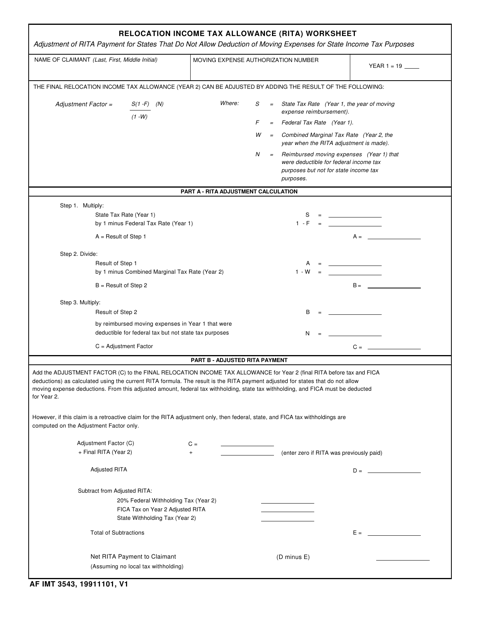

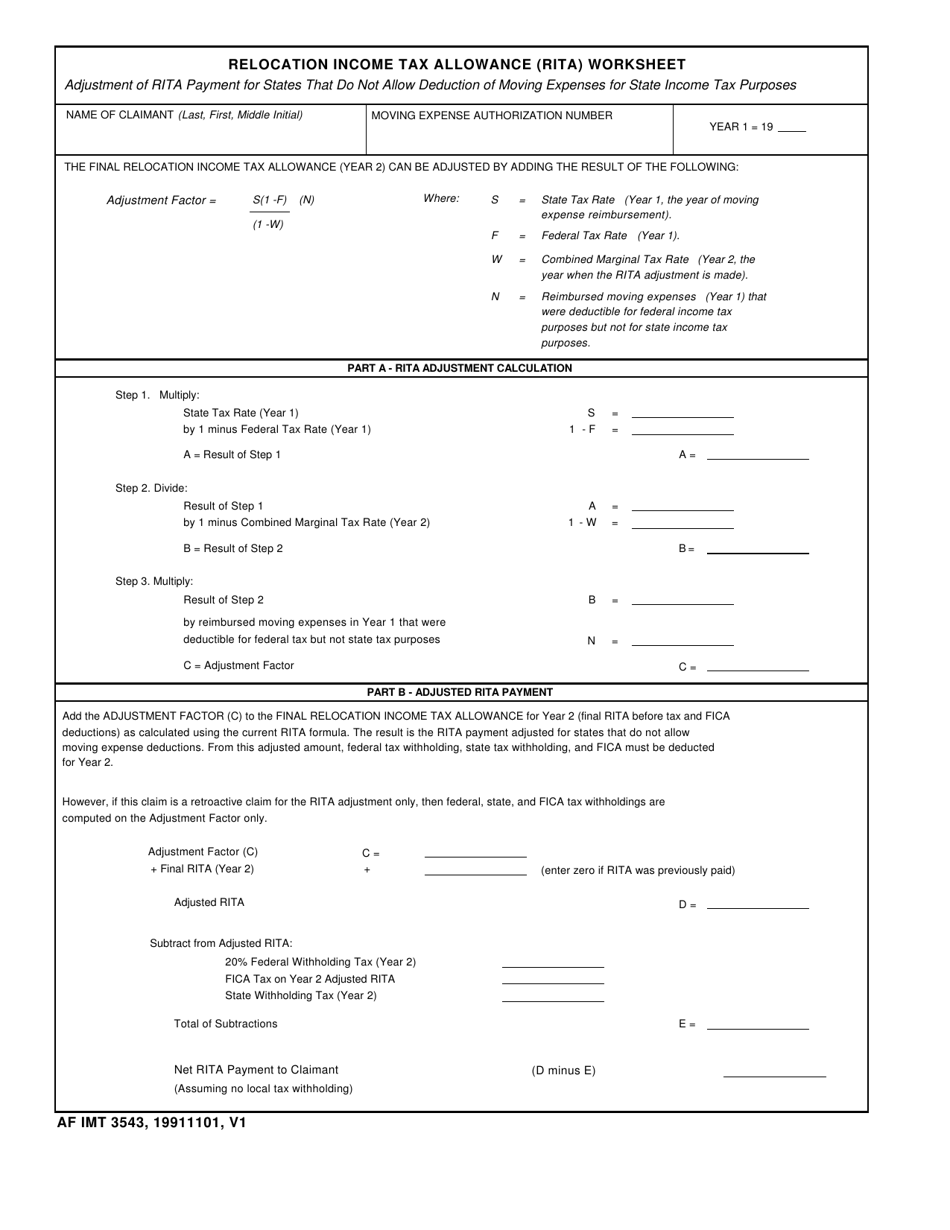

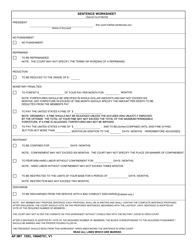

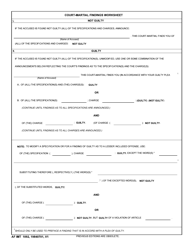

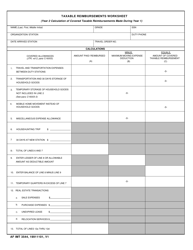

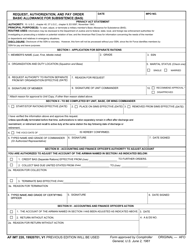

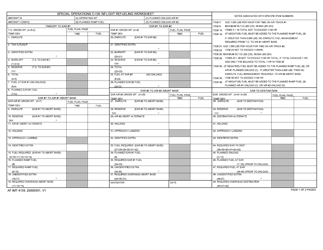

AF IMT Form 3543 Relocation Income Tax Allowance (Rita) Worksheet

What Is AF IMT Form 3543?

This is a legal form that was released by the U.S. Air Force IMT (Information Management Tool) on November 1, 1991 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is AF IMT Form 3543?

A: AF IMT Form 3543 is a document used for the Relocation Income Tax Allowance (RITA) Worksheet.

Q: What is the purpose of the RITA Worksheet?

A: The RITA Worksheet is used to calculate and claim the Relocation Income Tax Allowance for military personnel.

Q: Who uses the AF IMT Form 3543?

A: Military personnel who are eligible for the Relocation Income Tax Allowance use the AF IMT Form 3543.

Q: What does the Relocation Income Tax Allowance (RITA) cover?

A: The RITA covers certain expenses related to the income taxes incurred as a result of relocation.

Q: How do I fill out the RITA Worksheet?

A: You will need to provide information about your relocation expenses and income tax situation to fill out the RITA Worksheet.

Q: Can I claim the Relocation Income Tax Allowance if I am not in the military?

A: No, the Relocation Income Tax Allowance is specifically for military personnel.

Q: Is the Relocation Income Tax Allowance taxable?

A: No, the Relocation Income Tax Allowance is not taxable.

Q: What documents do I need to submit along with the RITA Worksheet?

A: You may need to submit supporting documents such as receipts or proof of payment for your relocation expenses.

Q: Can I claim the Relocation Income Tax Allowance more than once?

A: Yes, you can claim the Relocation Income Tax Allowance for each qualifying relocation you make during your military career.

Form Details:

- Released on November 1, 1991;

- The latest available edition released by the U.S. Air Force IMT (Information Management Tool);

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of AF IMT Form 3543 by clicking the link below or browse more documents and templates provided by the U.S. Air Force IMT (Information Management Tool).