This version of the form is not currently in use and is provided for reference only. Download this version of

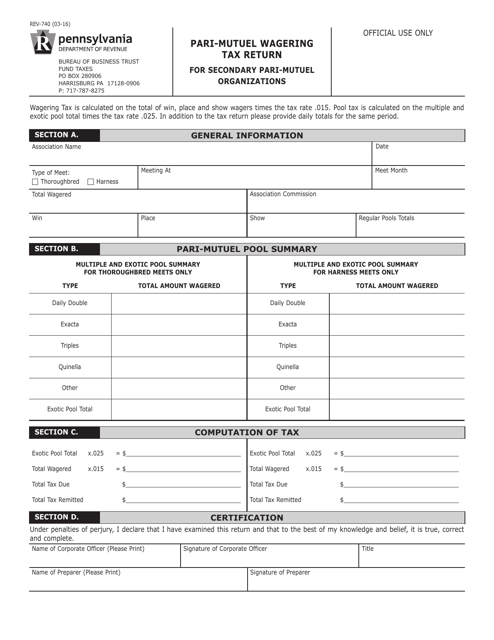

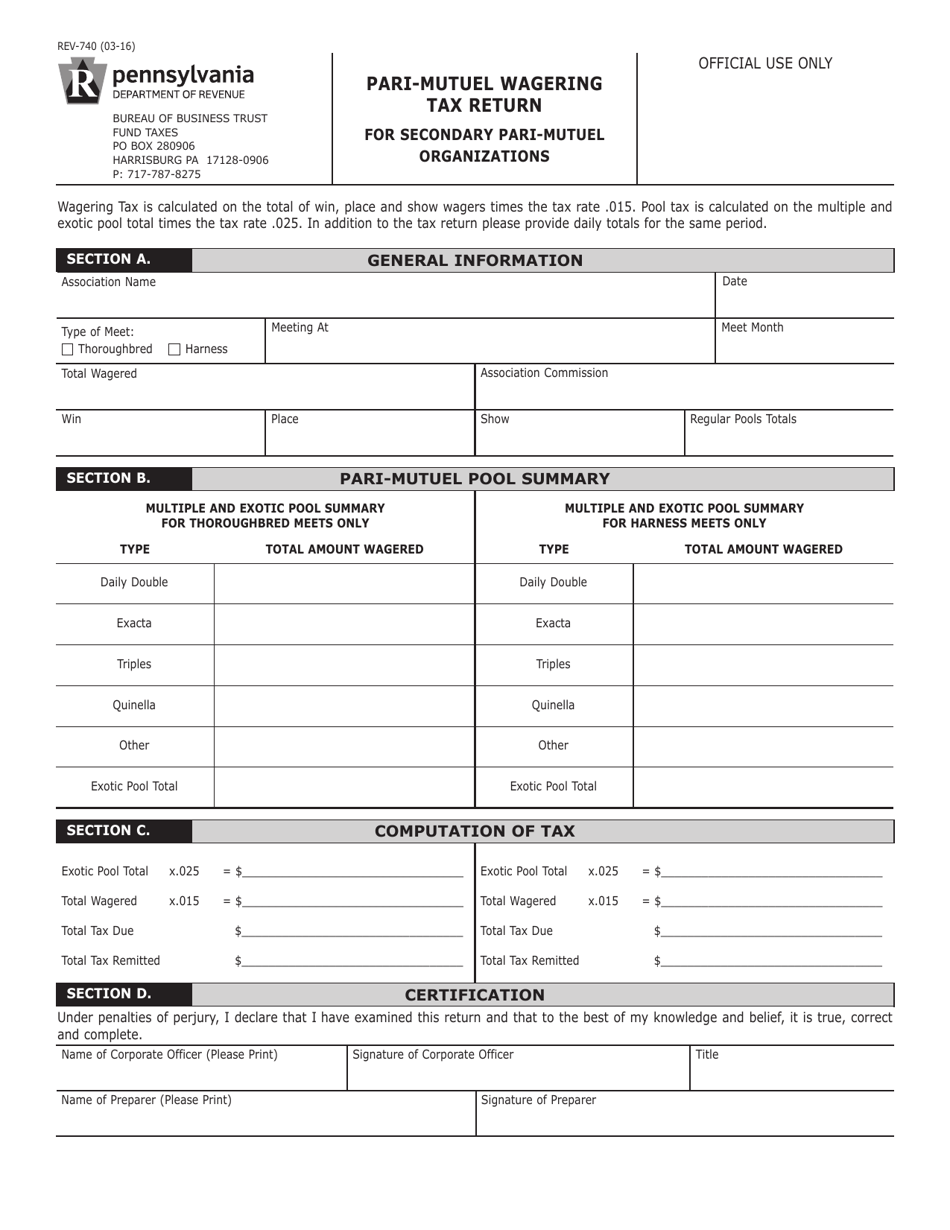

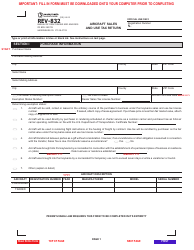

Form REV-740

for the current year.

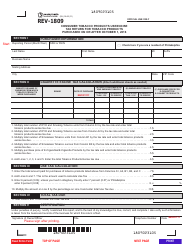

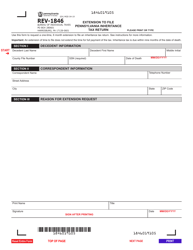

Form REV-740 Pari-Mutuel Wagering Tax Return for Secondary Pari-Mutuel Organizations - Pennsylvania

What Is Form REV-740?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-740?

A: Form REV-740 is the Pari-Mutuel Wagering Tax Return for Secondary Pari-Mutuel Organizations in Pennsylvania.

Q: Who needs to file Form REV-740?

A: Secondary Pari-Mutuel Organizations in Pennsylvania need to file Form REV-740.

Q: What is the purpose of Form REV-740?

A: The purpose of Form REV-740 is to report and pay the pari-mutuel wagering tax by secondary pari-mutuel organizations.

Q: When is Form REV-740 due?

A: Form REV-740 is due on or before the last day of the month following the end of the reporting period.

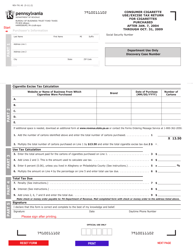

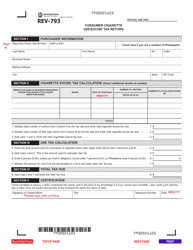

Q: What information do I need to complete Form REV-740?

A: You will need information about your pari-mutuel wagering activities and income for the reporting period.

Q: Are there any penalties for late filing of Form REV-740?

A: Yes, there may be penalties for late filing or failure to file Form REV-740.

Q: Is Form REV-740 the only tax return I need to file for pari-mutuel wagering?

A: No, secondary pari-mutuel organizations may have additional tax filing requirements.

Q: Can I file Form REV-740 electronically?

A: Yes, you can file Form REV-740 electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-740 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.