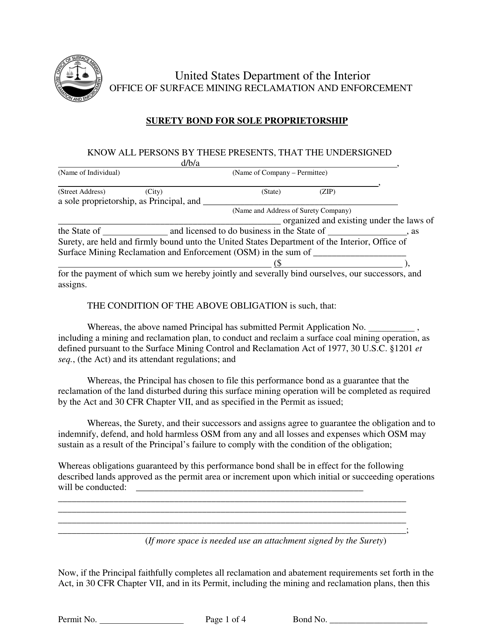

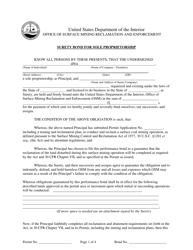

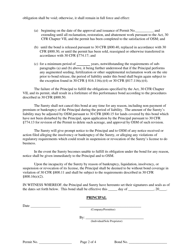

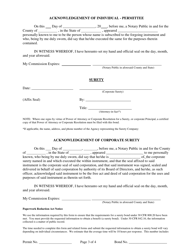

Surety Bond for Sole Proprietorship

Surety Bond for Sole Proprietorship is a 4-page legal document that was released by the U.S. Department of the Interior - Office of Surface Mining, Reclamation and Enforcement and used nation-wide.

FAQ

Q: What is a surety bond for a sole proprietorship?

A: A surety bond for a sole proprietorship is a type of insurance that provides financial protection to customers or clients of a sole proprietorship in case the business owner fails to fulfill their contractual obligations.

Q: Why might a sole proprietor need a surety bond?

A: A sole proprietor may need a surety bond to build trust and confidence with their customers or clients. It can also be a requirement for obtaining certain licenses or permits.

Q: What are the benefits of having a surety bond as a sole proprietor?

A: Having a surety bond as a sole proprietor can help attract more customers or clients, demonstrate financial responsibility, and provide assurance that the business will fulfill its obligations.

Q: How does a surety bond work for a sole proprietor?

A: If a sole proprietor fails to fulfill their contractual obligations, a customer or client can make a claim against the surety bond. If the claim is valid, the surety company will compensate the customer or client up to the bond's coverage amount.

Q: How much does a surety bond for a sole proprietorship cost?

A: The cost of a surety bond for a sole proprietorship can vary depending on factors such as the bond amount, the type of business, and the business owner's creditworthiness.

Form Details:

- The latest edition currently provided by the U.S. Department of the Interior - Office of Surface Mining, Reclamation and Enforcement;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.