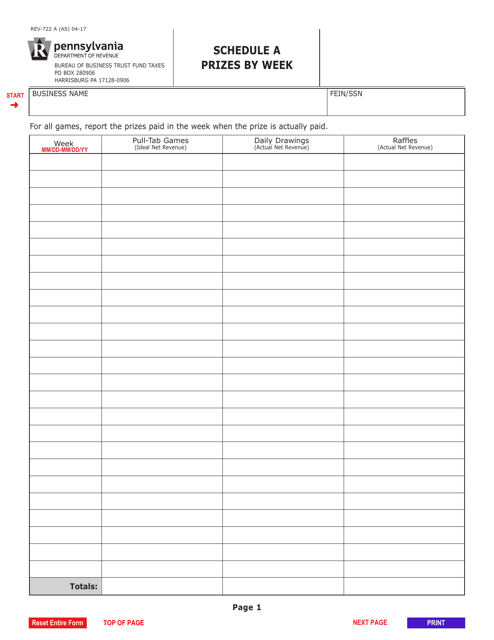

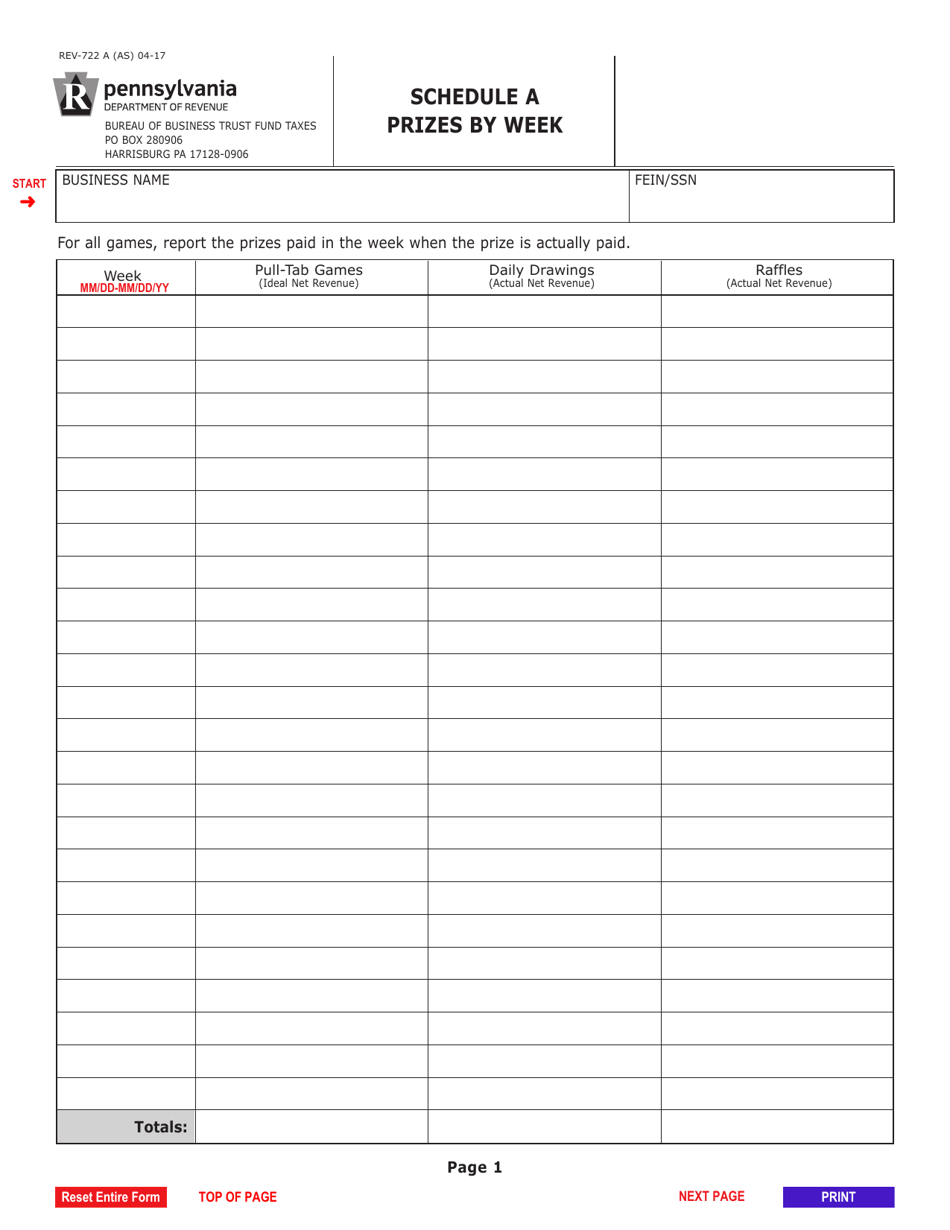

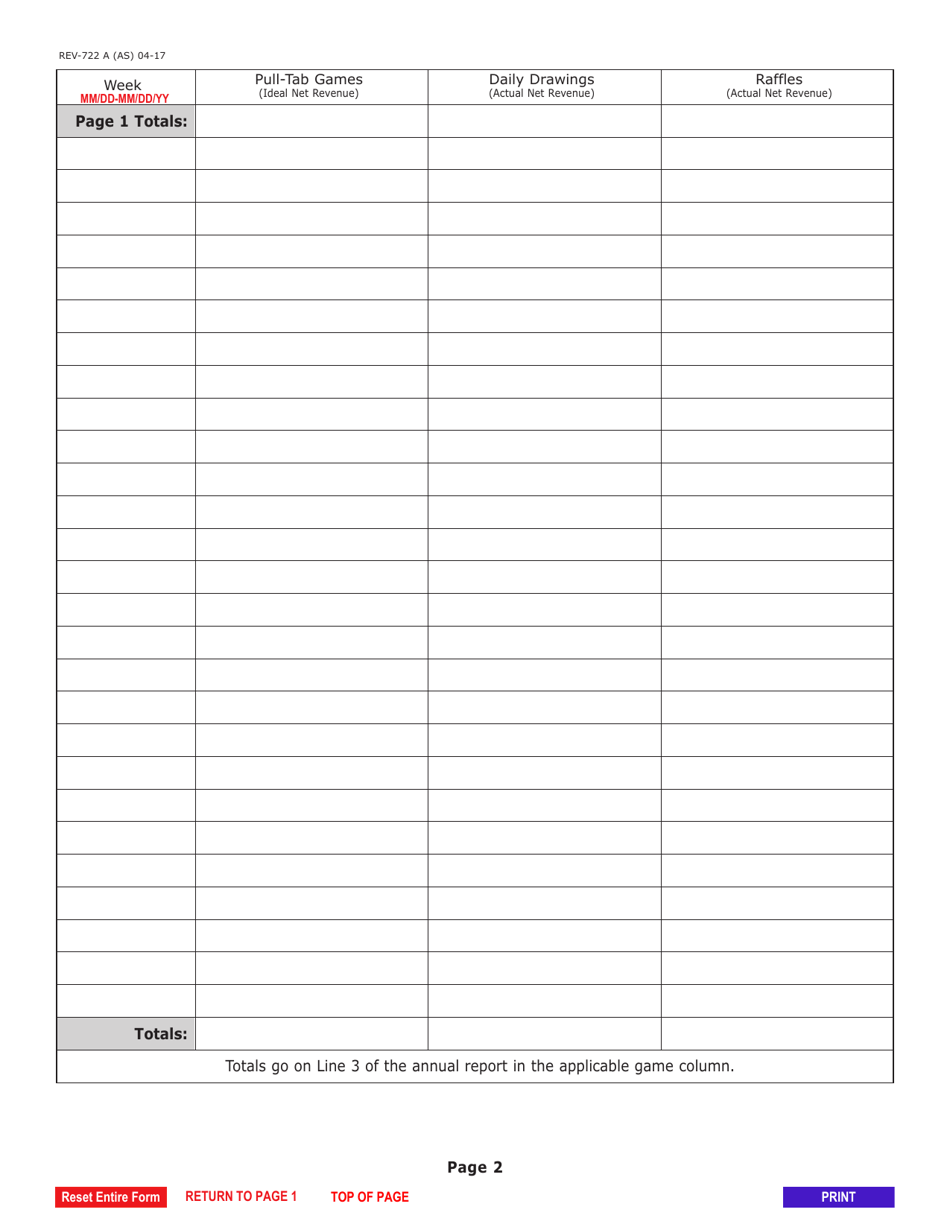

Form REV-722 A Schedule A Prizes by Week - Pennsylvania

What Is Form REV-722 A Schedule A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-722 A?

A: Form REV-722 A is a schedule for reporting prizes by week in Pennsylvania.

Q: Who needs to file Form REV-722 A?

A: Anyone who awards prizes in Pennsylvania and meets the reporting requirements.

Q: What does Form REV-722 A report?

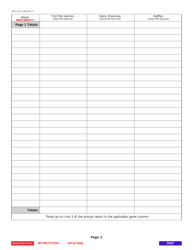

A: Form REV-722 A reports prizes awarded in Pennsylvania on a weekly basis.

Q: Why do I need to report prizes by week?

A: Reporting prizes by week allows for accurate tracking and compliance with Pennsylvania prize reporting requirements.

Q: What information is required on Form REV-722 A?

A: Form REV-722 A requires information about the prize provider, the prize recipient, and the value of the prize.

Q: When is Form REV-722 A due?

A: Form REV-722 A is due on a weekly basis, no later than the 20th day of the following week.

Q: What happens if I don't file Form REV-722 A?

A: Failure to file Form REV-722 A may result in penalties or other enforcement actions by the Pennsylvania Department of Revenue.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-722 A Schedule A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.