This version of the form is not currently in use and is provided for reference only. Download this version of

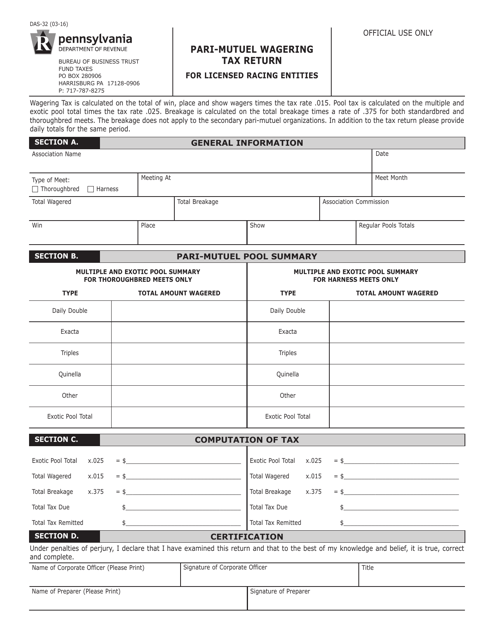

Form DAS-32

for the current year.

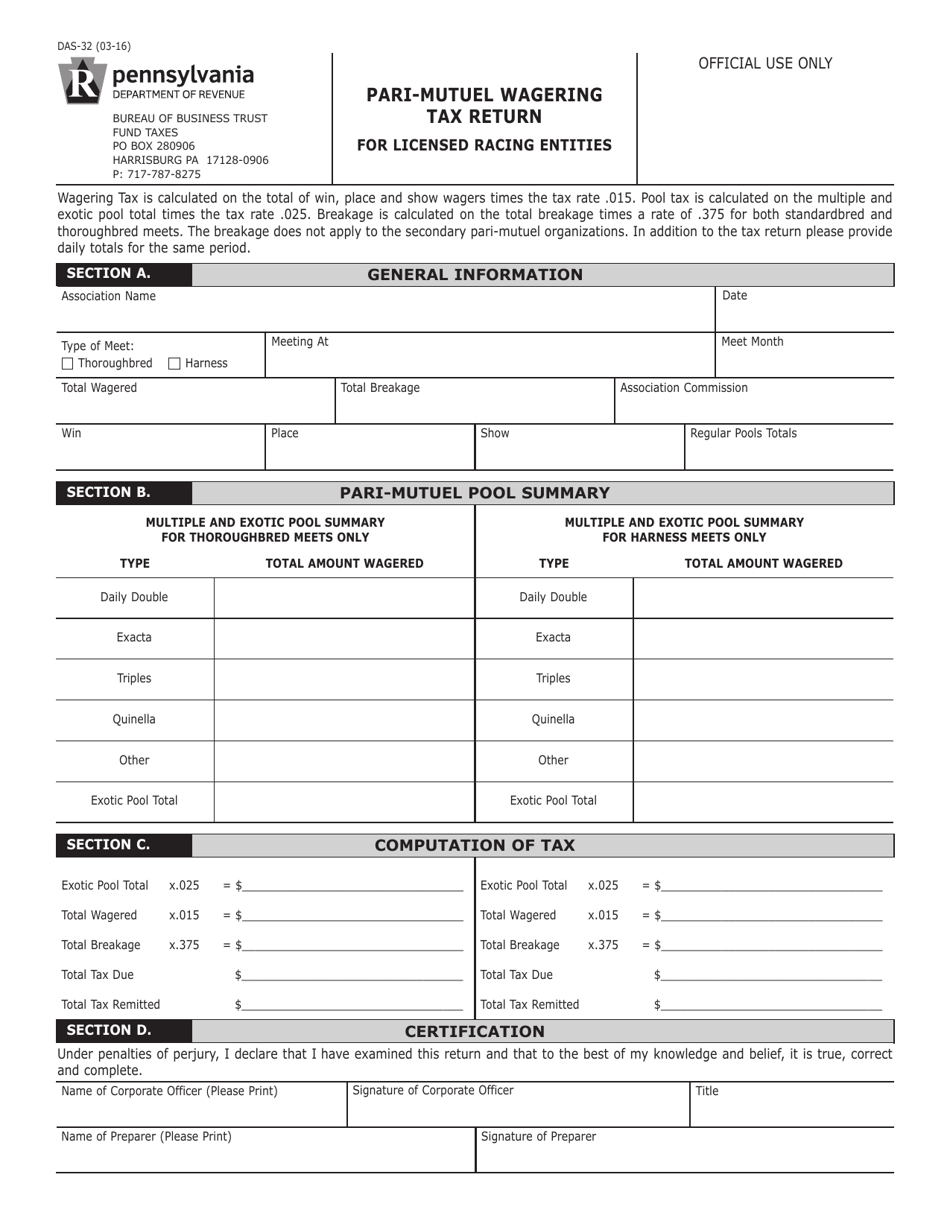

Form DAS-32 Pari-Mutuel Wagering Tax Return for Licensed Racing Entities - Pennsylvania

What Is Form DAS-32?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DAS-32?

A: Form DAS-32 is the Pari-Mutuel Wagering Tax Return for Licensed Racing Entities in Pennsylvania.

Q: Who needs to file Form DAS-32?

A: Licensed racing entities in Pennsylvania need to file Form DAS-32.

Q: What is the purpose of Form DAS-32?

A: The purpose of Form DAS-32 is to report and pay the pari-mutuel wagering tax on racing activities.

Q: How often should Form DAS-32 be filed?

A: Form DAS-32 should be filed quarterly.

Q: What information is required on Form DAS-32?

A: Form DAS-32 requires information such as total wagering receipts, prizes paid, and the amount of tax due.

Q: When is the deadline to file Form DAS-32?

A: The deadline to file Form DAS-32 is the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing of Form DAS-32?

A: Yes, there are penalties for late filing of Form DAS-32, including interest on unpaid taxes.

Q: Do I need to include payment with Form DAS-32?

A: Yes, payment for the tax due should be included with Form DAS-32.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DAS-32 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.