This version of the form is not currently in use and is provided for reference only. Download this version of

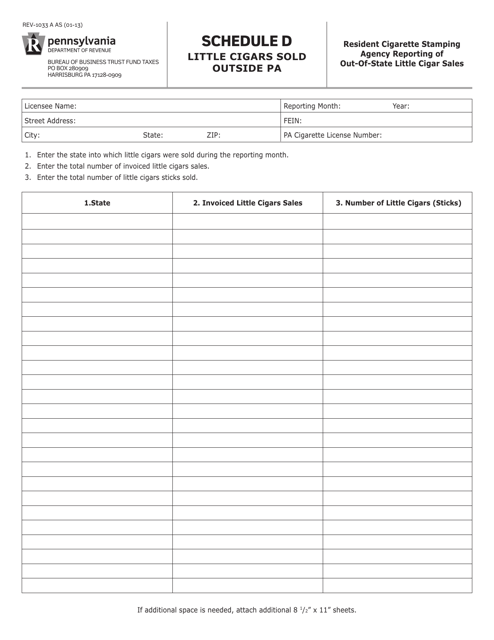

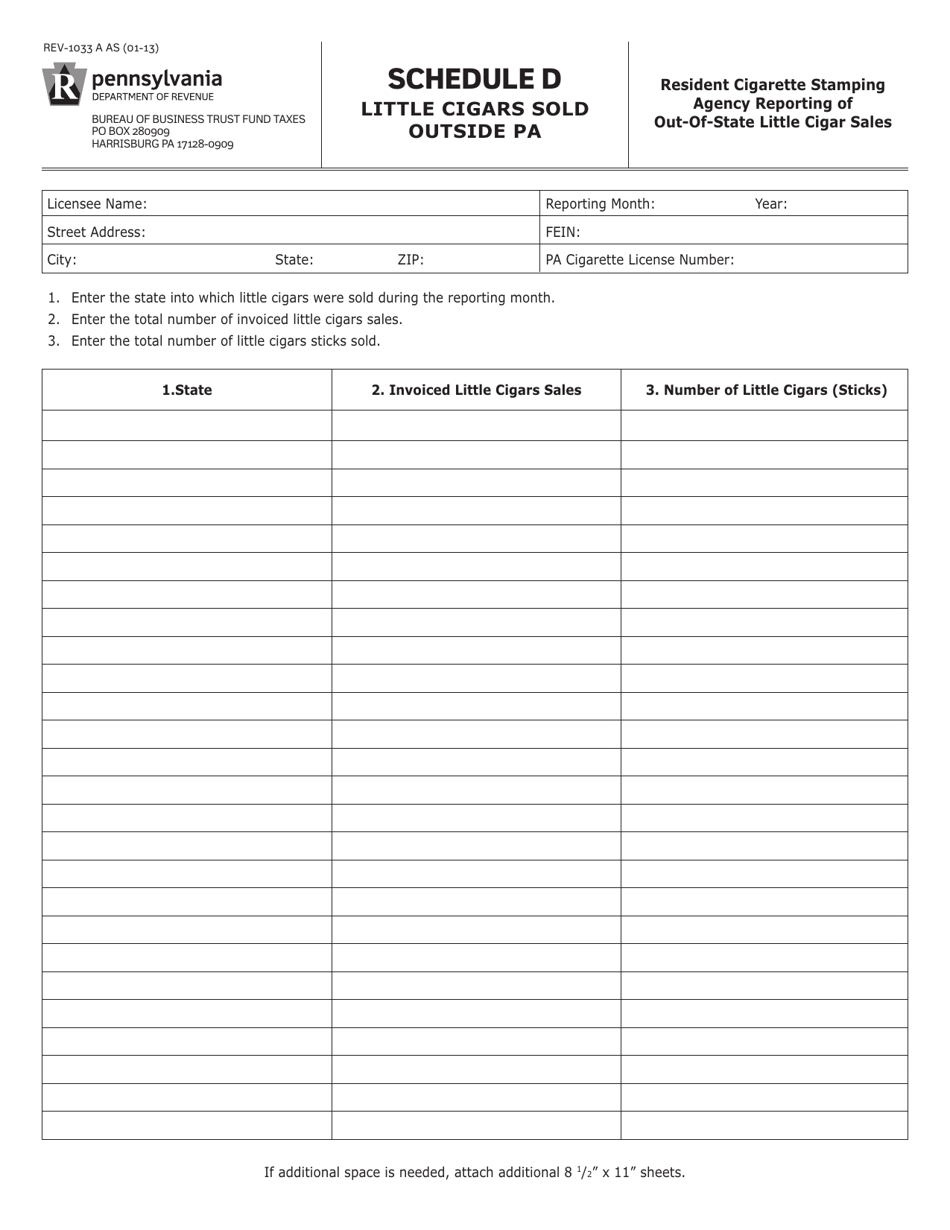

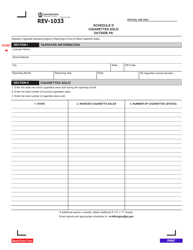

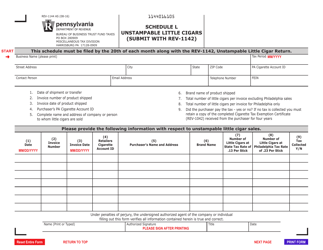

Form REV-1033 A Schedule D

for the current year.

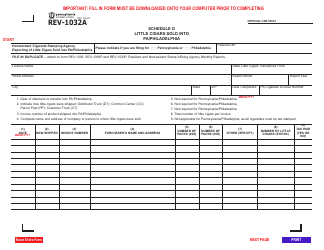

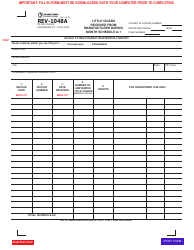

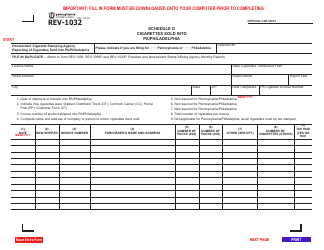

Form REV-1033 A Schedule D Little Cigars Sold Outside Pa - Pennsylvania

What Is Form REV-1033 A Schedule D?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1033?

A: Form REV-1033 is a schedule used by Pennsylvania residents to report their sales of little cigars that were sold outside of Pennsylvania.

Q: What is a Little Cigar?

A: A little cigar is a small, cigarette-sized cigar that can be smoked like a cigarette.

Q: Who needs to file Form REV-1033?

A: Pennsylvania residents who have sold little cigars outside of the state need to file Form REV-1033.

Q: What information is required on Form REV-1033?

A: Form REV-1033 requires information about the total number of little cigars sold, the purchase price, and the date of sale.

Q: When is the deadline to file Form REV-1033?

A: The deadline to file Form REV-1033 is usually April 15th of the year following the reporting period.

Q: Are there any penalties for not filing Form REV-1033?

A: Yes, failure to file Form REV-1033 or submitting false information can result in penalties and fines.

Q: Is there any tax owed on the little cigars sold outside of Pennsylvania?

A: Yes, you may owe sales tax on the little cigars sold outside of Pennsylvania, depending on the state where the cigars were sold.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-1033 A Schedule D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.