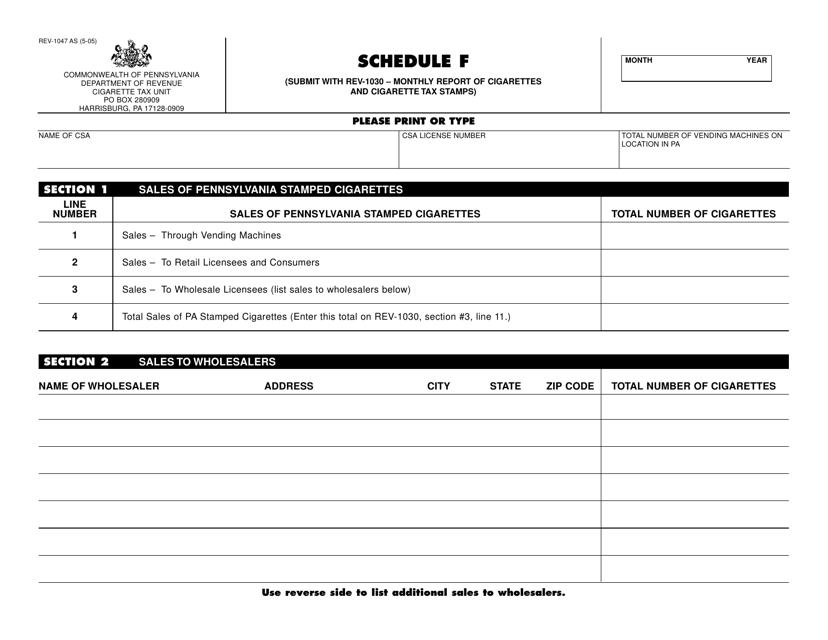

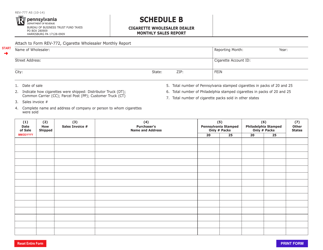

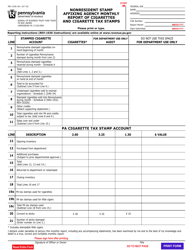

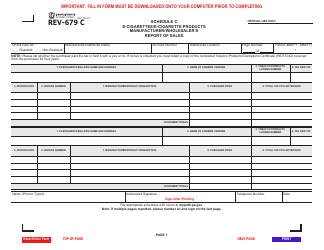

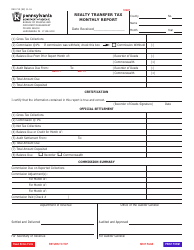

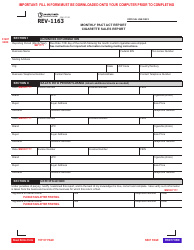

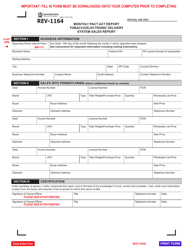

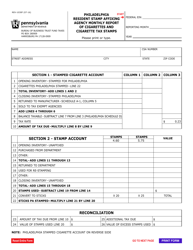

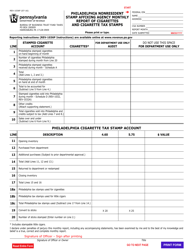

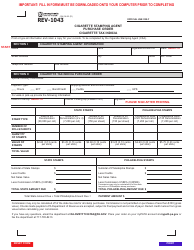

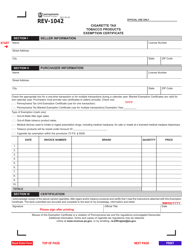

Form REV-1047 Schedule F Monthly Reports of Cigarettes and Cigarette Tax Stamps - Pennsylvania

What Is Form REV-1047 Schedule F?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1047 Schedule F?

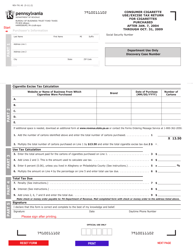

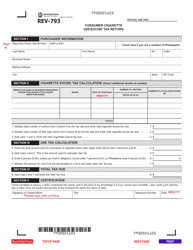

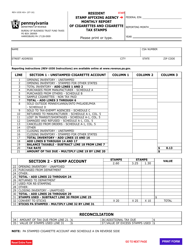

A: Form REV-1047 Schedule F is used to report monthly sales of cigarettes and cigarette tax stamps in Pennsylvania.

Q: Who needs to file Form REV-1047 Schedule F?

A: Any person or business that sells cigarettes in Pennsylvania must file Form REV-1047 Schedule F.

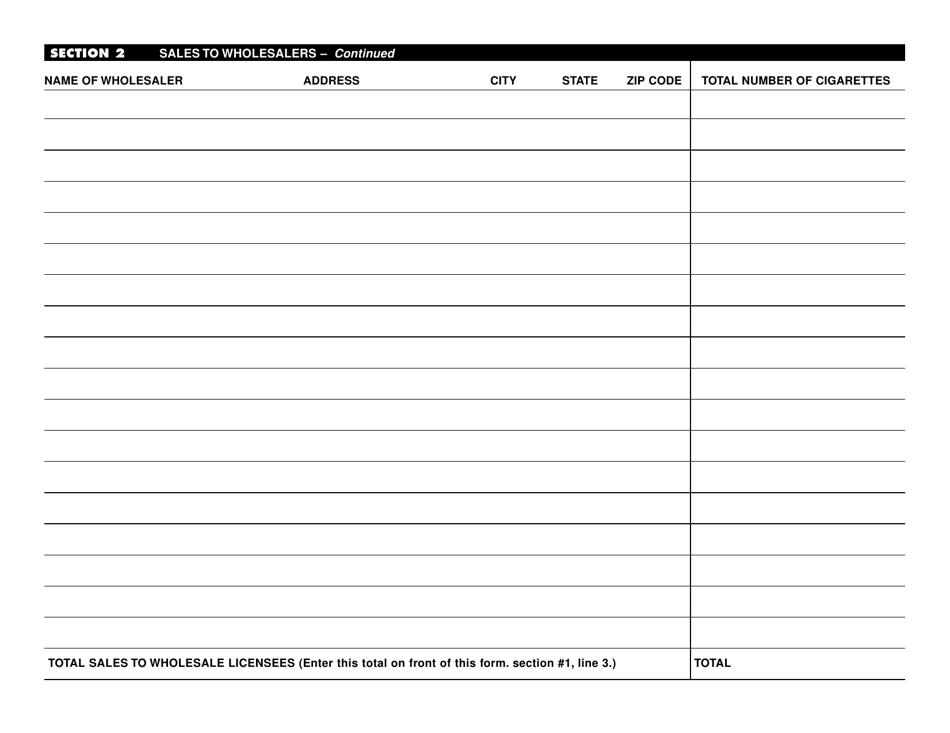

Q: What information is required to complete Form REV-1047 Schedule F?

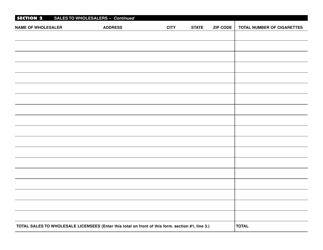

A: You will need to provide details about cigarette sales, including the number of cigarettes sold, the number of cigarette tax stamps purchased, and the total sales amount.

Q: When is Form REV-1047 Schedule F due?

A: Form REV-1047 Schedule F is due on the 20th day of each month for the previous month's sales. For example, the report for January sales would be due on February 20th.

Q: Are there any penalties for not filing Form REV-1047 Schedule F?

A: Yes, failure to file Form REV-1047 Schedule F or filing it late can result in penalties and interest charges.

Q: Can I file Form REV-1047 Schedule F electronically?

A: Yes, you can file Form REV-1047 Schedule F electronically using the Pennsylvania Department of Revenue's e-TIDES system.

Q: Is there a fee to file Form REV-1047 Schedule F?

A: There is no fee to file Form REV-1047 Schedule F.

Q: Can I amend Form REV-1047 Schedule F if I make a mistake?

A: Yes, you can amend Form REV-1047 Schedule F if you make a mistake. You will need to file an amended report with the correct information.

Form Details:

- Released on May 1, 2005;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-1047 Schedule F by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.