This version of the form is not currently in use and is provided for reference only. Download this version of

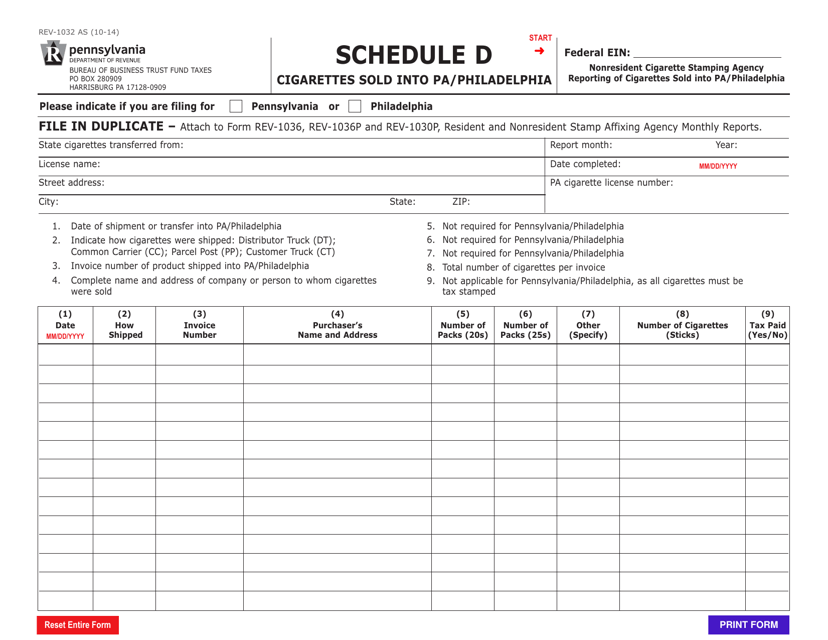

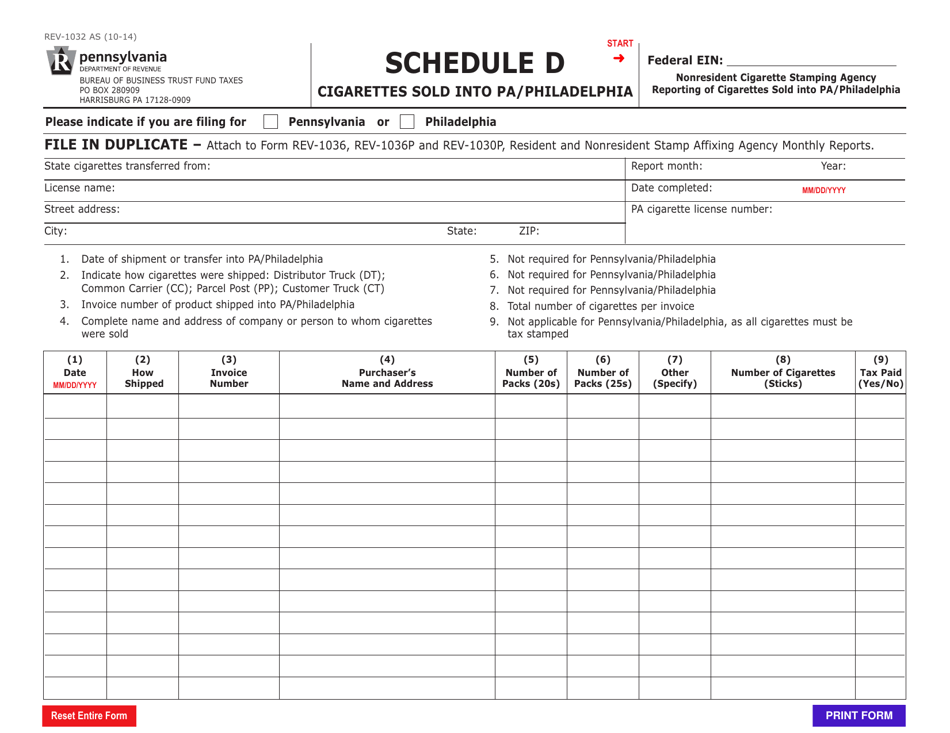

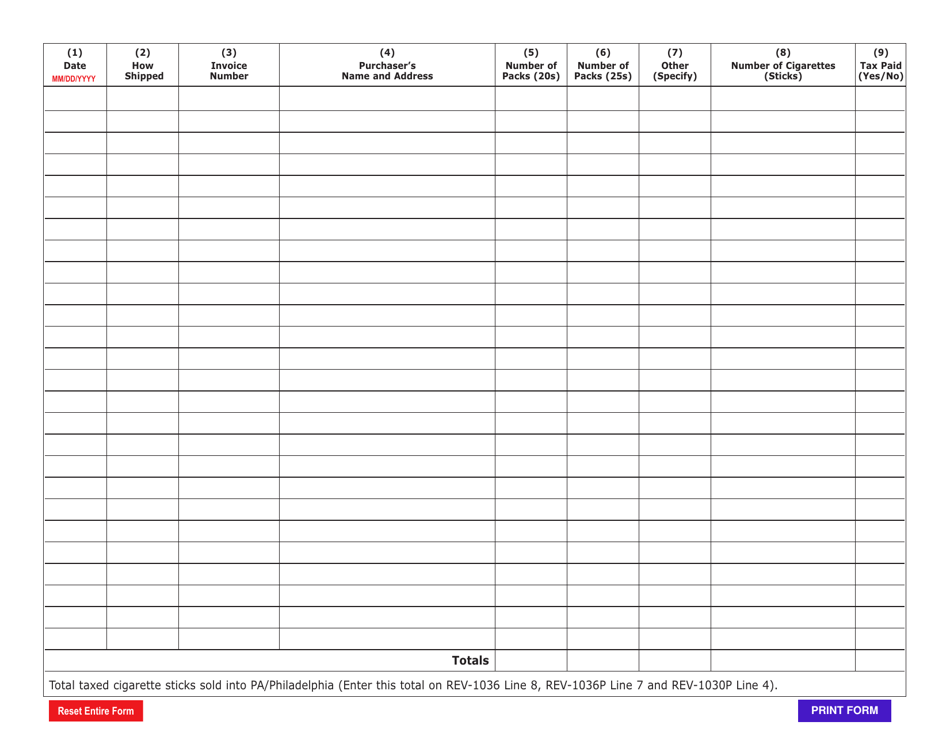

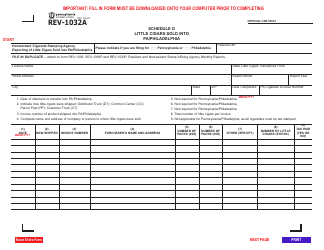

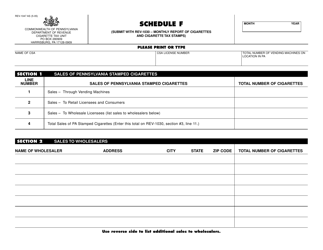

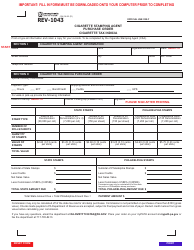

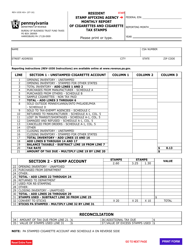

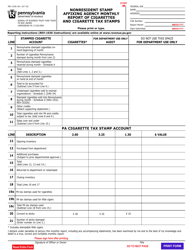

Form REV-1032 Schedule D

for the current year.

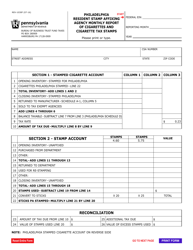

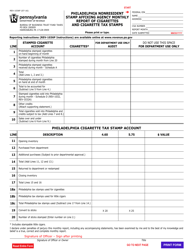

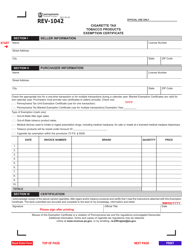

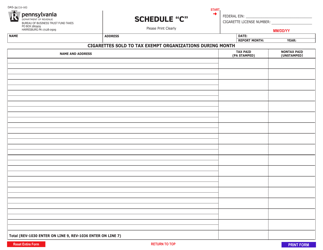

Form REV-1032 Schedule D Cigarettes Sold Into Pa / Philadelphia - Pennsylvania

What Is Form REV-1032 Schedule D?

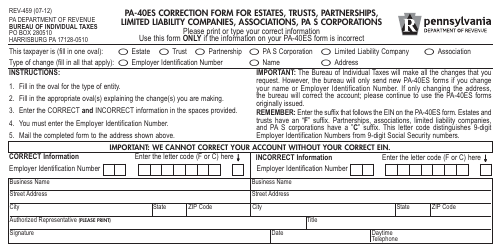

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1032?

A: Form REV-1032 is a tax form used in Pennsylvania for reporting the sale of cigarettes.

Q: What is Schedule D?

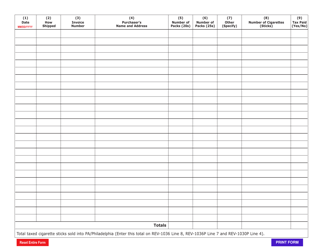

A: Schedule D is a specific section of Form REV-1032 used for reporting cigarettes sold into Pennsylvania or Philadelphia.

Q: Who needs to file Form REV-1032 Schedule D?

A: Any business or individual selling cigarettes into Pennsylvania or Philadelphia needs to file Form REV-1032 Schedule D.

Q: What is the purpose of filing Form REV-1032 Schedule D?

A: The purpose of filing Form REV-1032 Schedule D is to report the number of cigarettes sold into Pennsylvania or Philadelphia, so the appropriate taxes can be calculated and paid.

Q: How often do you need to file Form REV-1032 Schedule D?

A: Form REV-1032 Schedule D is filed on a monthly basis.

Q: Are there any penalties for not filing Form REV-1032 Schedule D?

A: Yes, there may be penalties for failing to file Form REV-1032 Schedule D or for submitting incorrect information.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1032 Schedule D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.