This version of the form is not currently in use and is provided for reference only. Download this version of

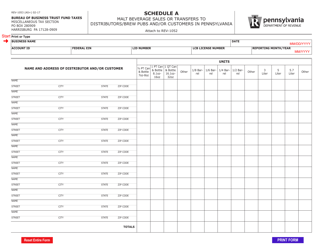

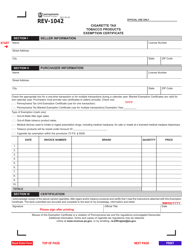

Form REV-1809

for the current year.

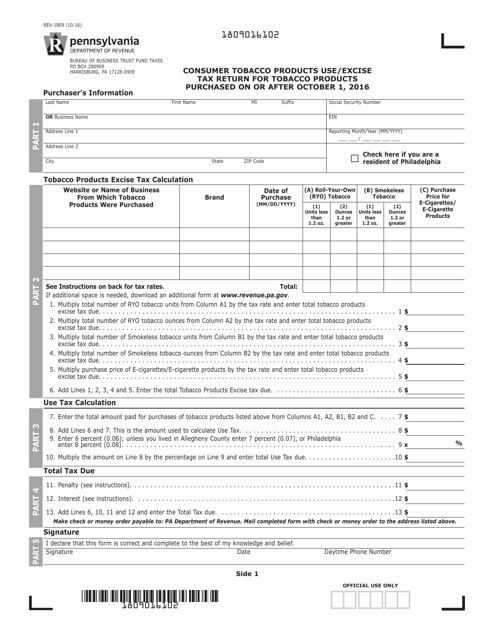

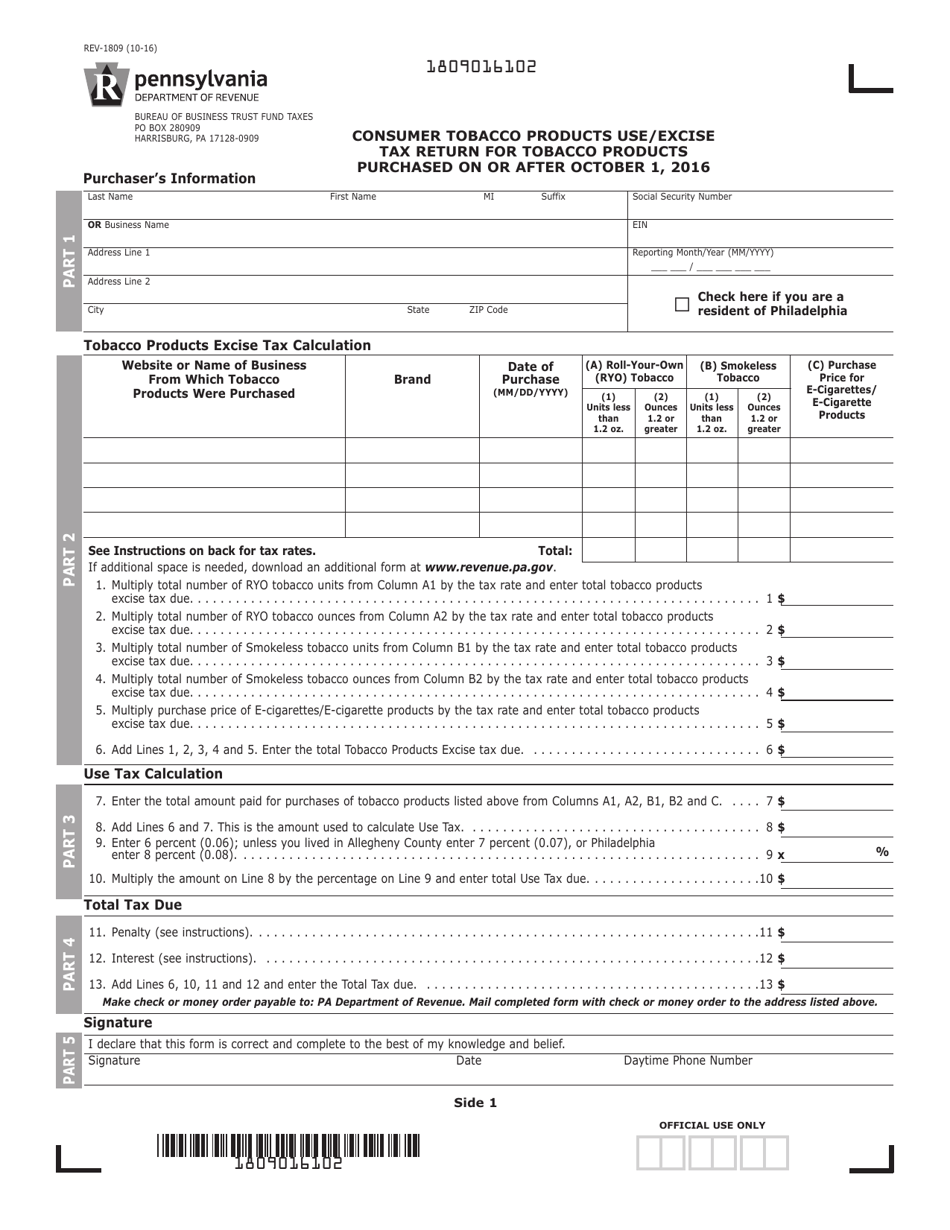

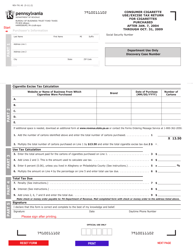

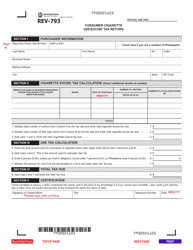

Form REV-1809 Consumer Tobacco Products Use / Excise Tax Return for Tobacco Products Purcased on or After October 1, 2016 - Pennsylvania

What Is Form REV-1809?

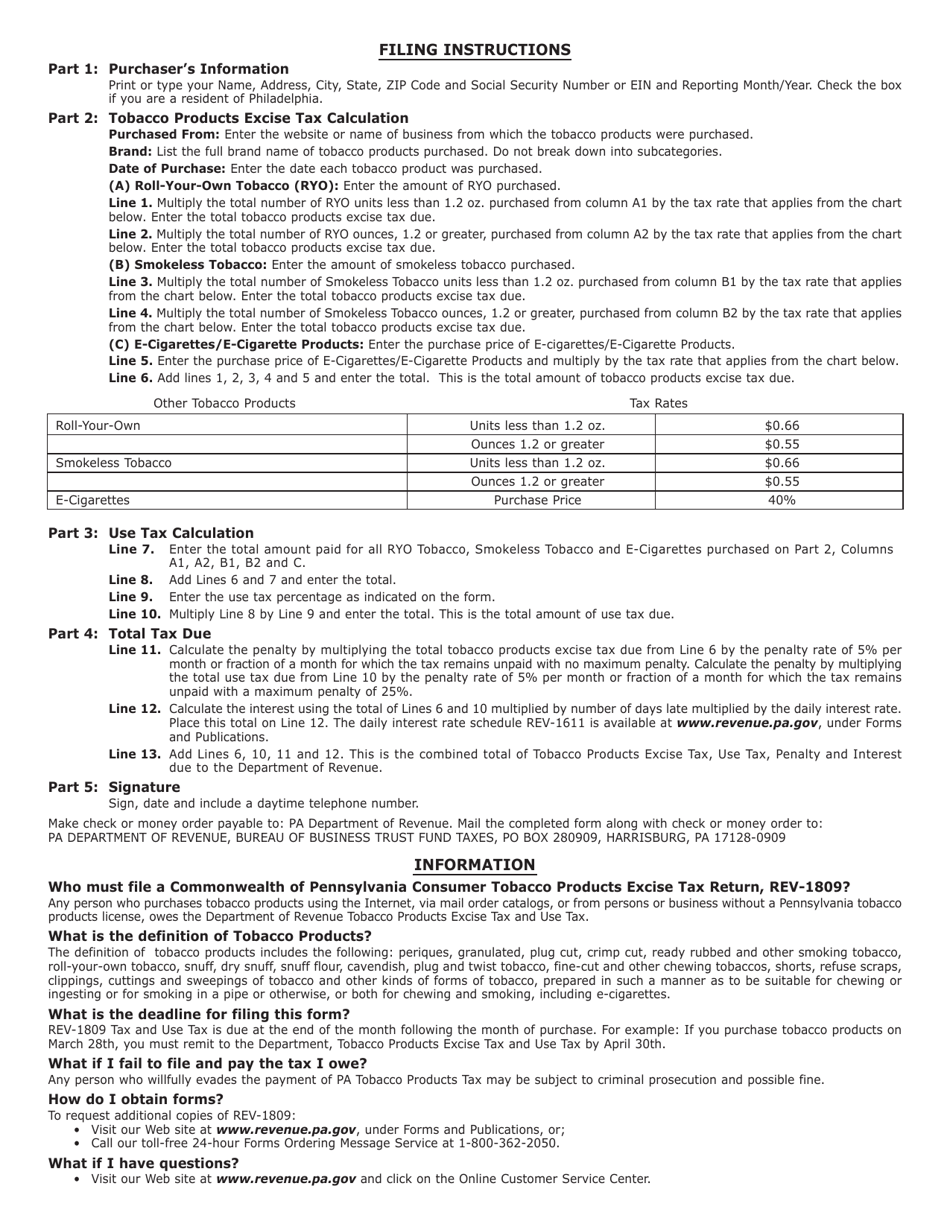

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-1809?

A: Form REV-1809 is the Consumer Tobacco Products Use/Excise Tax Return for tobacco products purchased on or after October 1, 2016 in Pennsylvania.

Q: When should I use Form REV-1809?

A: You should use Form REV-1809 if you have purchased tobacco products in Pennsylvania on or after October 1, 2016.

Q: What is the purpose of Form REV-1809?

A: The purpose of Form REV-1809 is to report and pay the consumer tobacco products use/excise tax for tobacco products purchased in Pennsylvania on or after October 1, 2016.

Q: What information is required on Form REV-1809?

A: Some of the information required on Form REV-1809 includes the name and address of the purchaser, the date and location of purchase, and the amount of tobacco products purchased.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-1809 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.