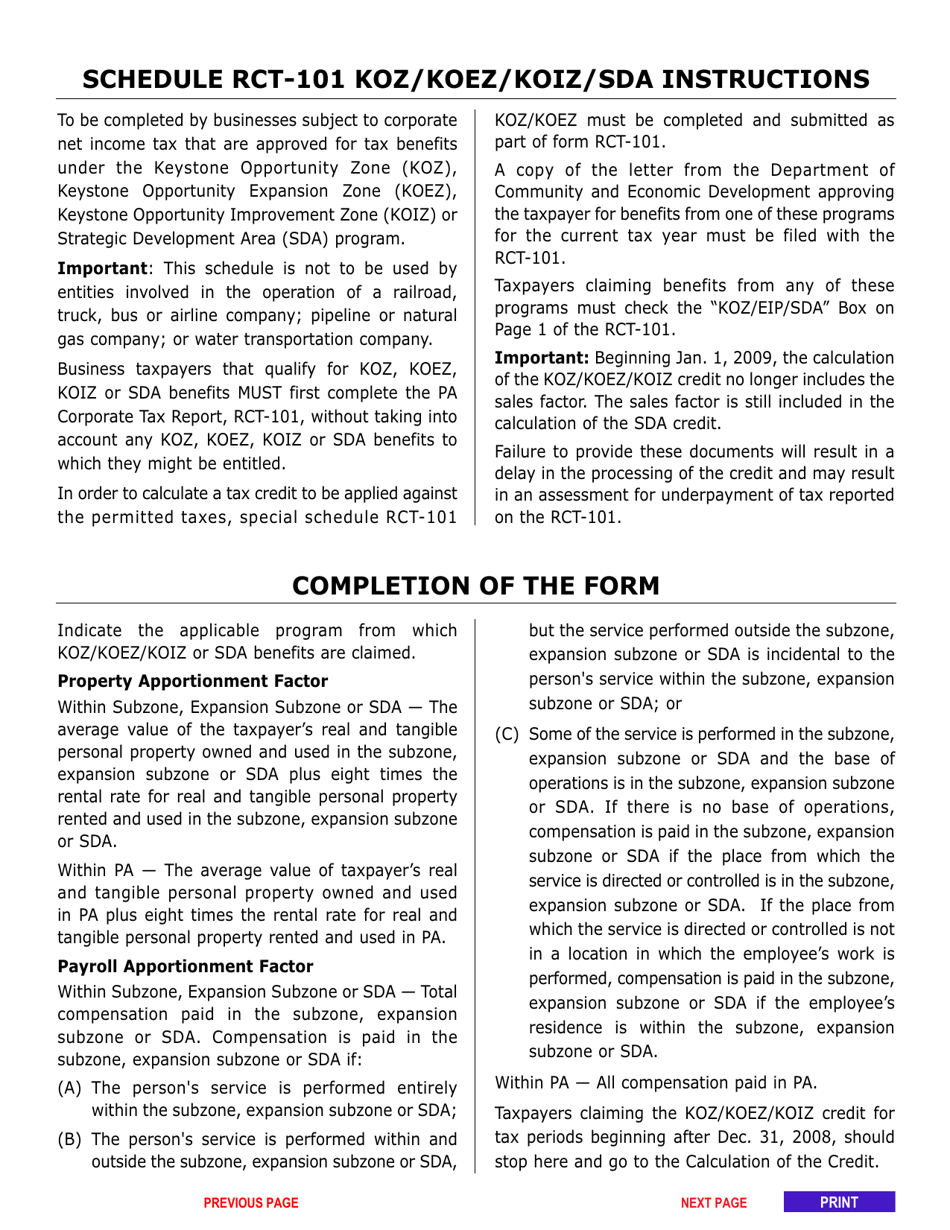

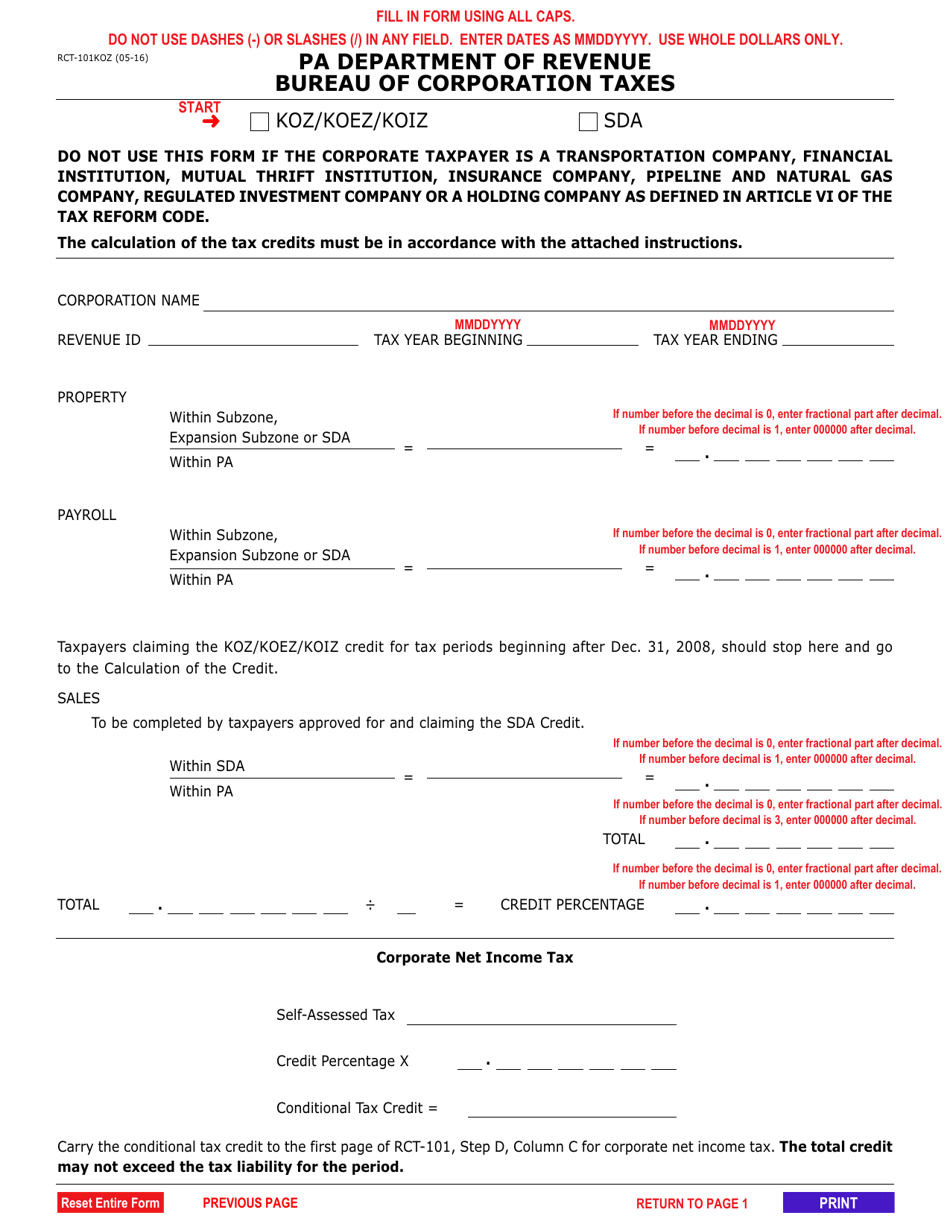

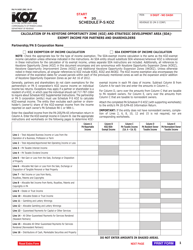

Form RCT-101KOZ Keystone Opportunity Zone / Strategic Development Area Form and Instructions - Calculation of Tax Credit for Corporate Net Income Tax - Pennsylvania

What Is Form RCT-101KOZ?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RCT-101KOZ?

A: RCT-101KOZ is a form for Keystone Opportunity Zone/Strategic Development Area.

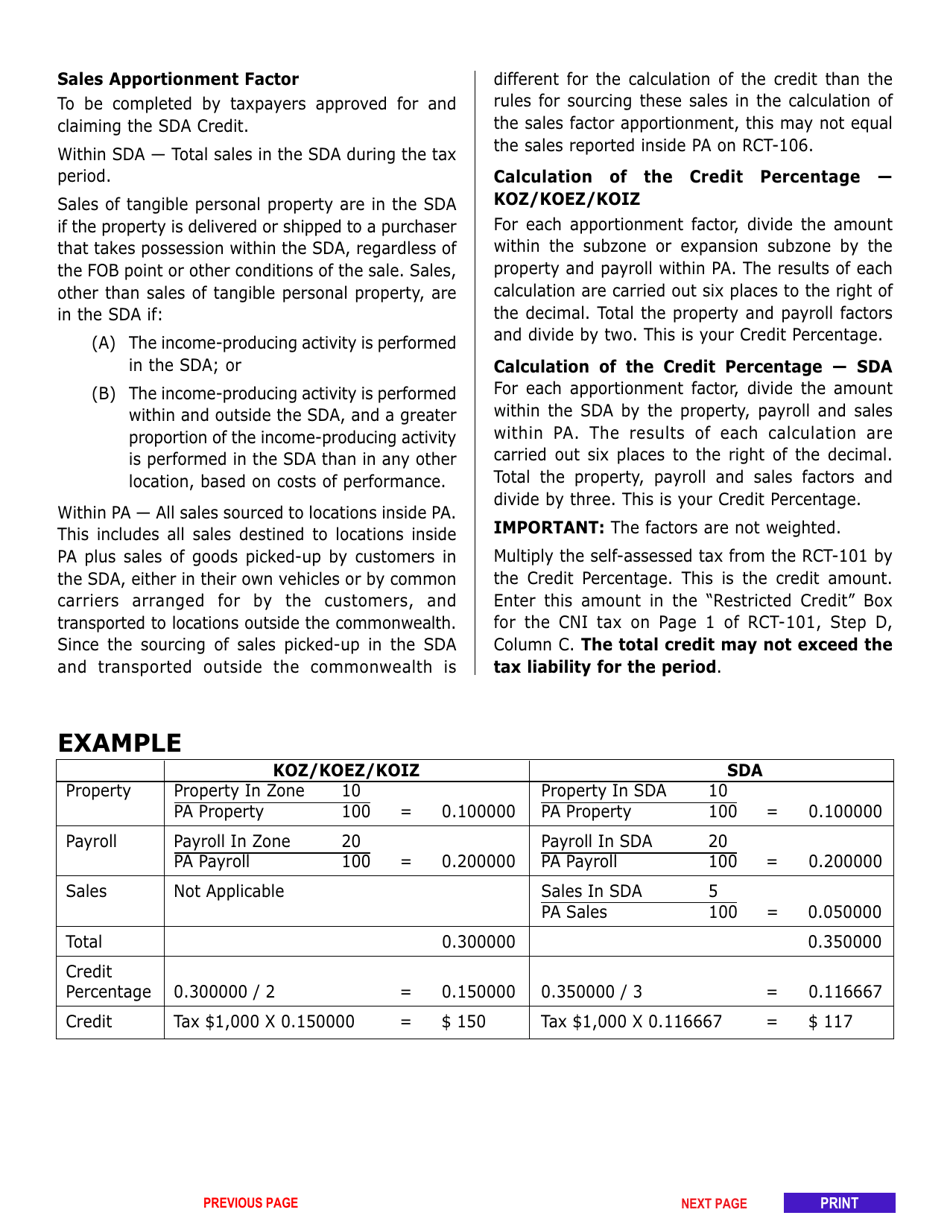

Q: What is the purpose of RCT-101KOZ?

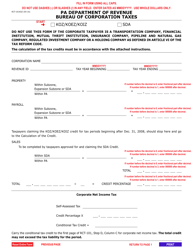

A: The purpose of RCT-101KOZ is to calculate the tax credit for corporate net income tax in Pennsylvania.

Q: What is a Keystone Opportunity Zone?

A: A Keystone Opportunity Zone is a designated area where businesses can receive tax incentives and other benefits to encourage economic development.

Q: What is a Strategic Development Area?

A: A Strategic Development Area is another term for a Keystone Opportunity Zone, referring to areas targeted for economic revitalization and development.

Q: Who needs to file Form RCT-101KOZ?

A: Businesses operating in a Keystone Opportunity Zone or Strategic Development Area in Pennsylvania need to file Form RCT-101KOZ.

Q: What is the purpose of the tax credit?

A: The tax credit is designed to incentivize businesses to invest and create jobs in designated economic development areas.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-101KOZ by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.