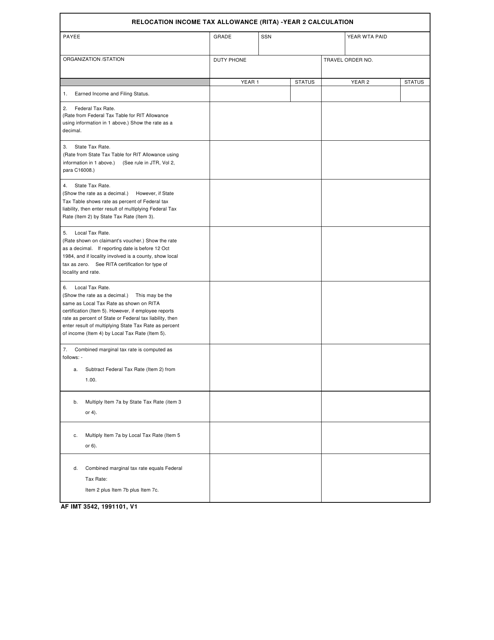

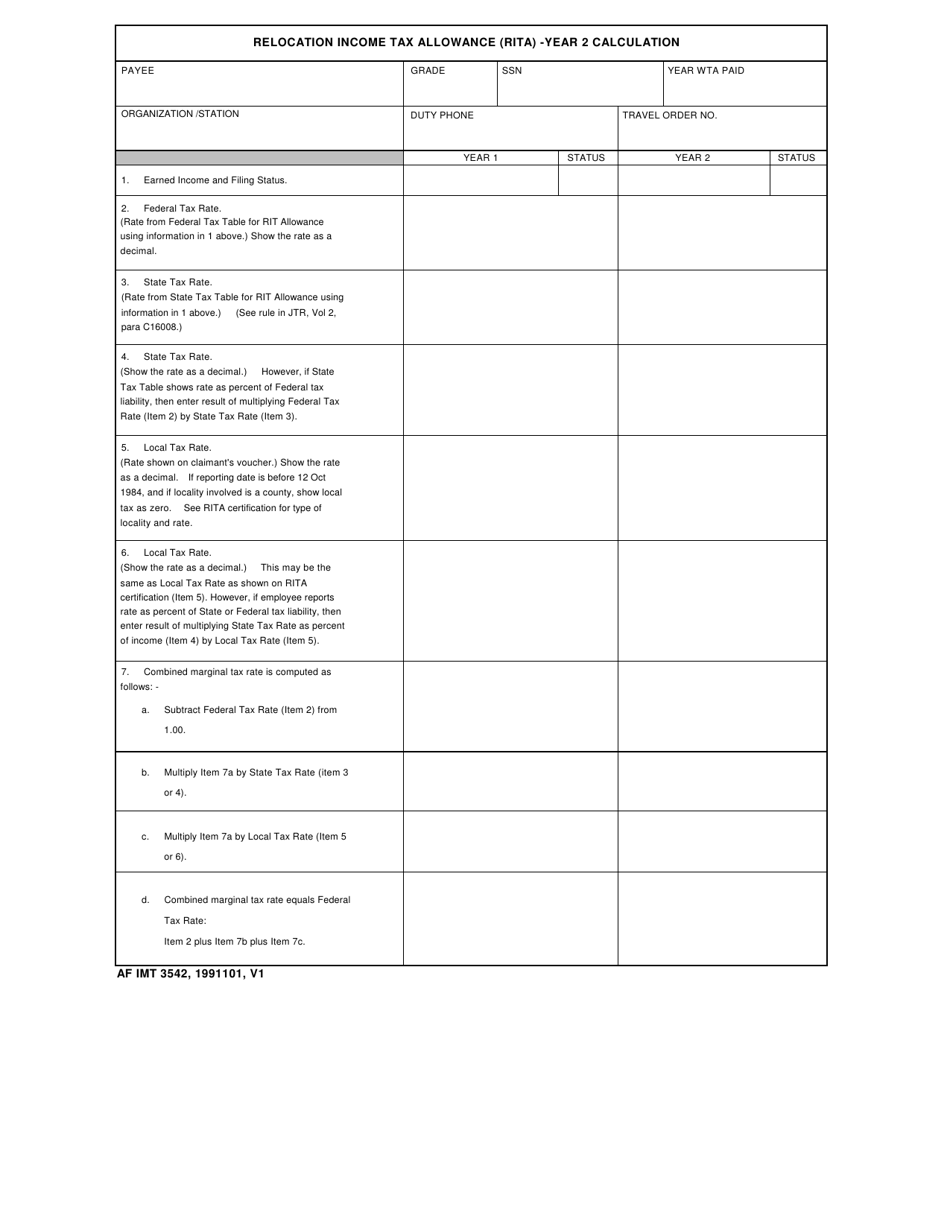

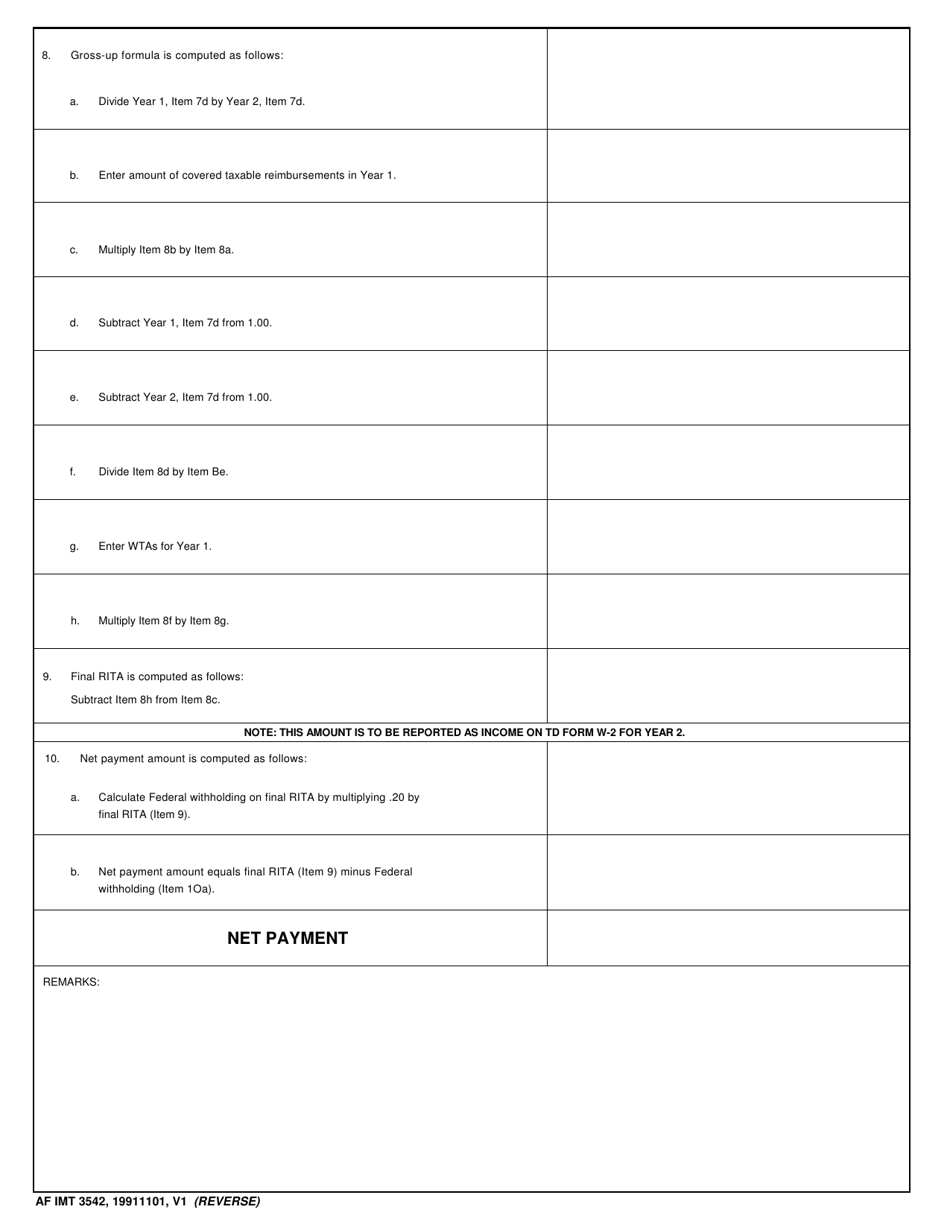

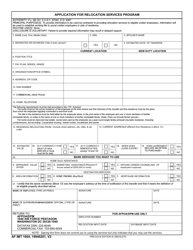

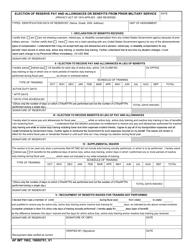

AF IMT Form 3542 Relocation Income Tax Allowance (Rita) - Year 2 Calculation

What Is AF IMT Form 3542?

This is a legal form that was released by the U.S. Air Force IMT (Information Management Tool) on November 1, 1991 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is AF IMT Form 3542?

A: AF IMT Form 3542 is a form used for claiming the Relocation Income Tax Allowance (RITA).

Q: What is the Relocation Income Tax Allowance (RITA)?

A: The Relocation Income Tax Allowance (RITA) is a benefit provided to military members to cover the tax impact of certain moving related expenses.

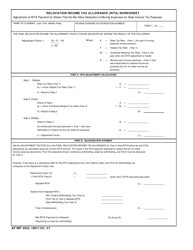

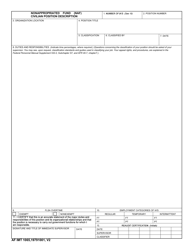

Q: What is the purpose of Year 2 Calculation on AF IMT Form 3542?

A: The Year 2 Calculation on AF IMT Form 3542 is used to determine the amount of RITA allowance for the second year of a military member's relocation.

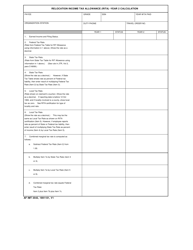

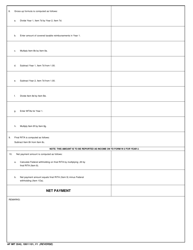

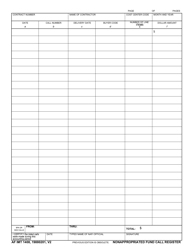

Q: How is the Year 2 Calculation done on AF IMT Form 3542?

A: The Year 2 Calculation on AF IMT Form 3542 takes into account the military member's income, federal and state tax rates, and the location of the move to calculate the eligible RITA allowance.

Q: Who is eligible for the Relocation Income Tax Allowance (RITA)?

A: Active duty military members and their dependents who are required to move due to permanent change of station (PCS) orders are eligible for the Relocation Income Tax Allowance (RITA).

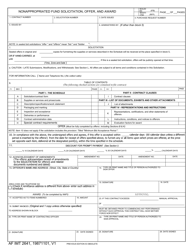

Q: What expenses are covered by the Relocation Income Tax Allowance (RITA)?

A: The Relocation Income Tax Allowance (RITA) covers certain moving-related expenses, such as transportation, meals, and lodging. It is intended to help military members offset the tax impact of these expenses.

Q: How do I submit AF IMT Form 3542?

A: AF IMT Form 3542 should be submitted to the finance office or designated personnel at your military installation.

Q: Are there any time limits for submitting AF IMT Form 3542?

A: Yes, there are time limits for submitting AF IMT Form 3542. It should be submitted within one year of the date of your PCS move.

Q: Can I claim the Relocation Income Tax Allowance (RITA) for multiple years?

A: Yes, military members can claim the Relocation Income Tax Allowance (RITA) for multiple years if they meet the eligibility criteria and have incurred moving-related expenses.

Form Details:

- Released on November 1, 1991;

- The latest available edition released by the U.S. Air Force IMT (Information Management Tool);

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of AF IMT Form 3542 by clicking the link below or browse more documents and templates provided by the U.S. Air Force IMT (Information Management Tool).