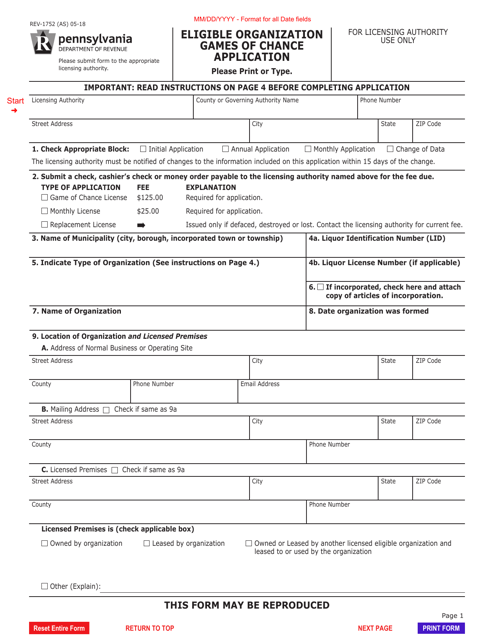

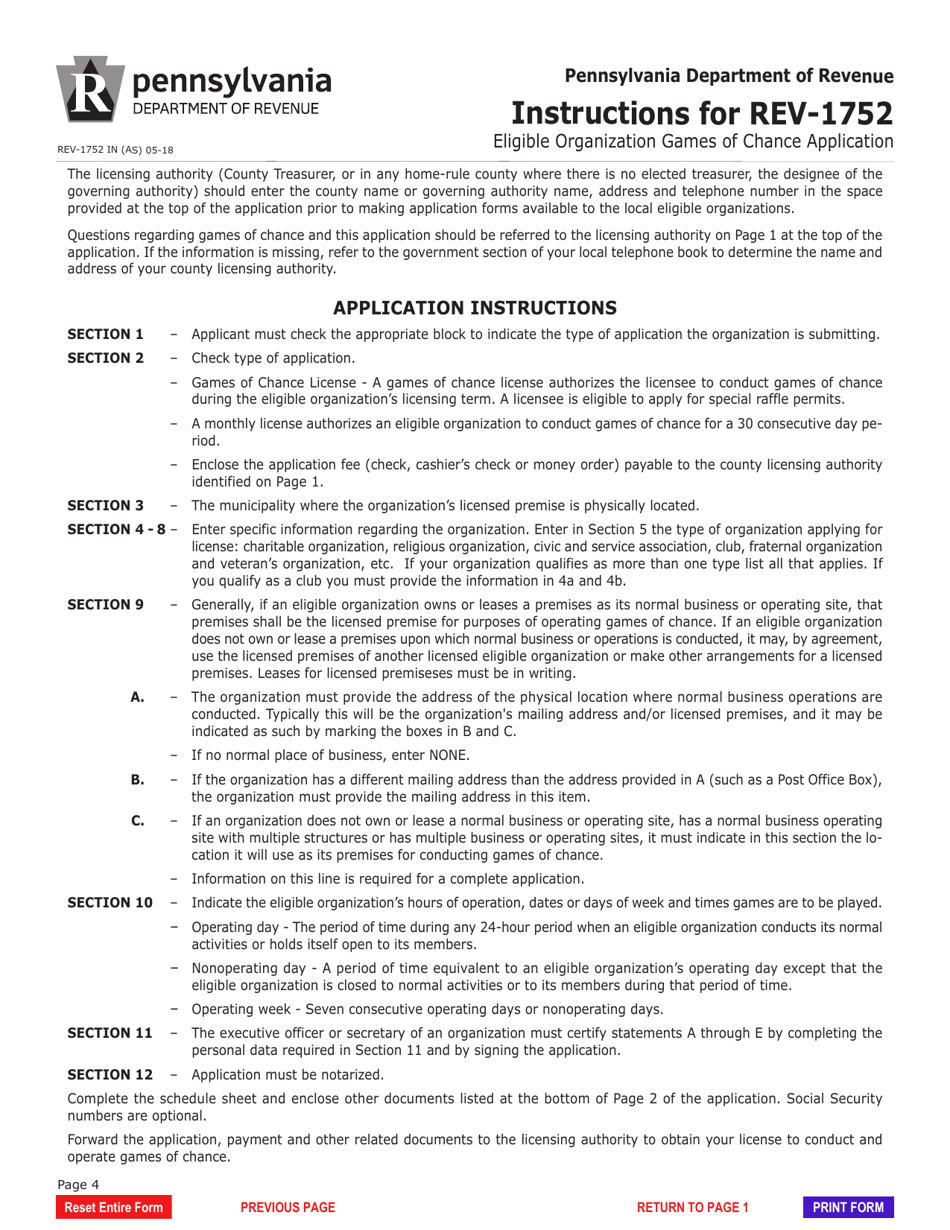

Form REV-1752 Eligible Organization Games of Chance Application - Pennsylvania

What Is Form REV-1752?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

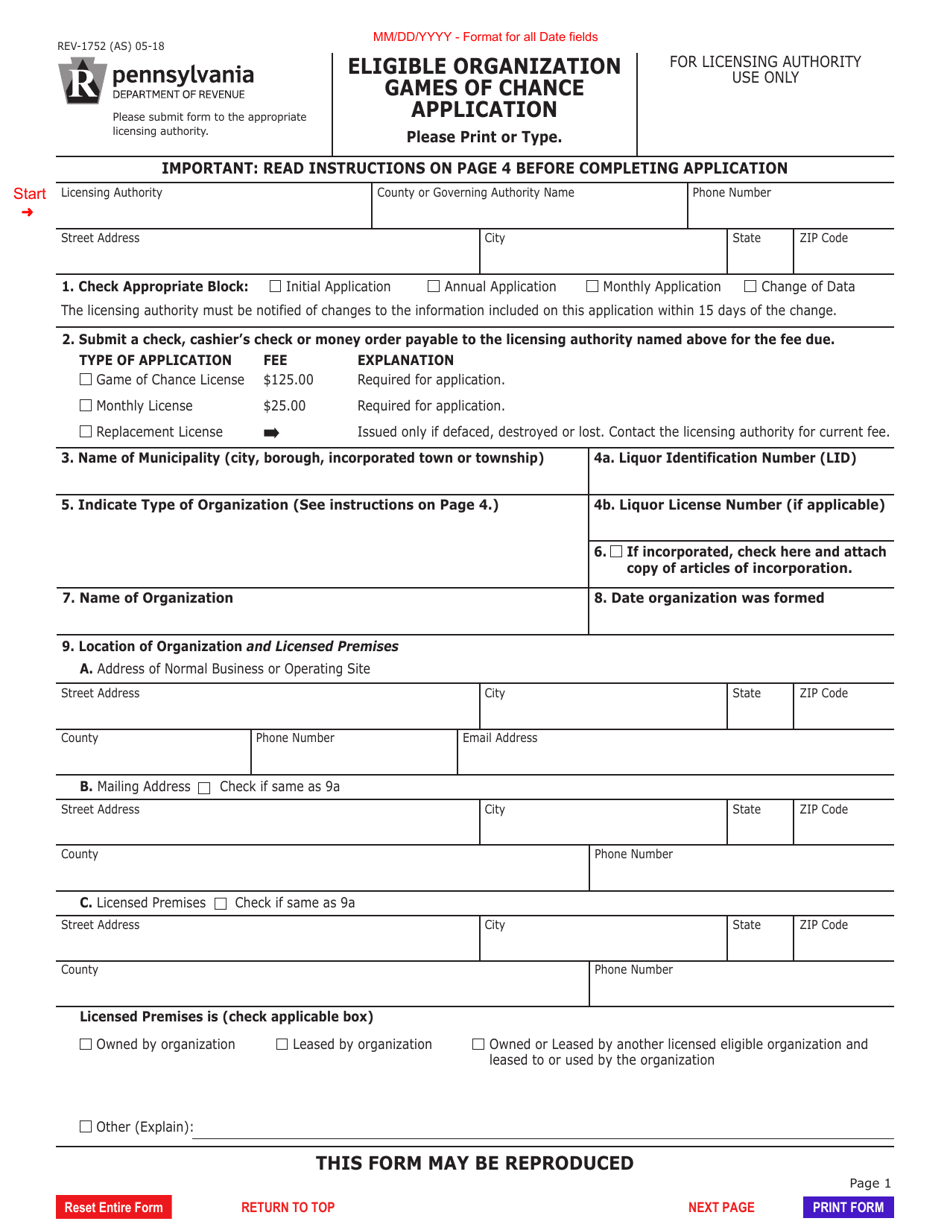

Q: What is Form REV-1752?

A: Form REV-1752 is an application for eligible organizations in Pennsylvania to conduct games of chance.

Q: What is an eligible organization?

A: An eligible organization is a non-profit entity that is qualified to conduct games of chance under the specific laws and regulations of Pennsylvania.

Q: What are games of chance?

A: Games of chance are activities where the outcome is predominantly determined by luck or chance, rather than skill. Examples include raffles, pull tabs, and punch boards.

Q: Who needs to fill out Form REV-1752?

A: Eligible organizations in Pennsylvania that wish to conduct games of chance need to fill out and submit Form REV-1752.

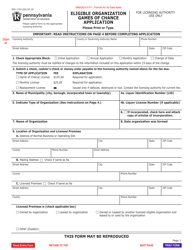

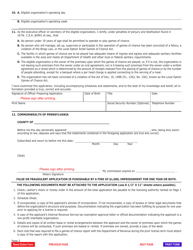

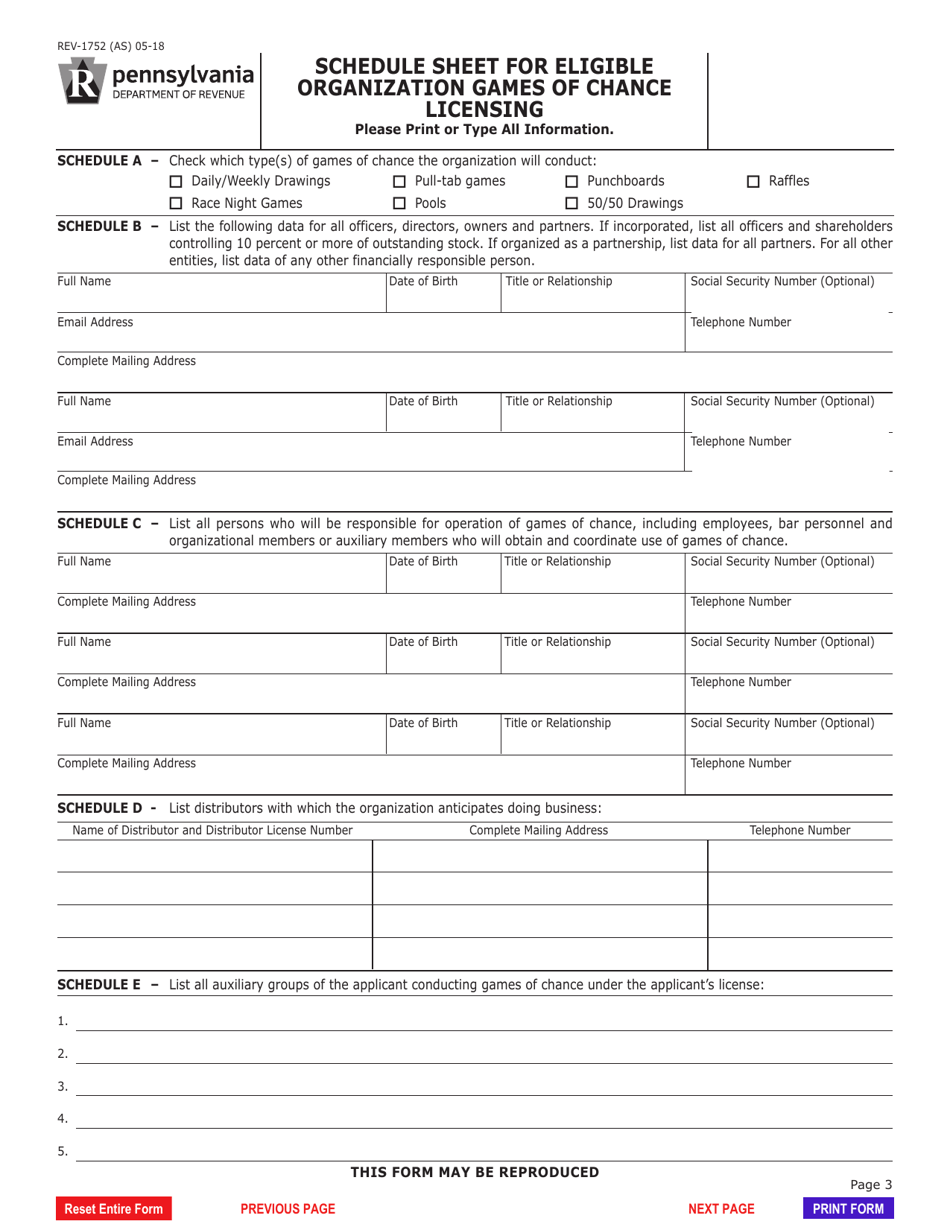

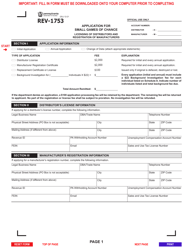

Q: What information is required on Form REV-1752?

A: Form REV-1752 requires information about the organization, its officers and members, the proposed games of chance, and financial details related to the event.

Q: Are there any fees associated with submitting Form REV-1752?

A: Yes, eligible organizations are required to pay a fee when submitting Form REV-1752. The fee amount varies depending on the type and value of prizes involved.

Q: Is there a deadline for submitting Form REV-1752?

A: Yes, Form REV-1752 must be submitted at least 30 days prior to the proposed event.

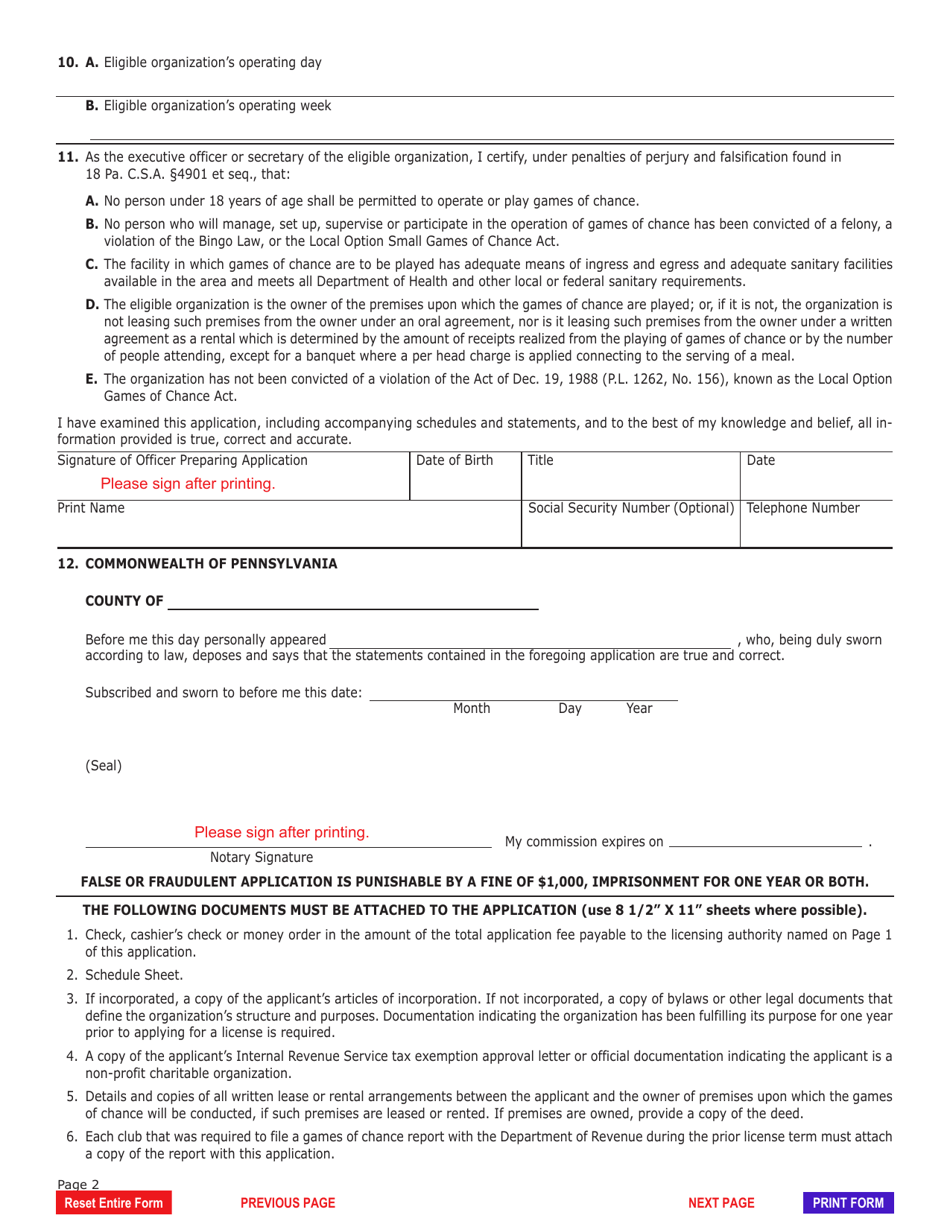

Q: What happens after Form REV-1752 is submitted?

A: After submitting Form REV-1752, the application will be reviewed by the Pennsylvania Department of Revenue. If approved, the eligible organization will receive a permit to conduct the games of chance.

Q: Are there any reporting requirements after the games of chance event?

A: Yes, eligible organizations are required to submit a post-event report to the Pennsylvania Department of Revenue, detailing the financial aspects of the event.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1752 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.