This version of the form is not currently in use and is provided for reference only. Download this version of

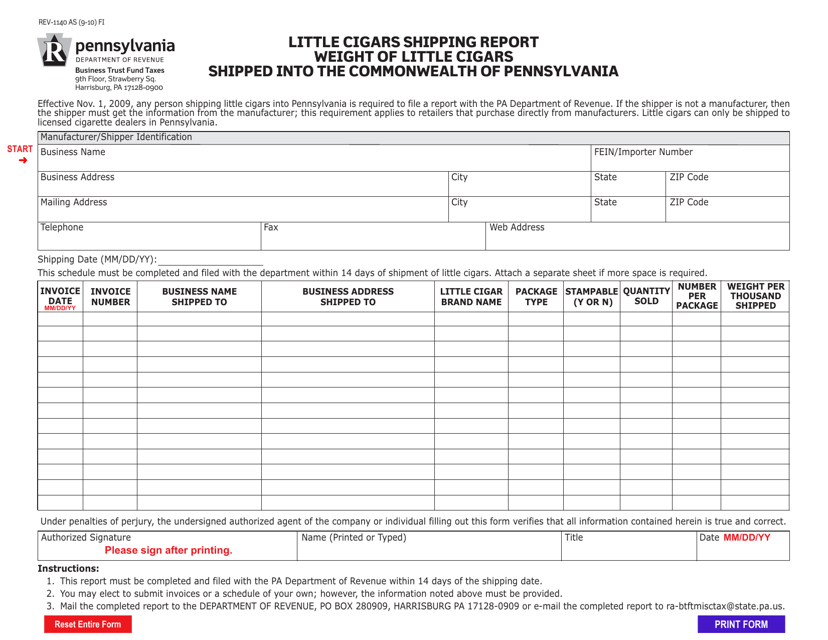

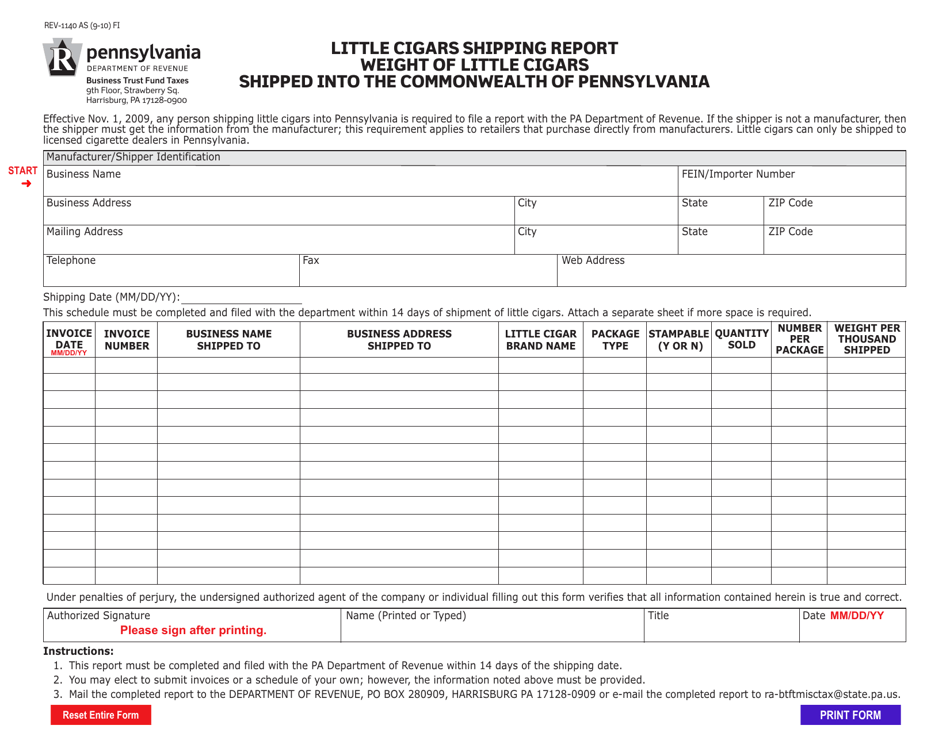

Form REV-1140

for the current year.

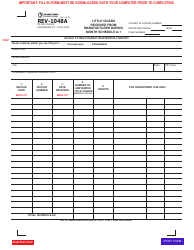

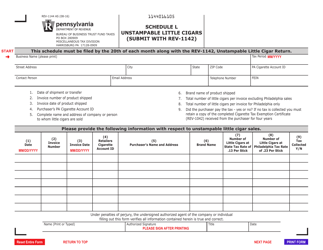

Form REV-1140 Little Cigars Shipping Report - Weight of Little Cigars Shipped Into the Commonwealth of Pennsylvania - Pennsylvania

What Is Form REV-1140?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is REV-1140?

A: REV-1140 is the form for filing a Little CigarsShipping Report.

Q: What is the purpose of REV-1140?

A: The purpose of REV-1140 is to report the weight of little cigars shipped into the Commonwealth of Pennsylvania.

Q: Who needs to file REV-1140?

A: Any business or individual who ships little cigars into Pennsylvania needs to file REV-1140.

Q: What information is required on REV-1140?

A: REV-1140 requires the shipping date, shipping company name, weight of the little cigars shipped, and other related details.

Q: Is REV-1140 specific to Pennsylvania?

A: Yes, REV-1140 is specific to the Commonwealth of Pennsylvania.

Q: Are little cigars subject to tax in Pennsylvania?

A: Yes, little cigars are subject to tax in Pennsylvania.

Q: Is REV-1140 required for personal shipments?

A: REV-1140 is required for both business and personal shipments of little cigars into Pennsylvania.

Form Details:

- Released on September 1, 2010;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1140 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.