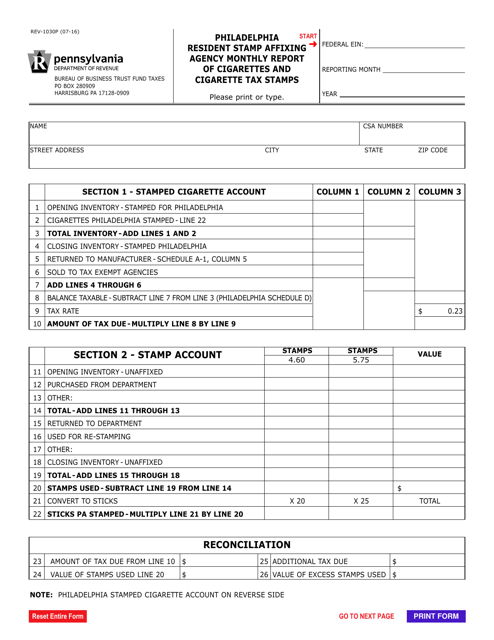

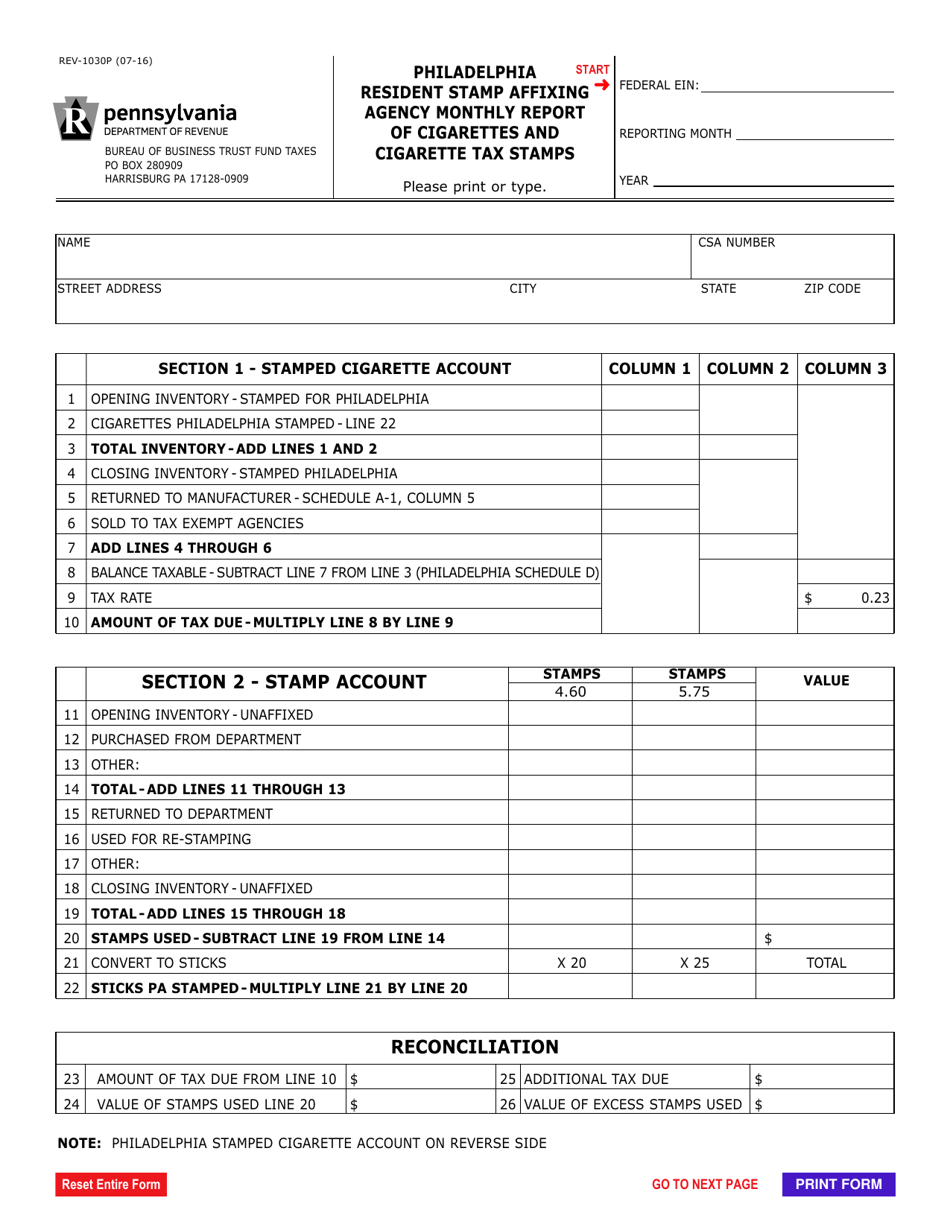

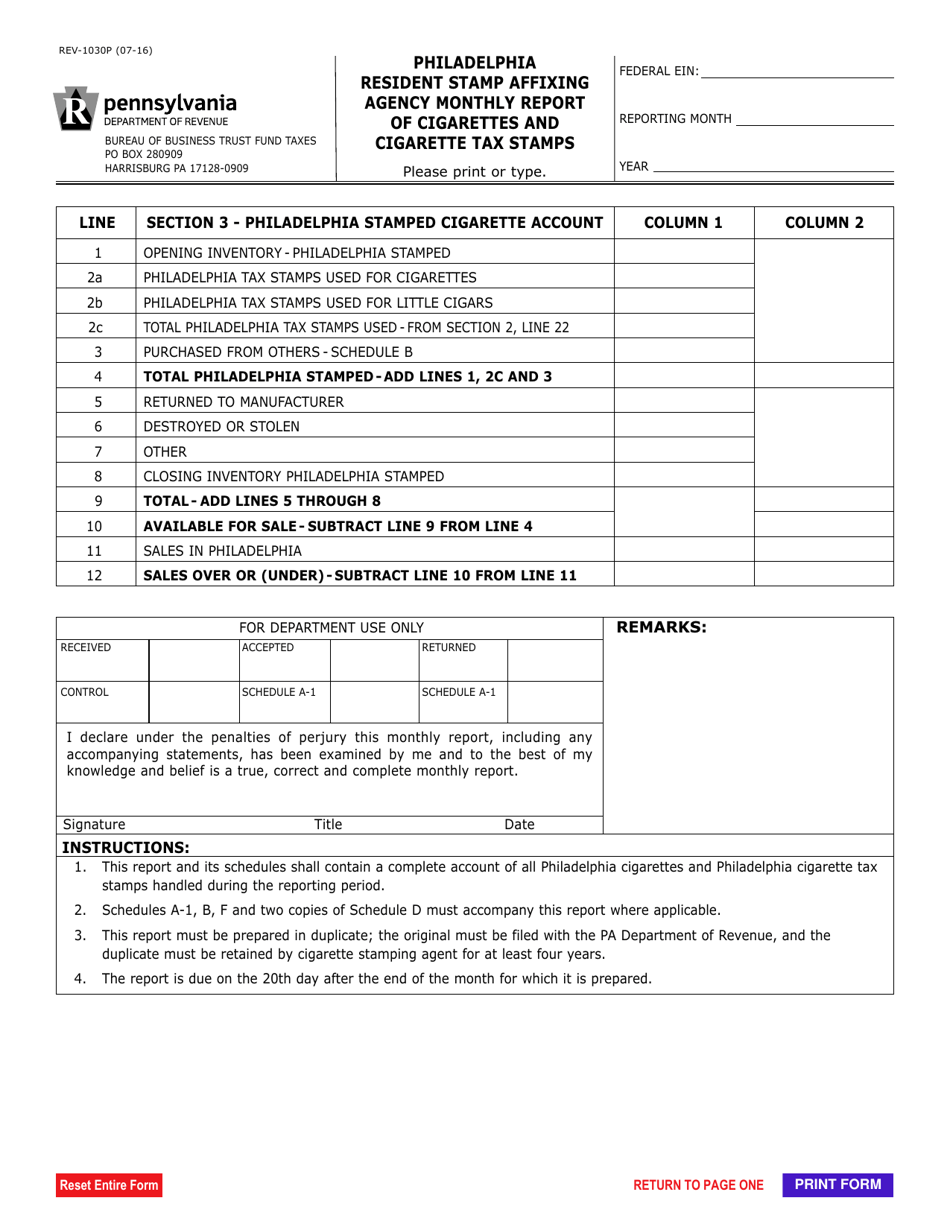

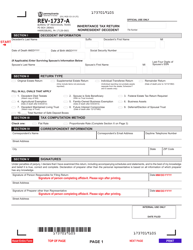

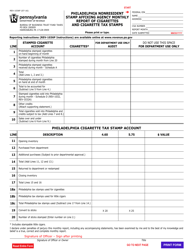

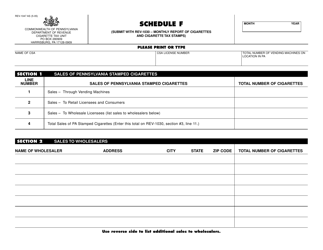

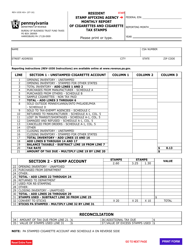

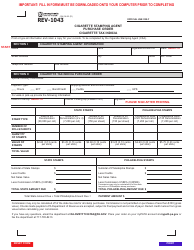

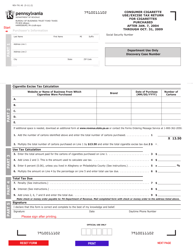

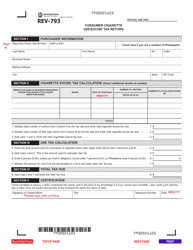

Form REV-1030P Philadelphia Resident Stamp Affixing Agency Monthly Report of Cigarettes and Cigarette Tax Stamps - Pennsylvania

What Is Form REV-1030P?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1030P?

A: Form REV-1030P is the Philadelphia Resident Stamp Affixing Agency Monthly Report of Cigarettes and Cigarette Tax Stamps for the state of Pennsylvania.

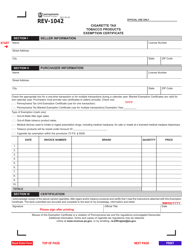

Q: Who needs to file Form REV-1030P?

A: Resident Stamp Affixing Agencies in Philadelphia, Pennsylvania need to file Form REV-1030P.

Q: What is the purpose of Form REV-1030P?

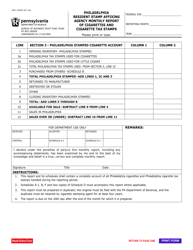

A: The purpose of Form REV-1030P is to report the monthly sales, distribution, and affixing of cigarettes and cigarette tax stamps in Philadelphia, Pennsylvania.

Q: What information is required on Form REV-1030P?

A: Form REV-1030P requires information such as the total number of cigarettes sold, the total amount of cigarette tax collected, and the number of cigarette tax stamps affixed.

Q: When is the deadline to file Form REV-1030P?

A: Form REV-1030P must be filed by the 20th day of the month following the reporting month.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1030P by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.