This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule P-S KOZ

for the current year.

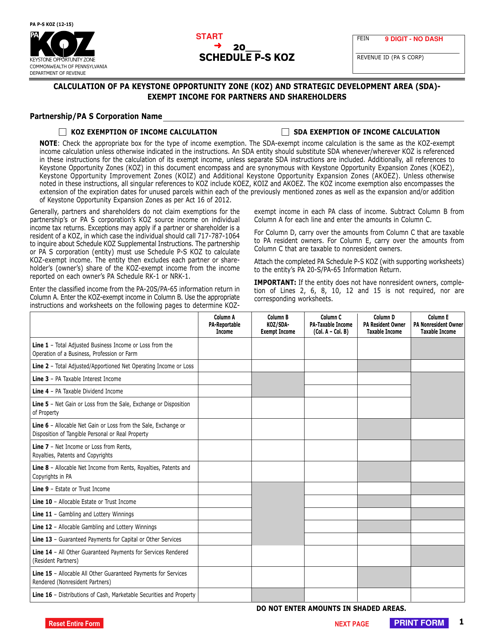

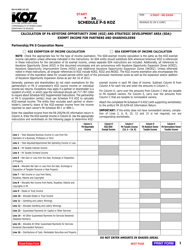

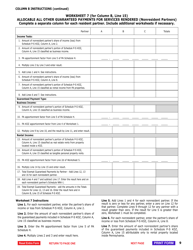

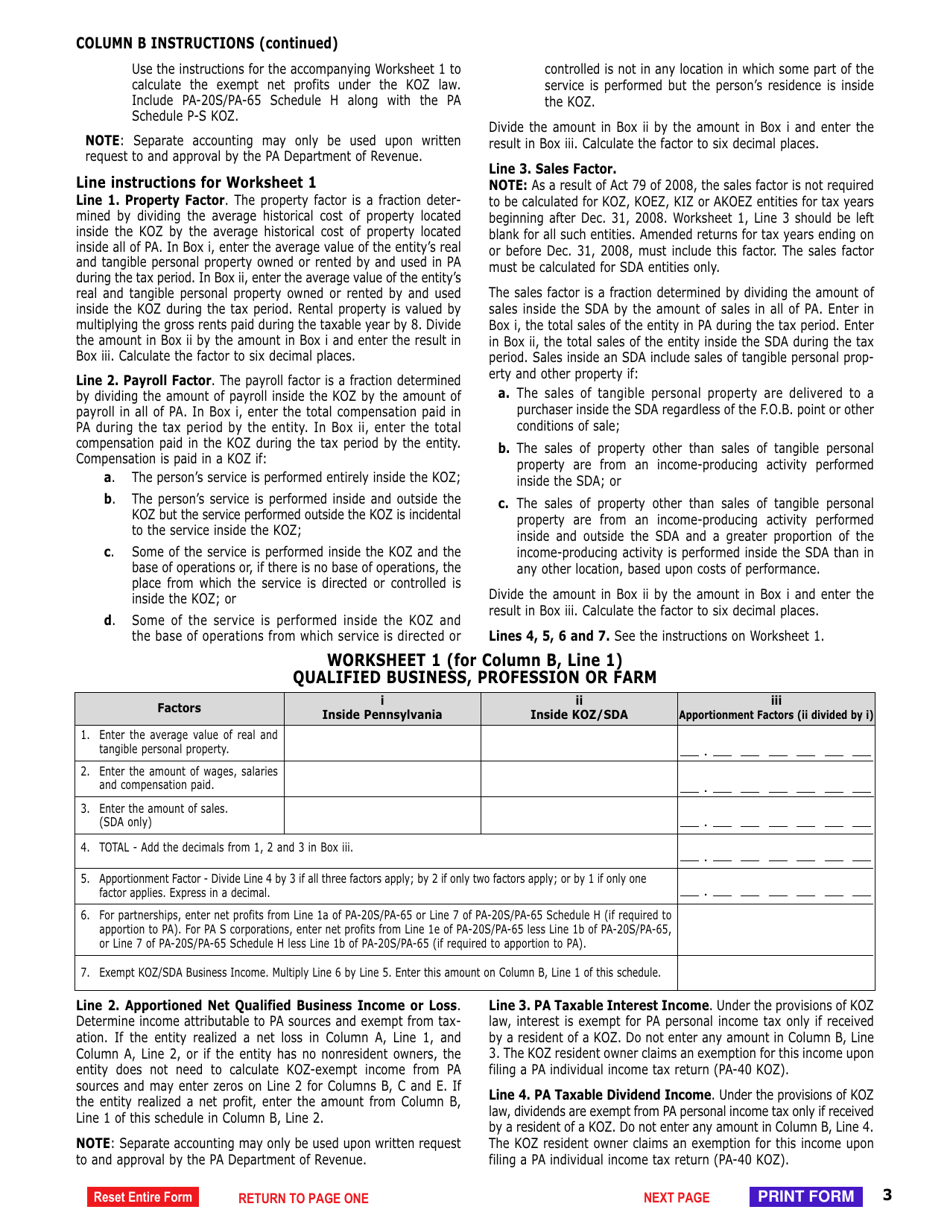

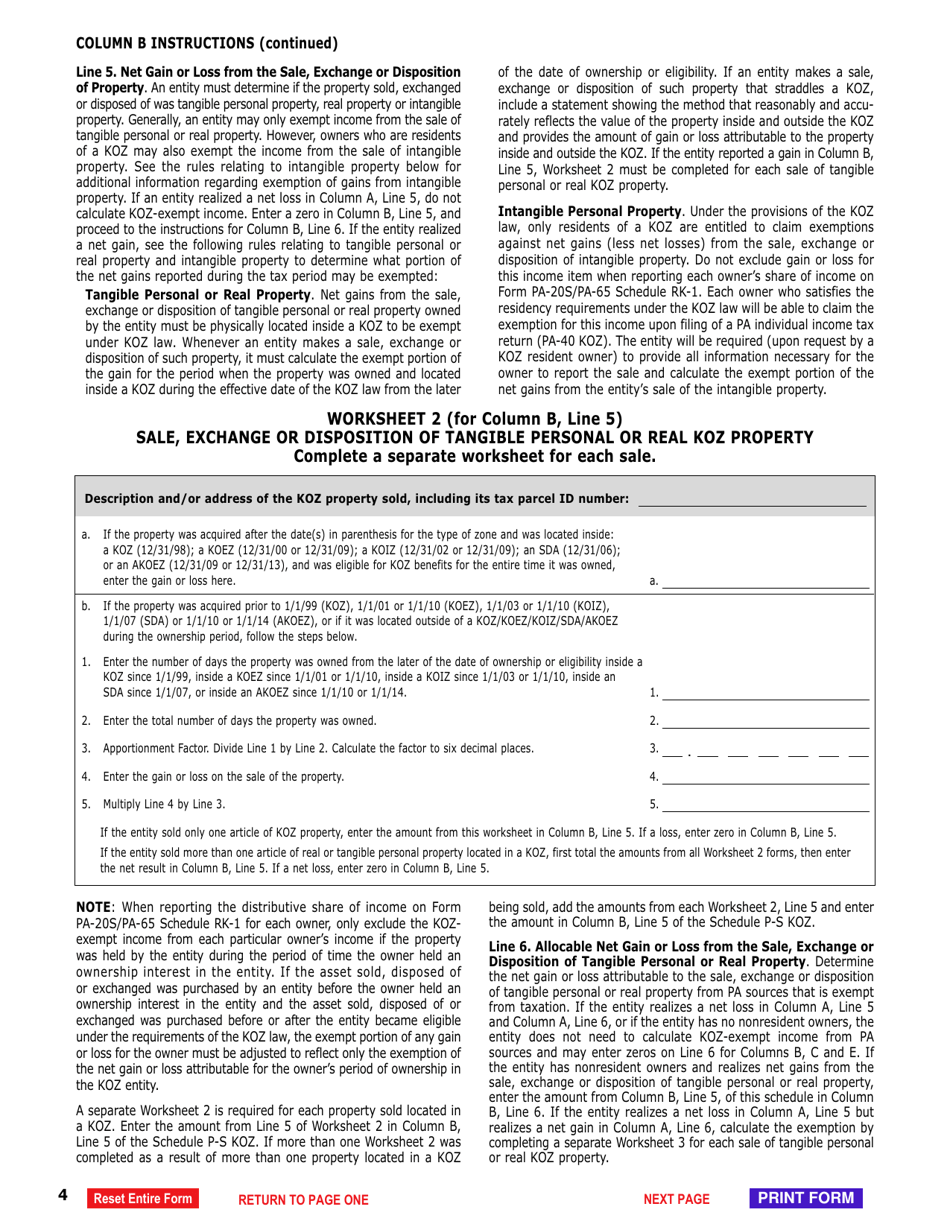

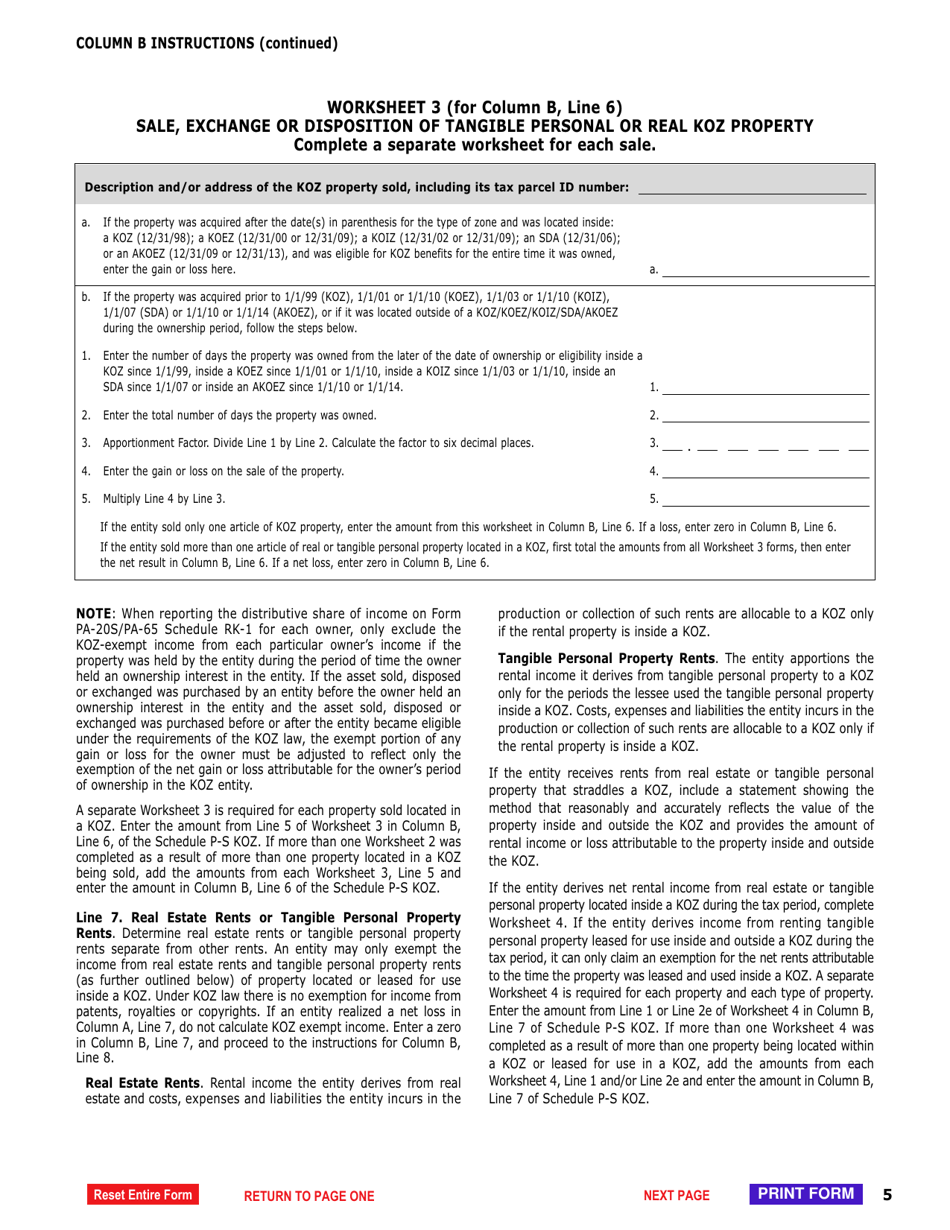

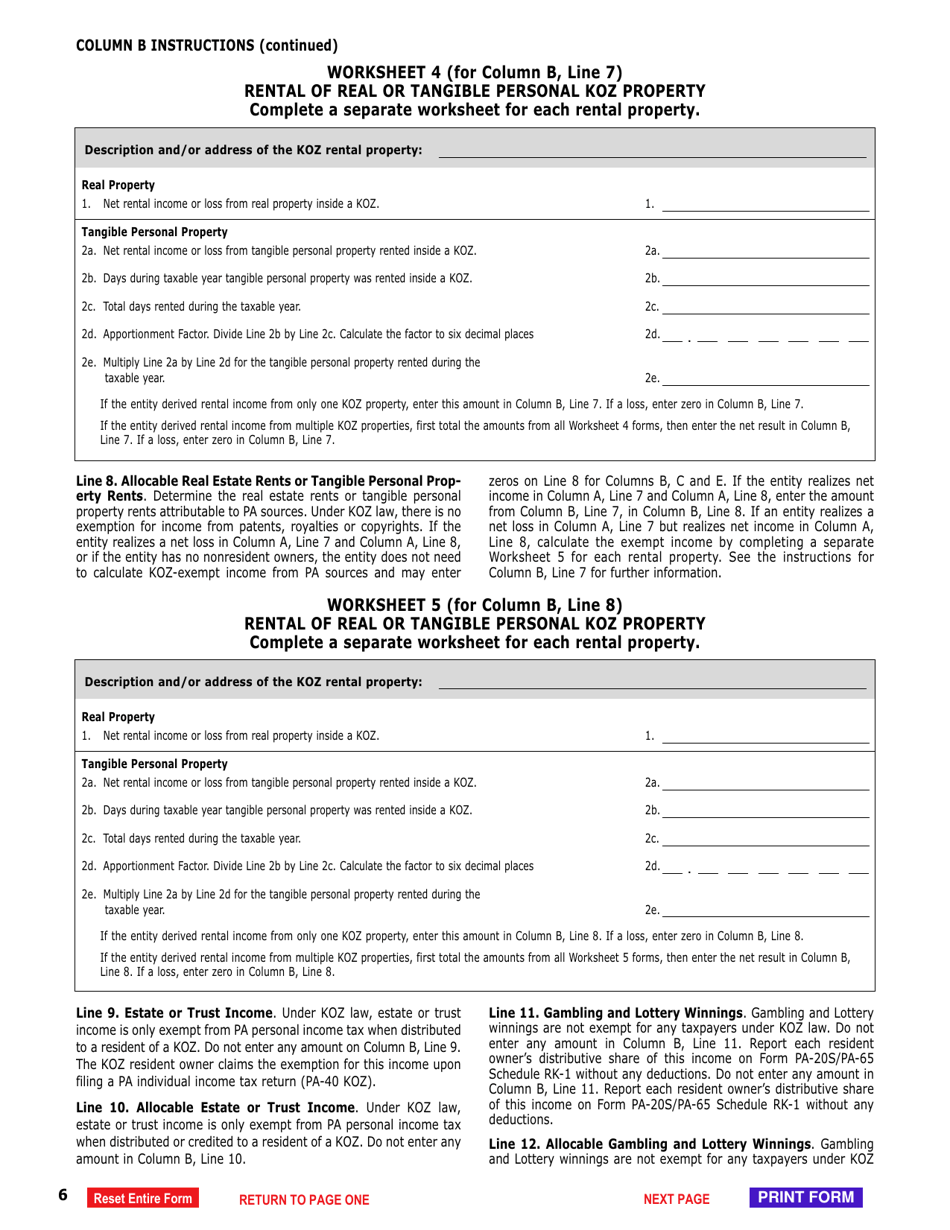

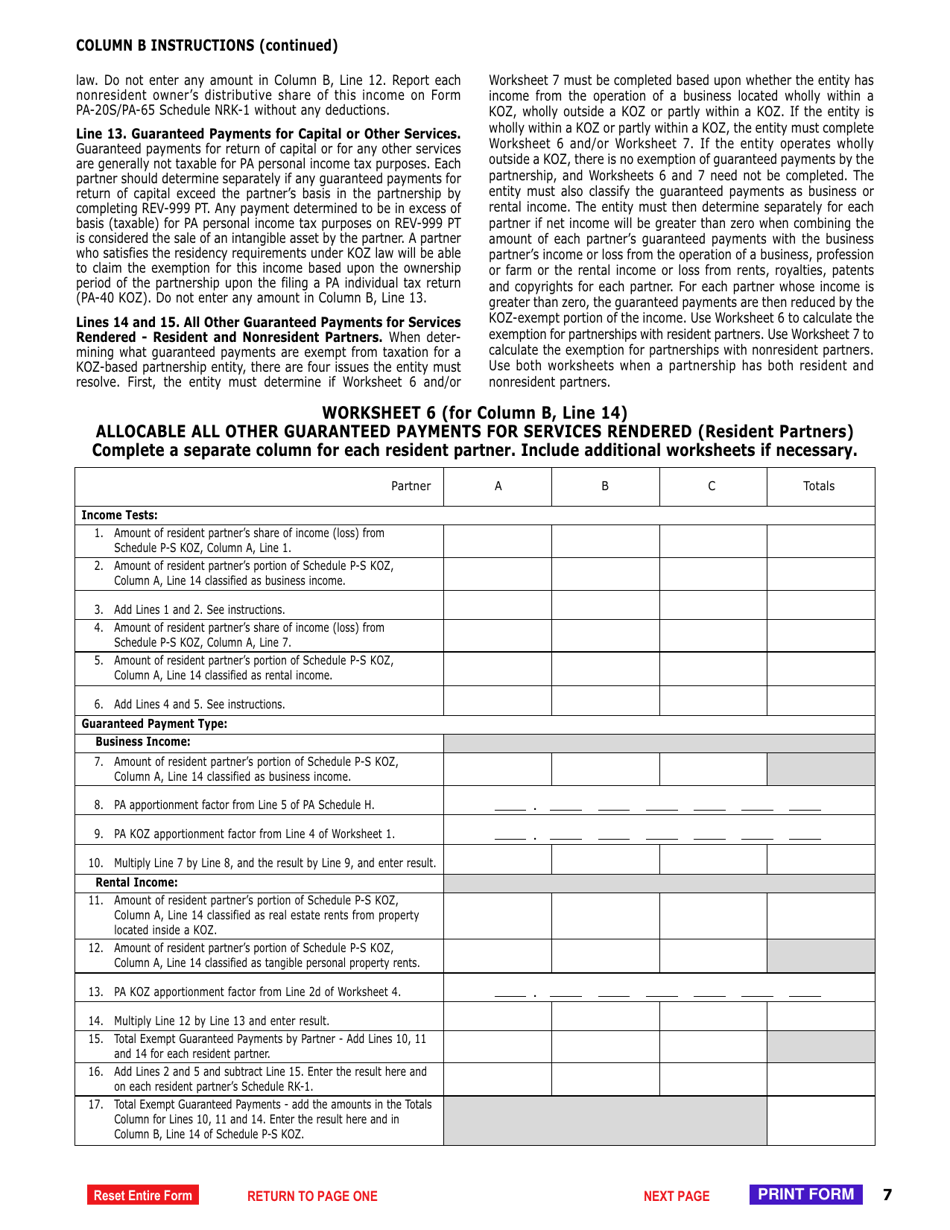

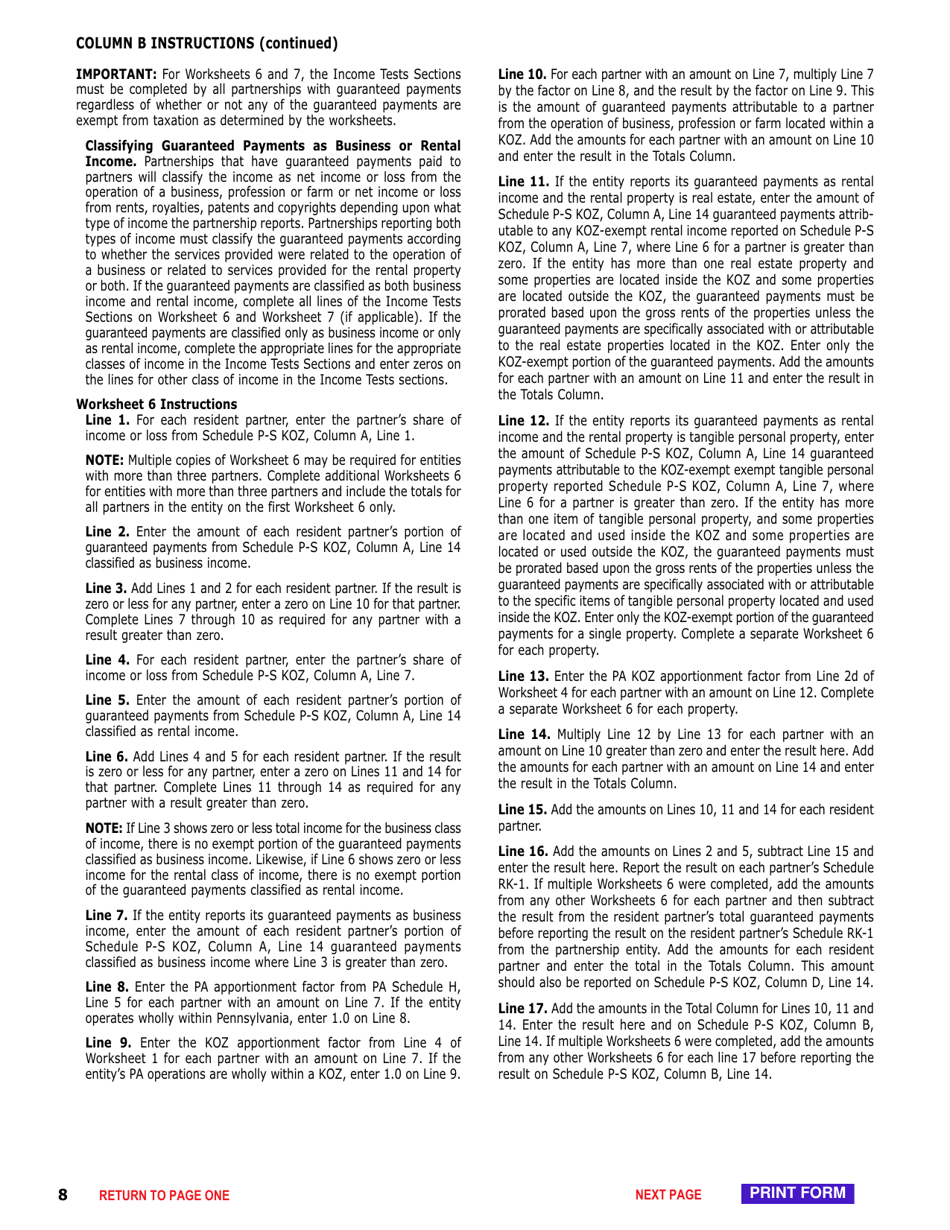

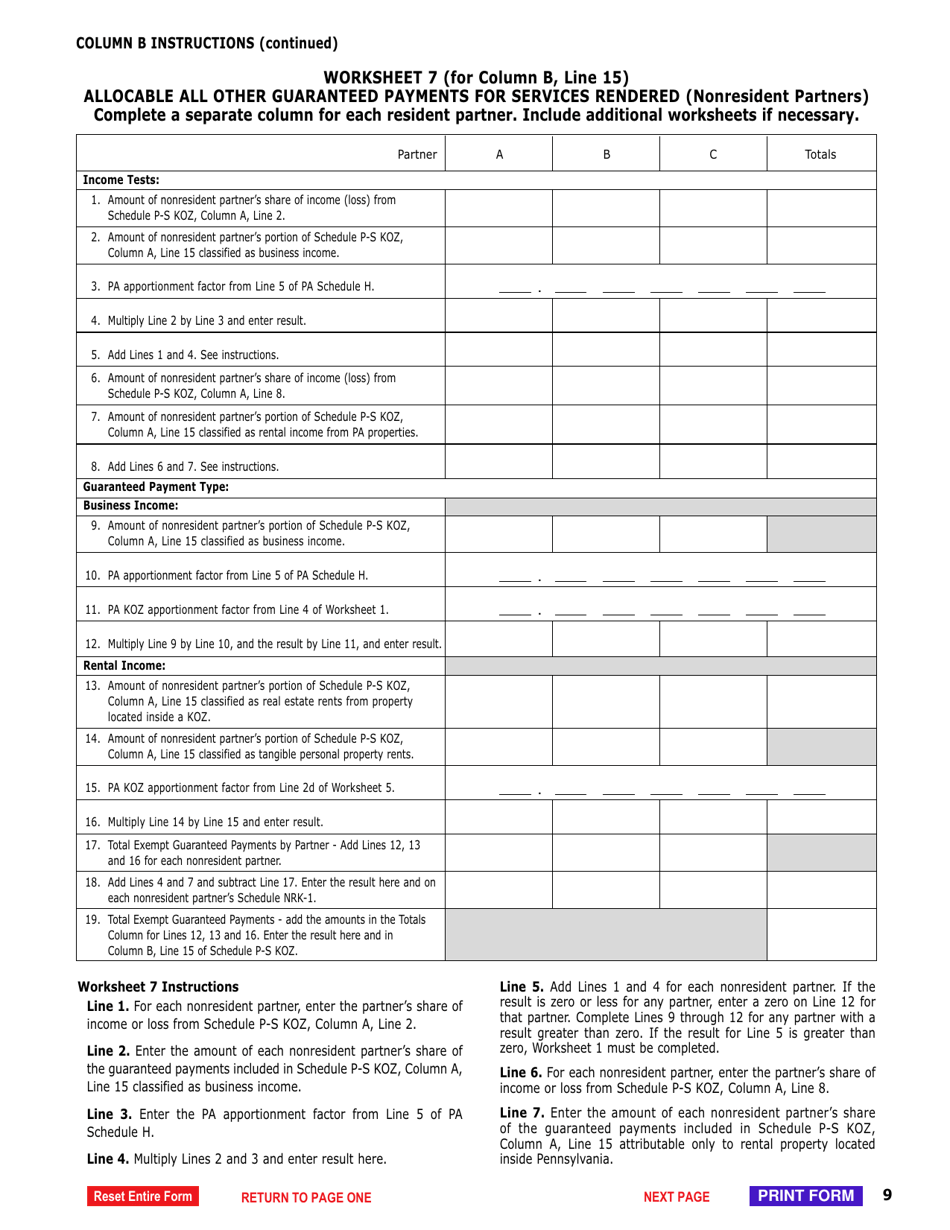

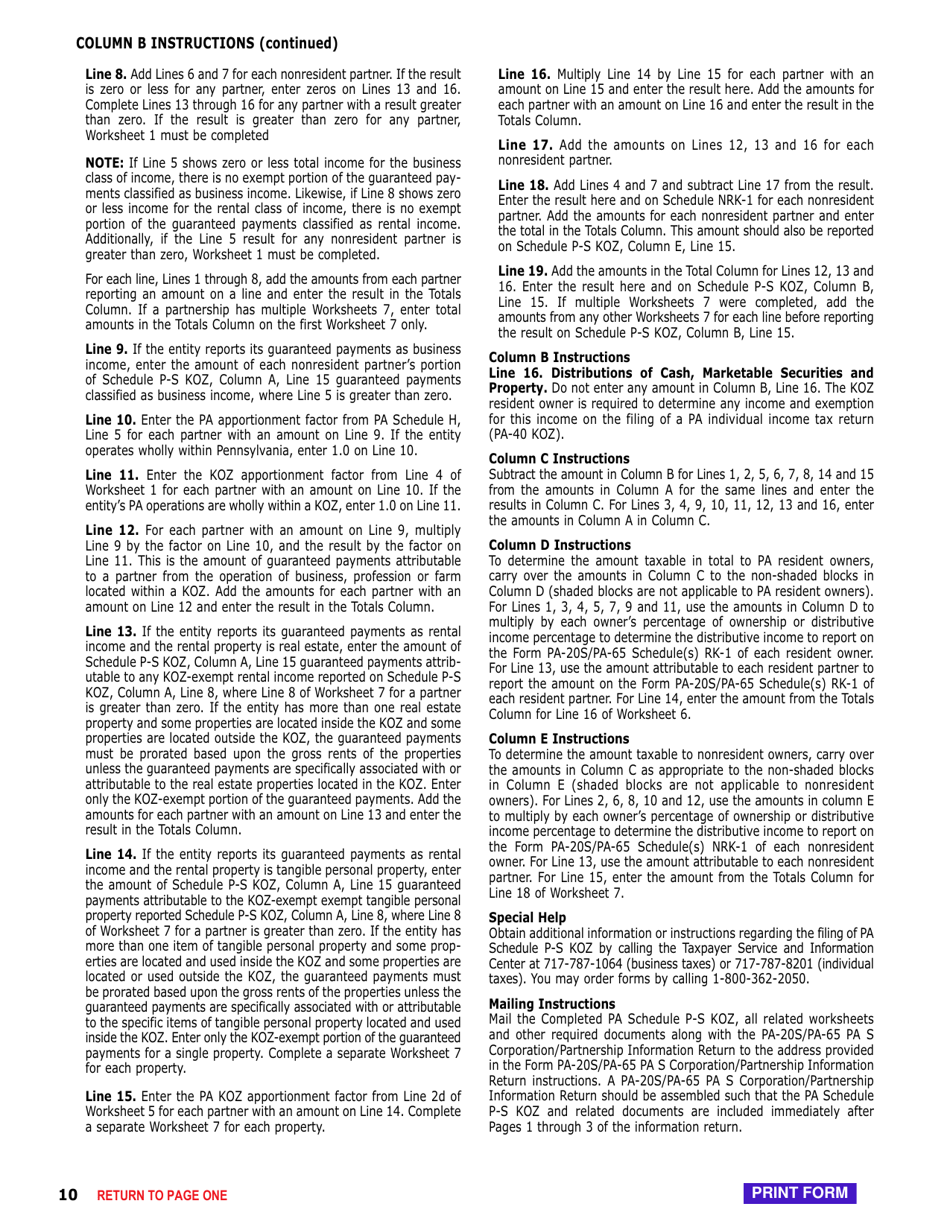

Schedule P-S KOZ Calculation of Pa Keystone Opportunity Zone (Koz) and Strategic Development Area (Sda) - Exempt Income for Partners and Shareholders - Pennsylvania

What Is Schedule P-S KOZ?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule P-S for KOZ calculation?

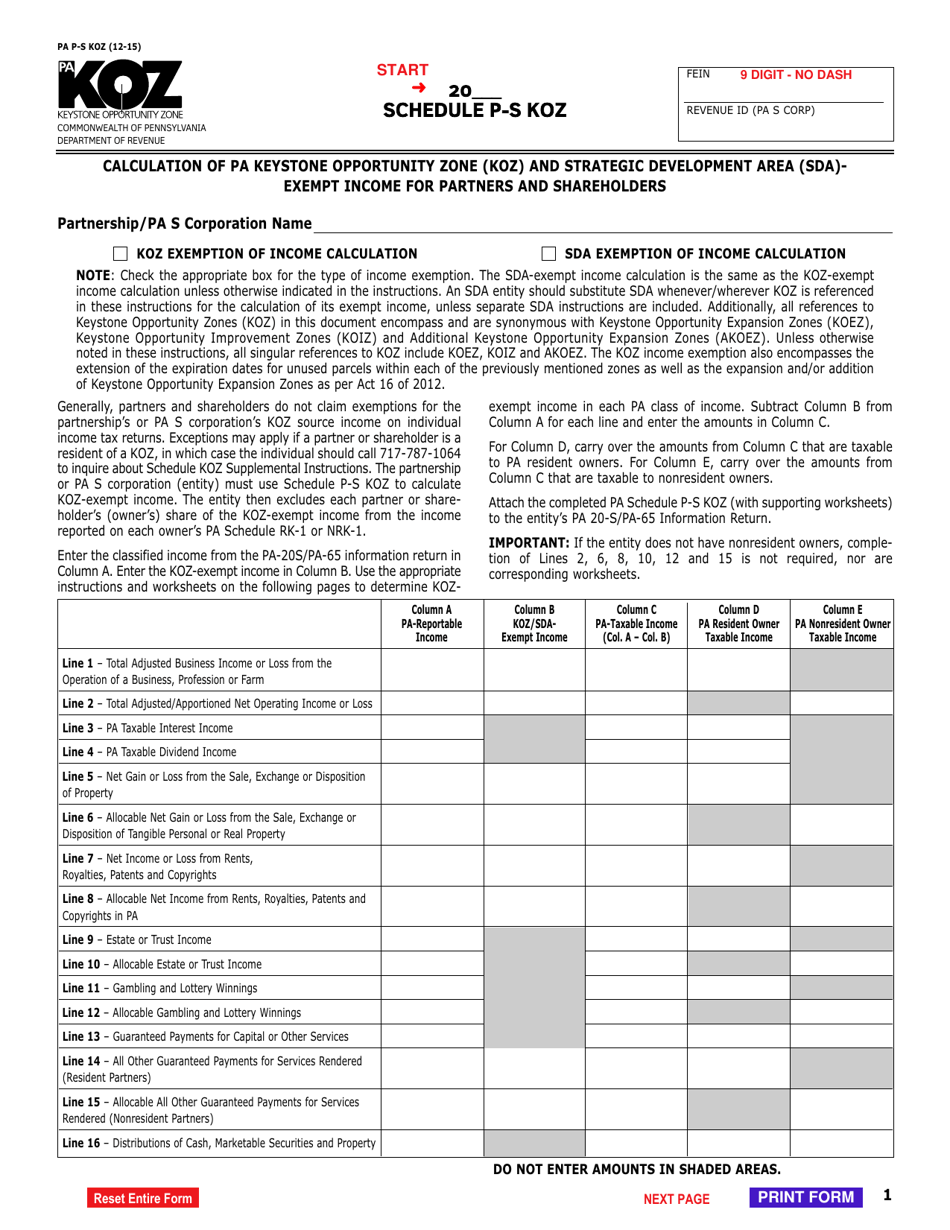

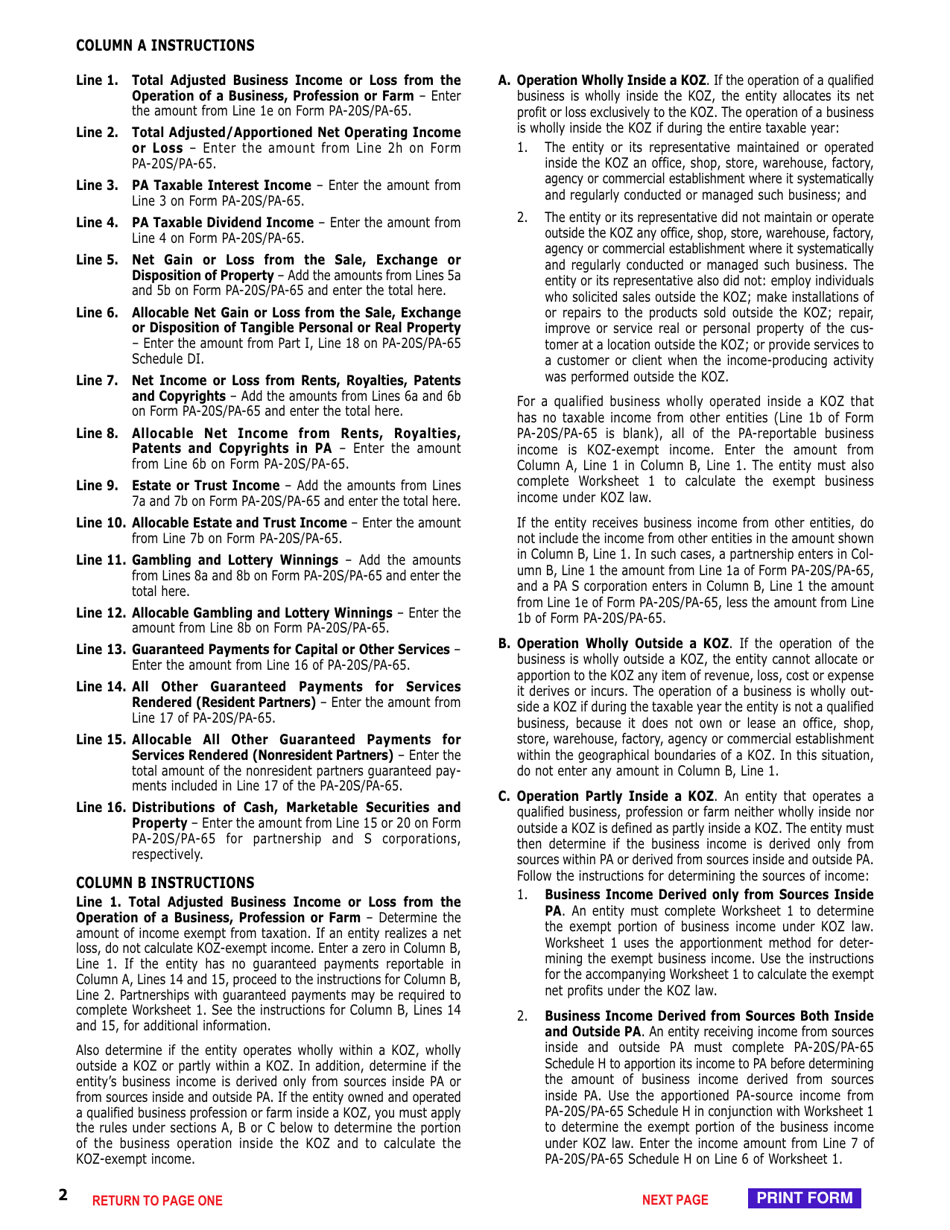

A: Schedule P-S is used to calculate the exempt income for partners and shareholders in the Pennsylvania Keystone Opportunity Zone (KOZ) and Strategic Development Area (SDA).

Q: What is a Keystone Opportunity Zone (KOZ)?

A: A Keystone Opportunity Zone (KOZ) is a designated area within Pennsylvania where businesses can qualify for certain tax benefits and incentives.

Q: What is a Strategic Development Area (SDA)?

A: A Strategic Development Area (SDA) is a specific portion of a Keystone Opportunity Zone (KOZ) that has been targeted for additional development and investment.

Q: What is exempt income?

A: Exempt income refers to income that is not subject to taxation.

Q: Who is required to file Schedule P-S?

A: Partners and shareholders who have income from a Pennsylvania Keystone Opportunity Zone (KOZ) or Strategic Development Area (SDA) are required to file Schedule P-S.

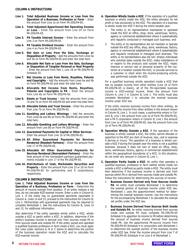

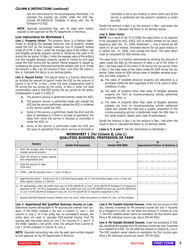

Q: What information is needed to complete Schedule P-S?

A: To complete Schedule P-S, you will need the exempt income information for each partner or shareholder, including their share of the income and any deductions or adjustments.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule P-S KOZ by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.