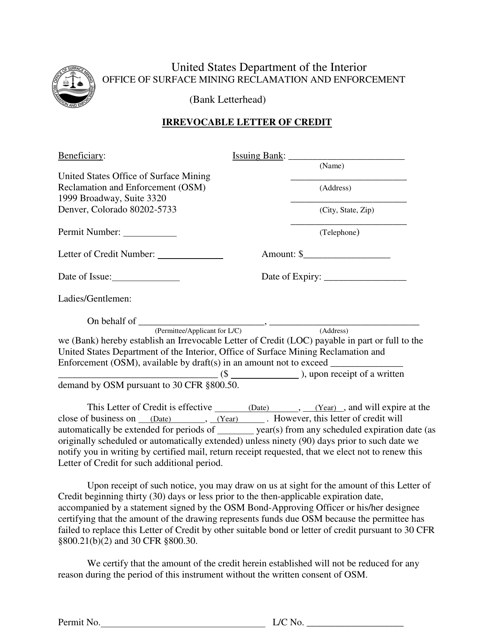

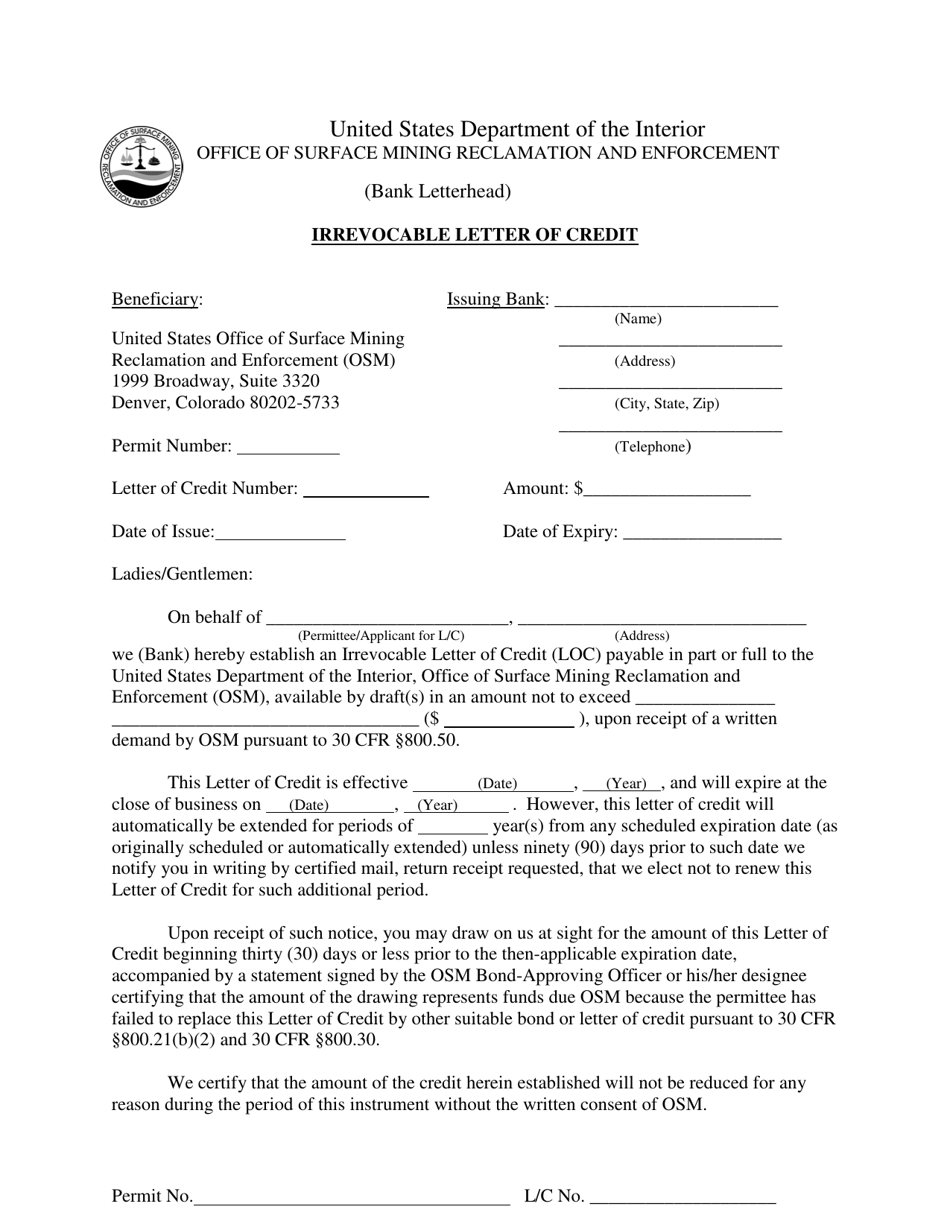

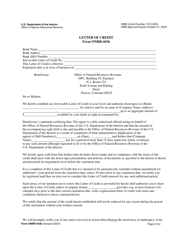

Irrevocable Letter of Credit

Irrevocable Letter of Credit is a 2-page legal document that was released by the U.S. Department of the Interior - Office of Surface Mining, Reclamation and Enforcement and used nation-wide.

FAQ

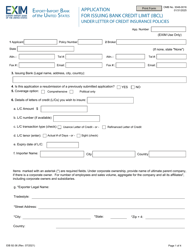

Q: What is an irrevocable letter of credit?

A: An irrevocable letter of credit is a financial instrument issued by a bank that guarantees payment to a beneficiary under specified conditions.

Q: How does an irrevocable letter of credit work?

A: When a letter of credit is irrevocable, it means that the issuing bank cannot cancel or modify it without the consent of all parties involved.

Q: What are the benefits of an irrevocable letter of credit?

A: An irrevocable letter of credit provides security to the beneficiary by ensuring that payment will be made as long as all terms and conditions are met.

Q: Who typically uses an irrevocable letter of credit?

A: Businesses and individuals involved in international trade often use irrevocable letters of credit to provide assurance of payment.

Q: What are the risks associated with an irrevocable letter of credit?

A: The main risk is that the issuing bank may default or become insolvent, which could result in non-payment to the beneficiary.

Form Details:

- The latest edition currently provided by the U.S. Department of the Interior - Office of Surface Mining, Reclamation and Enforcement;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.