This version of the form is not currently in use and is provided for reference only. Download this version of

Form REV-1164

for the current year.

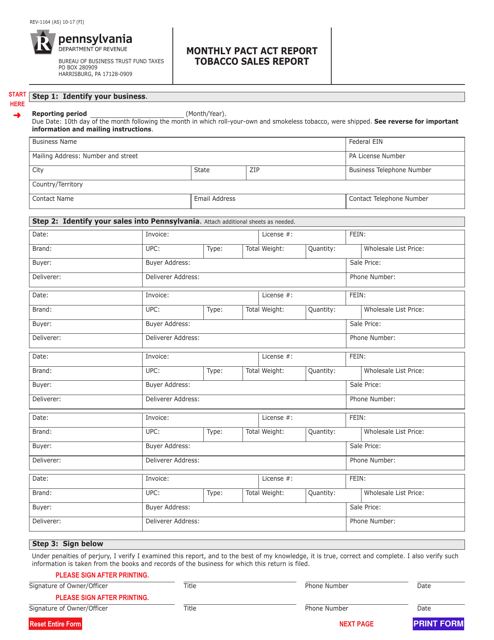

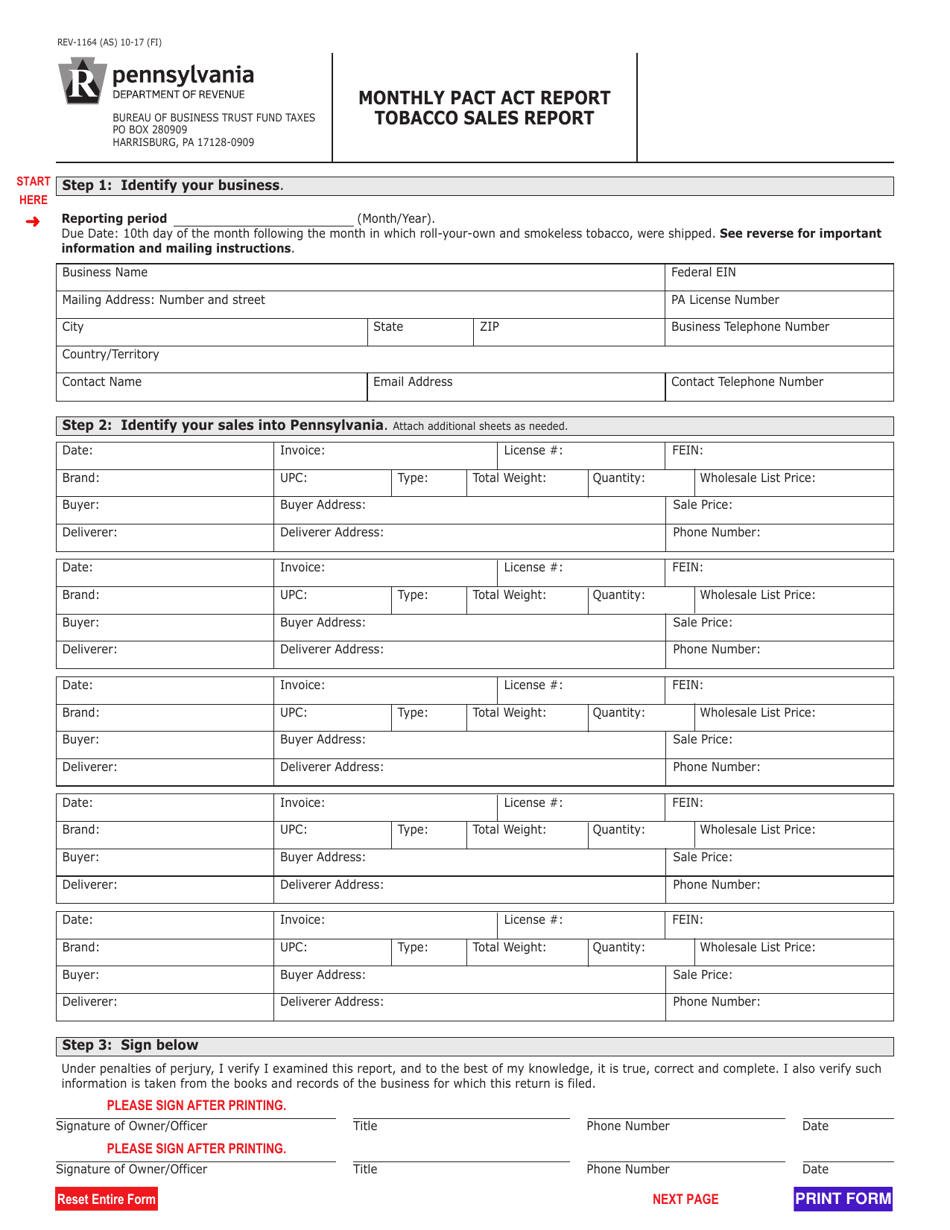

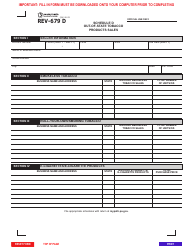

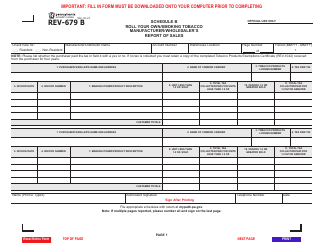

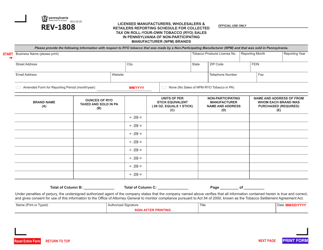

Form REV-1164 Monthly Pact Act Report - Tobacco Sales Report - Pennsylvania

What Is Form REV-1164?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

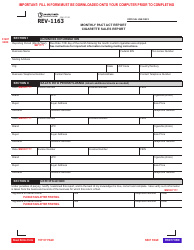

Q: What is the REV-1164 Monthly Pact Act Report?

A: The REV-1164 Monthly Pact Act Report is a report used in Pennsylvania to report monthly tobacco sales.

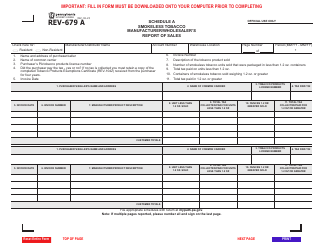

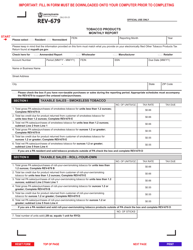

Q: What is the Tobacco Sales Report?

A: The Tobacco Sales Report is a report used to provide information on tobacco sales in Pennsylvania.

Q: Who needs to file the REV-1164 Monthly Pact Act Report?

A: Any business engaged in the sale of tobacco products in Pennsylvania needs to file the REV-1164 Monthly Pact Act Report.

Q: What information is required in the REV-1164 Monthly Pact Act Report?

A: The report requires information on the quantity and value of tobacco products sold, as well as information on the buyer and seller.

Q: When is the REV-1164 Monthly Pact Act Report due?

A: The report is due on the 20th day of the month following the month of sales.

Q: Are there any penalties for not filing the REV-1164 Monthly Pact Act Report?

A: Yes, failure to file the report or filing a late or incomplete report may result in penalties.

Q: Can the REV-1164 Monthly Pact Act Report be filed electronically?

A: Yes, the report can be filed electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1164 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.