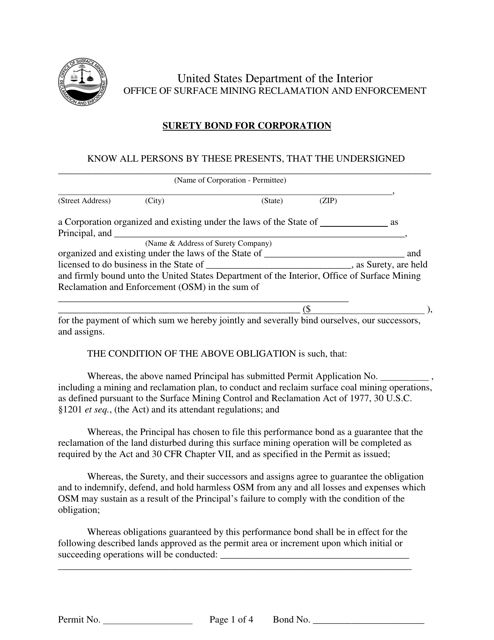

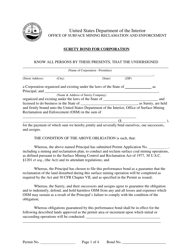

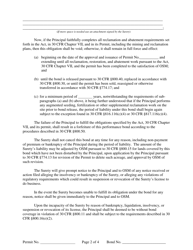

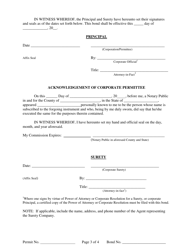

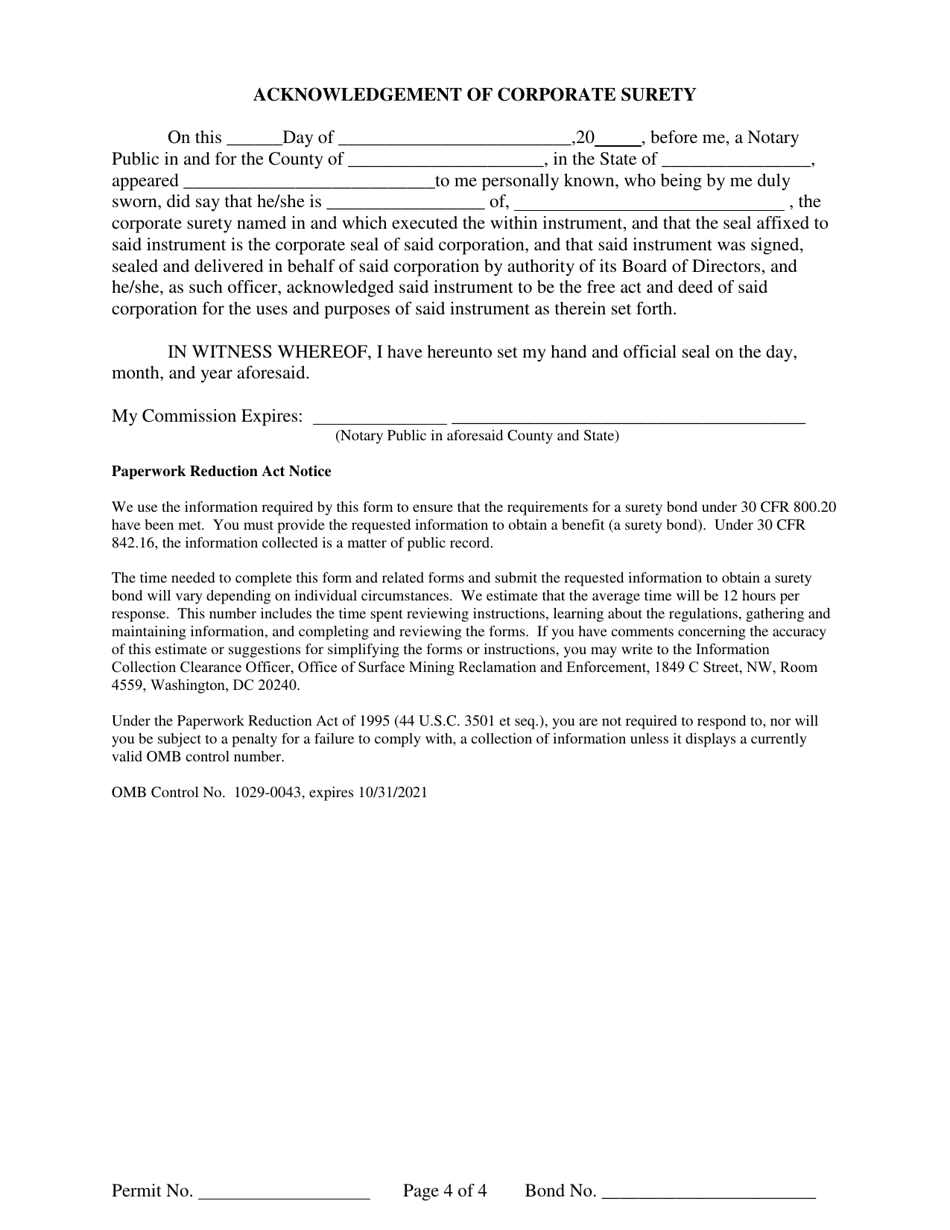

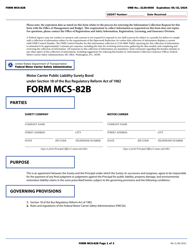

Surety Bond for Corporation

Surety Bond for Corporation is a 4-page legal document that was released by the U.S. Department of the Interior - Office of Surface Mining, Reclamation and Enforcement and used nation-wide.

FAQ

Q: What is a surety bond for a corporation?

A: A surety bond for a corporation is a contract between the corporation, a surety company, and the entity requiring the bond. It guarantees that the corporation will fulfill its obligations or responsibilities as outlined in the bond.

Q: When is a surety bond required for a corporation?

A: A surety bond for a corporation may be required in various situations, such as when bidding on a government contract, obtaining a professional license, or guaranteeing payment of taxes or other financial obligations.

Q: How does a surety bond benefit a corporation?

A: A surety bond can provide financial protection and reassurance to the parties involved. It ensures that the corporation will fulfill its contractual or legal obligations, and if it fails to do so, the surety company will compensate the affected party.

Q: How much does a surety bond for a corporation cost?

A: The cost of a surety bond for a corporation can vary depending on factors such as the bond amount, the corporation's financial strength, and its creditworthiness. Generally, the premium is a percentage of the bond amount.

Q: How can a corporation obtain a surety bond?

A: To obtain a surety bond, a corporation typically needs to work with a licensed surety company. The company will evaluate the corporation's financial stability, credit history, and other relevant factors before issuing the bond.

Q: Can a corporation get a surety bond with poor credit?

A: It may be more challenging for a corporation with poor credit to obtain a surety bond. However, some surety companies specialize in providing bonds to high-risk applicants, albeit at higher premiums.

Q: How long does a surety bond for a corporation last?

A: The duration of a surety bond for a corporation can vary depending on the specific terms of the bond agreement. It may be valid for a specific project, a set term, or until the obligations covered by the bond are fulfilled.

Q: What happens if a corporation fails to fulfill its obligations covered by a surety bond?

A: If a corporation fails to fulfill its obligations covered by a surety bond, the affected party can file a claim with the surety company. If the claim is valid, the surety company will compensate the party up to the bond amount. The corporation is then required to reimburse the surety company for the paid amount.

Q: Can a corporation cancel a surety bond?

A: Generally, a surety bond for a corporation cannot be canceled by the corporation itself. Only the surety company or the entity requiring the bond can cancel it, usually by providing a written notice within a specific timeframe.

Q: Are surety bonds the same as insurance for a corporation?

A: No, surety bonds and insurance are different. While insurance protects against unforeseen events, surety bonds guarantee the performance of a specific obligation or contract.

Form Details:

- The latest edition currently provided by the U.S. Department of the Interior - Office of Surface Mining, Reclamation and Enforcement;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.