This version of the form is not currently in use and is provided for reference only. Download this version of

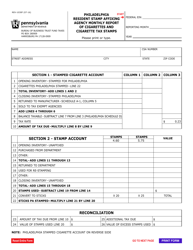

Form REV-1163

for the current year.

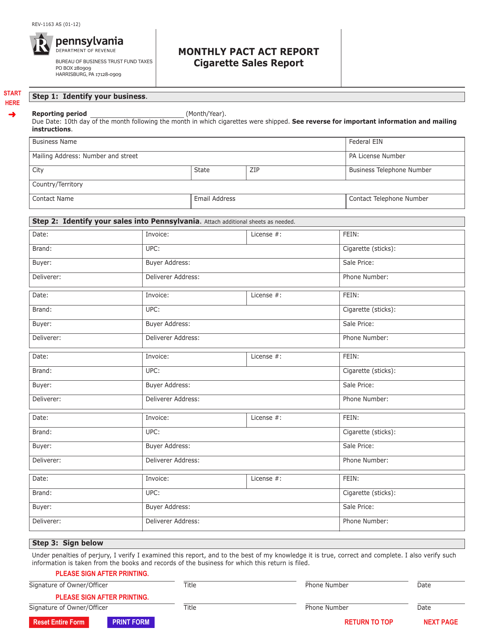

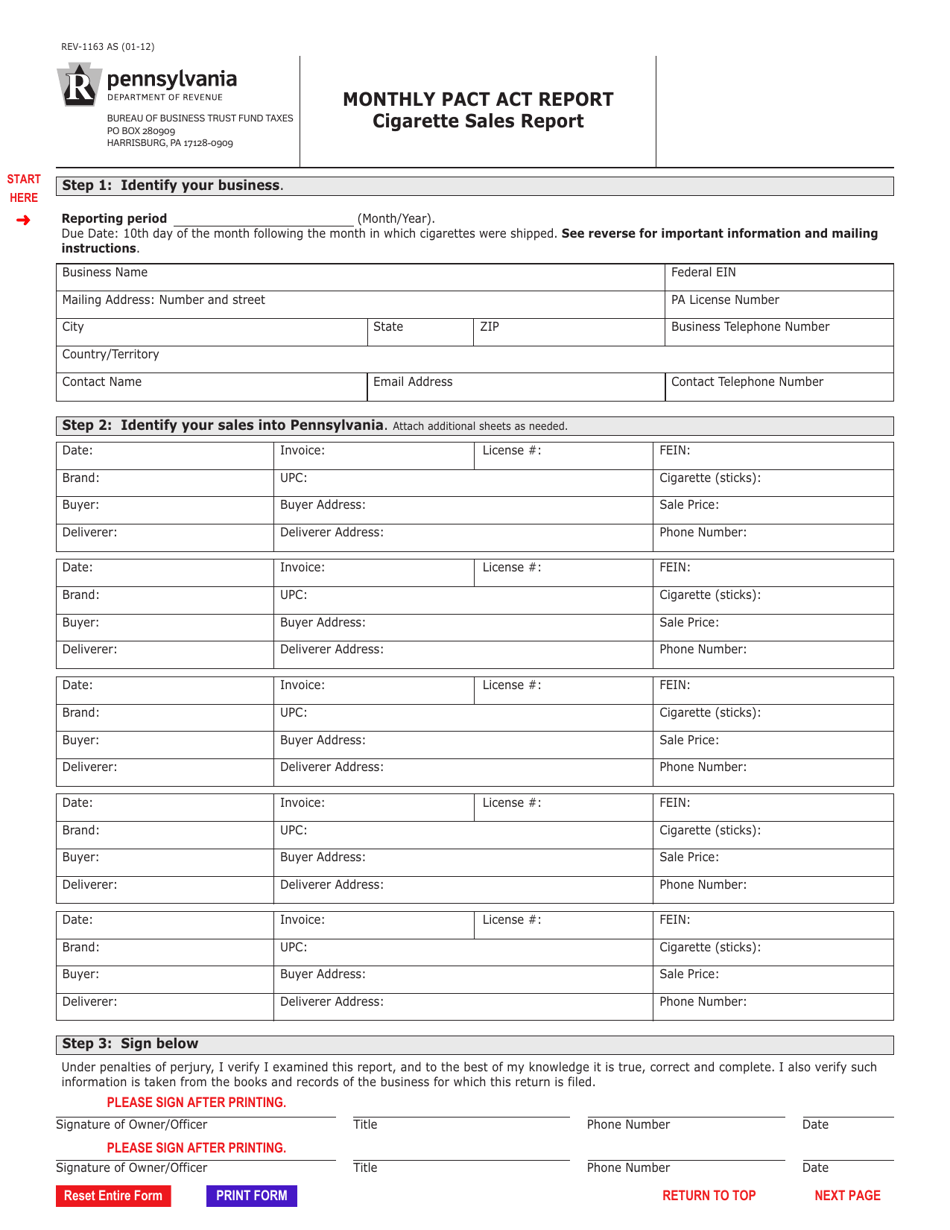

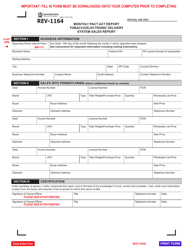

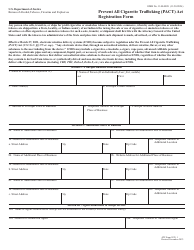

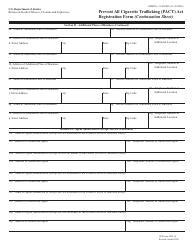

Form REV-1163 Monthly Pact Act Report - Cigarette Sales Report - Pennsylvania

What Is Form REV-1163?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1163?

A: Form REV-1163 is the Monthly Pact Act Report - Cigarette Sales Report for Pennsylvania.

Q: What is the purpose of Form REV-1163?

A: The purpose of Form REV-1163 is to report monthly cigarette sales in Pennsylvania.

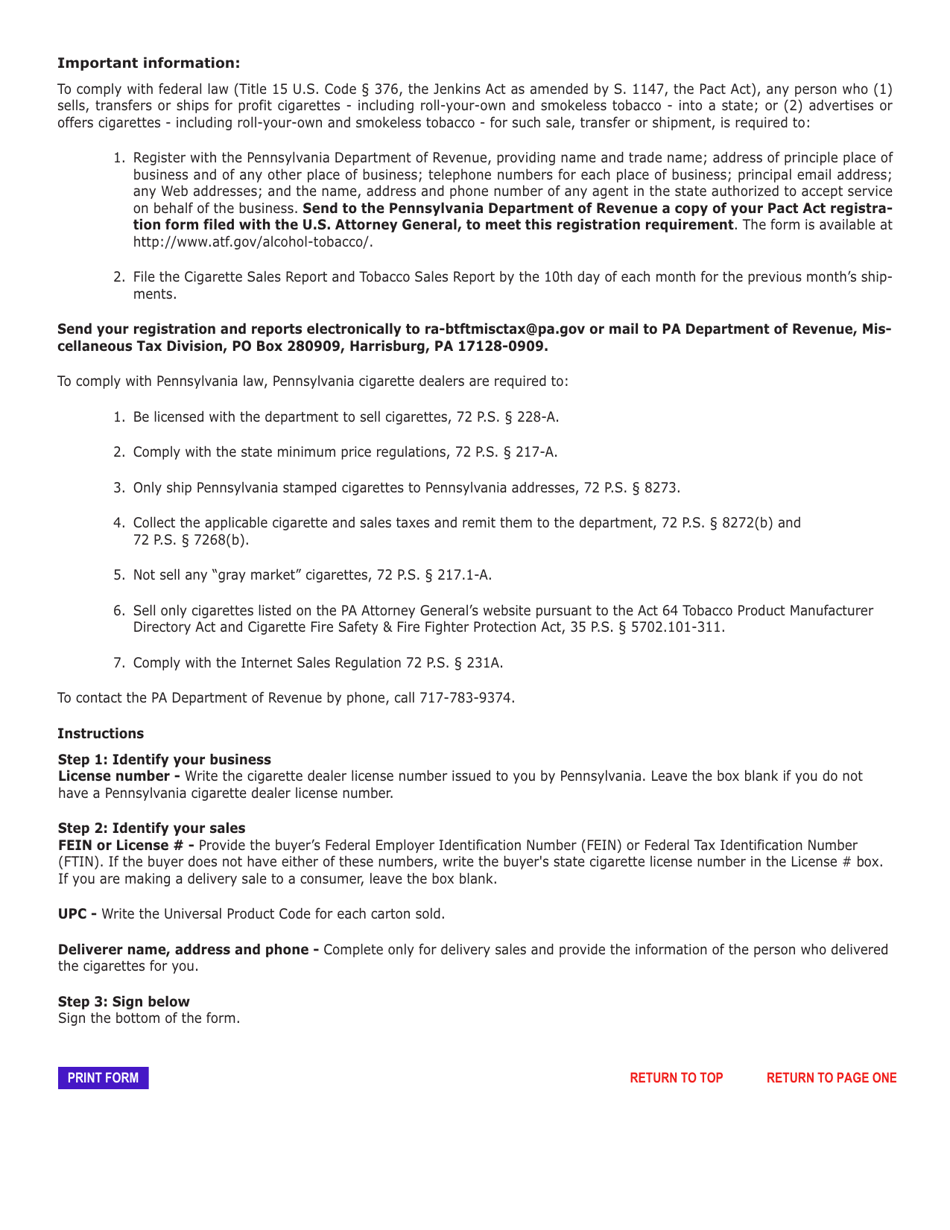

Q: Who is required to file Form REV-1163?

A: Businesses engaged in the sale of cigarettes in Pennsylvania are required to file Form REV-1163.

Q: How often should Form REV-1163 be filed?

A: Form REV-1163 should be filed on a monthly basis.

Q: What information is required on Form REV-1163?

A: Form REV-1163 requires information such as the quantity and wholesale value of cigarettes sold.

Q: Is there a deadline for filing Form REV-1163?

A: Yes, Form REV-1163 must be filed by the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing Form REV-1163?

A: Yes, failing to file or filing late can result in penalties and interest.

Q: Can Form REV-1163 be filed electronically?

A: Yes, Form REV-1163 can be filed electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Q: Are there any exemptions to filing Form REV-1163?

A: There are no specific exemptions mentioned for filing Form REV-1163. It is generally required for businesses engaged in cigarette sales.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1163 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.