7 fillable version is available for download below.

ATF Form 5630.7 Instructions

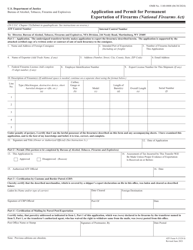

FFLs who are NFA taxpayers must file an ATF Form 5630.7 and pay a special occupational tax, which is an annual tax that is due before starting a business and by July 1 the subsequent years. Taxpayers in arrears will be charged interest and may incur in penalties.

As evidence payment, taxpayers will be issued a Special Tax Stamp ( ATF Form 5630.6A ) for each location and business. Holding a Federal Firearms License (FFL) for the location that corresponds to the type of the conducted activity is mandatory, and the type of business must be the same for the taxable activity and the FFL. If a trade name is used, it shall be the same on the tax stamp and the FFL.

While a separate return must be submitted for each tax period, it is possible to file one return to cover several locations and several types of activity. If engaged in a taxable activity at more than one location, taxpayers must attach a sheet with the following information to the return: taxpayer's name, trade name, address, employer identification number, street addresses, and the FFL number of all additional locations.

Taxpayers who change their address, location, or a trade name must file an amended ATF Form 5630.7 that needs to be approved before the change is made. This process requires that taxpayers return their ATF Form 5630.6A together with the completed ATF Form 5630.7 to the address below in order to receive an amended ATF Form 5630.6A:

NFA Division-SOT, Bureau of ATF, 244 Needy Road, Martinsburg, WV 25405

Also, all taxpayers performing these changes must return their FFL to the ATF Federal Firearms Licensing Center for an amendment.

This form must be signed by the individual owner, a partner, or an individual authorized to sign for the corporation. Payment should be made by check or money order payable to the ATF for the total tax amount due. After placing their signature and the date on the return, taxpayers are to mail the form together with the payment to the following address: Special Occupational Tax, P.O. Box 6200-13, Portland, OR 97228-6200. For further assistance, the ATF NFA Division should be contacted at 304-616-4500.