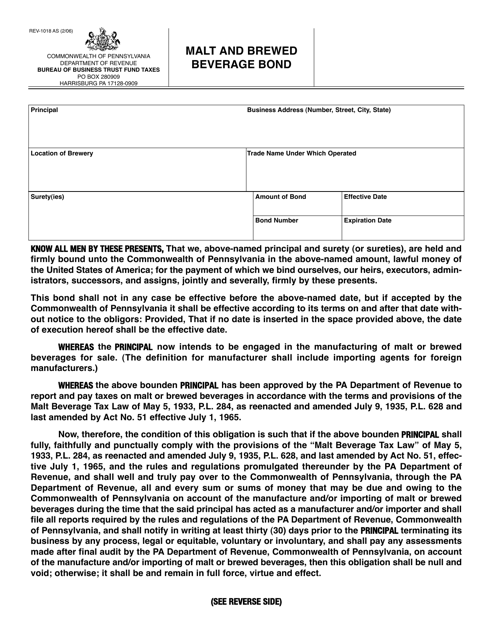

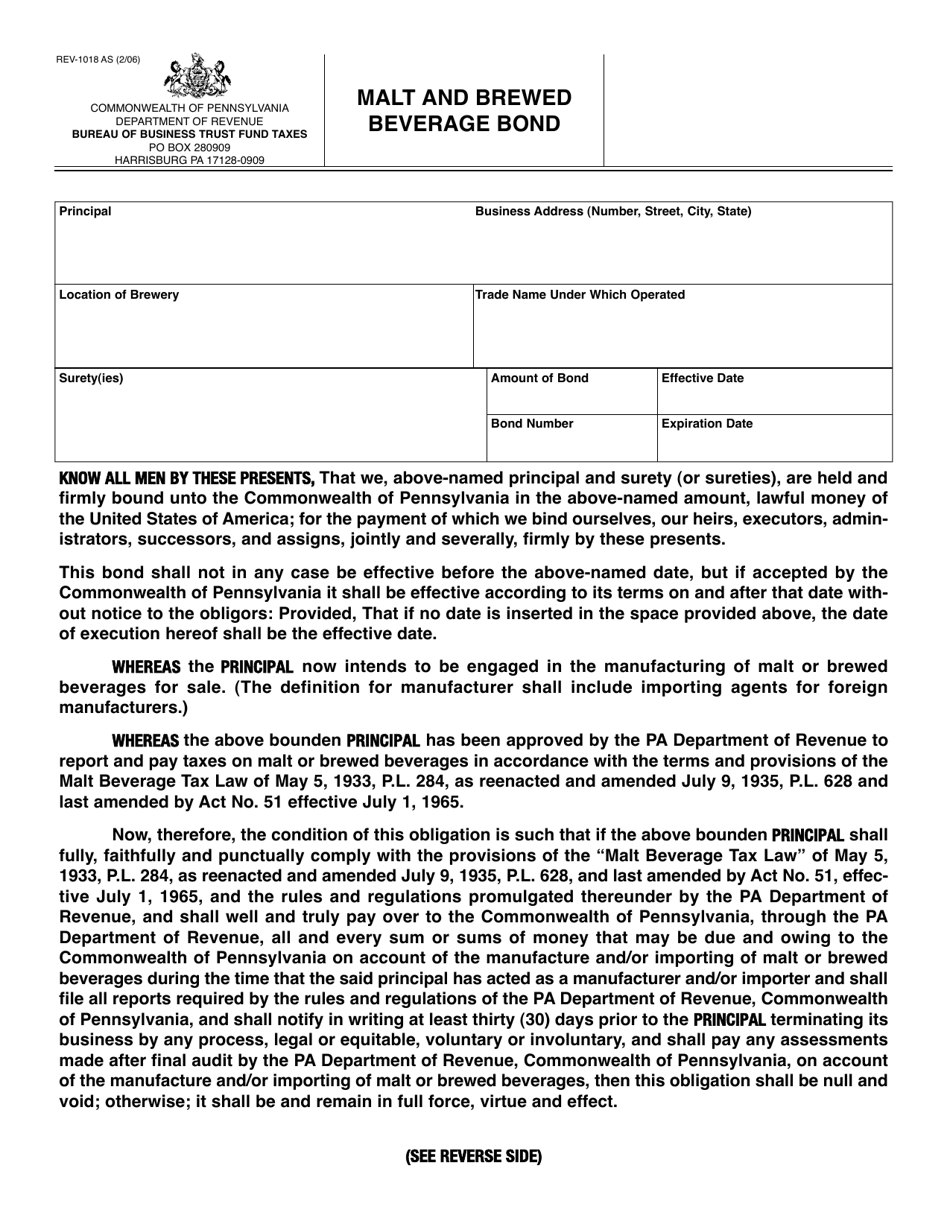

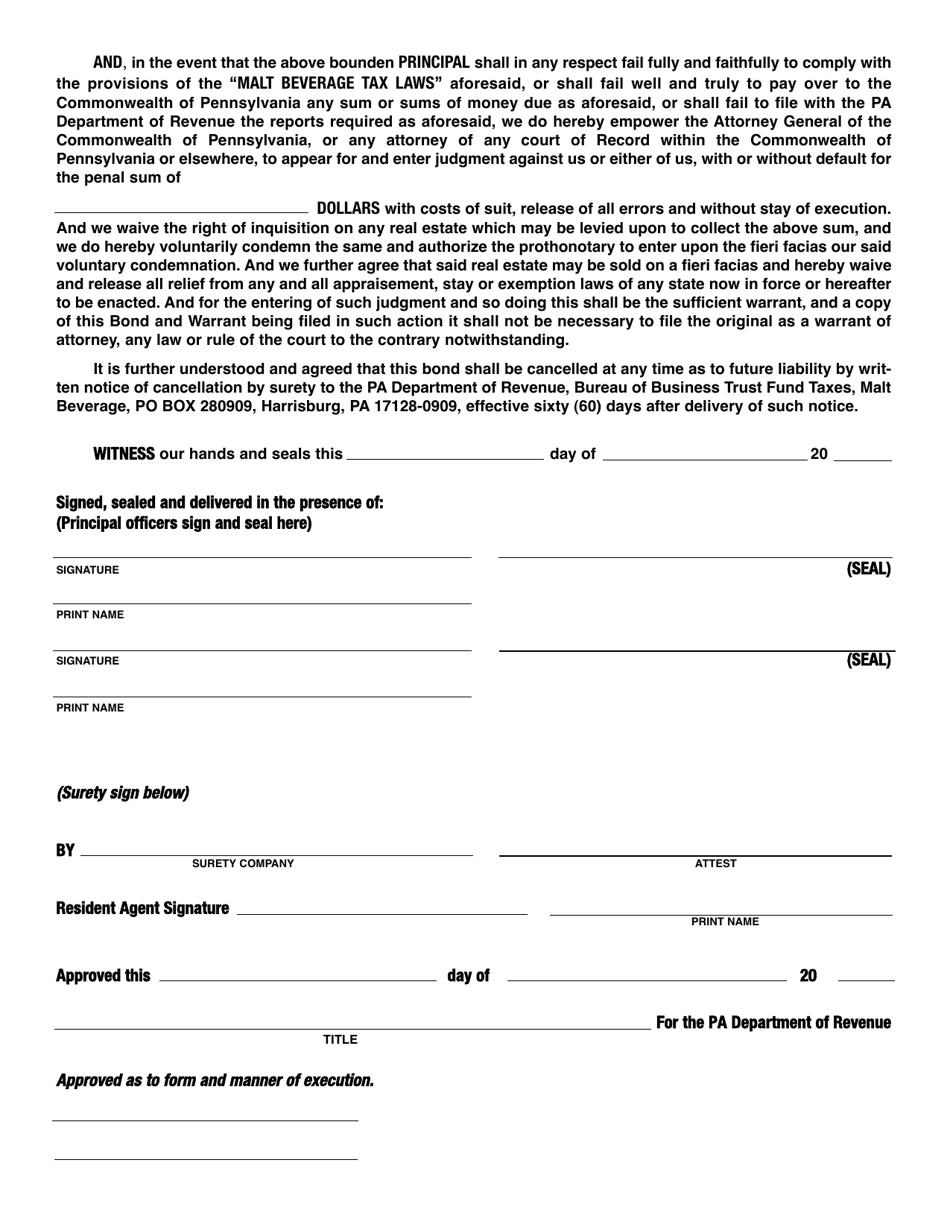

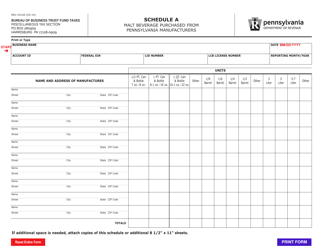

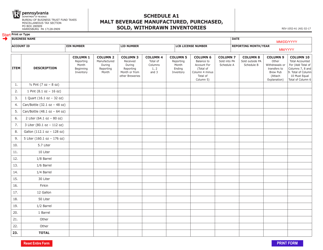

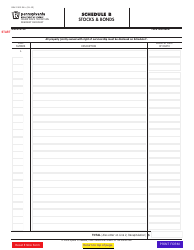

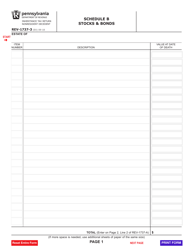

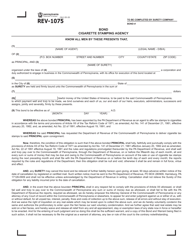

Form REV-1018 Malt and Brewed Beverage Bond - Pennsylvania

What Is Form REV-1018?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1018?

A: Form REV-1018 is the Malt and Brewed Beverage Bond required by the state of Pennsylvania.

Q: What is a Malt and Brewed Beverage Bond?

A: A Malt and Brewed Beverage Bond is a type of surety bond that ensures breweries and beverage distributors comply with state laws and regulations.

Q: Why do I need to file Form REV-1018?

A: You need to file Form REV-1018 to fulfill the bonding requirement for operating a brewery or beverage distribution business in Pennsylvania.

Q: What information do I need to provide on Form REV-1018?

A: Form REV-1018 requires information about your business, including its name, address, and license number, as well as the bond amount and surety company details.

Q: How much does the Malt and Brewed Beverage Bond cost?

A: The cost of the Malt and Brewed Beverage Bond varies depending on factors such as the bond amount, business's financial history, and credit score.

Q: How long does it take to process Form REV-1018?

A: The processing time for Form REV-1018 can vary, but it typically takes a few weeks to receive approval and the bonded status.

Q: What happens if I don't file Form REV-1018?

A: Failure to file Form REV-1018 and obtain the Malt and Brewed Beverage Bond can result in penalties, fines, or the suspension of your business license.

Q: Can I cancel the Malt and Brewed Beverage Bond?

A: The Malt and Brewed Beverage Bond can be canceled, but you must notify the Pennsylvania Department of Revenue and provide a replacement bond.

Q: Are there any exemptions from filing Form REV-1018?

A: There are no exemptions from filing Form REV-1018. All breweries and beverage distributors in Pennsylvania are required to obtain this bond.

Form Details:

- Released on February 1, 2006;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-1018 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.