This version of the form is not currently in use and is provided for reference only. Download this version of

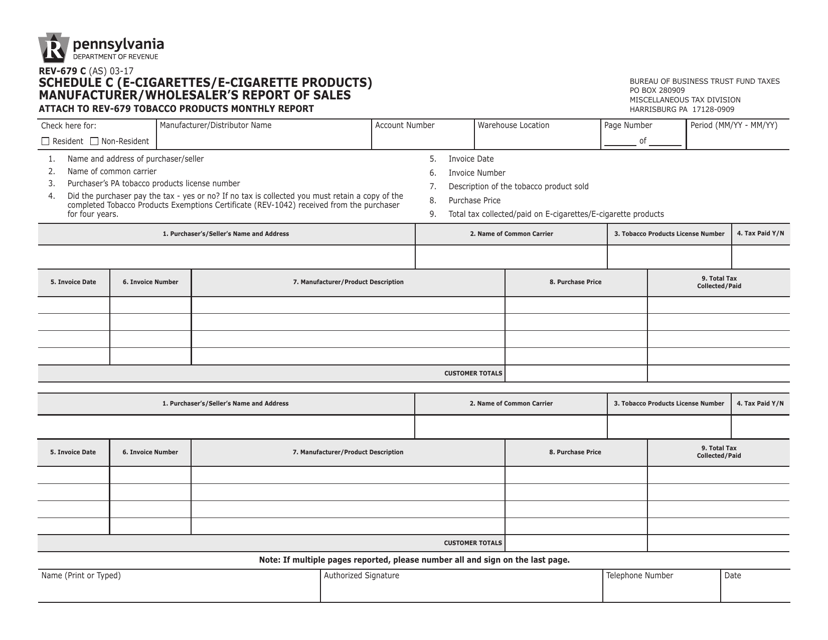

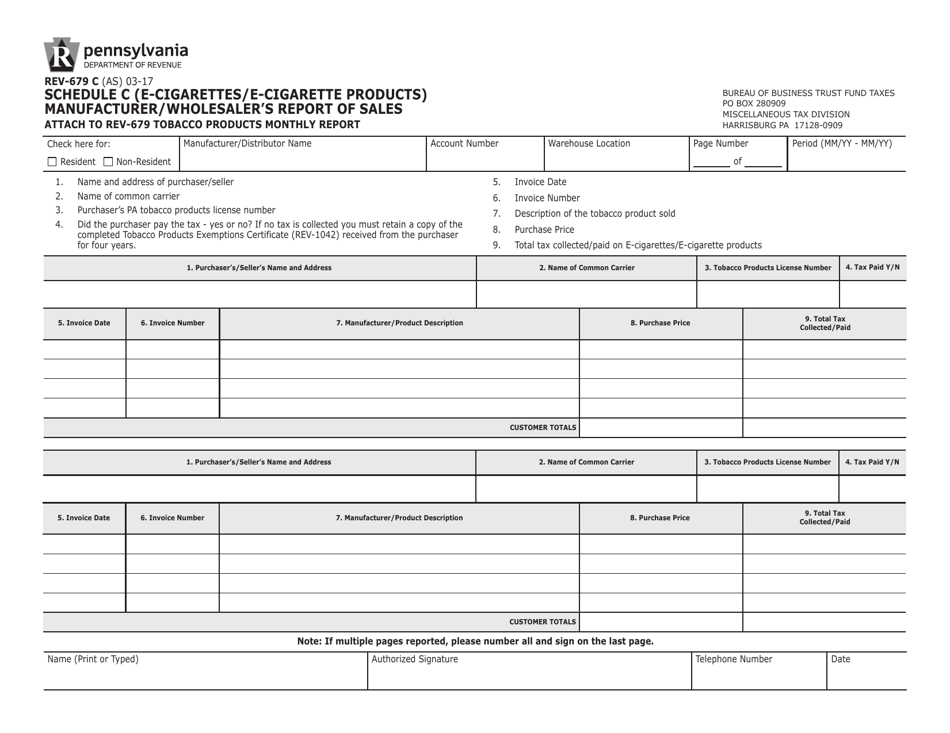

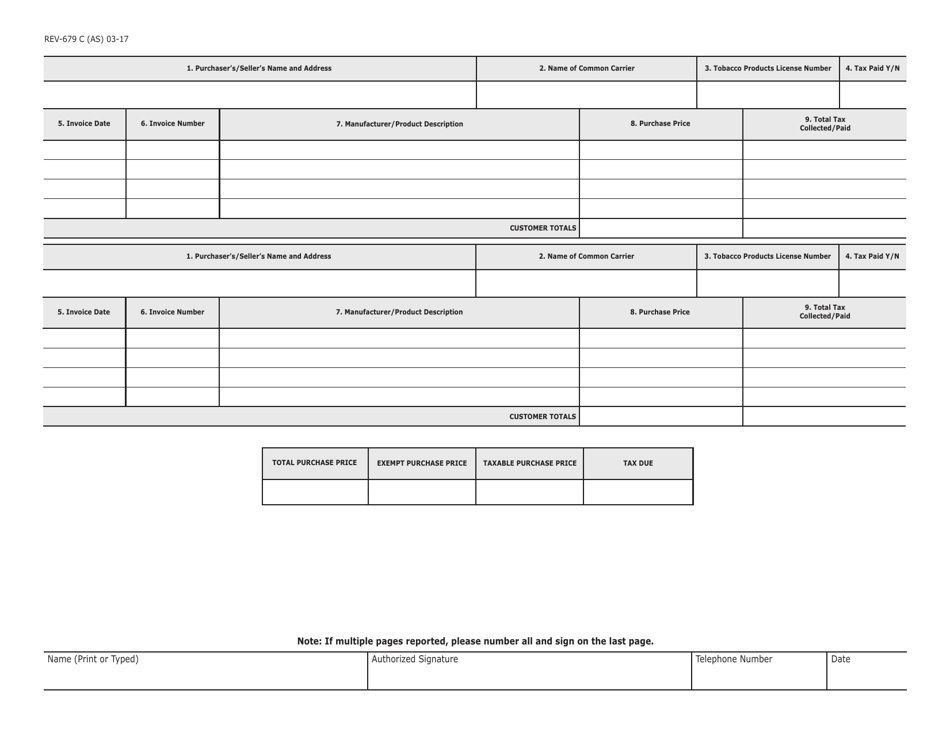

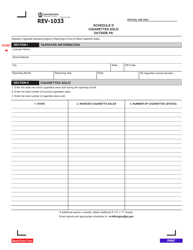

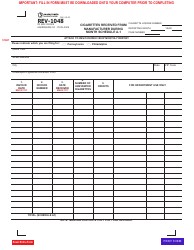

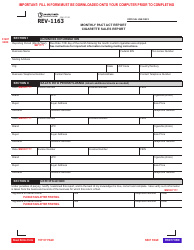

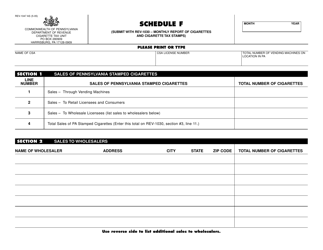

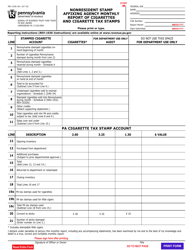

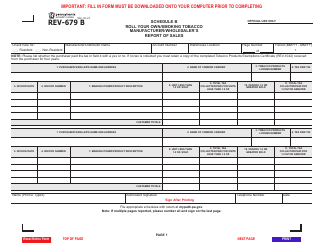

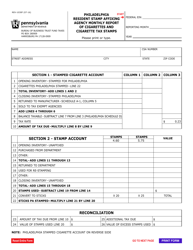

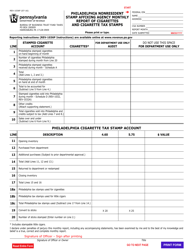

Form REV-679 C Schedule C

for the current year.

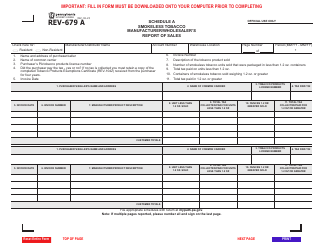

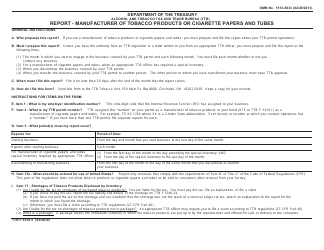

Form REV-679 C Schedule C E-Cigarettes / E-Cigarette Products - Manufacturer / Wholesaler's Report of Sales - Pennsylvania

What Is Form REV-679 C Schedule C?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-679 C?

A: Form REV-679 C is a report for manufacturers and wholesalers of e-cigarettes and e-cigarette products in Pennsylvania.

Q: Who needs to file Form REV-679 C?

A: Manufacturers and wholesalers of e-cigarettes and e-cigarette products in Pennsylvania need to file Form REV-679 C.

Q: What is the purpose of filing Form REV-679 C?

A: The purpose of filing Form REV-679 C is to report sales of e-cigarettes and e-cigarette products in Pennsylvania.

Q: When is the deadline for filing Form REV-679 C?

A: The deadline for filing Form REV-679 C is on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form REV-679 C?

A: Yes, there are penalties for late filing of Form REV-679 C, including interest charges and possible additional penalties.

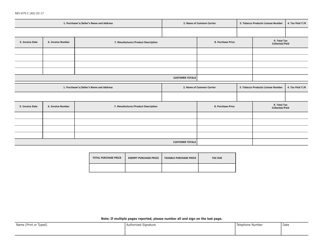

Q: What information is required to be reported on Form REV-679 C?

A: Form REV-679 C requires the reporting of sales of e-cigarettes and e-cigarette products, including the total retail value and wholesale price.

Q: Are there any exemptions for filing Form REV-679 C?

A: There are no exemptions for filing Form REV-679 C. All manufacturers and wholesalers of e-cigarettes and e-cigarette products in Pennsylvania are required to file the form.

Q: Can Form REV-679 C be filed electronically?

A: Yes, Form REV-679 C can be filed electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Q: Is there a fee for filing Form REV-679 C?

A: No, there is no fee for filing Form REV-679 C.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-679 C Schedule C by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.