This version of the form is not currently in use and is provided for reference only. Download this version of

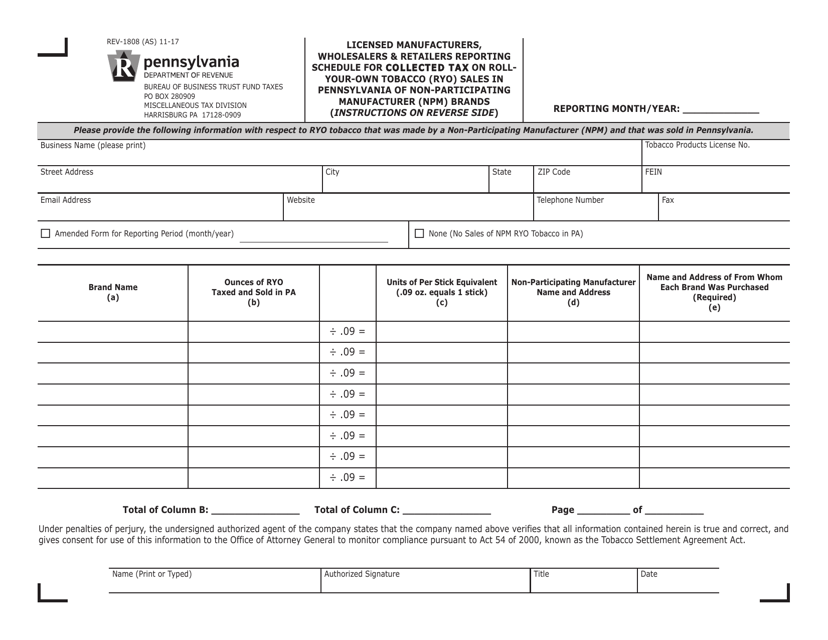

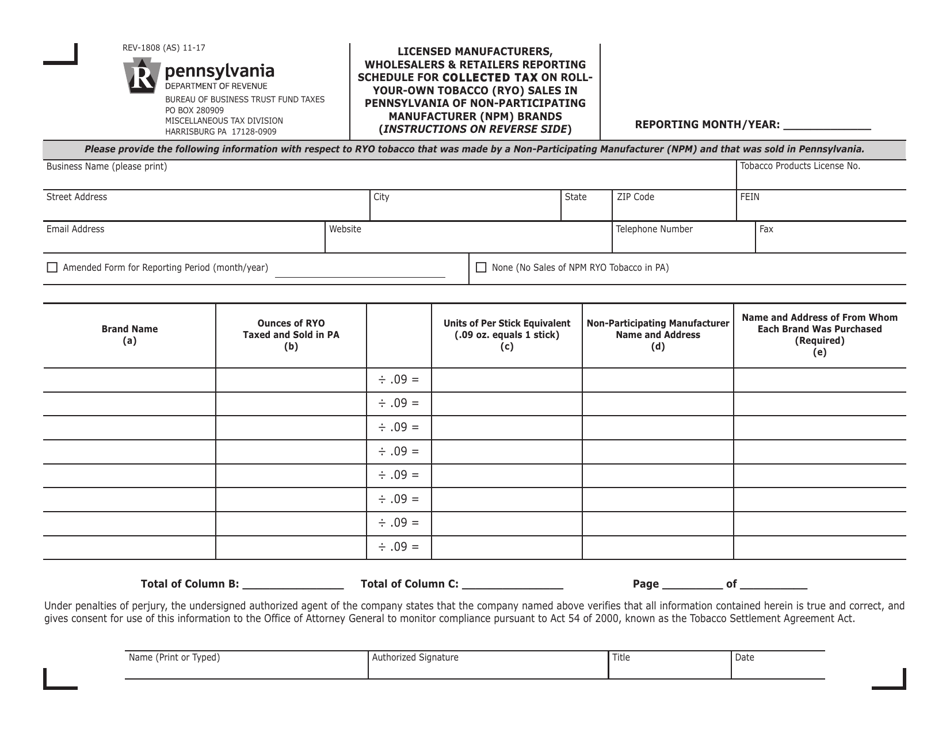

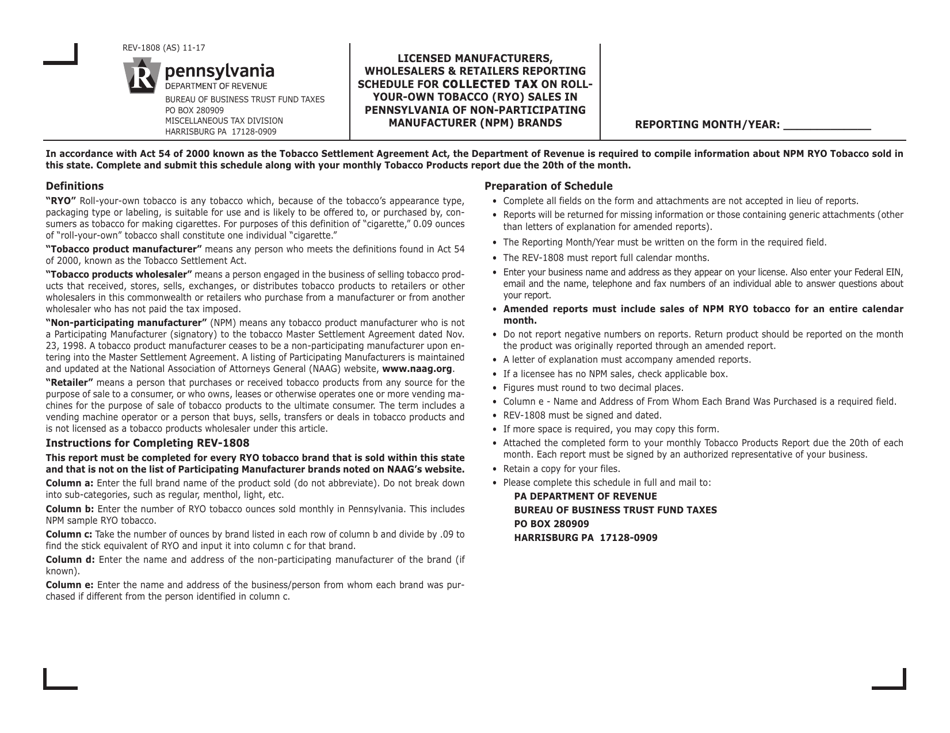

Form REV-1808

for the current year.

Form REV-1808 Licensed Manufacturers & Retailers Reporting Schedule for Collected Tax on Roll-Your-Own Tobacco (Ryo) Sales in Pennsylvania of Non-participating Manufacturer (Npm) Brands - Pennsylvania

What Is Form REV-1808?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1808?

A: Form REV-1808 is a reporting schedule for licensed manufacturers and retailers in Pennsylvania who collect tax on Roll-Your-Own Tobacco (RYO) sales of Non-participating Manufacturer (NPM) brands.

Q: Who needs to file Form REV-1808?

A: Licensed manufacturers and retailers in Pennsylvania who collect tax on RYO tobacco sales of NPM brands need to file Form REV-1808.

Q: What is Roll-Your-Own Tobacco (RYO)?

A: Roll-Your-Own Tobacco (RYO) refers to tobacco that is made and rolled by individuals for personal use.

Q: What are Non-participating Manufacturer (NPM) brands?

A: Non-participating Manufacturer (NPM) brands are tobacco brands that have not participated in the Master Settlement Agreement (MSA) with the states.

Q: What is the purpose of Form REV-1808?

A: The purpose of Form REV-1808 is to report the tax collected on RYO tobacco sales of NPM brands in Pennsylvania.

Q: When is Form REV-1808 due?

A: Form REV-1808 is due on a quarterly basis. The due dates are March 31, June 30, September 30, and December 31 for the preceding calendar quarters.

Q: Is filing Form REV-1808 mandatory?

A: Yes, filing Form REV-1808 is mandatory for licensed manufacturers and retailers in Pennsylvania who collect tax on RYO tobacco sales of NPM brands.

Q: What happens if I don't file Form REV-1808?

A: If you fail to file Form REV-1808 or file it late, you may be subject to penalties and interest charges imposed by the Pennsylvania Department of Revenue.

Q: Who should I contact for more information about Form REV-1808?

A: For more information about Form REV-1808, you can contact the Pennsylvania Department of Revenue.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-1808 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.