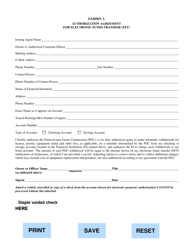

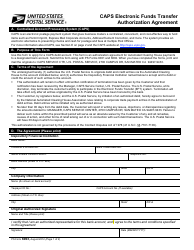

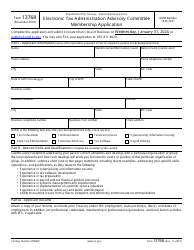

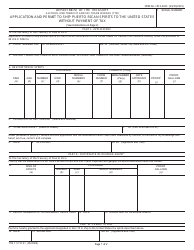

This version of the form is not currently in use and is provided for reference only. Download this version of

Form REV-331A

for the current year.

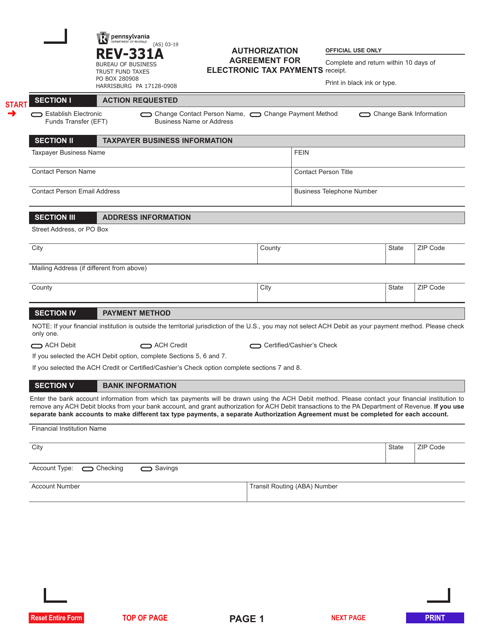

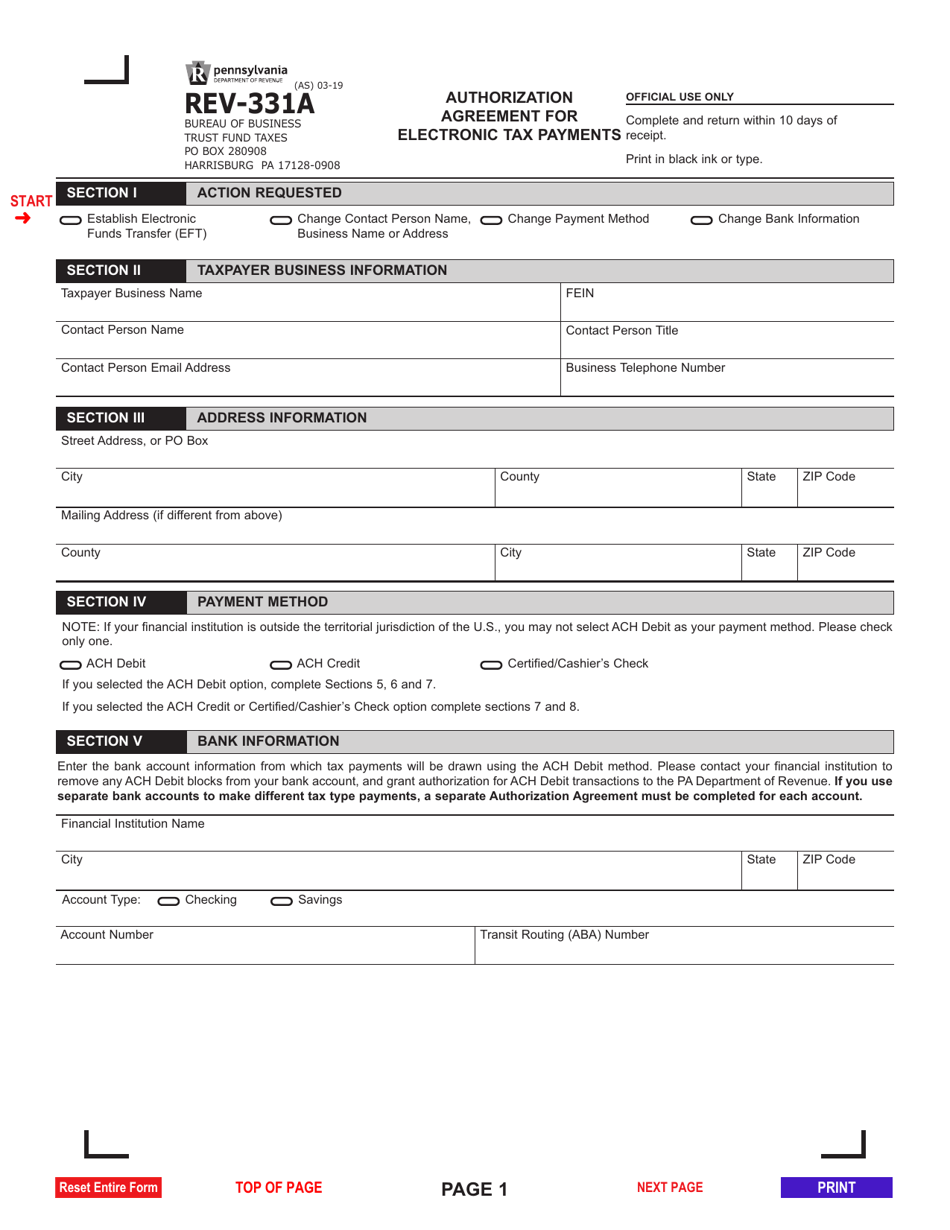

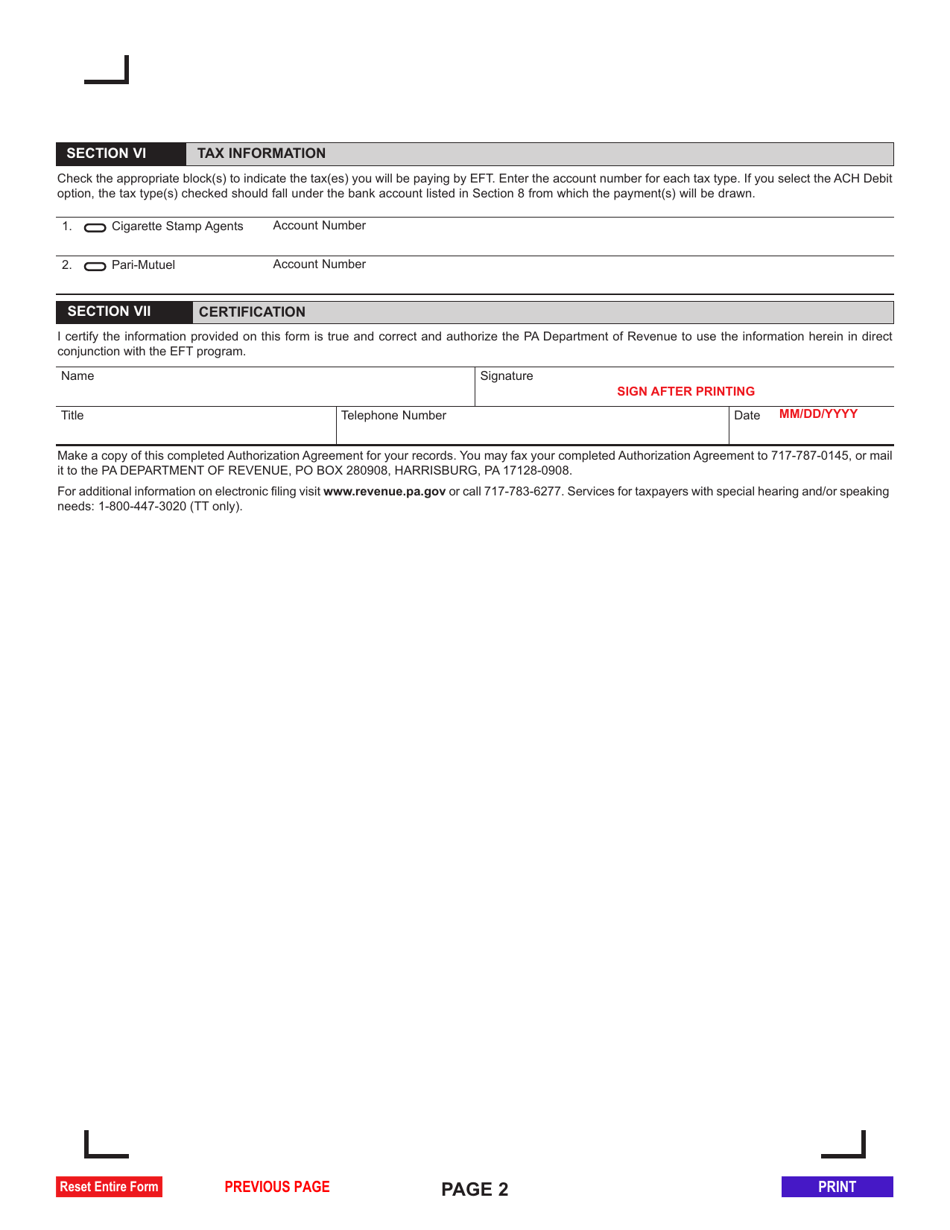

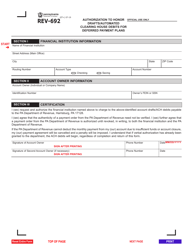

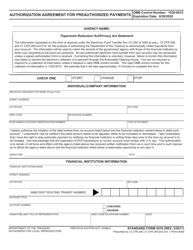

Form REV-331A Authorization Agreement for Electronic Tax Payments - Pennsylvania

What Is Form REV-331A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-331A?

A: Form REV-331A is the Authorization Agreement for Electronic Tax Payments in Pennsylvania.

Q: What is the purpose of Form REV-331A?

A: The purpose of Form REV-331A is to authorize the Pennsylvania Department of Revenue to make electronic withdrawals from your bank account for tax payments.

Q: Who needs to fill out Form REV-331A?

A: Any individual or business in Pennsylvania who wants to make electronic tax payments needs to fill out Form REV-331A.

Q: Do I need to provide my bank account information on Form REV-331A?

A: Yes, you will need to provide your bank account information, including the bank name, routing number, and account number, on Form REV-331A.

Q: Can I use Form REV-331A for all types of taxes in Pennsylvania?

A: Yes, you can use Form REV-331A for all types of taxes administered by the Pennsylvania Department of Revenue, including individual income tax, corporate tax, and sales tax.

Q: Can I cancel my authorization for electronic tax payments?

A: Yes, you can cancel your authorization for electronic tax payments by submitting a written request to the Pennsylvania Department of Revenue.

Q: Is there a fee for using electronic tax payments?

A: No, there is no fee for using electronic tax payments in Pennsylvania.

Q: How long does it take for electronic tax payments to be processed?

A: Electronic tax payments are typically processed within 24-48 hours.

Q: Are electronic tax payments secure?

A: Yes, electronic tax payments in Pennsylvania are processed through a secure system and your bank account information is encrypted for protection.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-331A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.