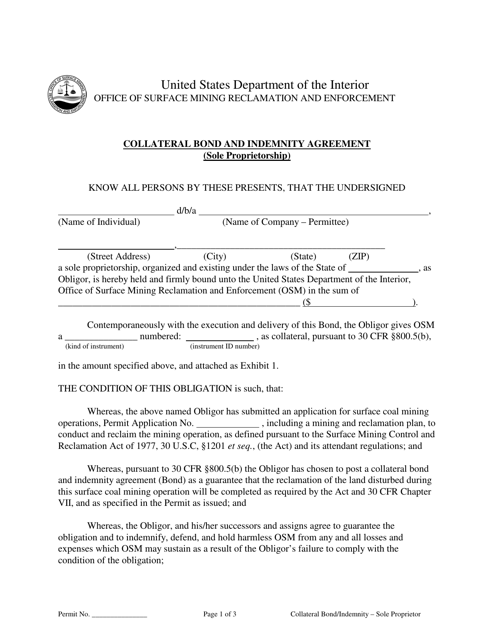

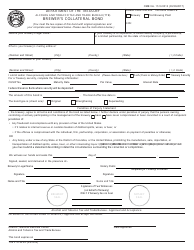

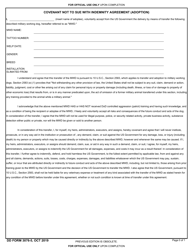

Collateral Bond and Indemnity Agreement (Sole Proprietorships)

Collateral Bond and Indemnity Agreement (Sole Proprietorships) is a 3-page legal document that was released by the U.S. Department of the Interior - Office of Surface Mining, Reclamation and Enforcement and used nation-wide.

FAQ

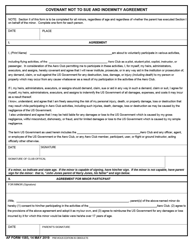

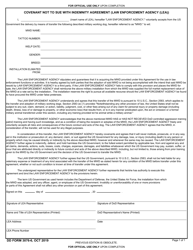

Q: What is a Collateral Bond and Indemnity Agreement?

A: A Collateral Bond and Indemnity Agreement is a legal document that provides a guarantee for a bond in case of default or non-performance by a party.

Q: What is the purpose of a Collateral Bond and Indemnity Agreement for Sole Proprietorships?

A: The purpose of this agreement is to secure a bond for a business owned and operated by a sole proprietor, providing a guarantee for the performance of obligations under the bond.

Q: Who is a party to a Collateral Bond and Indemnity Agreement for Sole Proprietorships?

A: The parties involved in this agreement are the sole proprietorship business and the entity requiring the bond, such as a government agency or private company.

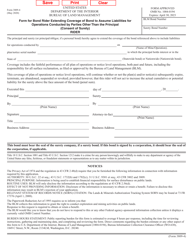

Q: What does the Collateral Bond and Indemnity Agreement cover?

A: The agreement typically covers the terms and conditions of the bond, the collateral provided as security, and the indemnification of the bond issuer for any losses incurred due to default or non-performance.

Q: What is collateral in a Collateral Bond and Indemnity Agreement?

A: Collateral refers to the assets or property that the sole proprietorship pledges as security for the bond. It can be seized or used to cover any losses if the bond terms are not met.

Form Details:

- The latest edition currently provided by the U.S. Department of the Interior - Office of Surface Mining, Reclamation and Enforcement;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.