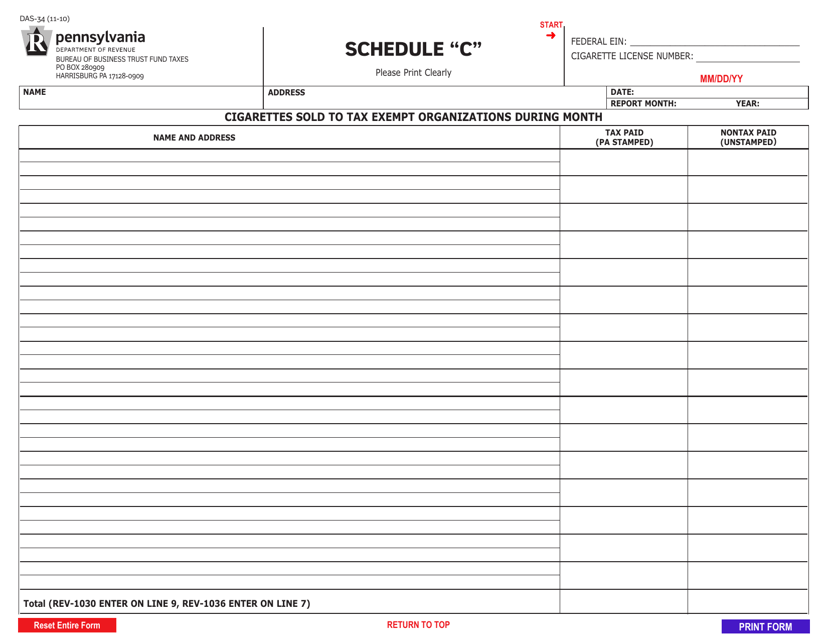

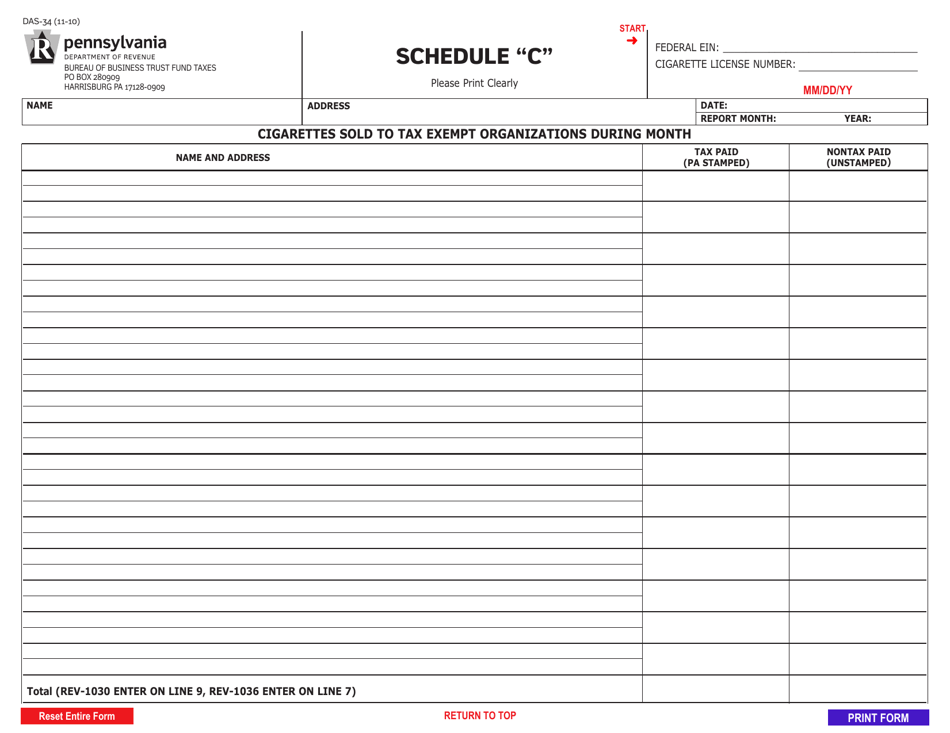

Form DAS-34 Schedule C Cigarettes Sold to Tax Exempt Organizations During Month - Pennsylvania

What Is Form DAS-34 Schedule C?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DAS-34 Schedule C?

A: Form DAS-34 Schedule C is a document used to report the sale of cigarettes to tax-exempt organizations.

Q: What does Schedule C on Form DAS-34 report?

A: Schedule C on Form DAS-34 reports the cigarettes sold to tax-exempt organizations during a specific month.

Q: What is the purpose of reporting cigarettes sold to tax-exempt organizations?

A: The purpose of reporting cigarettes sold to tax-exempt organizations is to ensure compliance with tax regulations and to track the sale of cigarettes.

Q: What does 'Tax Exempt Organizations' mean?

A: Tax-exempt organizations are organizations that are exempt from paying certain taxes, such as charitable organizations.

Q: Which state is Form DAS-34 Schedule C for?

A: Form DAS-34 Schedule C is specific to Pennsylvania.

Q: What information is required on Form DAS-34 Schedule C?

A: Form DAS-34 Schedule C requires information about the quantity and value of cigarettes sold to tax-exempt organizations during a specific month.

Q: When is Form DAS-34 Schedule C due?

A: The due date for Form DAS-34 Schedule C may vary, and it is important to refer to the instructions provided by the Pennsylvania Department of Revenue.

Q: Are there any penalties for not filing Form DAS-34 Schedule C?

A: Penalties may apply for not filing Form DAS-34 Schedule C or for filing it late, so it is important to meet the filing deadline.

Q: Can I file Form DAS-34 Schedule C electronically?

A: Yes, you may be able to file Form DAS-34 Schedule C electronically, depending on the options provided by the Pennsylvania Department of Revenue.

Form Details:

- Released on November 1, 2010;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DAS-34 Schedule C by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.