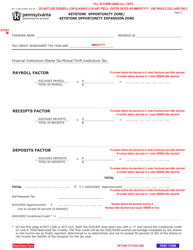

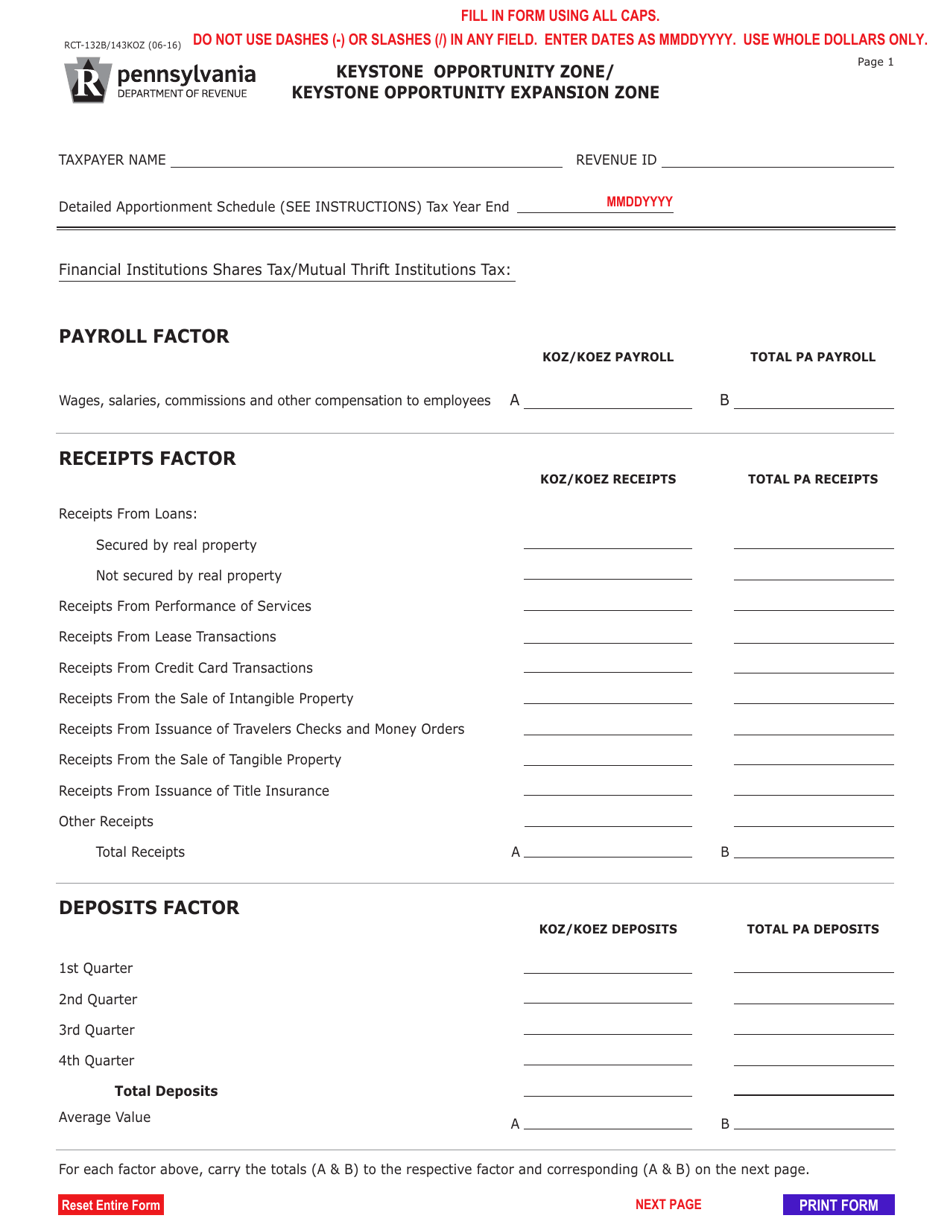

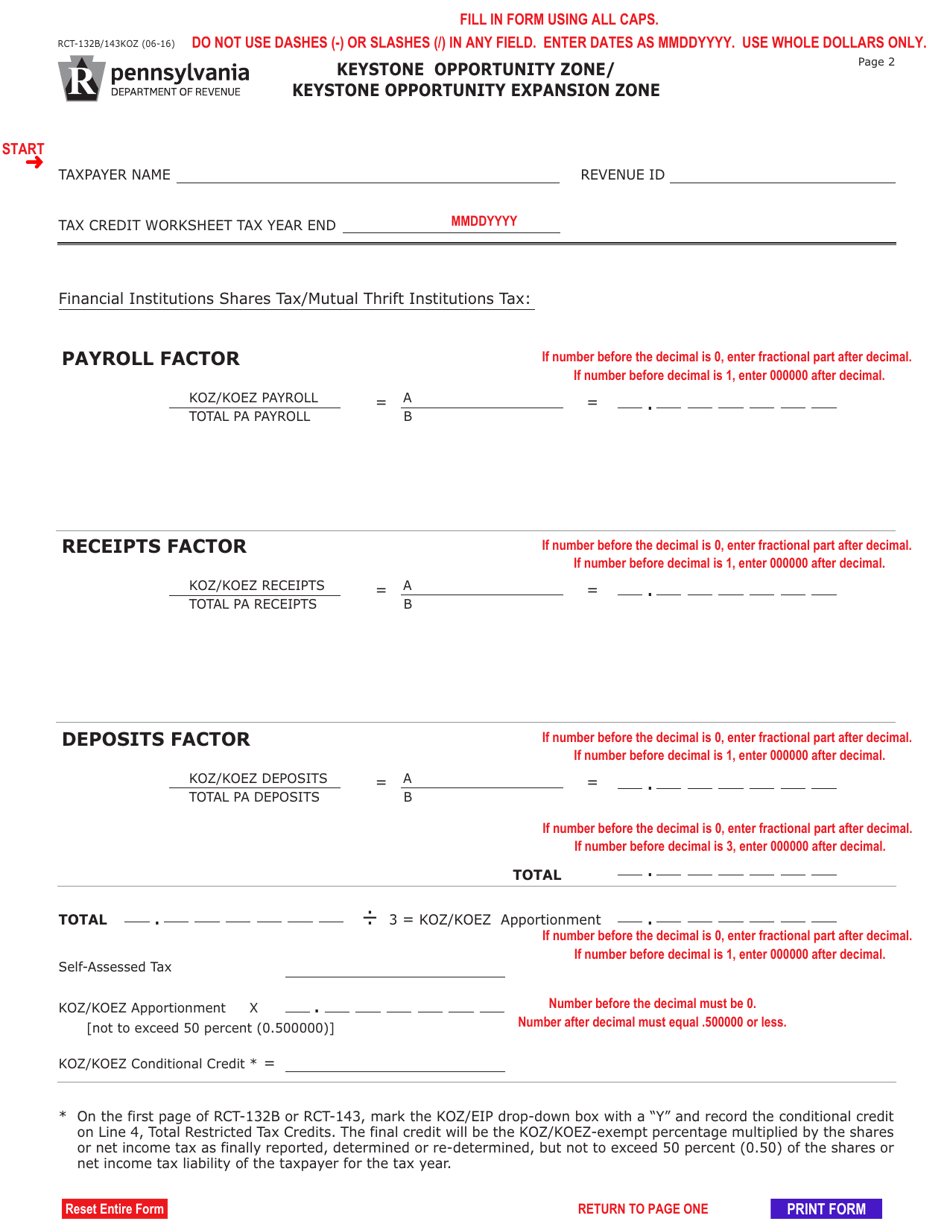

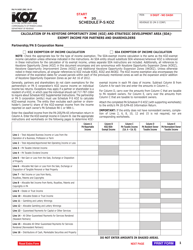

Form RCT-132B / 143KOZ Keystone Opportunity Zone / Keystone Opportunity Expansion Zone - Pennsylvania

What Is Form RCT-132B/143KOZ?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

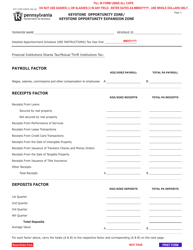

Q: What is RCT-132B?

A: RCT-132B is a form used for reporting and remitting Keystone Opportunity Zone (KOZ) tax credits in Pennsylvania.

Q: What is RCT-143KOZ?

A: RCT-143KOZ is a form used for claiming Keystone Opportunity Expansion Zone (KOEZ) tax credits in Pennsylvania.

Q: What are Keystone Opportunity Zones (KOZ)?

A: Keystone Opportunity Zones (KOZ) are designated areas in Pennsylvania where certain taxes are reduced or eliminated to encourage economic development and job creation.

Q: What are Keystone Opportunity Expansion Zones (KOEZ)?

A: Keystone Opportunity Expansion Zones (KOEZ) are designated areas within Keystone Opportunity Zones (KOZ) where additional tax benefits may be available to businesses.

Q: How can I claim Keystone Opportunity Zone (KOZ) tax credits?

A: You can claim Keystone Opportunity Zone (KOZ) tax credits by using Form RCT-132B and submitting it to the Pennsylvania Department of Revenue.

Q: How can I claim Keystone Opportunity Expansion Zone (KOEZ) tax credits?

A: You can claim Keystone Opportunity Expansion Zone (KOEZ) tax credits by using Form RCT-143KOZ and submitting it to the Pennsylvania Department of Revenue.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-132B/143KOZ by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.