This version of the form is not currently in use and is provided for reference only. Download this version of

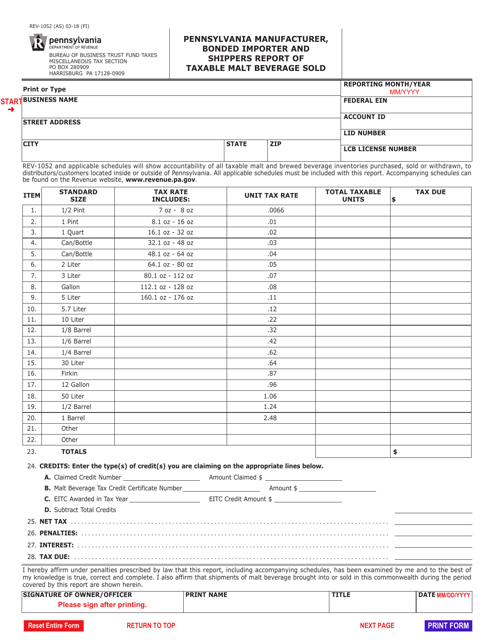

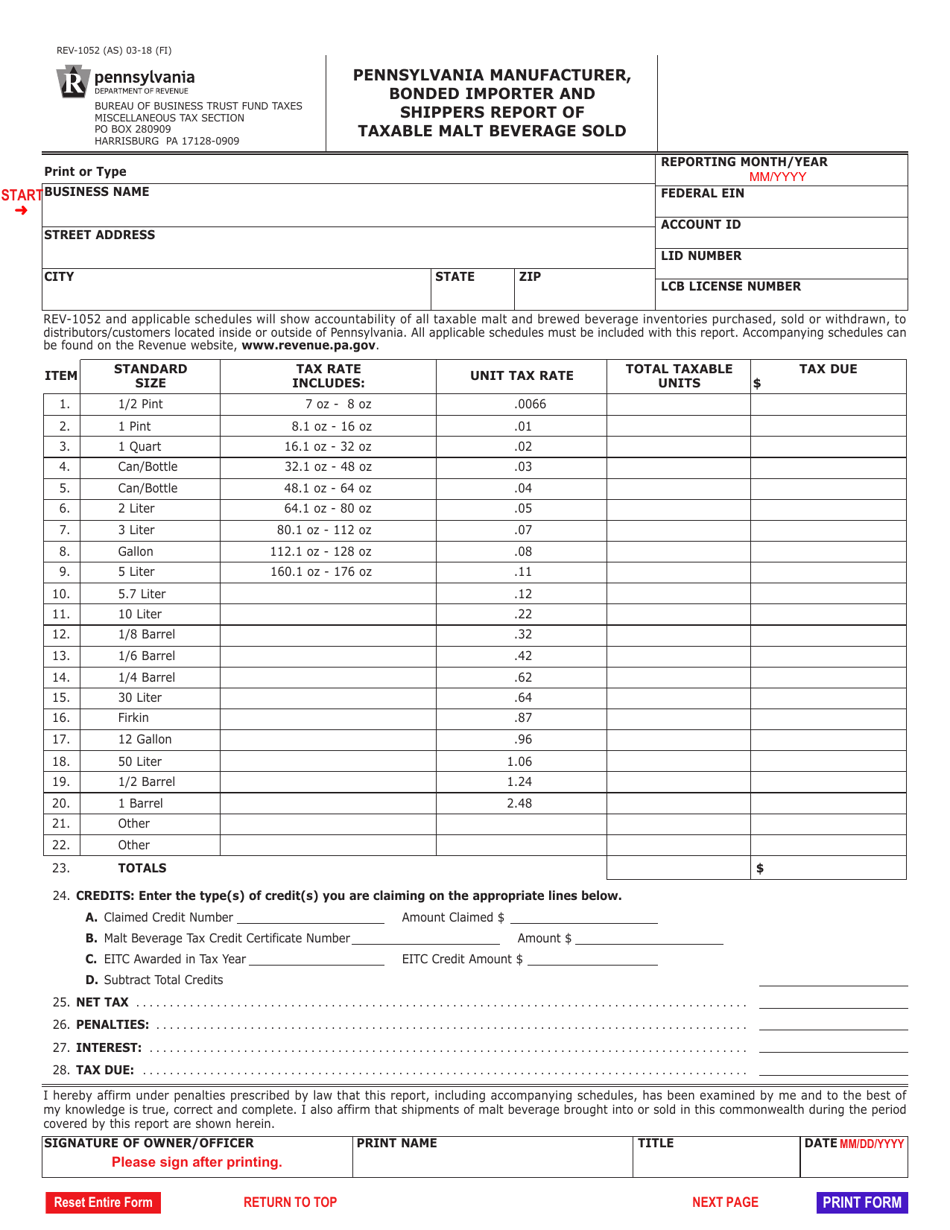

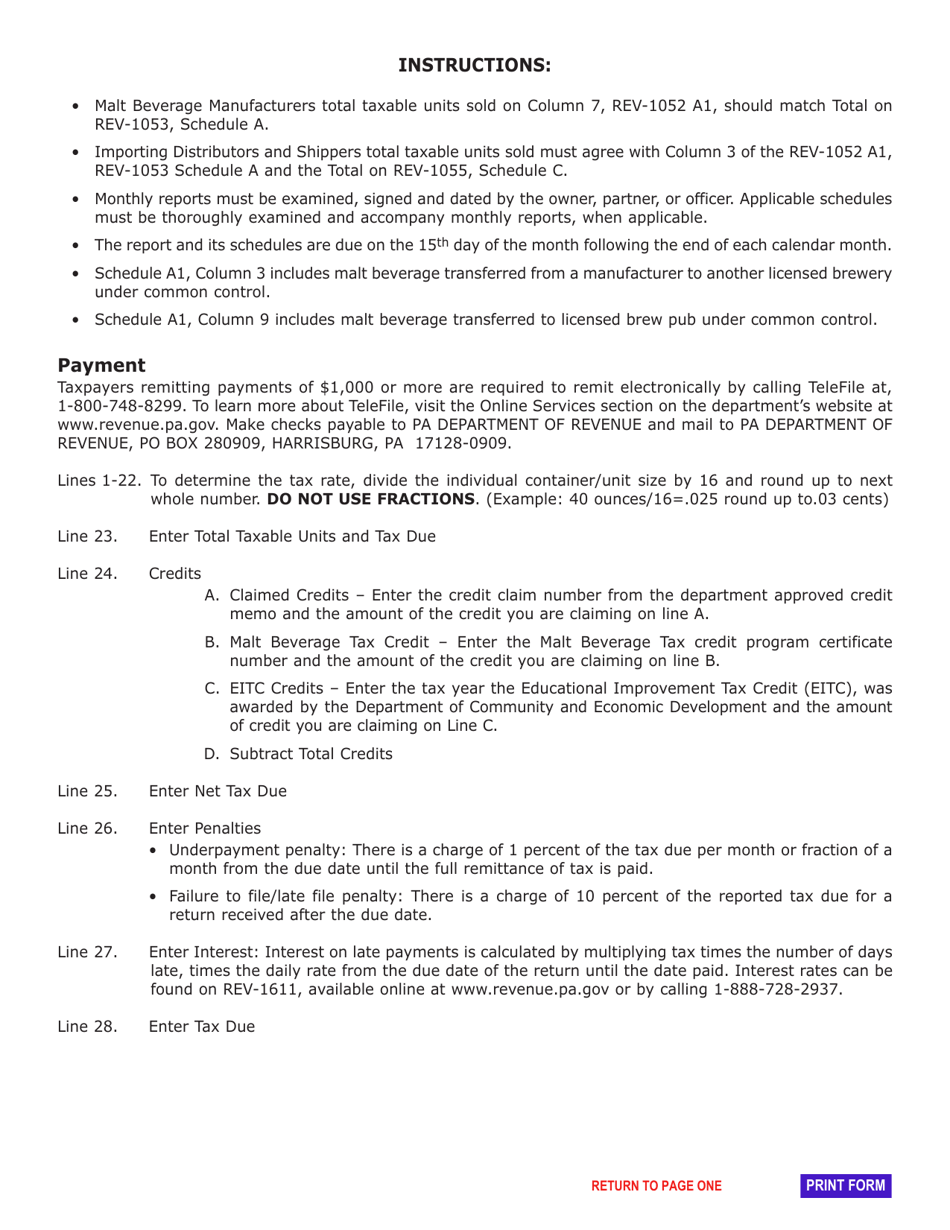

Form REV-1052

for the current year.

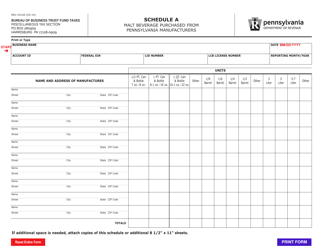

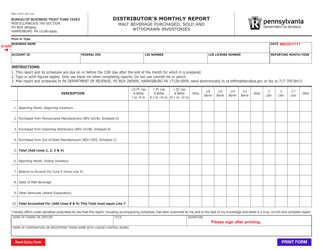

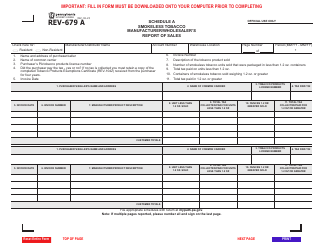

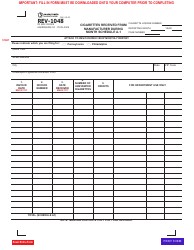

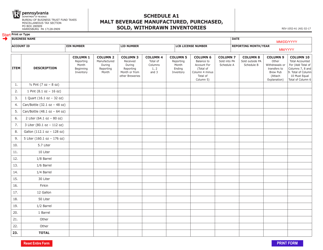

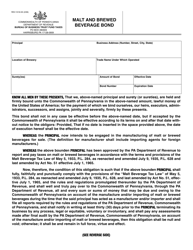

Form REV-1052 Pennsylvania Manufacturer, Bonded Importer, and Shippers Report of Taxable Malt Beverage Sold - Pennsylvania

What Is Form REV-1052?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form REV-1052?

A: Form REV-1052 is the Pennsylvania Manufacturer, Bonded Importer, and Shippers Report of Taxable Malt Beverage Sold.

Q: Who needs to file form REV-1052?

A: Manufacturers, bonded importers, and shippers of taxable malt beverages in Pennsylvania need to file form REV-1052.

Q: What is the purpose of form REV-1052?

A: Form REV-1052 is used to report the sale of taxable malt beverages in Pennsylvania.

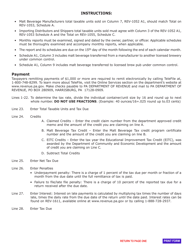

Q: When is the deadline to file form REV-1052?

A: The deadline to file form REV-1052 is determined by the Pennsylvania Department of Revenue and may vary.

Q: Is form REV-1052 specific to Pennsylvania?

A: Yes, form REV-1052 is specific to Pennsylvania as it is used to report taxable malt beverage sales in the state.

Q: Are there any penalties for late filing of form REV-1052?

A: There may be penalties for late filing of form REV-1052, so it is important to file on time.

Q: Is form REV-1052 only for businesses?

A: Yes, form REV-1052 is specifically for manufacturers, bonded importers, and shippers of taxable malt beverages in Pennsylvania.

Q: What information do I need to complete form REV-1052?

A: To complete form REV-1052, you will need information about the sales of taxable malt beverages, including quantities sold and prices.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1052 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.