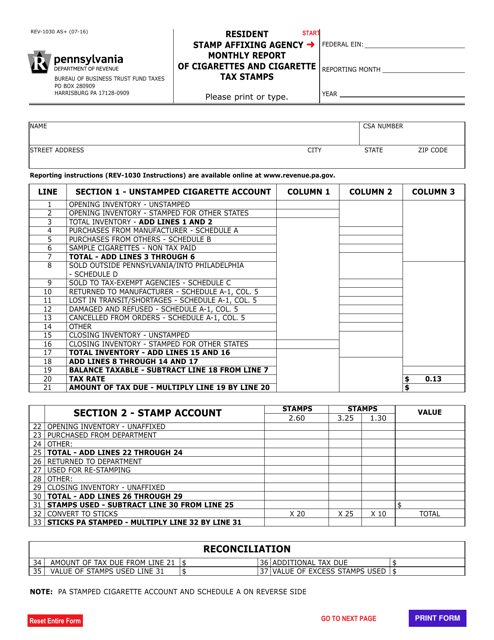

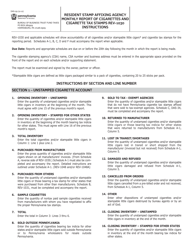

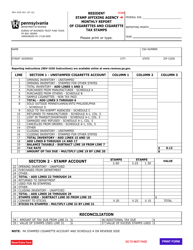

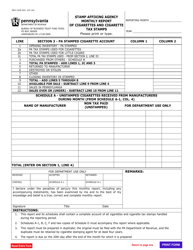

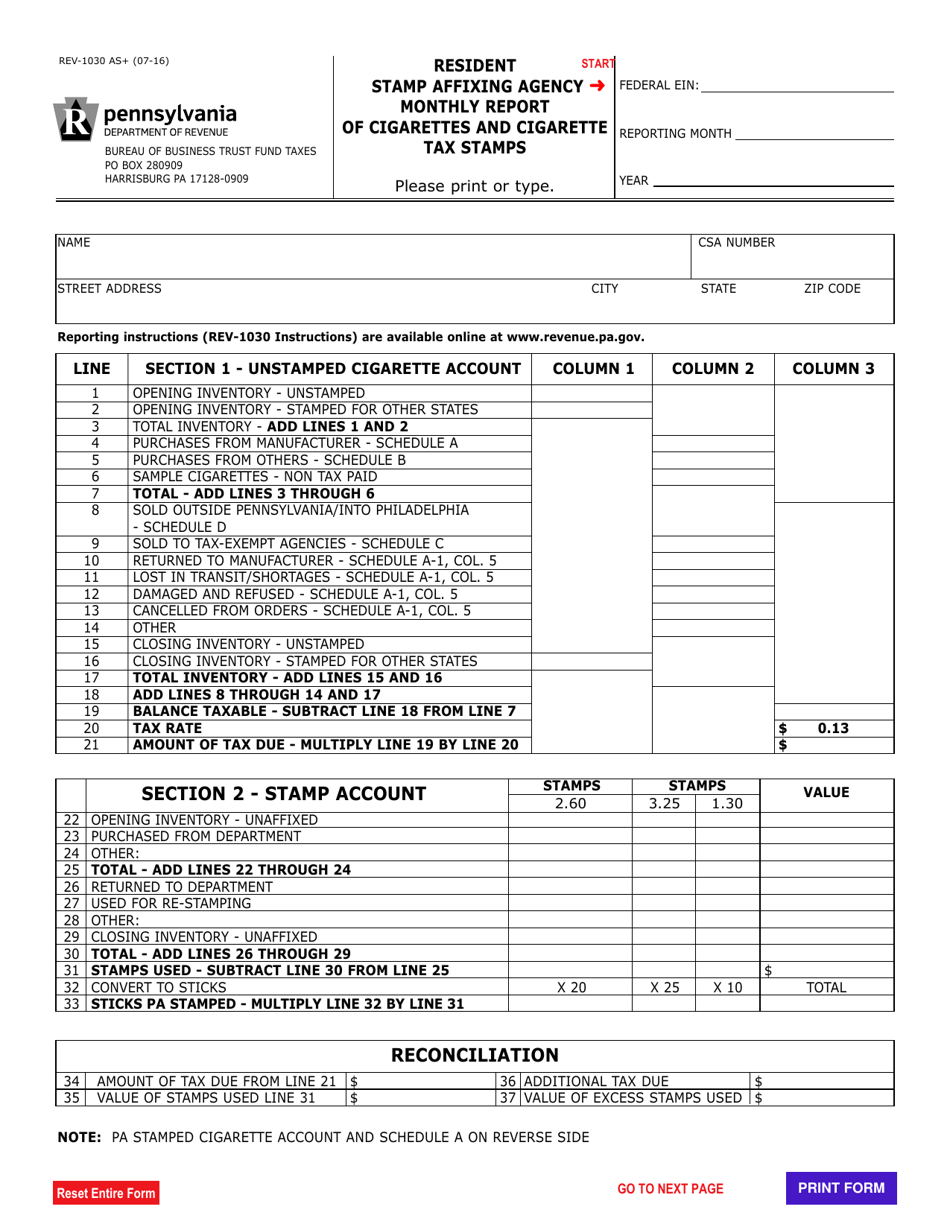

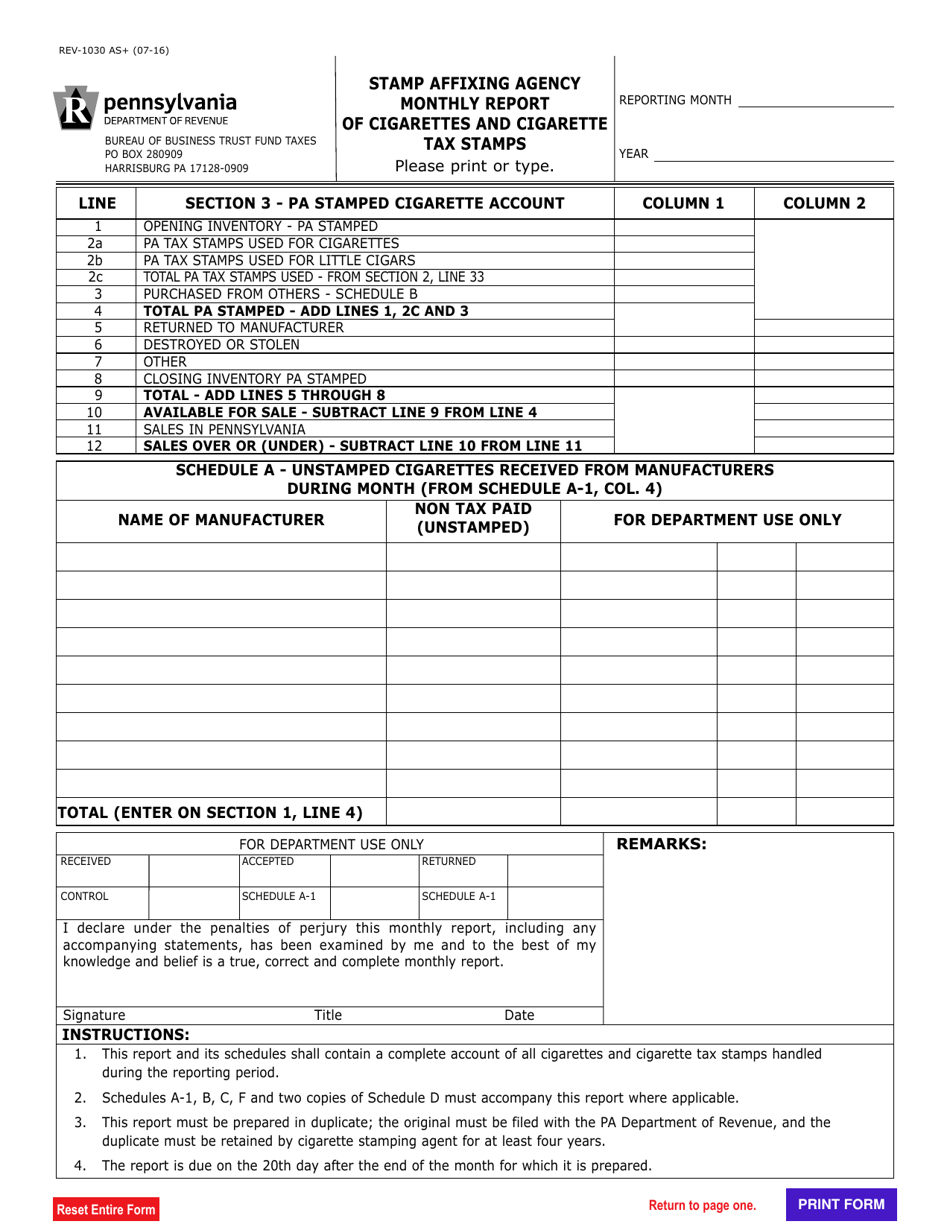

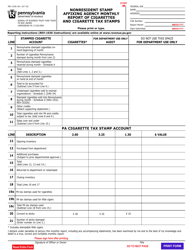

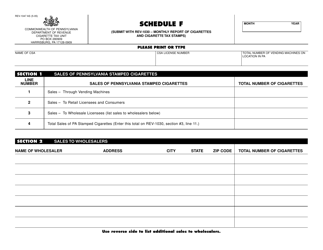

Form REV-1030 Resident Stamp Affixing Agency Monthly Report of Cigarettes and Cigarette Tax Stamps - Pennsylvania

What Is Form REV-1030?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form REV-1030?

A: Form REV-1030 is the monthly report for Resident Stamp Affixing Agencies in Pennsylvania for cigarettes and cigarette tax stamps.

Q: Who needs to fill out form REV-1030?

A: Resident Stamp Affixing Agencies in Pennsylvania who sell cigarettes and affix cigarette tax stamps need to fill out Form REV-1030.

Q: What is the purpose of form REV-1030?

A: The purpose of form REV-1030 is to report the monthly sales and purchases of cigarettes and cigarette tax stamps by Resident Stamp Affixing Agencies in Pennsylvania.

Q: When is form REV-1030 due?

A: Form REV-1030 is due on the 20th day of the month following the reporting period.

Q: How should form REV-1030 be submitted?

A: Form REV-1030 can be submitted electronically through the Pennsylvania Department of Revenue's e-TIDES system or by mail.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1030 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.