This version of the form is not currently in use and is provided for reference only. Download this version of

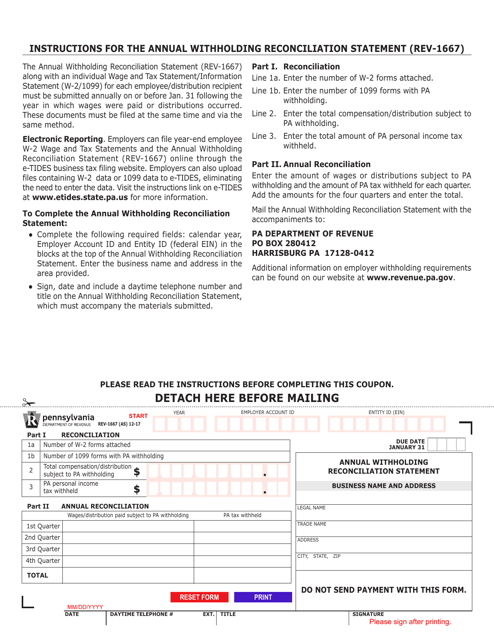

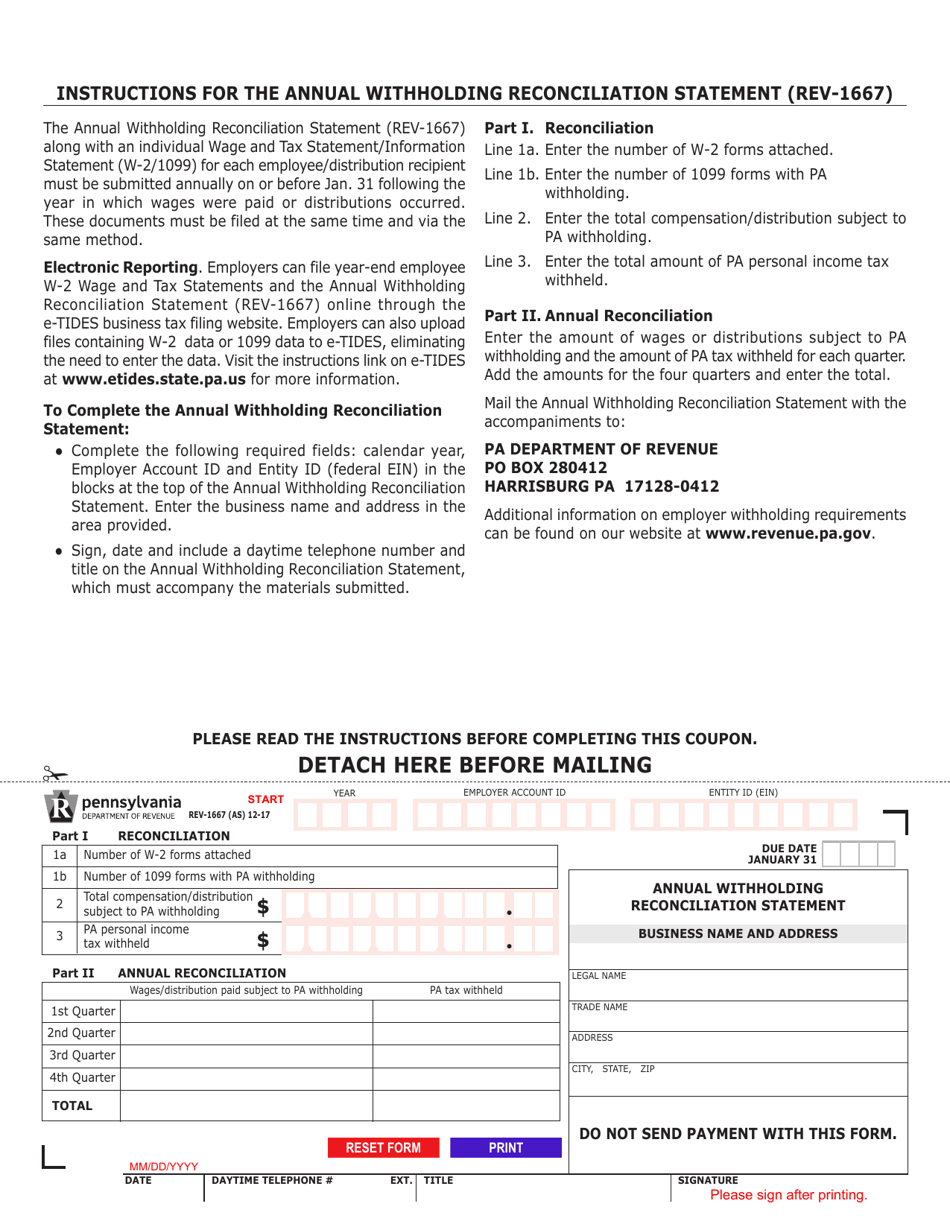

Form REV-1667

for the current year.

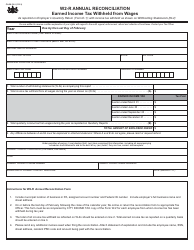

Form REV-1667 Annual Withholding Reconciliation Statement - Pennsylvania

What Is Form REV-1667?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1667?

A: Form REV-1667 is the Annual Withholding Reconciliation Statement for Pennsylvania.

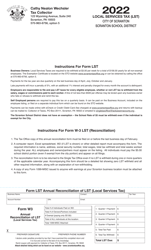

Q: Who needs to file Form REV-1667?

A: Employers in Pennsylvania who withhold state income taxes from their employees' wages need to file Form REV-1667.

Q: What is the purpose of Form REV-1667?

A: The purpose of Form REV-1667 is to reconcile the amount of state income taxes withheld from employees' wages with the amount remitted to the Pennsylvania Department of Revenue.

Q: When is Form REV-1667 due?

A: Form REV-1667 is due on or before January 31st of the following year.

Q: Are there any penalties for not filing Form REV-1667?

A: Yes, there are penalties for not filing Form REV-1667 or filing it late. It is important to file the form on time to avoid any penalties.

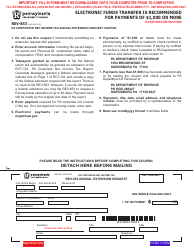

Q: Do I need to attach any supporting documents with Form REV-1667?

A: Yes, you may need to attach certain supporting documents such as copies of W-2 forms or 1099 forms. It is recommended to review the instructions provided with the form for a complete list of required documents.

Q: Can I file Form REV-1667 electronically?

A: Yes, you can file Form REV-1667 electronically through the Pennsylvania Department of Revenue's e-Services platform.

Q: What if I have questions or need assistance with Form REV-1667?

A: If you have questions or need assistance with Form REV-1667, you can contact the Pennsylvania Department of Revenue for guidance.

Q: Can I request an extension to file Form REV-1667?

A: Yes, you can request an extension to file Form REV-1667 by submitting Form REV-853, Application for Extension of Time to File a Pennsylvania Personal Income Tax Return.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1667 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.